Policy and Fintech Innovations Protect Against Fraud Risk in the Uncertain Days Ahead

By

Mark Fleming on March 30, 2020

A historical view of overall defect risk, as measured by our Loan Application Defect Index, shows a long-run downward trend since we began tracking defect risk in 2011, with a few exceptions. In February 2020, this long-run trend continued as overall defect risk reached its lowest level in index history. The Defect Index for purchase transactions ...

Read More ›

Are Negative Mortgage Rates on the Horizon?

By

Odeta Kushi on March 18, 2020

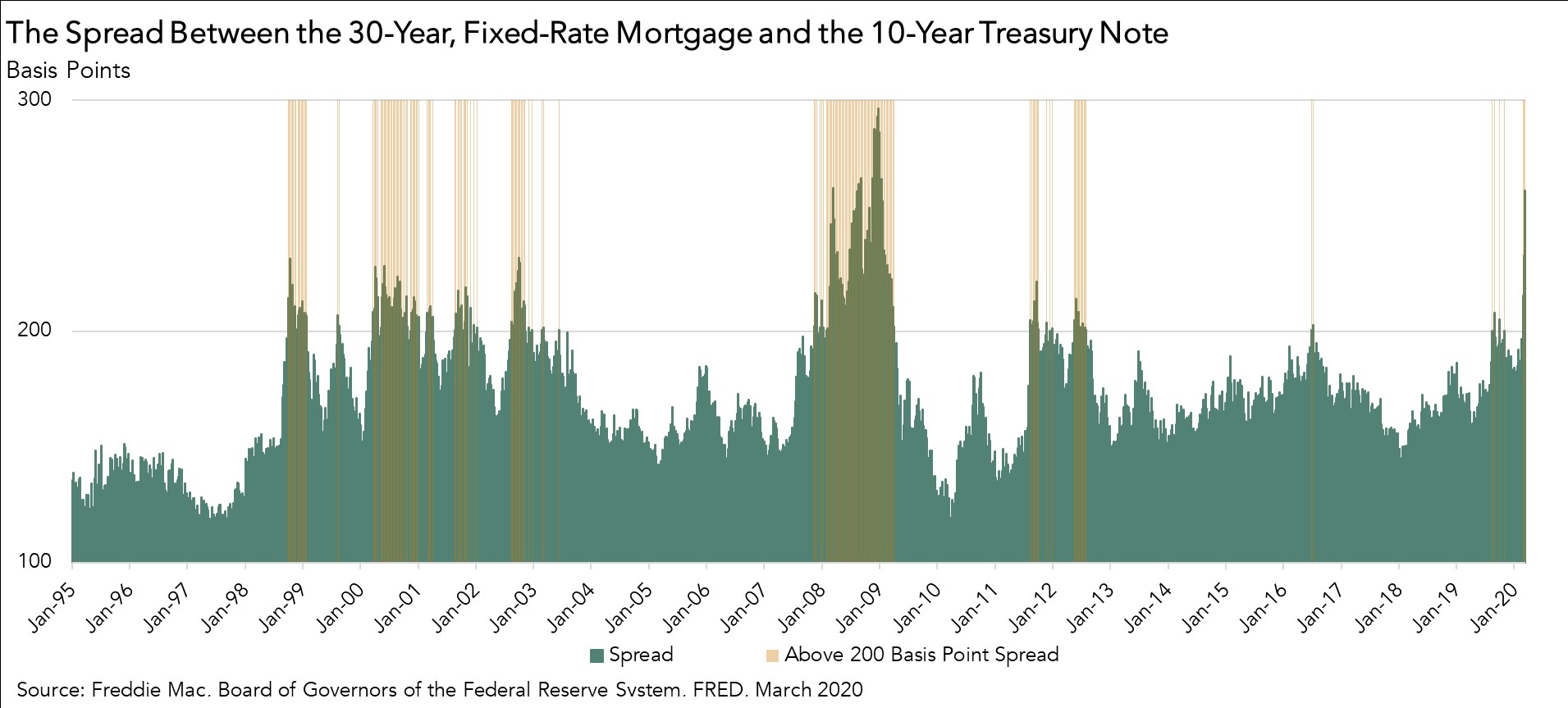

Given both emergency rate cuts of the Federal Reserve and the recent economic uncertainty due to the spread of the Coronavirus, the 10-year Treasury yield dropped to its lowest level in 150 years, according to Nobel Laureate Robert Shiller. For added perspective, that takes us back to the time of Ulysses S. Grant’s presidency. The 10-year Treasury ...

Read More ›

Where Rent-Burdened Households Declined the Most

By

Odeta Kushi on March 11, 2020

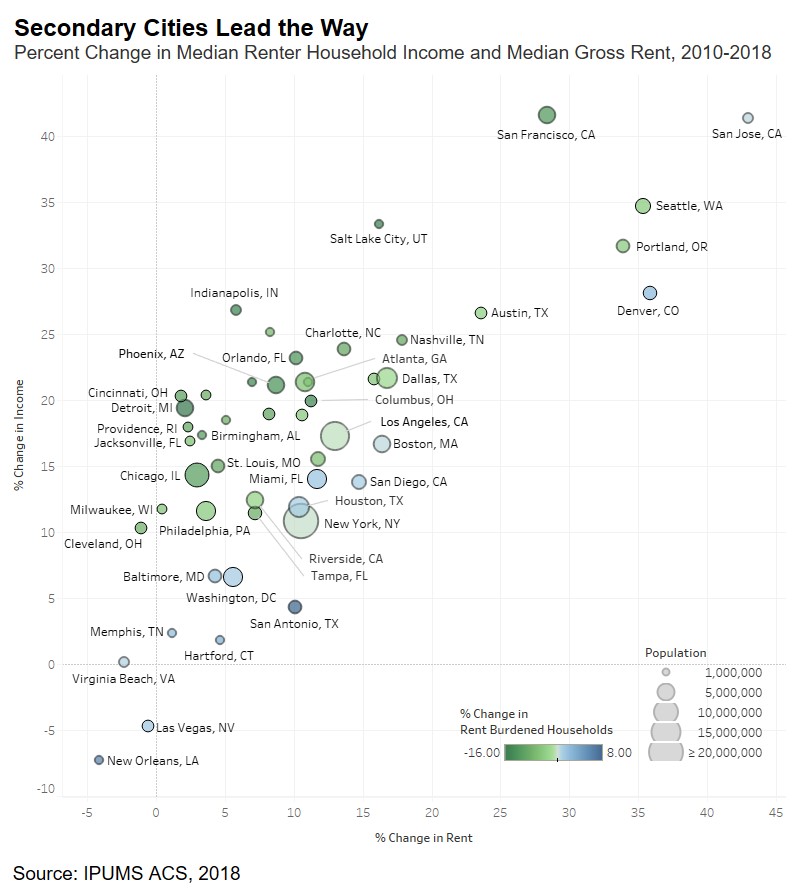

Beginning in 2011 and continuing through 2018, the share of rent-burdened households declined nationally – a trend reversal from the decade between 2000 and 2010. According to the Department of Housing and Urban Development, rent-burdened households spend over 30 percent of their income on rent. However, as the old adage goes, it’s all about ...

Read More ›

Why the Share of Rent-Burdened Households Has Declined in the Post-Recession Era

By

Odeta Kushi on March 2, 2020

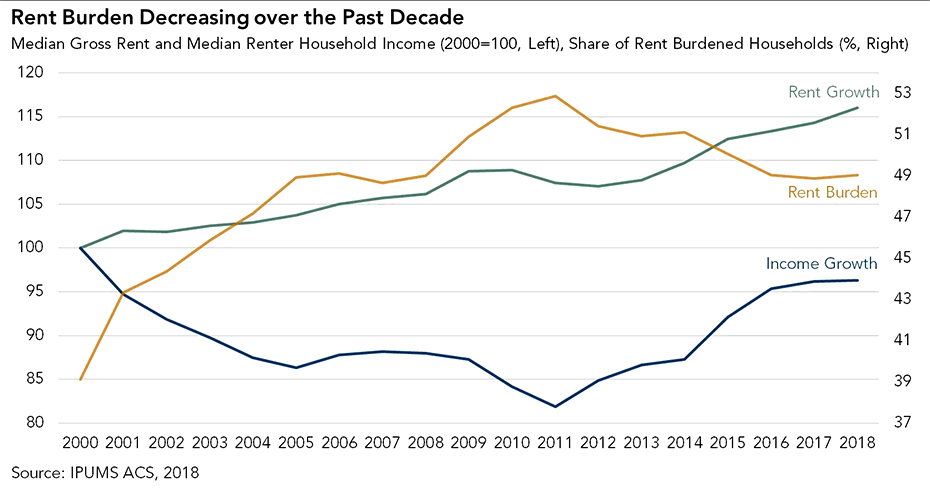

After nearly 20 years of rising rents, renter affordability, or the lack thereof, is a hot topic in housing. The long-running increase in rents has fueled a rise in the share of rent-burdened households, defined by the Department of Housing and Urban Development (HUD) as households that spend over 30 percent of their income on rent.

Read More ›

Mini Refinance Boom Drives Fraud Risk to New Low

By

Mark Fleming on February 28, 2020

Overall defect risk, as measured by our Loan Application Defect Index, has largely trended down since early 2019 with a few exceptions. In January 2020, this long-run trend continued as overall defect risk reached its lowest level since we began tracking it in 2011. While the Defect Index for purchase transactions remained the same after two ...

Read More ›

Where Wages Grow, Affordability Follows

By

Mark Fleming on February 24, 2020

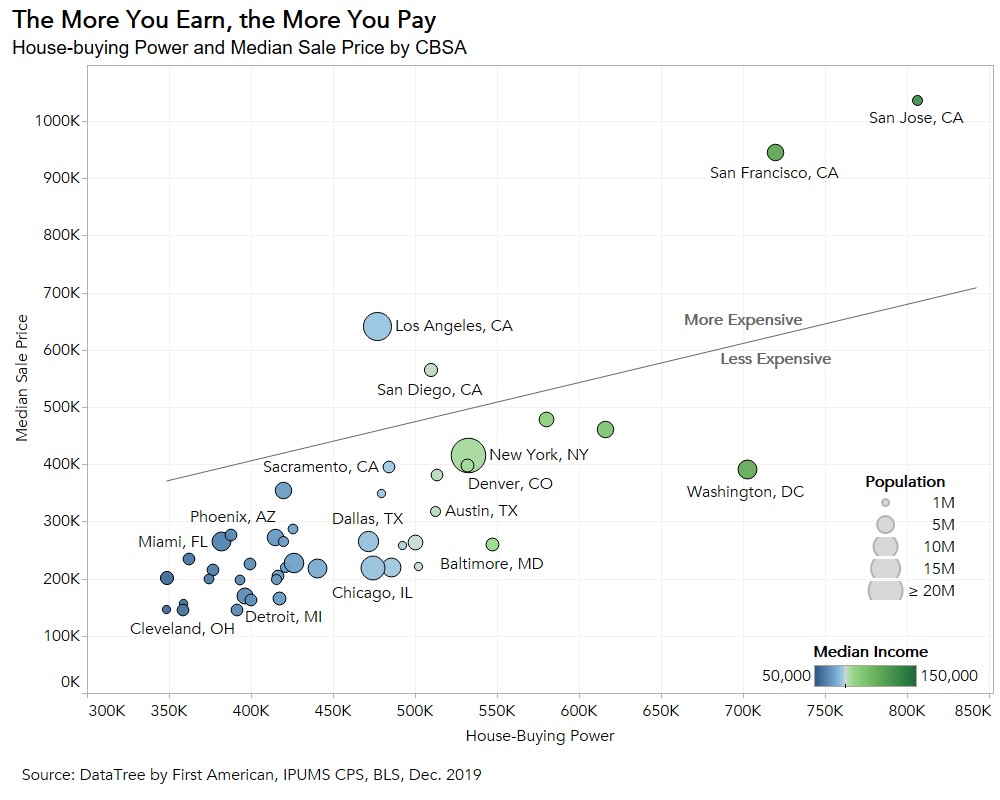

As 2019 came to a close, potential home buyers received a year-end gift as affordability improved relative to one year ago. Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in December.

Read More ›