What Triggered the Biggest Increase in House-Buying Power in Five Years?

By

Mark Fleming on February 25, 2019

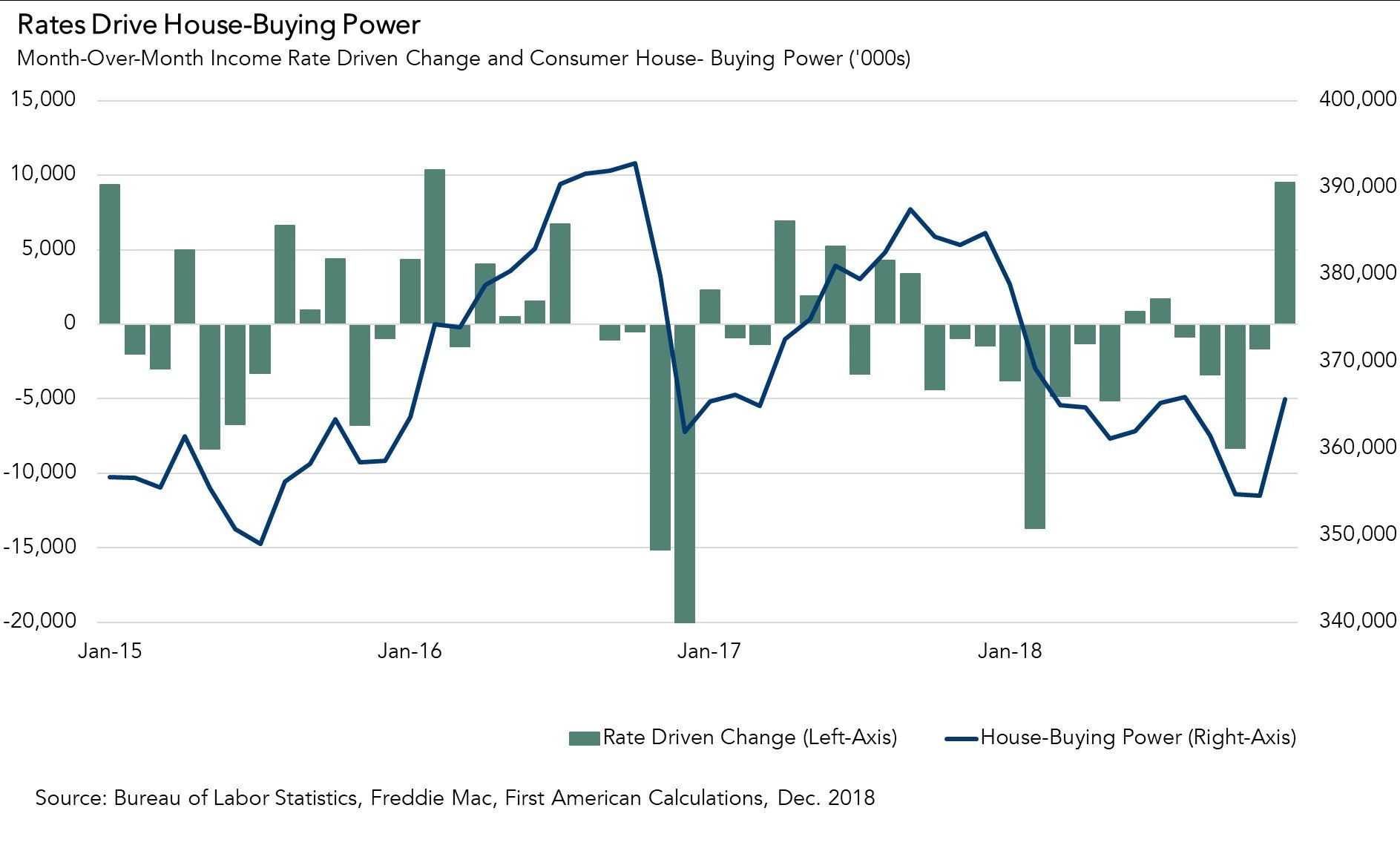

Housing affordability is a function of three economic drivers: nominal house prices, household income and mortgage rates. When incomes rise, consumer house-buying power increases. Declining mortgage rates or declining nominal house prices also increase consumer house-buying power. Our Real House Price Index (RHPI) uses consumer house-buying power ...

Read More ›

Six More Months of Housing Winter or Early Spring Home-Buying Season?

By

Mark Fleming on February 20, 2019

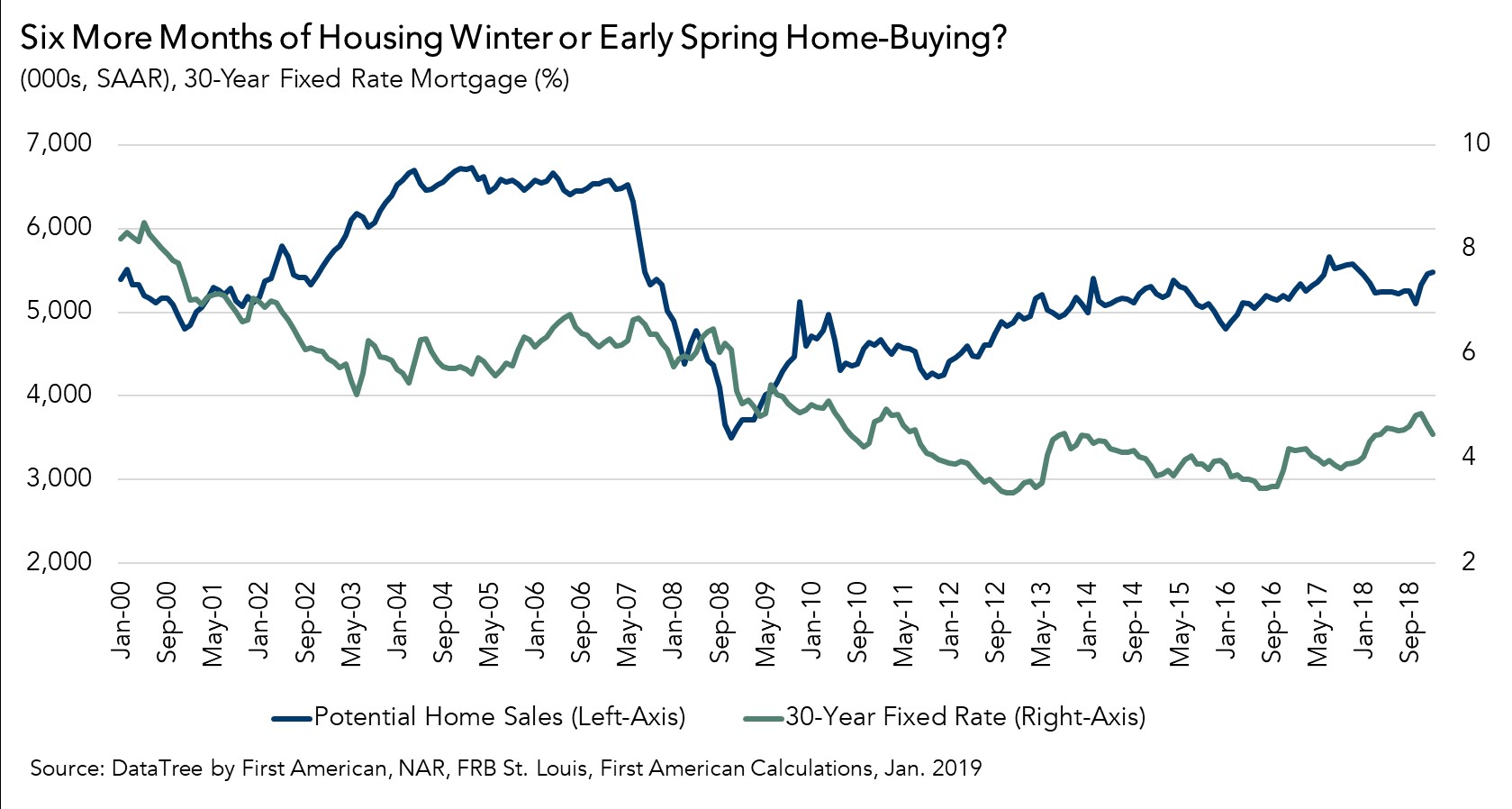

In the first month of the new year, the housing market continued to underperform its potential, but gave us signs of promise for the future. Actual existing-home sales are 5.3 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support 293,000 more home sales than the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

What is the Impact of Student Loan Debt on House-Buying Power?

By

Odeta Kushi on February 15, 2019

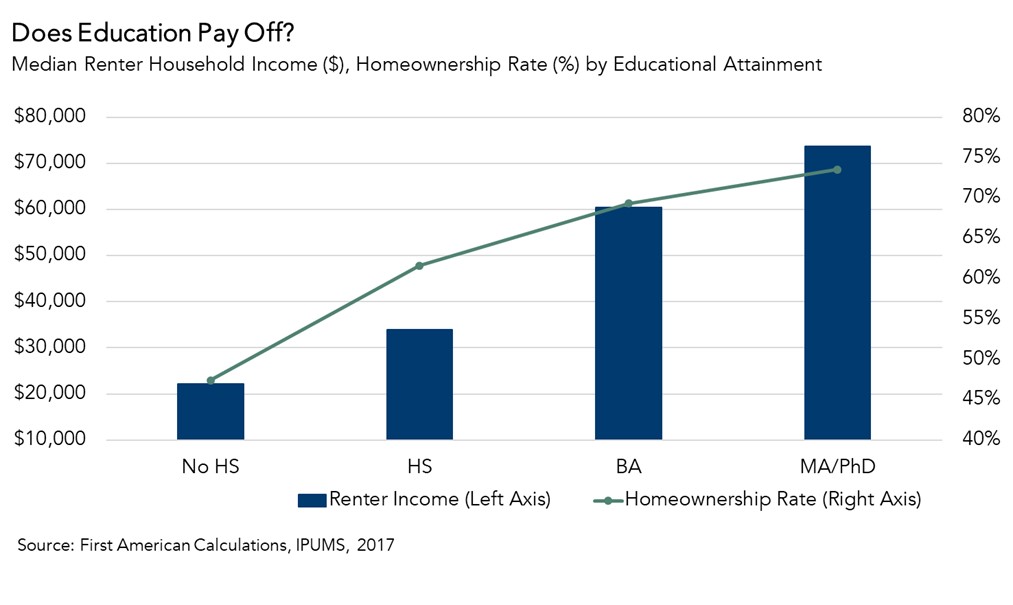

Contrary to many reports, student loan debt is not an insurmountable barrier to homeownership for millennials. Student loan debt is more likely to delay the timing of homeownership, but it does not necessarily prevent homeownership. But, this begs the questions, how does student loan debt impact house-buying power? And, is higher education a ...

Read More ›

Millennials Education Homeownership Progress Index Homeownership

Interviews on NPR and Forbes.com: Discussing Millennial Homeownership and the 2019 Spring Home Buying Season

By

FirstAm Editor on February 6, 2019

First American Deputy Chief Economist Odeta Kushi provided perspective on millennial homeownership in an interview with National Public Radio and Chief Economist Mark Fleming’s expectations for the spring home buying season were featured in a Forbes.com article earlier this month.

Read More ›

Housing In The News Interest Rates Millennials Affordability

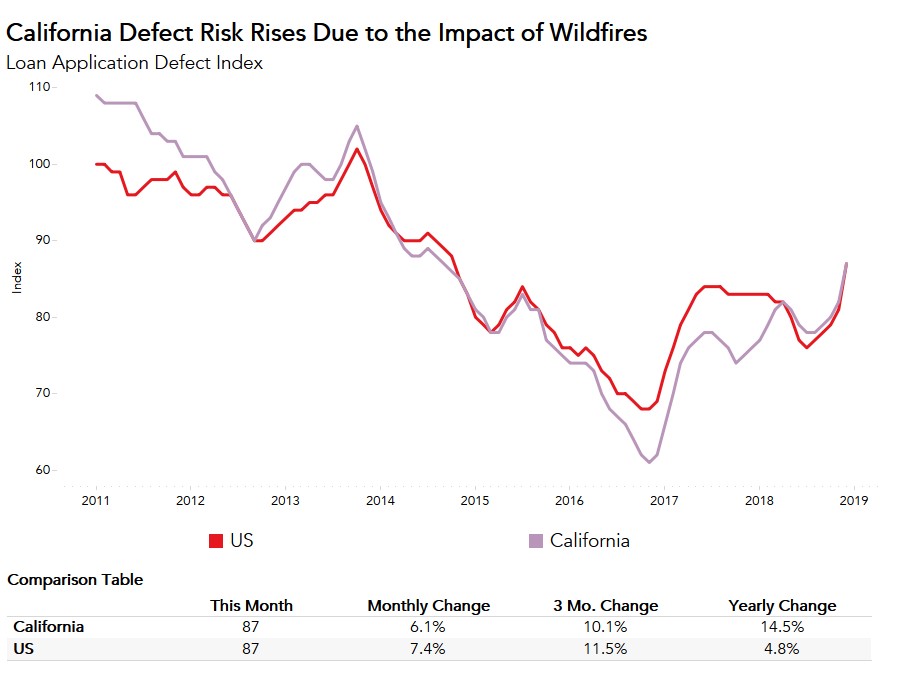

Will Loan Application Defect Risk Stabilize in 2019?

By

Mark Fleming on January 30, 2019

In December 2018, the Loan Application Defect Index for purchase transactions continued its string of month-over-month increases, rising for the fourth month in a row. Despite the upswing, the Defect Index for purchase transactions still remains 1.1 percent below its level in December 2017. The Defect Index for refinance transactions also ...

Read More ›

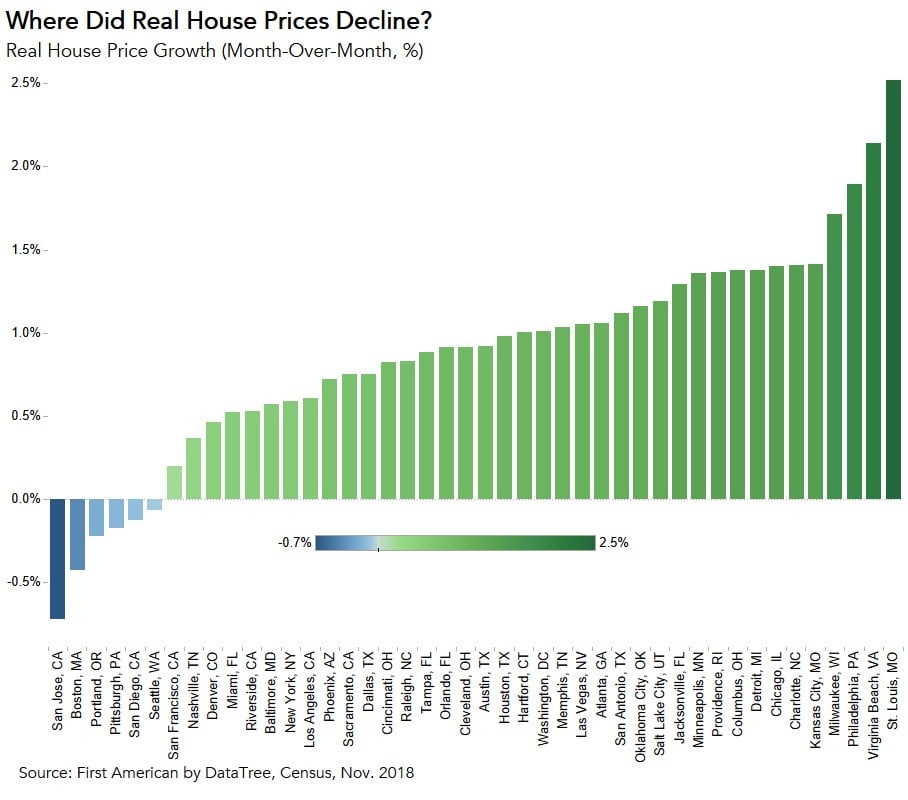

Where is the Housing Market Cooling the Most?

By

Mark Fleming on January 28, 2019

Throughout 2018, consistent growth among three driving forces – mortgage rates, household income, and unadjusted house prices – defined the housing market. These three factors are also the core metrics that comprise the Real House Price Index (RHPI). November 2018 was no exception, as household income, mortgage rates, and the unadjusted house ...

Read More ›