Thus far in 2019, the story of the housing market has been a tale of strong housing demand and limited supply. On the demand side, steadily rising house-buying power has fueled greater demand. Falling mortgage rates and rising household income sparked a nearly 12.6 percent increase in house-buying power year to date through September. The impact on demand is evident in overall mortgage application volume, which was 58 percent higher annually (purchase applications 10 percent higher, and refinances 133 percent higher) in the last week of September.

“In a market with low mortgage rates and a healthy labor market, if you build it, they will buy it.”

However, the challenge facing the housing market is not on the demand side -- it’s the supply side, as inventory levels remain historically low. The good news in September is that a year-over-year increase in housing starts signaled some supply shortage relief. But the question is, was this an anomaly or a sign that new home construction is ramping up to help meet demand?

You Can’t Buy What’s Not for Sale

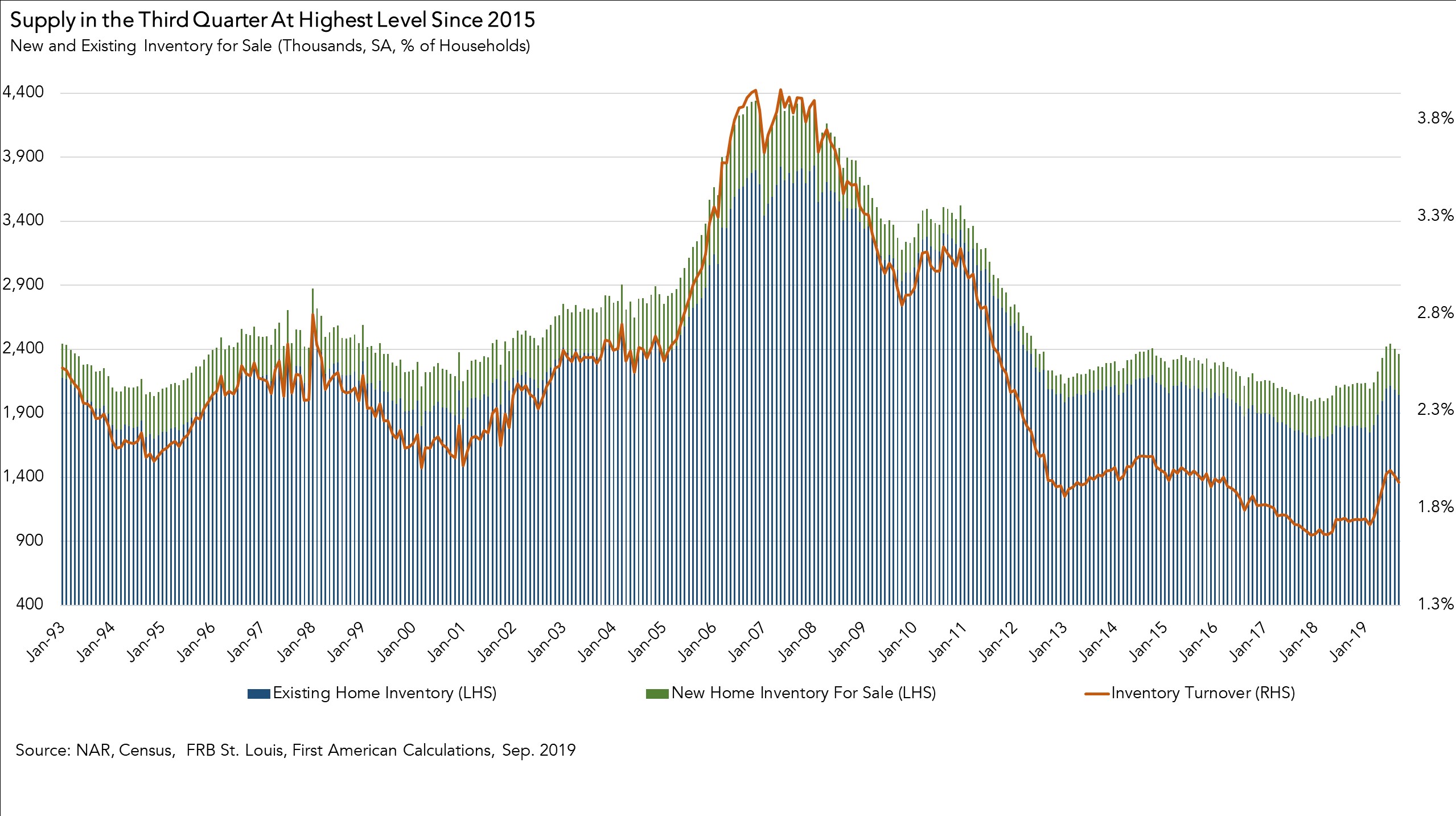

The graph below shows inventory turnover, the total supply of homes for sale nationwide as a percentage of occupied residential inventory. A quick look will show that inventory hit a 25-year low point in December 2017, with a turnover rate of 1.66 percent. In other words, only 166 homes in every 10,000 were for sale. Since then, housing supply has slowly increased. In September, inventory turnover reached 1.9 percent, up from 1.7 percent at the beginning of the year. Indeed, the 2019 third quarter average in housing inventory is the highest level we’ve seen since the third quarter of 2015. While an improvement, this is well below the historical average of about 2.5 percent, or 250 homes for sale out of every 10,000.

The chart also breaks down inventory by its components: existing homes and new homes. Existing-home sales make up approximately 90 percent of all home sales, which means existing homeowners must sell their homes in order for homes to add supply to the housing market. The challenge is tenure length (the amount of time someone lives in their home) has soared to a historic high of over 11 years, which means both fewer homes on the market and fewer buyers and reduces the market potential for existing-home sales. In August and September, lower mortgage rates helped erode the rate “lock-in” effect and more homeowners were enticed to move, marking two consecutive months of growth. But, this was the exception in 2019. Overall, the lack of existing-home inventory in 2019 has created an opportunity for new construction to meet demand.

More Hammers, More Homes

If there aren’t enough existing-homes available for sale to meet demand, what’s preventing homebuilders from building more homes? The construction industry continues to face several supply-side headwinds: increasing material costs, a chronic lack of construction workers, a dearth of buildable lots, and restrictive regulatory requirements in many markets.

However, in September, housing starts increased 1.6 percent from September 2018 as builders overcame these headwinds and delivered new supply to the housing market. Further increases in new home construction may be on the way as well. Residential construction jobs increased 4.1 percent between September 2018 and September 2019.

More people at work in residential construction signals that housing construction is likely to increase in the months ahead, reinforcing reports that builder confidence increased in October, even in the face of cost challenges. Additionally, the month-over-month increase in single-family housing starts to a seasonally adjusted annual rate of 918,000 is good news for future supply, but still falls short of the 1.2 million units that would be needed to meet the increased demand stemming from rising household formation.

What Does the Future Hold?

In September, builders were rewarded for bringing more housing supply to the market, as new home sales increased 15.5 percent year-over-year. Demand for new homes remains strong as household formation continues to grow, and low mortgage rates and rising household income buoy purchasing power. And the good news for home buyers is that the year-over-year growth in both housing starts and permits in September is a sign that more housing is on the way. In a market with low mortgage rates and a healthy labor market, if you build it, they will buy it.