For Potential First-Time Home Buyers, it May Be Memphis or Bust

By

Odeta Kushi on June 26, 2024

As National Homeownership Month comes to a close, it’s important to examine the current challenges facing the housing market. Nationally, housing affordability has declined compared with one year ago, especially for potential first-time home buyers. According to our First Time Home Buyer Outlook Report, the median renter, who can also be ...

Read More ›

Housing First-Time Homebuyer First-Time Home Buyer Outlook Report Mortgage Rates

It Doesn’t Take Much House Price Appreciation to Make Owning a Better Choice than Renting

By

Ksenia Potapov on April 15, 2022

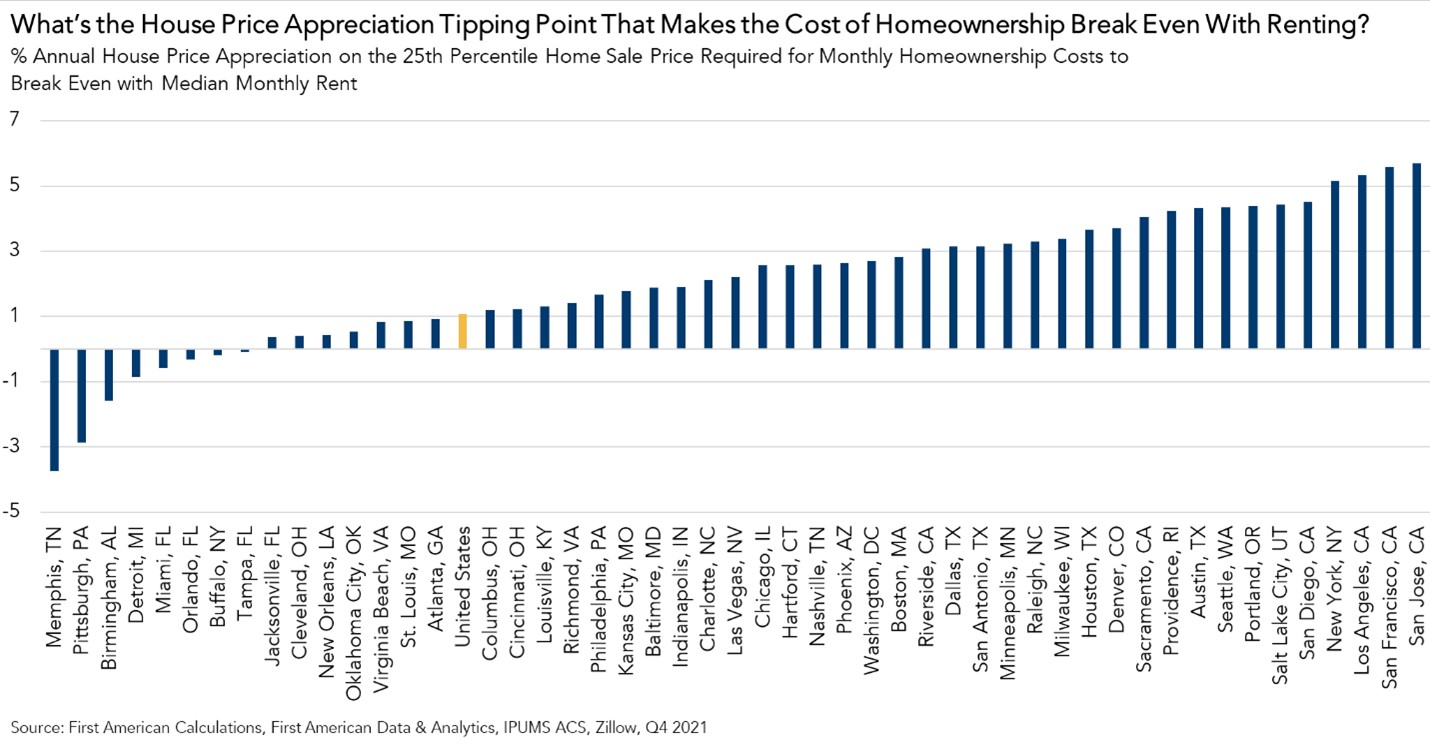

In August 2021, our analysis found that owning a home was cheaper than renting in all 50 of the top U.S. markets, largely due to the ownership benefit of house price appreciation. Given house price appreciation nationally was historically strong in 2021, it’s unsurprising that owning a home made more financial sense than renting last year. Looking ...

Read More ›

What Do the Top 10 Cities for Entry-Level New Home Construction Have in Common?

By

Odeta Kushi on November 22, 2019

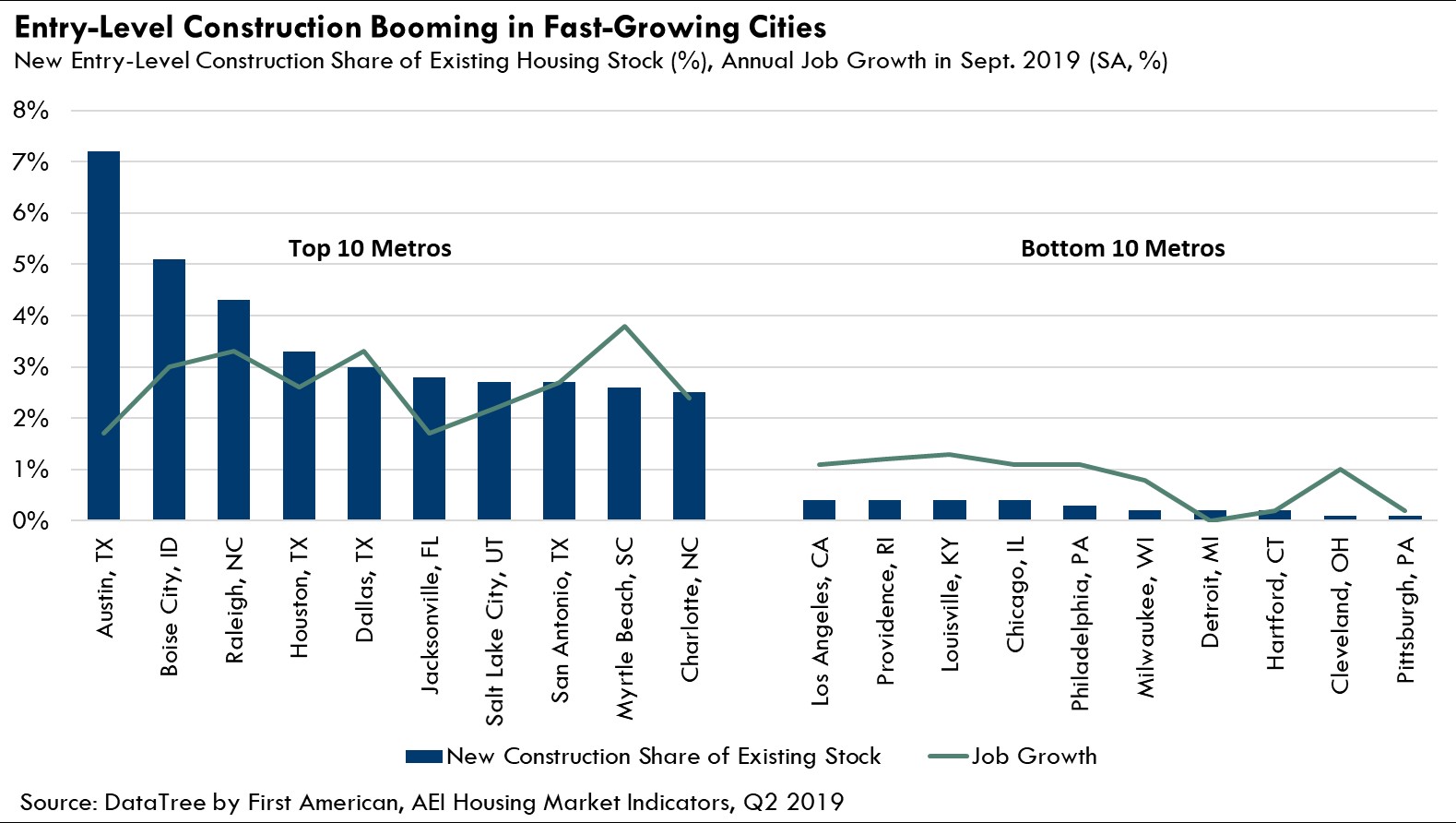

The dominant theme in the housing market nationally in 2019 has been the ongoing challenge of a dearth of housing supply amid rising demand. A natural solution to the challenge is to build more homes. Yet, nationally, supply headwinds still make it hard for builders to ramp up new construction, especially at the entry-level, where first-time home ...

Read More ›

Why Renter House-Buying Power is the Key to Understanding Housing Affordability

By

Mark Fleming on August 6, 2018

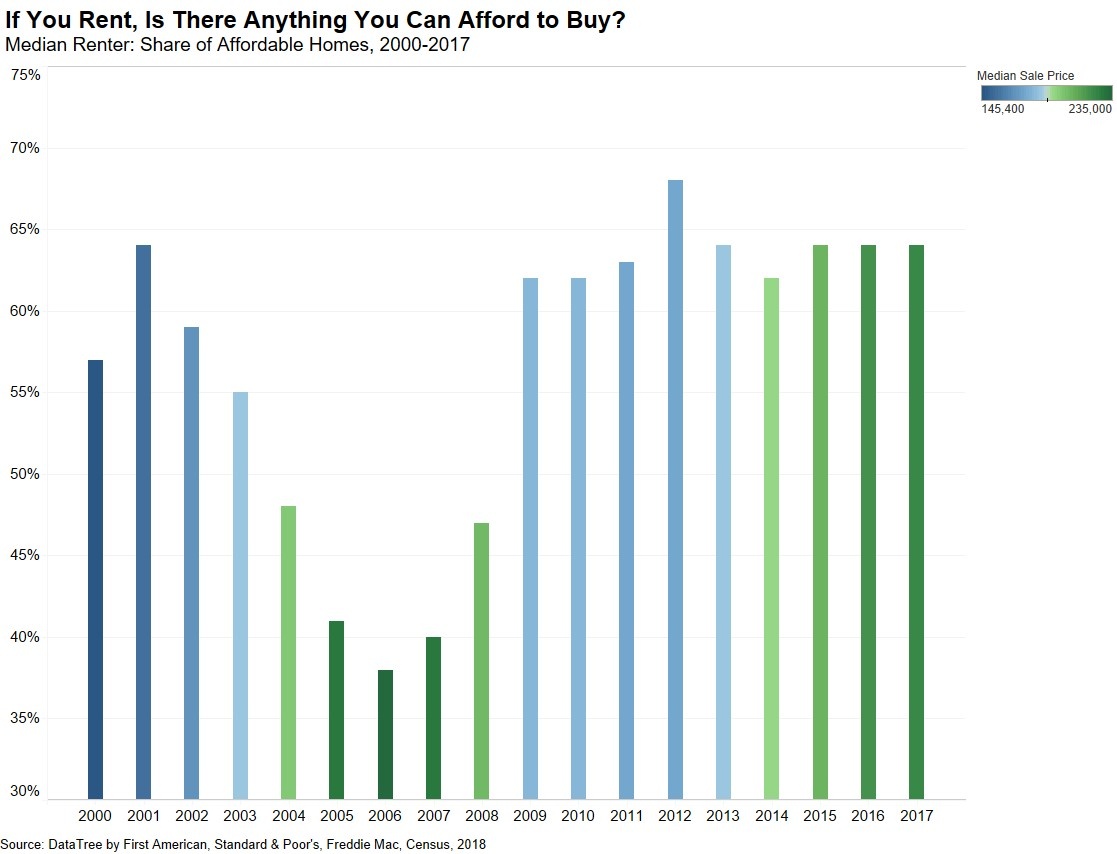

With unadjusted house prices recently eclipsing their 2006 housing boom peak, housing affordability is a concern in the industry and for potential home buyers. Existing home owners, by definition, can afford one so, when we are speaking about housing affordability, it is really a conversation about first-time home buyers.

Read More ›