Last week, the Census Bureau released its Residential Construction report for December. Housing completions decreased 8.4 percent compared with last December and continued to fall short of the number of new housing units necessary to keep pace with household formation. Housing starts also decreased 10.9 percent in December compared with a year ago, falling to their lowest level since September 2016.

“For more than a decade, home building has not kept up with the demand for shelter, creating a housing supply deficit that has proven difficult to reduce significantly.”

The bright spot in an otherwise underwhelming report comes from the overall number of permits issued, which can signal how much construction is in the pipeline. The overall number of permits edged up 0.5 percent compared with December of last year. The overall increase in permits was largely driven by multi-family homes (5 or more units), which increased 13.6 percent compared with a year ago. Building permits increased in three of the last four months, indicating that we should expect construction growth in the months ahead.

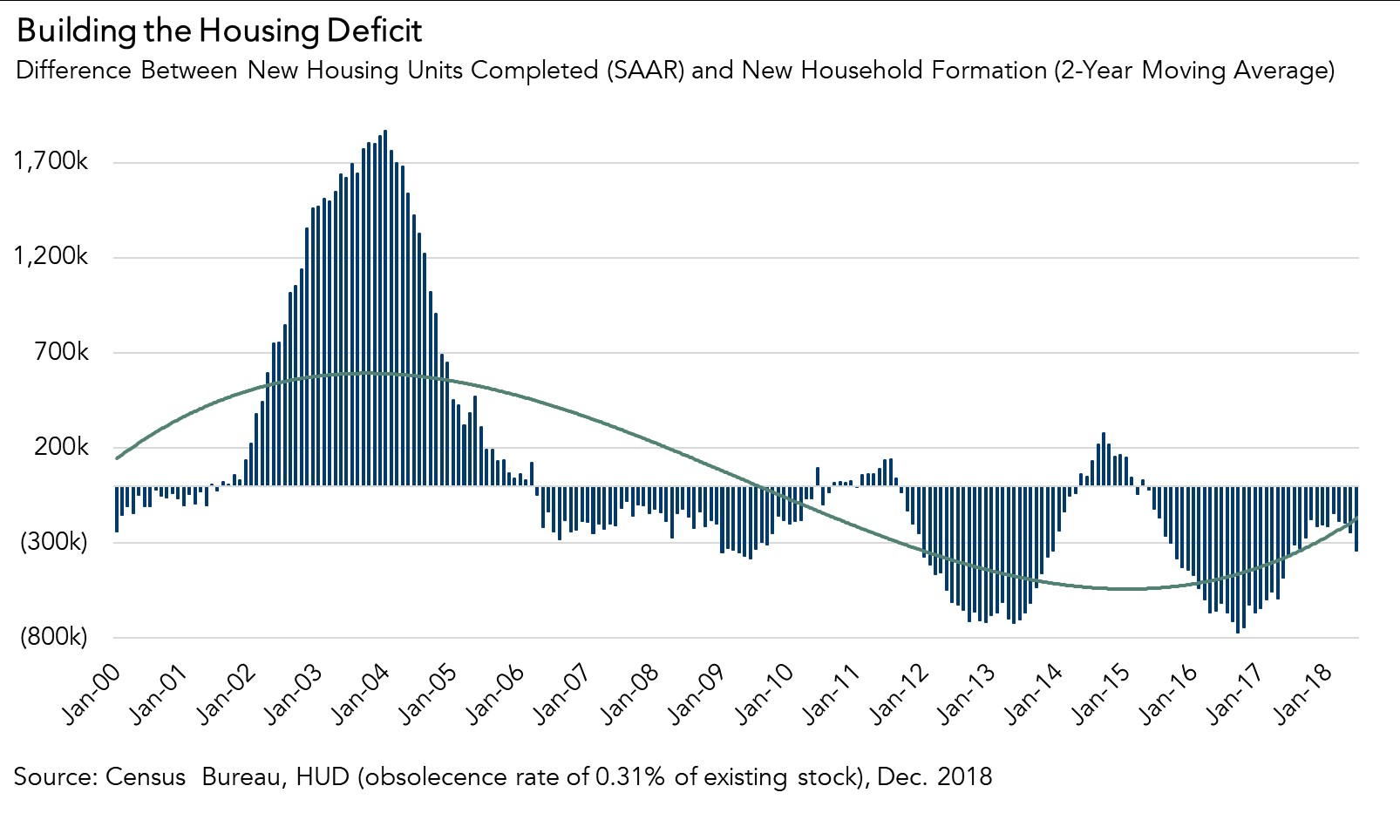

Building the Housing Deficit

Since 2007, household formation has significantly outstripped housing construction, creating a substantial housing supply deficit. While housing completions are above their post-crisis lows, they remain well below is the level needed to meet demand.

We estimate that over one million new households were created in 2018, adding to the demand for housing. Yet, only 761,000 new housing units completed – the net number of units completed when accounting for single-family dwellings, apartments, manufactured homes and obsolescence. This leaves a shortage of just over 648,000 housing units today, the highest housing deficit since December 2016.

During the housing boom, builders overbuilt relative to demand (new home construction exceeded new household formation), hitting a peak of nearly two million units in January 2004. The excess supply, as well the housing collapse and Great Recession, put downward pressure on prices. Home builders dramatically reduced construction to adjust and have struggled to ramp up construction in the years since.

For more than a decade, home building has not kept up with the demand for shelter, creating a housing supply deficit that has proven difficult to reduce significantly. In fact, the housing deficit in September 2016 was nearly 800,000 units – the widest gap between new household formation and housing completions in 18 years. While the monthly deficit has moderated substantially since then, home building has not increased sufficiently to close the gap left from more than a decade of underbuilding. Why? Construction faces several supply-side headwinds: increasing material costs, a chronic lack of construction workers, a dearth of buildable lots and restrictive regulatory requirements in many markets.

Despite these headwinds, there are signs of promise. January’s month-over-month gain of 9,000 residential construction jobs bodes well for more completions, and the modest growth in building permits, a leading indicator of housing starts, represents the green shoots of much-needed new housing supply. Home builder confidence echoes this sentiment, with builder confidence jumping to a four-month high this month. As builders begin to break ground on additional housing, we will inch closer to balancing our housing deficit.

Deputy Chief Economist Odeta Kushi contributed to this blog post.

December 2018 Housing Starts:

Per the Census Bureau, December's new residential construction report was "delayed due to the lapse in federal funding from December 22, 2018 through January 25, 2019." January's new residential construction report will be issued on Friday, March 8 and February's new residential construction report will be issued on Tuesday, March 26.

For the month of December 2018, the new residential construction report shows that:

- The number of building permits issued, a leading indicator of housing starts, increased by 0.5 percent year over year.

- Housing starts decreased by 10.9 percent, compared with a year ago.

- The stock of housing units authorized to be built increased by 0.5 percent, and the number of housing units under construction increased by 3.5 percent on an annual basis.

- The number of completed homes, which is additional new net supply added to the housing stock, decreased by 8.4 percent compared with a year ago.

Chief Economist Analysis Highlights

- The annual decrease in completions signals a slowdown in immediate housing supply relief.

- In December, the overall pace of housing starts, at 1.08 million units, is a 11.2 percent decrease from the previous month. Based on the less volatile three-month moving average, the volume of total residential (single- and multi-family) housing starts is 53,000 units less than November 2018, and 97,000 units less than a year ago.

- Housing starts are an important indicator of future supply as the housing market continues to face a supply constraint challenge.

- An estimated seasonally adjusted annualized rate of 1.10 million housing units were completed in December, representing an 8.4 percent decrease from the December 2017 figure of 1.20 million.

What Insight Does Monthly Housing Start Data Provide?

Housing starts data reports the number of housing units on which construction has been started in the month reported, providing a gauge of future real estate supply levels. The source of monthly housing starts data is the “New Residential Construction Report” issued by the U.S. Census Bureau jointly with the U.S. Department of Housing and Urban Development (HUD). The data is derived from surveys of homebuilders nationwide, and three metrics are provided: building permits, housing starts and housing completions. Building permits are a leading indicator of housing starts and completions, providing insight into the housing market and overall economic activity in upcoming months. Housing starts reflect the commitment of home builders to new construction, as home builders usually don't start building a house unless they are confident it will sell upon completion. Changes in the pace of housing starts tells us a lot about the future supply of homes available in the housing market. In addition, increase in housing starts can lead to increases in construction employment, which benefits the overall economy. Once the home is completed and sold, it generates revenue for the home builder and other related industries and is added to the housing stock.