Interview on CNBC: Discussing the Impact of Declining Mortgage Rates and Limited Supply on the Housing Market

By

FirstAm Editor on March 27, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC on Tuesday and discussed how the decline in mortgage rates over the last few months and continued tight housing supply are likely to impact the housing market.

Read More ›

Housing New Home Buying In The News Interest Rates Affordability

Three Reasons Home Buyers Have More Power This Spring

By

Mark Fleming on March 25, 2019

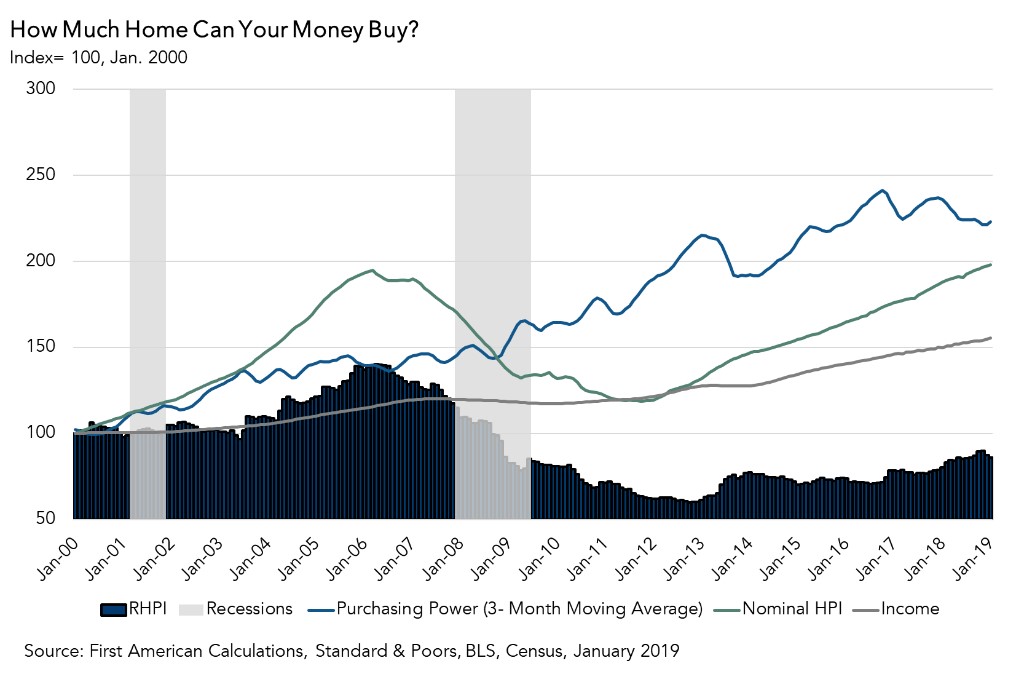

While 2018 was largely characterized by declining affordability, ending the year with a five percent yearly decline in house-buying power, this trend reversed sharply in early 2019. Moderating home prices, in conjunction with gains in household income and declining mortgage rates, boosted affordability for potential home buyers.

Read More ›

Why The Stage Is Set For A Stronger Spring Home-Buying Season

By

Mark Fleming on March 21, 2019

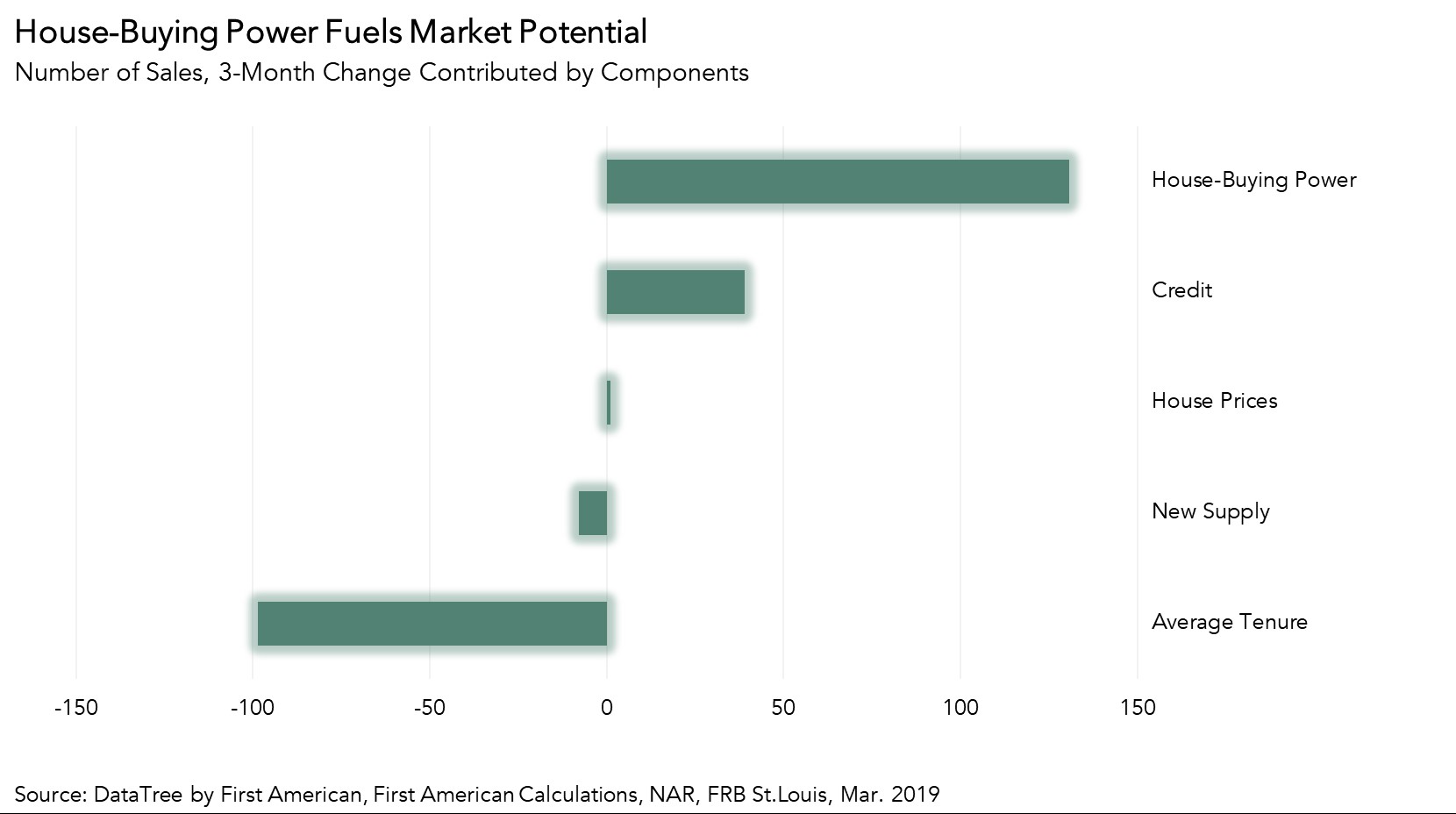

In February 2019, the housing market continued to underperform its potential, but showed signs of promise leading into the spring home-buying season. Actual existing-home sales are 2.5 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support 127,000 more home sales at a ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

How Homebodies Hold Down Home Sales

By

Odeta Kushi on March 19, 2019

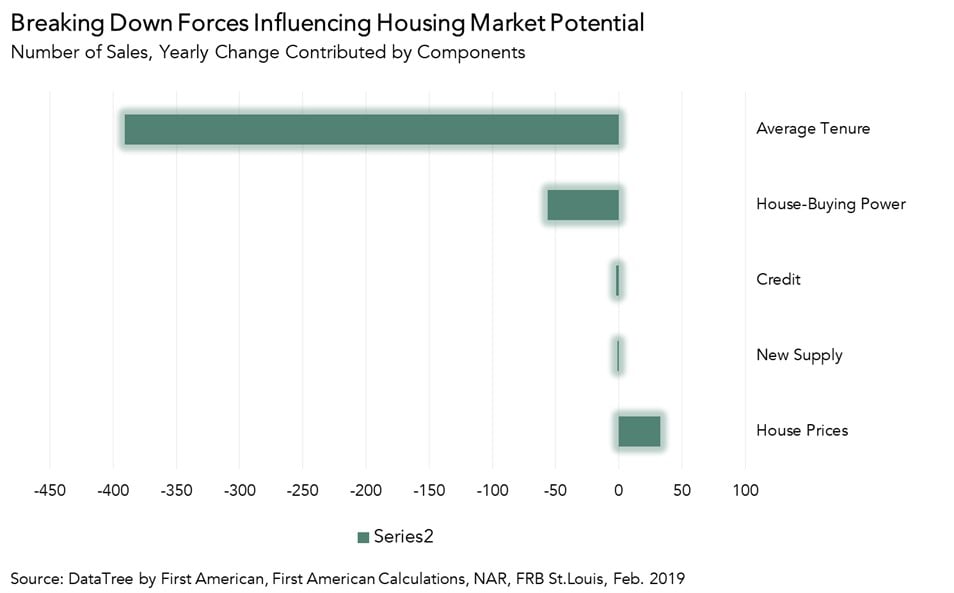

First American’s most recent Potential Home Sales model for January 2019 found a 5.7 percent decline in the market potential for existing home sales, compared to the previous year. Increasing tenure length (the length of time a homeowner stays in their home before moving) was the most prominent factor leading to this decline.

Read More ›

What Will it Take to Reduce the Housing Supply Deficit?

By

Mark Fleming on March 6, 2019

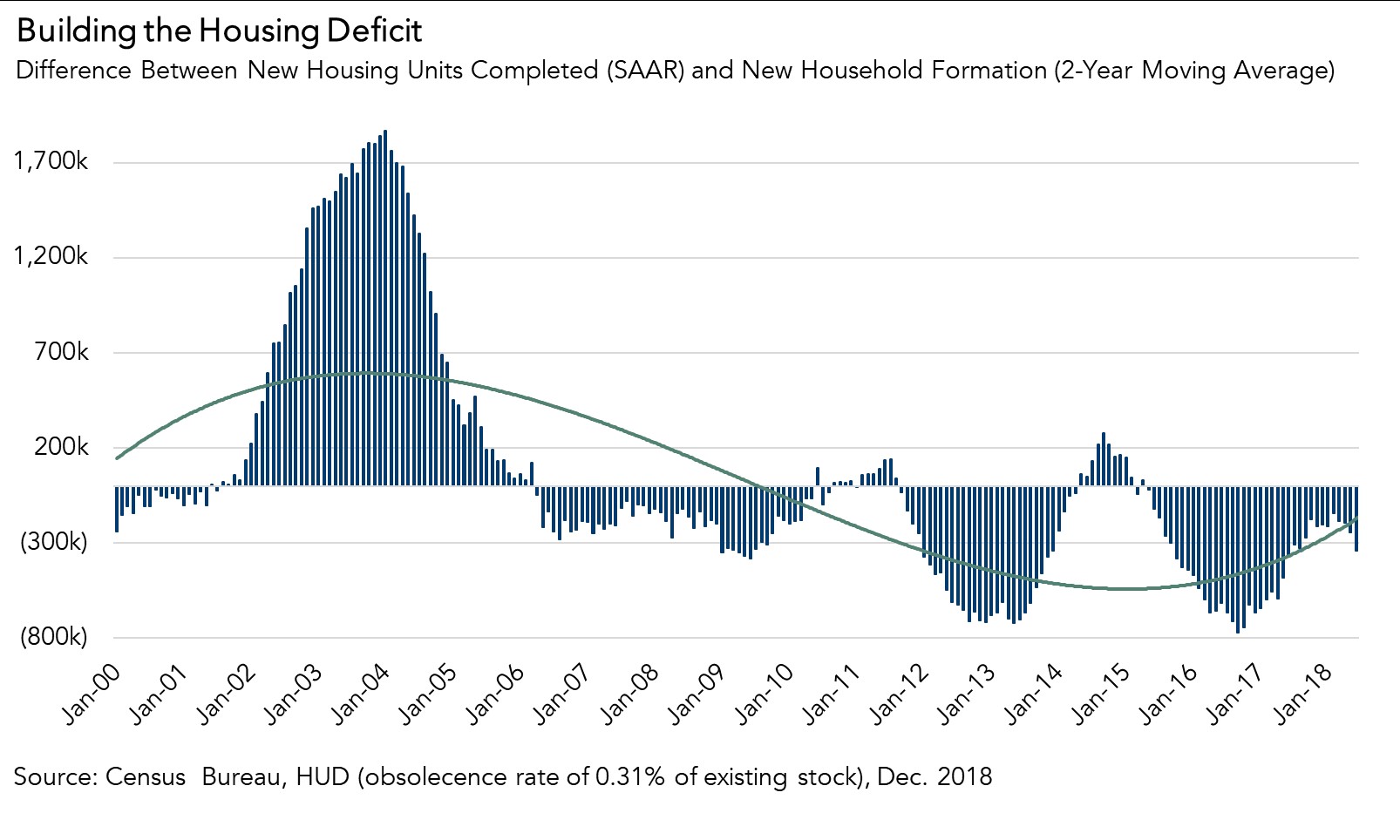

Last week, the Census Bureau released its Residential Construction report for December. Housing completions decreased 8.4 percent compared with last December and continued to fall short of the number of new housing units necessary to keep pace with household formation. Housing starts also decreased 10.9 percent in December compared with a year ...

Read More ›

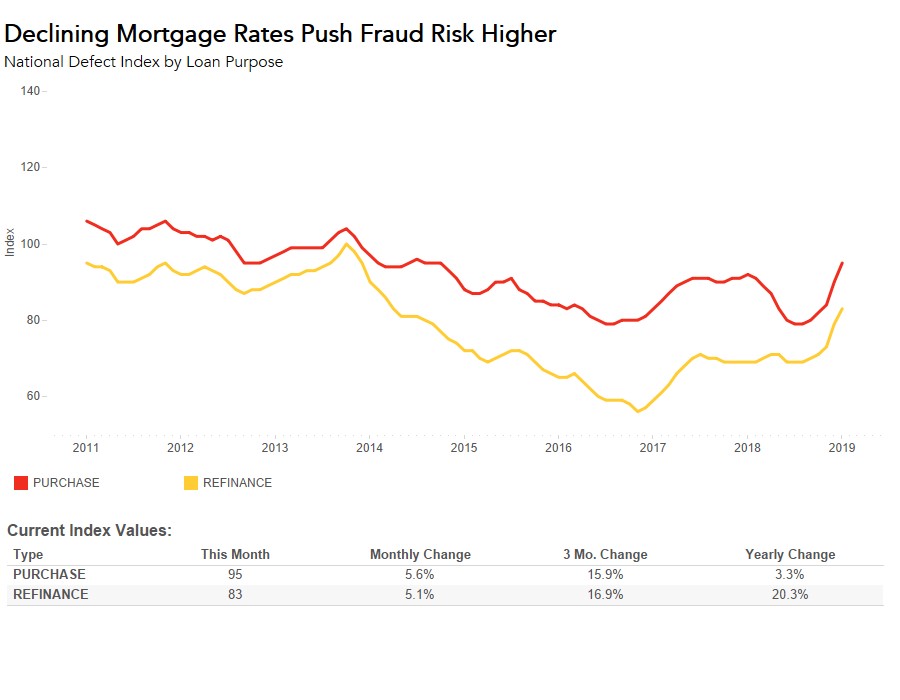

Why is Loan Application Fraud Risk Accelerating?

By

Mark Fleming on February 28, 2019

The Loan Application Defect Index for purchase transactions continued its upward trend, increasing 5.6 percent in January compared with the month before, the fifth consecutive month defect risk in purchase transactions has risen. Overall, the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan ...

Read More ›