Policy and Fintech Innovations Protect Against Fraud Risk in the Uncertain Days Ahead

By

Mark Fleming on March 30, 2020

A historical view of overall defect risk, as measured by our Loan Application Defect Index, shows a long-run downward trend since we began tracking defect risk in 2011, with a few exceptions. In February 2020, this long-run trend continued as overall defect risk reached its lowest level in index history. The Defect Index for purchase transactions ...

Read More ›

Mini Refinance Boom Drives Fraud Risk to New Low

By

Mark Fleming on February 28, 2020

Overall defect risk, as measured by our Loan Application Defect Index, has largely trended down since early 2019 with a few exceptions. In January 2020, this long-run trend continued as overall defect risk reached its lowest level since we began tracking it in 2011. While the Defect Index for purchase transactions remained the same after two ...

Read More ›

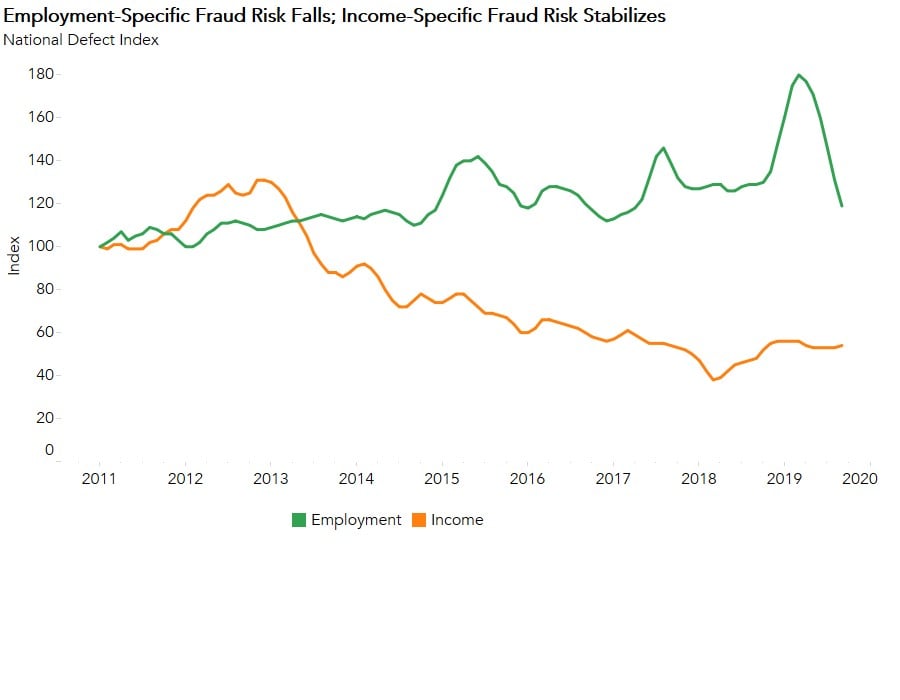

Why the Pace of Fraud Risk Decline Slowed in December

By

Mark Fleming on January 30, 2020

For the majority of 2019, overall fraud risk steadily declined, largely due to the rising volume of lower risk refinance transactions driven by low mortgage rates. After falling since March, overall defect risk stabilized in November, and then declined again in December. The overall Defect Index, which includes both purchase and refinance ...

Read More ›

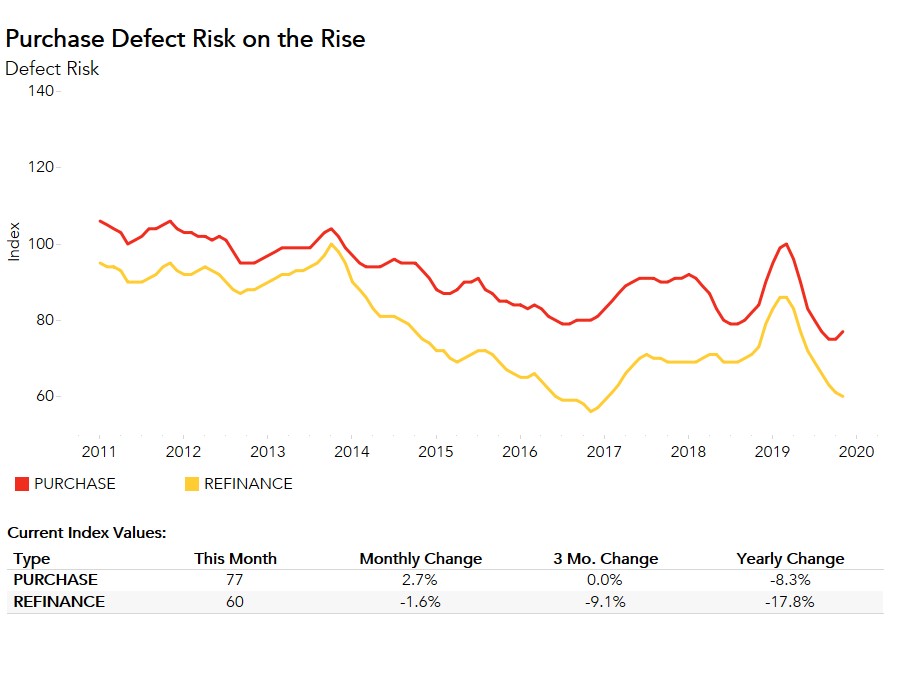

Why Did Defect Risk for Purchase Transactions Rise for the First Time Since March?

By

Mark Fleming on December 27, 2019

As we predicted last month, the Loan Application Defect Index for purchase transactions reached a turning point in November. After falling since March, the Defect Index for purchase transactions increased 2.7 percent compared with October, while the Defect Index for refinance transactions fell by 1.6 percent, its eighth straight month of declining ...

Read More ›

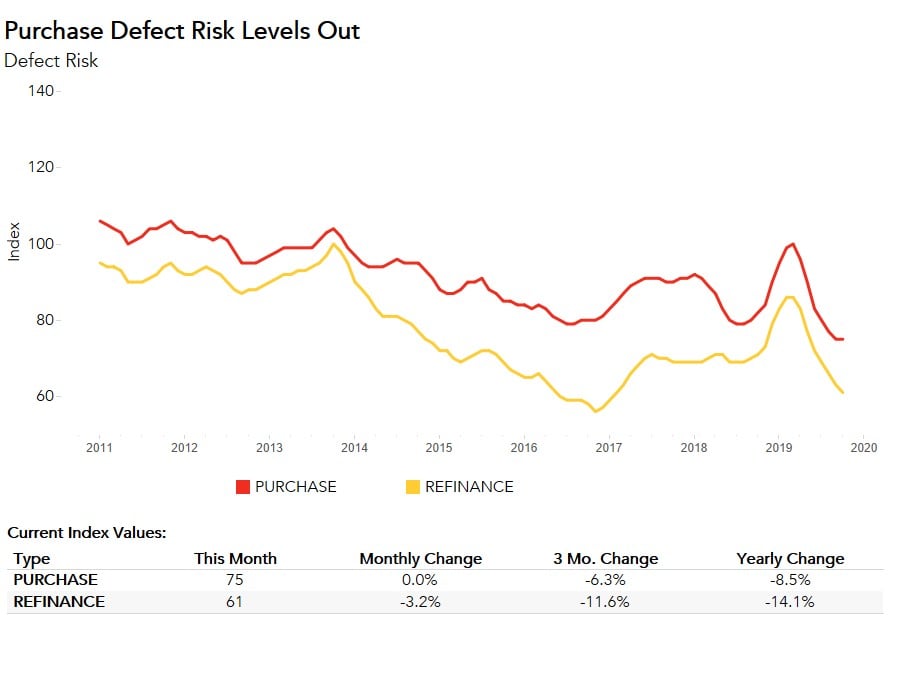

Has Defect Risk for Purchase Transactions Reached a Turning Point?

By

Mark Fleming on November 27, 2019

Based on our analysis, if mortgage rates continue to fall, the pressure on fraud risk may weaken. This has played out throughout most of 2019, as the 30-year, fixed mortgage rate has been falling since December 2018, and overall fraud risk alongside it. Fraud risk began declining in March 2019 and reached a historical low in October. The Loan ...

Read More ›

Why Has Defect Risk Reached a Multi-Year Low Point?

By

Mark Fleming on October 31, 2019

Declining for the sixth consecutive month, the Loan Application Defect Index for purchase transactions fell 2.6 percent in September compared with August. The Defect Index for refinance transactions also fell, declining 4.5 percent compared with the previous month. The overall Defect Index, which includes both purchase and refinance transactions, ...

Read More ›