Single Women Buck the Trend When it Comes to Homeownership

By

Odeta Kushi on March 6, 2025

Key Points: In 2024, single women overcame affordability challenges and increased their homeownership rate to nearly 52 percent, while the overall homeownership rate declined. Single women are making significant financial sacrifices, such as cutting non-essential spending and taking on second jobs, to save for down payments and purchase homes. ...

Read More ›

2024 House Price Blitz – Analyzing NFL Divisions by Median House Prices

By

Mark Fleming on October 7, 2024

Key Points: The NFC West has the highest median sales prices because it’s home to three of the most expensive markets in the country: San Francisco, Los Angeles, and Seattle. The AFC north has the lowest median sale prices because it includes two of the least expensive markets in the country – Cleveland and Pittsburgh. Markets comprising the NFC ...

Read More ›

‘She-Cession’ Can’t Slow Homeownership Surge Among Single Women

By

Ksenia Potapov on March 7, 2024

As we commemorate International Women’s Day and Women’s History Month, it’s an opportune time to celebrate the progress that single women have made in pursuit of the American Dream of homeownership. According to an analysis of anonymized household-level survey data, the homeownership rate among single, female-headed households (including widowed, ...

Read More ›

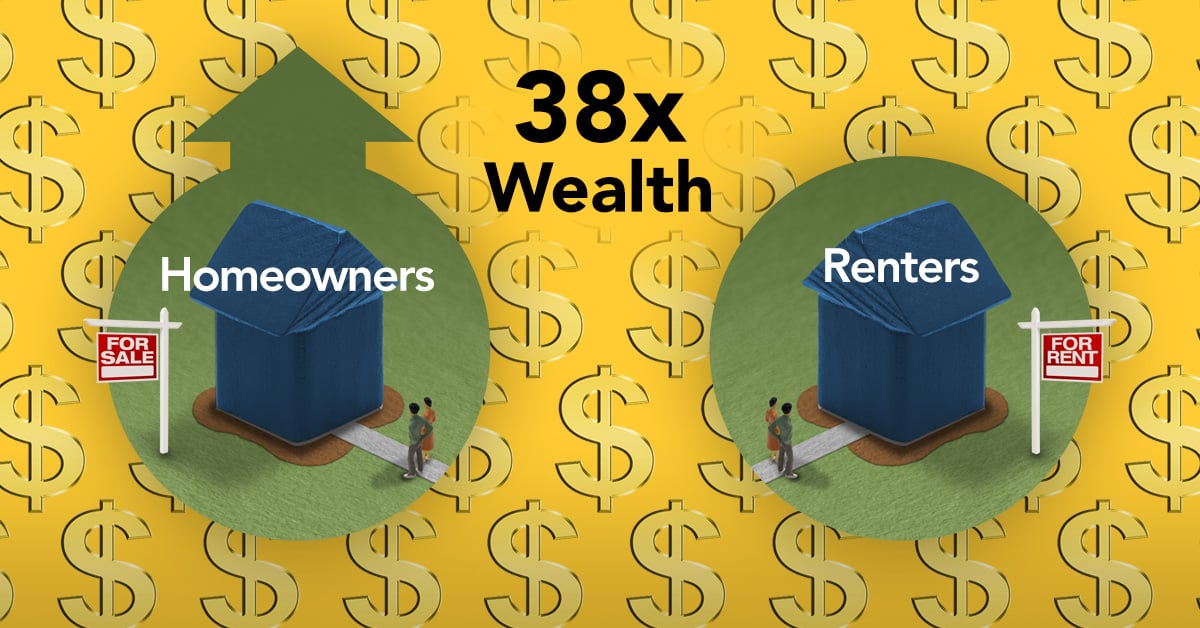

Building Wealth Brick by Brick

By

Ksenia Potapov on December 4, 2023

Homeownership is often touted as one of the most effective ways to build wealth, especially for lower income households, for several reasons. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners. ...

Read More ›

When Boomers and Millennials Collide: Tectonic Shifts in Demographics are Coming

By

Ksenia Potapov on October 6, 2023

Demographic trends are a fundamental driver of housing demand and supply and analyzing them can help us anticipate how many people will need housing, as well as roughly when, where and what kind of housing. During the pandemic, the peak of millennial demand for homeownership coincided with record-low mortgage rates and a shortage of homes for ...

Read More ›

Why Buy a Home Now if it’s Likely to Cost More in the Future?

By

Ksenia Potapov on September 7, 2023

The millennial generation, those born between 1981 and 1996, have recently dominated the demand side of the housing market. However, Generation Z, those born between 1997 and 2012, is on the cusp of aging into their prime home-buying years. While potential first-time home buyers, mostly millennials and older Gen Zers, jumped on the historically ...

Read More ›

.jpg)