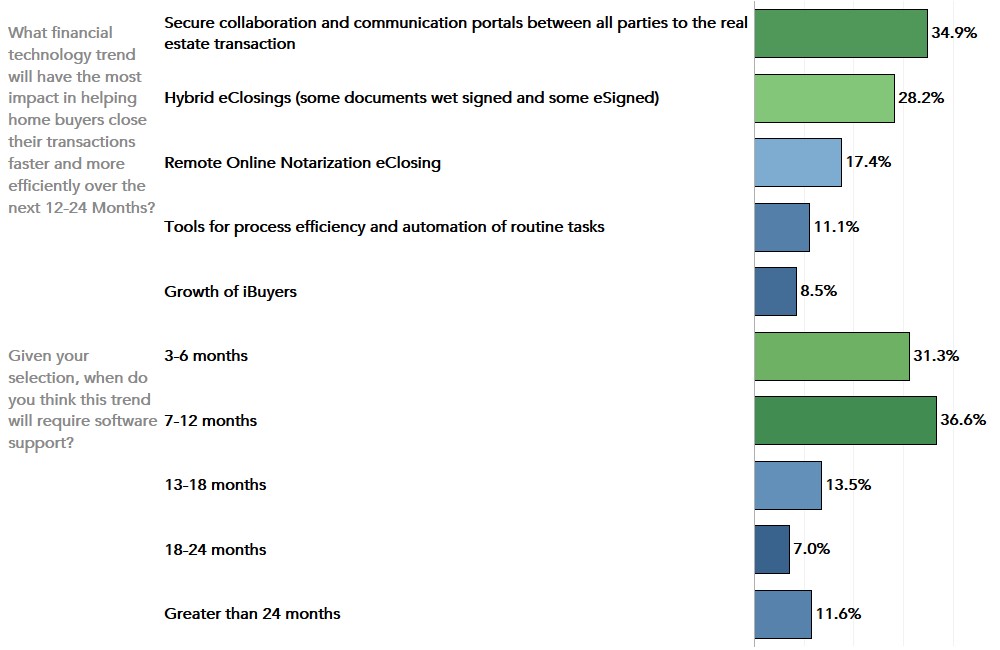

What Will Drive Further Fintech Innovation in Real Estate in 2020?

By

Mark Fleming on February 7, 2020

The 2019 housing market turned out to be surprisingly strong, driven by a variety of favorable dynamics. Millennial-driven, first-time home buyer demand continued to rise, the economy reached its longest expansion in U.S. history in the third quarter of 2019, and rising wages pushed household incomes higher. Mortgage rates, which began their ...

Read More ›

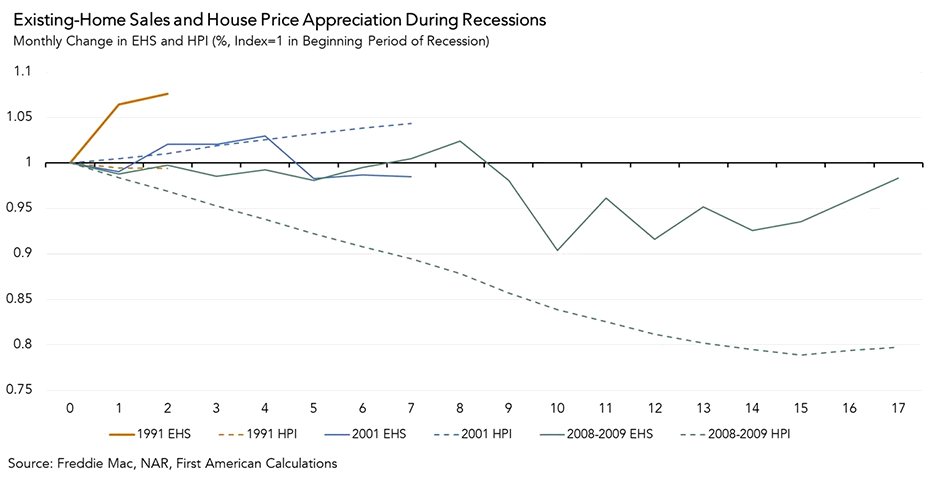

Why Today’s Housing Market May Be a Recession Buster

By

Odeta Kushi on February 4, 2020

In the third quarter of 2019, the United States reached its longest economic expansion in history, which caused some people to wonder whether we were overdue for a correction. Additionally, global uncertainty resulted in a flight to safety of U.S. Treasury bonds, prompting the dreaded inversion of the yield curve. When that happened, we discussed ...

Read More ›

Why the Pace of Fraud Risk Decline Slowed in December

By

Mark Fleming on January 30, 2020

For the majority of 2019, overall fraud risk steadily declined, largely due to the rising volume of lower risk refinance transactions driven by low mortgage rates. After falling since March, overall defect risk stabilized in November, and then declined again in December. The overall Defect Index, which includes both purchase and refinance ...

Read More ›

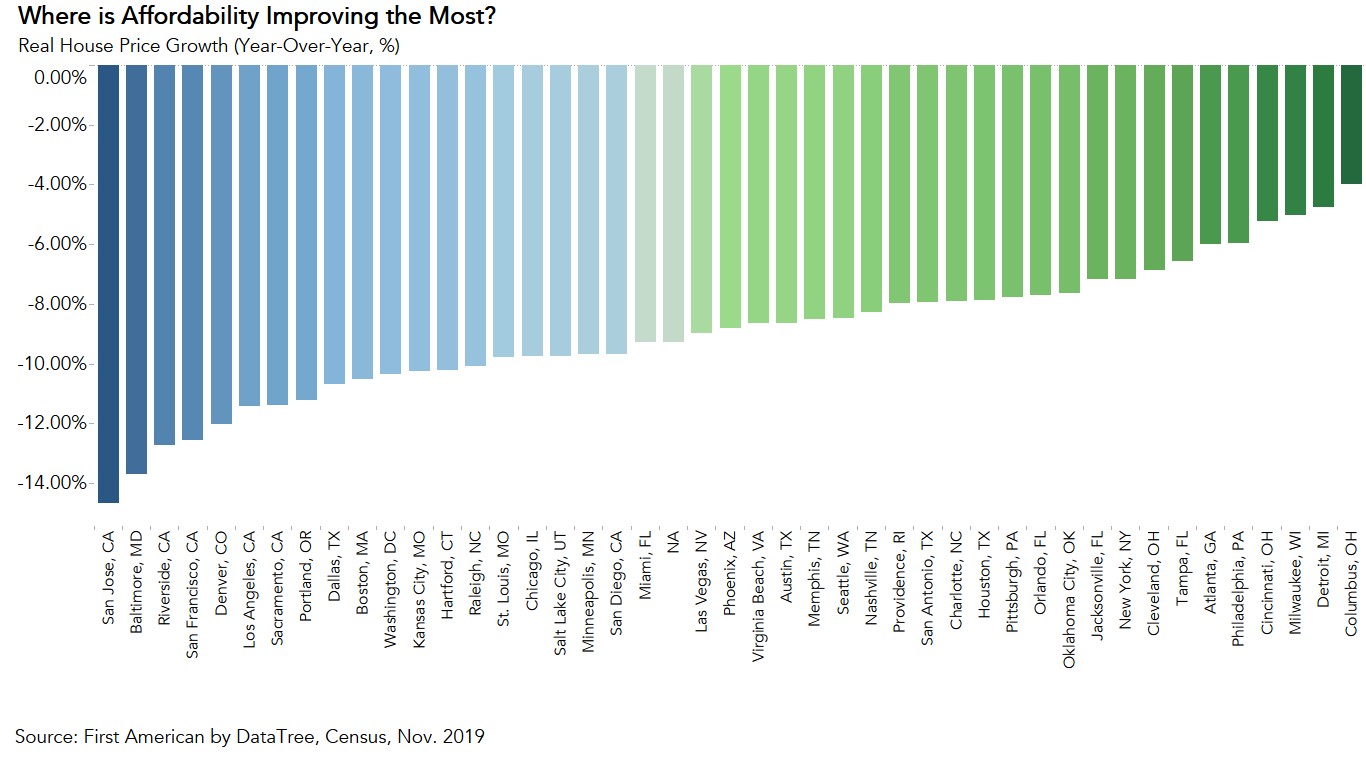

The Five Cities Where Affordability Improved the Most

By

Mark Fleming on January 27, 2020

Once again, home buyers benefitted from a year-over-year affordability boost as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in November. Compared with November 2018, the 30-year, fixed-rate mortgage fell by 1.2 percentage points and household ...

Read More ›

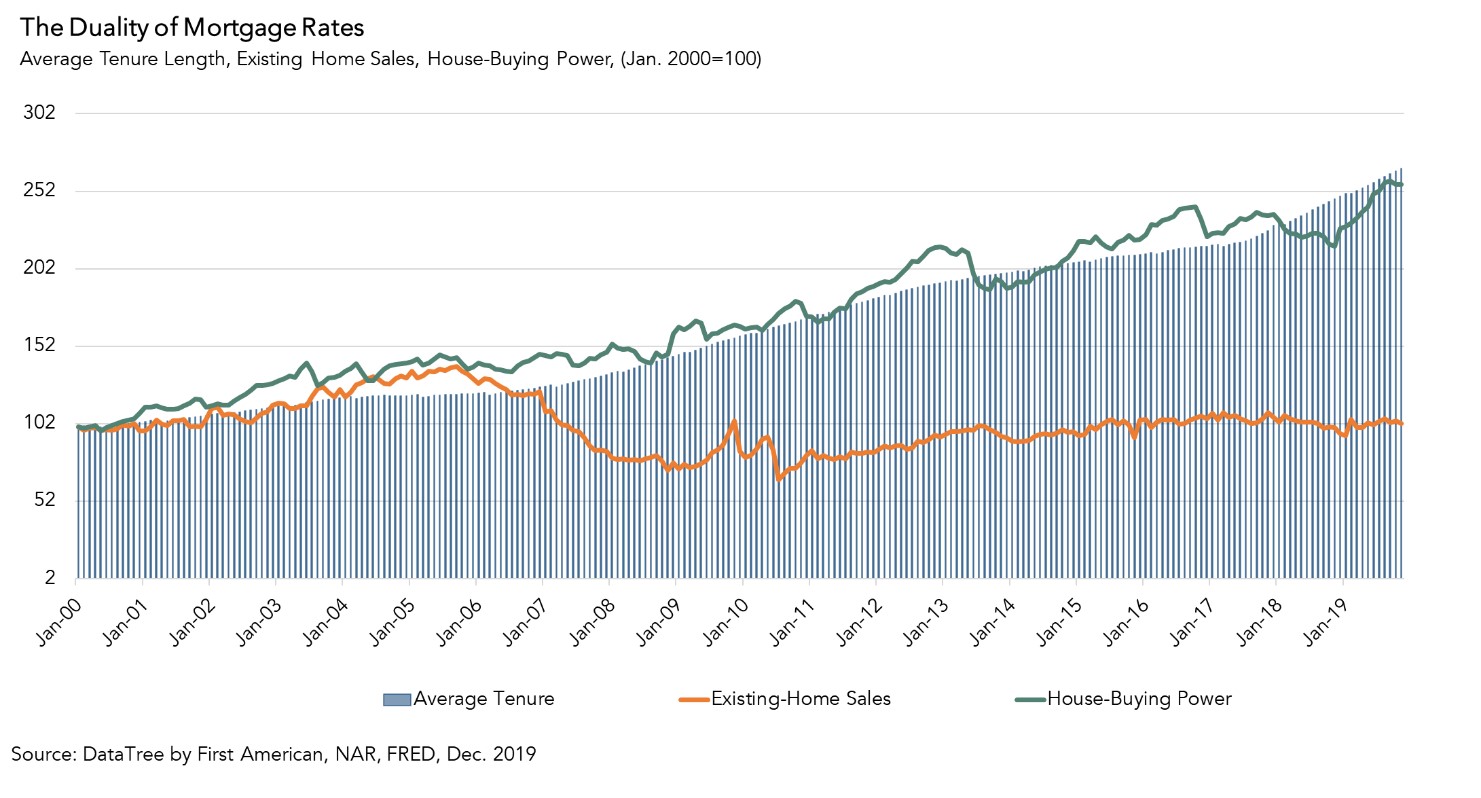

How Low Mortgage Rates Help and Hurt Housing Market Potential

By

Mark Fleming on January 22, 2020

The final month of 2019 saw actual existing-home sales exceed housing market potential by 1.2 percent, or an estimated 64,830 seasonally adjusted annualized sales. According to our Potential Home Sales Model, housing market potential increased 1.7 percent in December 2019 relative to the previous month, and grew 2.6 percent year over year, an ...

Read More ›

What Global Uncertainty Means for the Housing Market

By

Mark Fleming on January 10, 2020

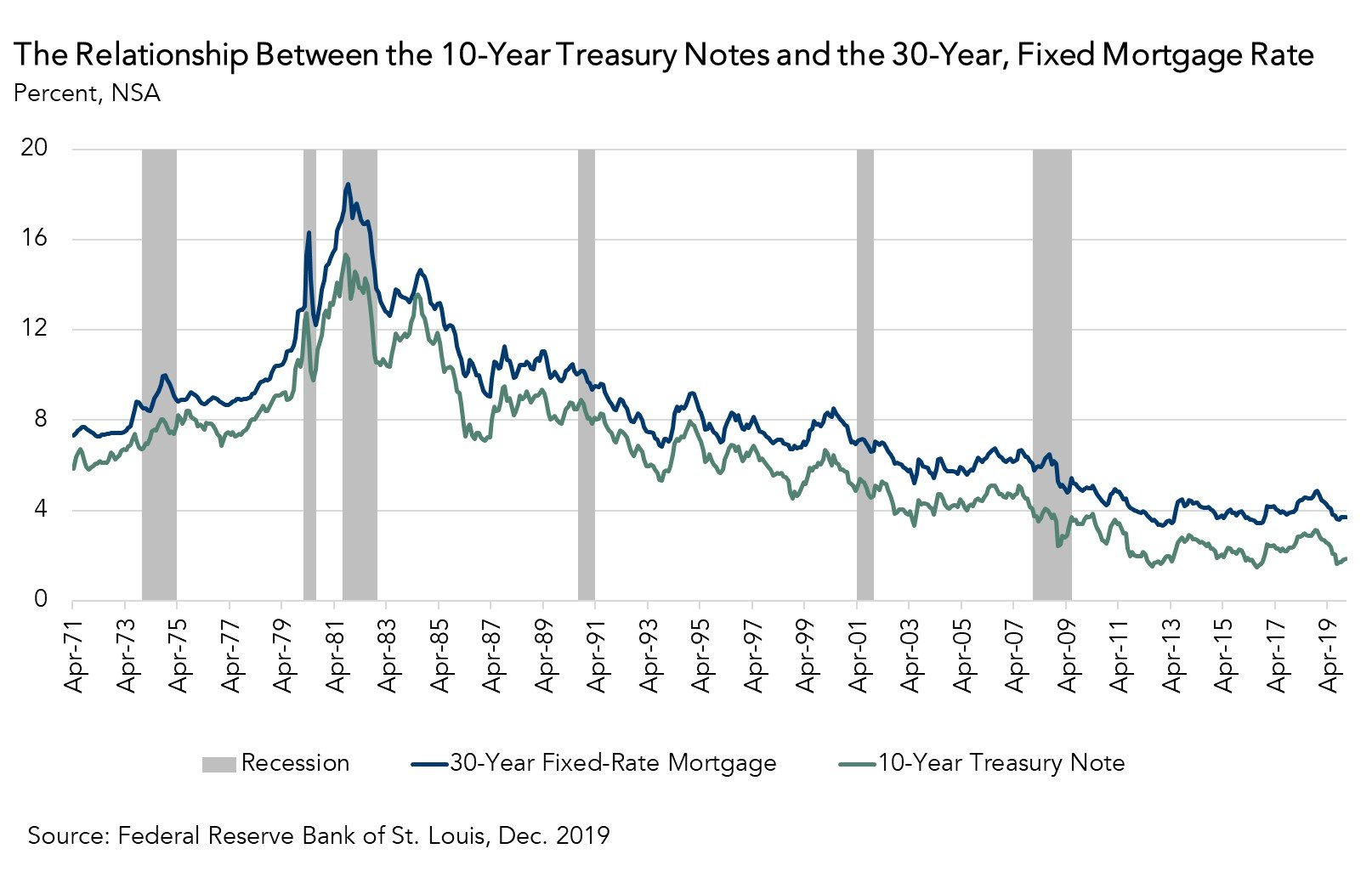

Global events and uncertainty, such as the conflict between the U.S. and Iran, clearly impacts geopolitical relations, but also impacts the U.S. economy, and more specifically, the U.S. housing market. How? Against a backdrop of uncertainty, investors worldwide look for a safe place to put their money. U.S. bonds, backed by the full faith and ...

Read More ›

Interest Rates Real House Price Index Federal Reserve Affordability