Can Stock Market Volatility Help Home Buyers?

By

Mark Fleming on January 21, 2019

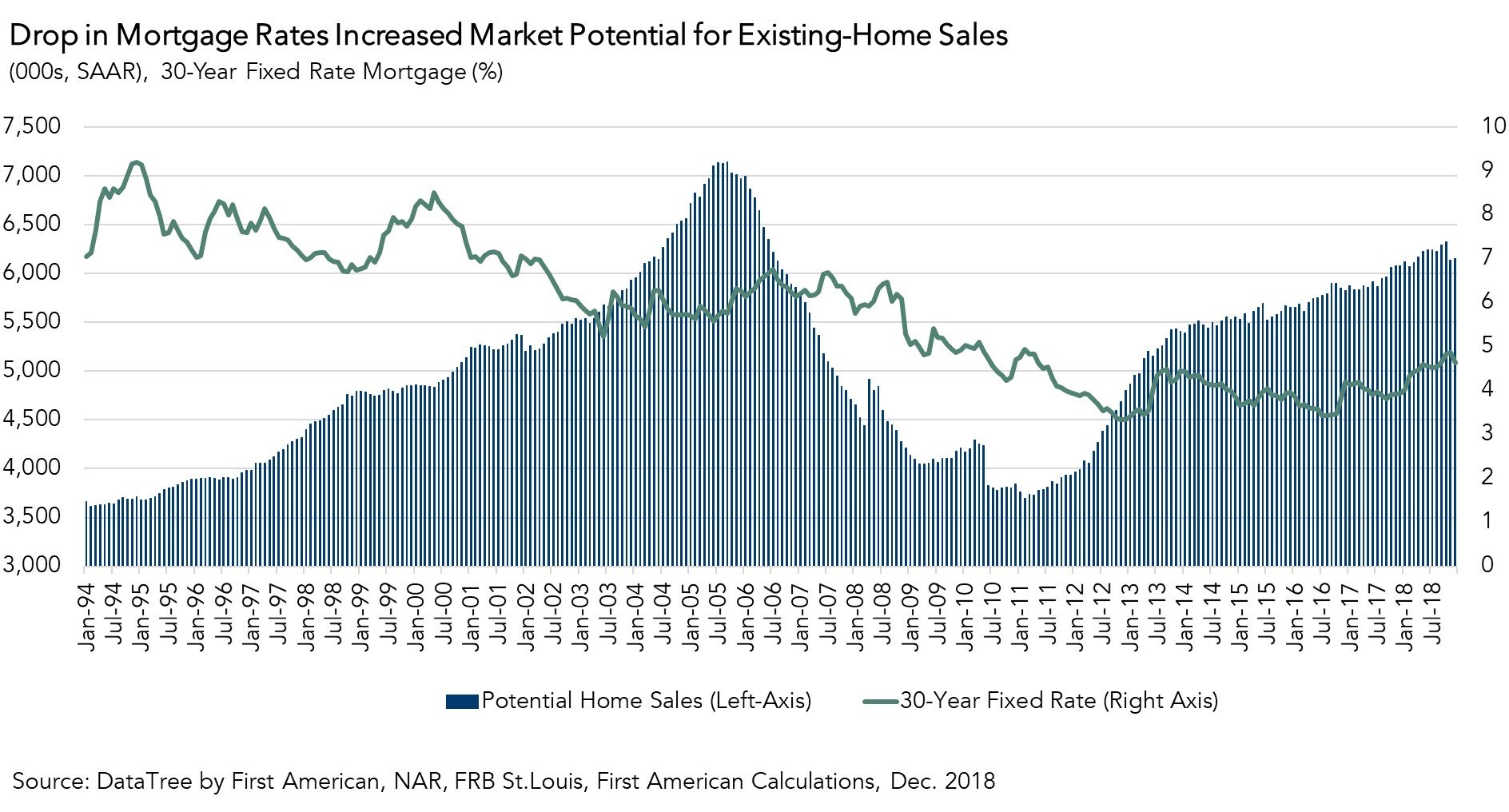

In December, the market potential for existing-home sales in December increased 1.1 percent to a seasonally adjusted annualized rate of 6.15 million compared with a year ago, but the housing market still underperformed its potential by 9.6 percent, according to our Potential Homes Sales Model. Month over month, the gap between actual existing-home ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

Interviews on CNBC and Yahoo! Finance: Discussing the 2019 Mortgage Rate Outlook, Millennials and Student Debt, and Baby Boomers and Limited Housing Supply

By

FirstAm Editor on January 18, 2019

First American Chief Economist Mark Fleming was interviewed on both CNBC and Yahoo! Finance earlier this week and discussed the outlook for mortgage rates in 2019, the impact of student debt on millennial first-time home buyers and how baby boomers aging in place is limiting housing supply.

Read More ›

Housing In The News Interest Rates Millennials Affordability Baby Boomers

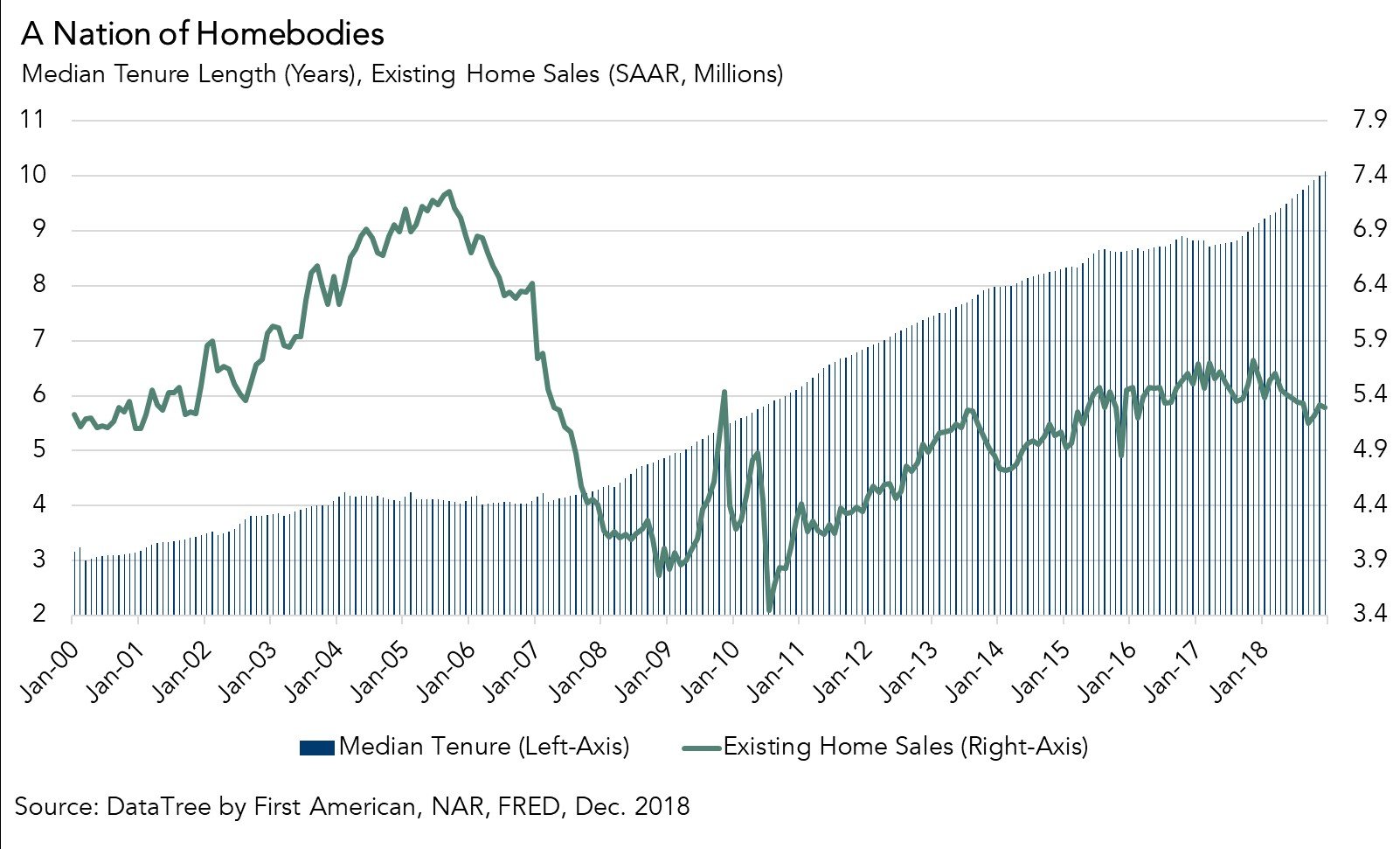

Blame The Homebodies: Why Are Homeowners Staying In Their Homes So Long?

By

Mark Fleming on January 11, 2019

It’s been over six years since house prices hit their trough and the housing market bottomed out. Since then, house prices have recovered nationally and reached historic highs. The price recovery has most recently been driven by a supply shortage. The availability of homes for sale is running near historic lows because single-family housing ...

Read More ›

Will Millennials Migrate Away from Coastal Markets for Homeownership in 2019?

By

Odeta Kushi on January 7, 2019

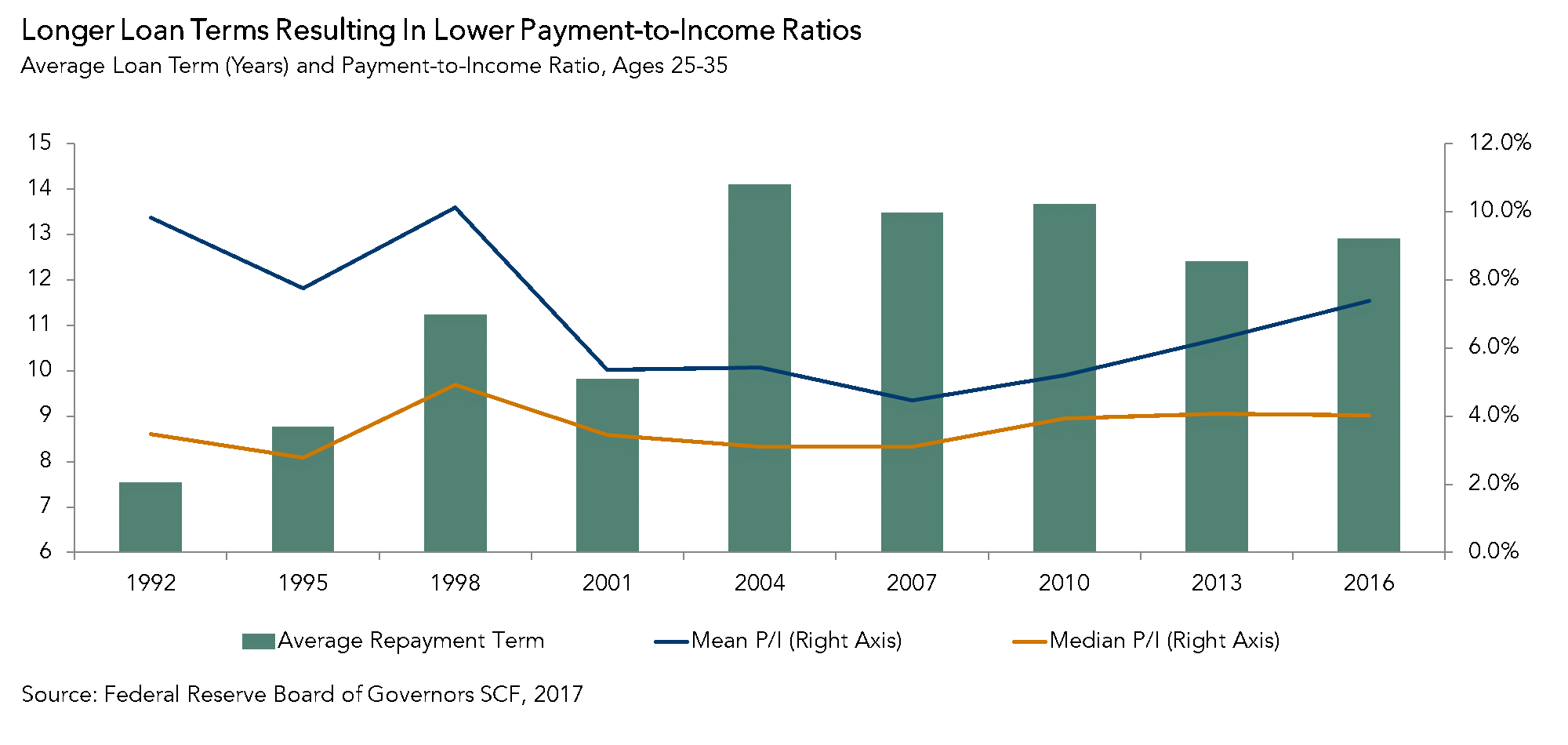

As we enter 2019 and the bulk of the millennial generation ages into their prime home-buying years, is homeownership an attainable New Year’s resolution for millennials?

Read More ›

Millennials Education Homeownership Progress Index Homeownership

Interview on CNBC: Discussing the 2019 housing market outlook

By

FirstAm Editor on January 4, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC earlier this week and shared his perspective on today’s housing market and the outlook for 2019.

Read More ›

Housing In The News Interest Rates Millennials Affordability

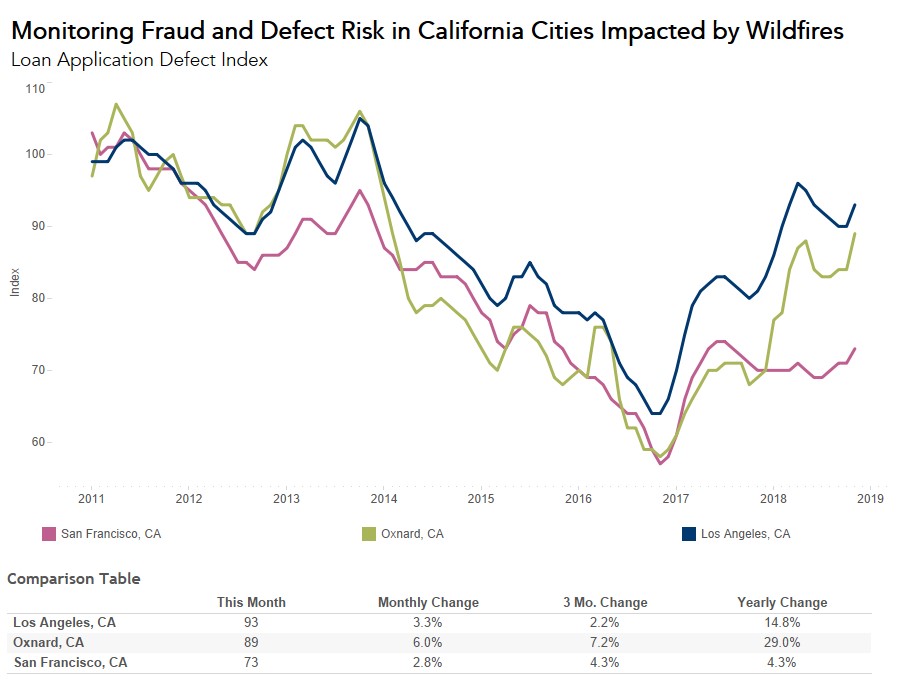

Defect Risk Jumps Nationally, Partially Influenced by Rising Defect Risk in California Wildfire Areas

By

Mark Fleming on December 26, 2018

In November, the Loan Application Defect Index for purchase transactions continued its string of month-over-month increases, rising for the third month in a row. Yet, year over year, the Defect Index for purchase transactions remains 7.7 percent below its level in November 2017. The Defect Index for refinance transactions also increased 2.8 ...

Read More ›