How Can Existing-Home Sales Exceed Market Potential?

By

Mark Fleming on September 18, 2019

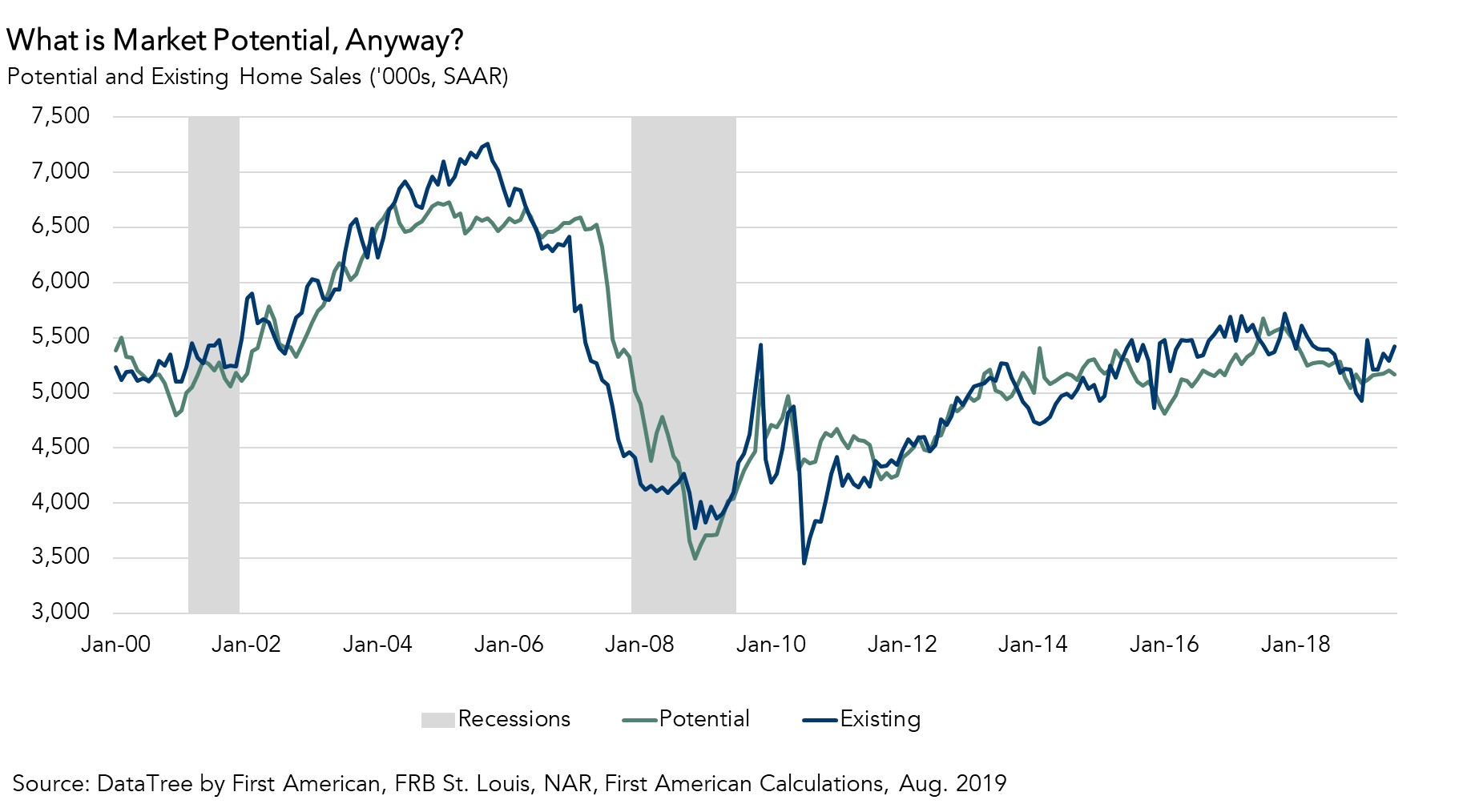

The housing market exceeded its potential in August 2019, as actual existing-home sales were 0.8 percent above the market’s potential. Housing market potential increased relative to last month, but declined 1.9 percent compared with August of last year. While down compared with a year ago, existing-home sales have slightly outperformed market ...

Read More ›

What is the Neutral Rate of Interest and How Does it Influence the Federal Reserve?

By

Mark Fleming on September 17, 2019

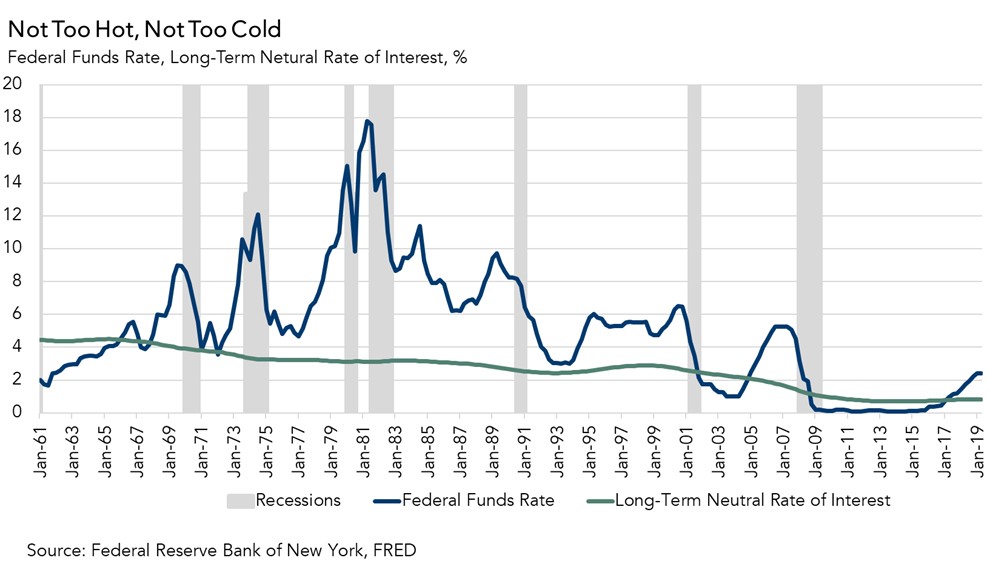

Many people understand the “natural rate of unemployment,” and if you don’t, you can probably guess what it is – the rate of unemployment when the labor market reaches equilibrium. What many people don’t know is that a similar concept exists in monetary policy.

Read More ›

Does Education Really Lead to Greater Earning Power?

By

Odeta Kushi on September 13, 2019

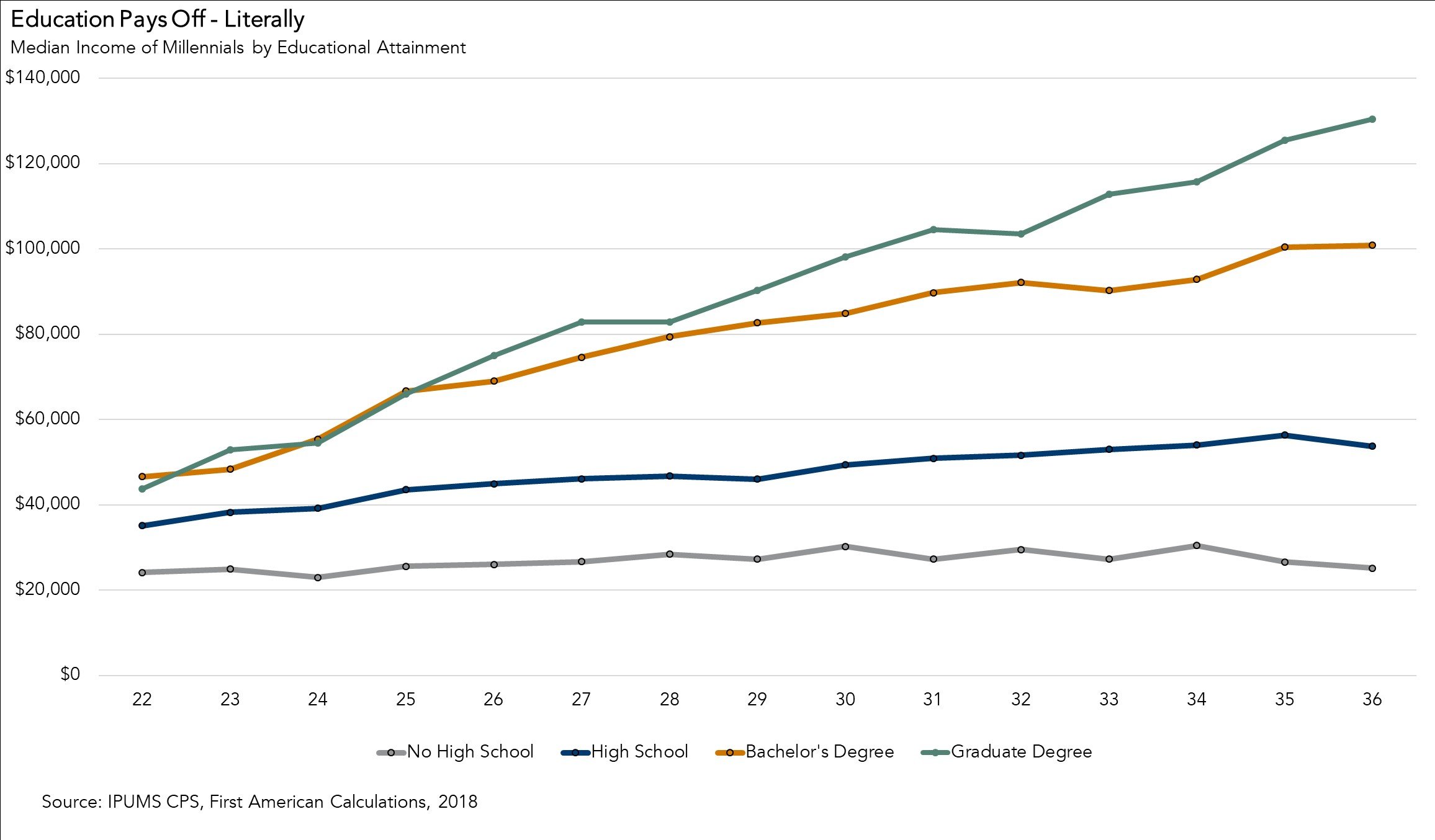

Whether it’s parents shuttling their children off to elementary school or students starting their final year of college, back-to-school season is here. We generally spend a minimum of 12 years as a student, more if you pursue a college degree. Along the way, we’re told that education is critical to your ability to earn a decent living.

Read More ›

Interview on FOXBusiness: Discussing the outlook for the U.S. economy, Federal Reserve policy and the state of the job market

By

FirstAm Editor on September 6, 2019

First American Chief Economist Mark Fleming was interviewed on FOXBusiness earlier this week and discussed the U.S. economy, Federal Reserve policy and the state of the job market.

Read More ›

Where Do Renters Have an Edge in the Pursuit of Homeownership?

By

Odeta Kushi on September 5, 2019

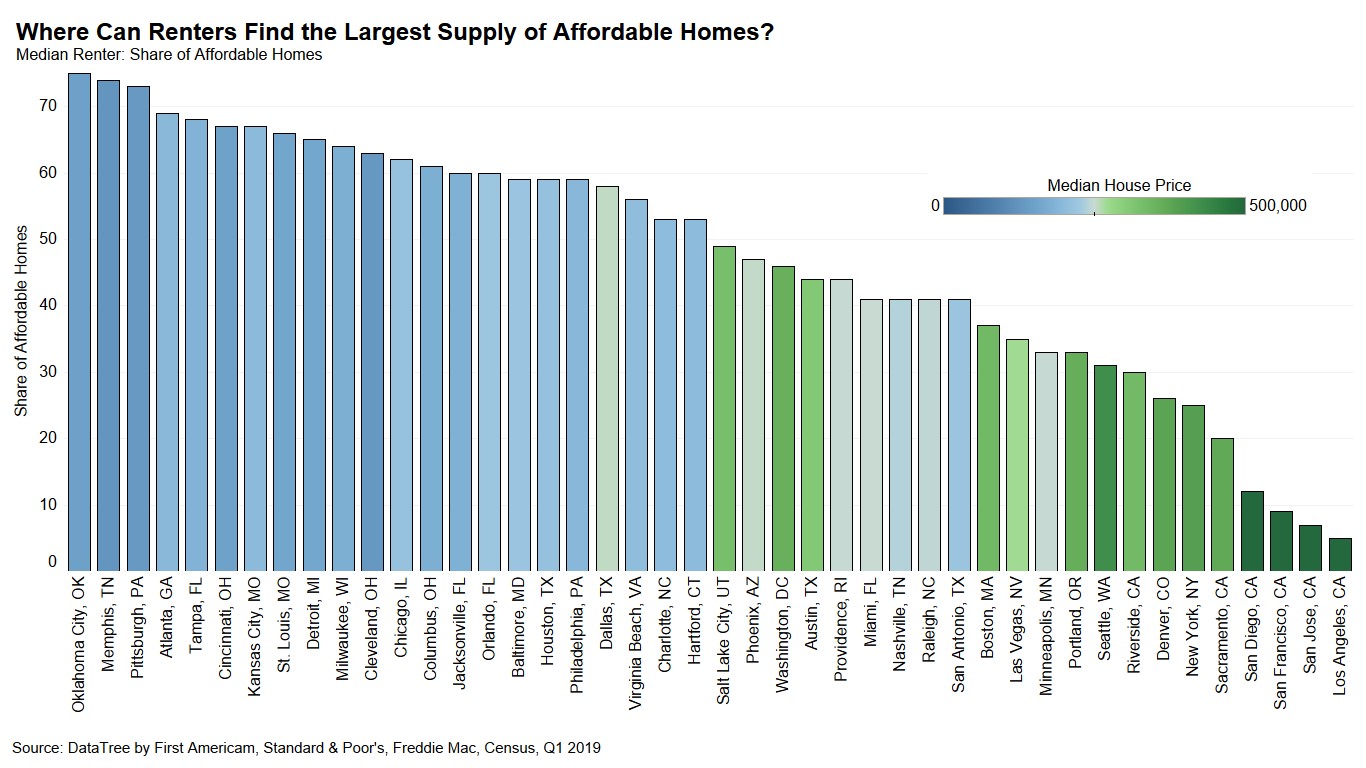

Traditional measures of affordability can be misleading to potential first-time home buyers because they compare overall median household income with the income required to purchase a median-priced home. However, median household income includes existing homeowner households, which have significantly higher median income than renter households, so ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

Interviews on CNBC and Nightly Business Report: Discussing the Refinance Boom and Tailwinds Boosting the Housing Market

By

FirstAm Editor on September 3, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi was interviewed on Nightly Business Report last week, where they discussed the refinance boom driven by low mortgage rates and the tailwinds boosting the housing market.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability