In late 2018, many experts believed the housing market in 2019 would behave very similar to the 2018 housing market, characterized by rising demand for homes and limited supply driving house price appreciation, while mortgage rates continued their steady ascent. Then, December 2018 brought a sudden drop in mortgage rates, a decline which has persisted into the first half of 2019. As part of our bi-annual First American Real Estate Sentiment Index (RESI), we recently surveyed title insurance agents and real estate professionals across the nation for their perspective on how the unexpectedly low mortgage rates have impacted home buyers and sellers in their market.

"Title agents and real estate professionals indicate home buyers encouraged by unexpectedly lower mortgage rates in 2019 – a tailwind helping to boost demand and inspire existing homeowners to sell their homes.”

Lower Rates Spurring Demand, But Affordability Remains a Leading Obstacle

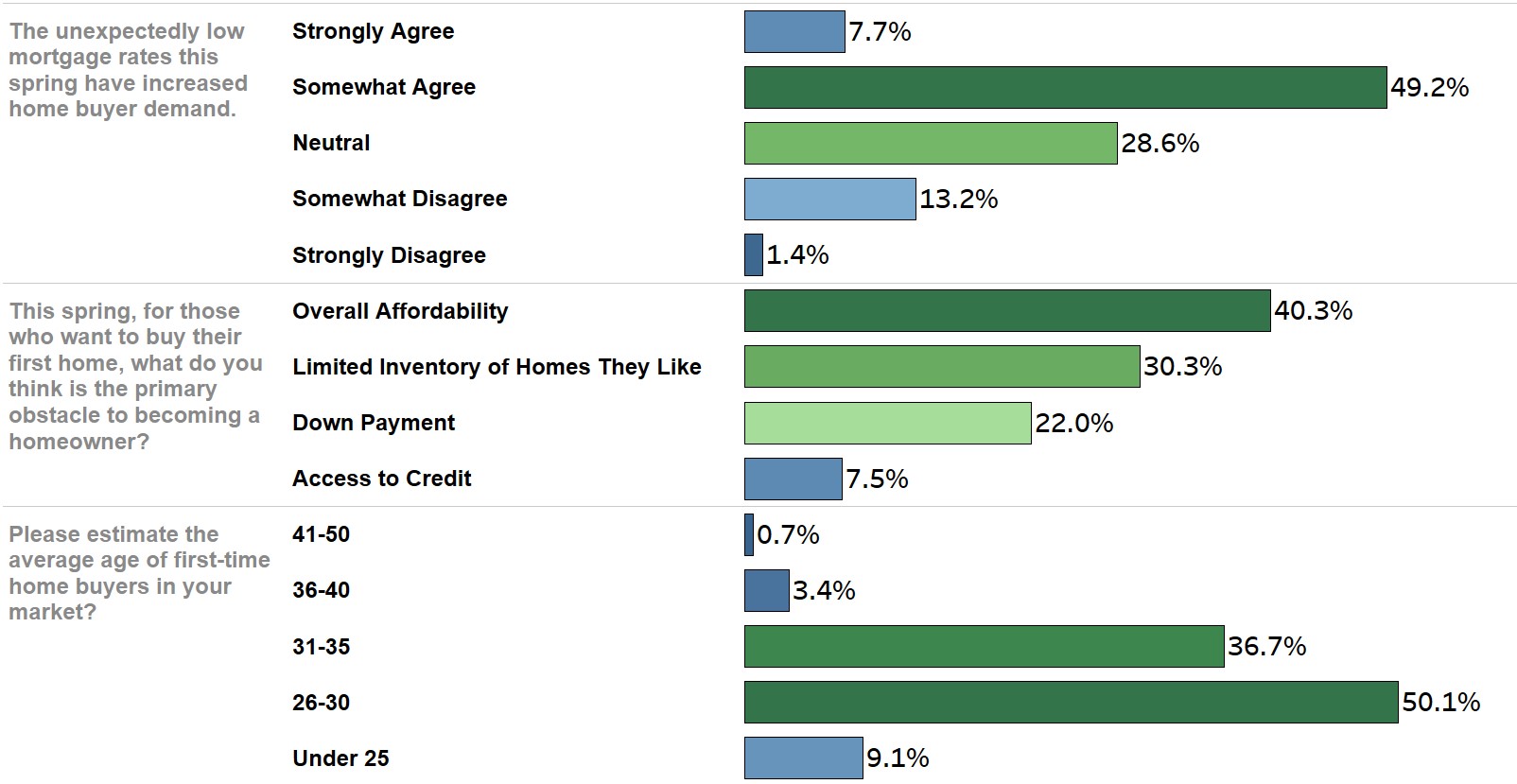

According to 57 percent of title agents and real estate professionals surveyed, the unexpectedly low mortgage rates of 2019 have increased home buyer demand in their market. In fact, only 15 percent disagreed with this sentiment. However, despite lower mortgage rates boosting affordability and stimulating demand, 40 percent of survey respondents indicated that affordability is the primary obstacle to becoming a homeowner – this is not surprising as house prices nationally continue to grow, albeit at a slower pace in 2019. The next highest-rated obstacles to becoming a homeowner were the limited inventory of homes they like (30 percent) and down payment (22 percent).

Affordability has overtaken the lack of supply as the primary obstacle to homeownership, according to a year-over-year review of survey results. When we asked this question a year ago, survey respondents (35.3 percent) slightly favored the limited inventory of homes as the primary obstacle over overall affordability (30.1 percent). Down payment (28 percent) followed closely behind in the second-quarter 2018 survey.

Title agents and real estate professionals no longer view limited inventory as the primary obstacle to becoming a homeowner. The main burden, affordability, confirms the strong sellers’ market conditions from 2018 have continued in many markets in early 2019, as demand outpaces supply and prices continue to rise.

Is Improving Supply Helping Homeowners Escape the Prisoner’s Dilemma?

Throughout 2017 and 2018, homeowners faced a ‘prisoner’s dilemma,’ a situation where many homeowners were ‘imprisoned’ in their current home by the fear of not finding a home to buy and the fear of losing their historically low mortgage rate. According to our survey of title insurance and real estate professionals, homeowners may finally be on the verge of escaping the ‘prisoner’s dilemma.’

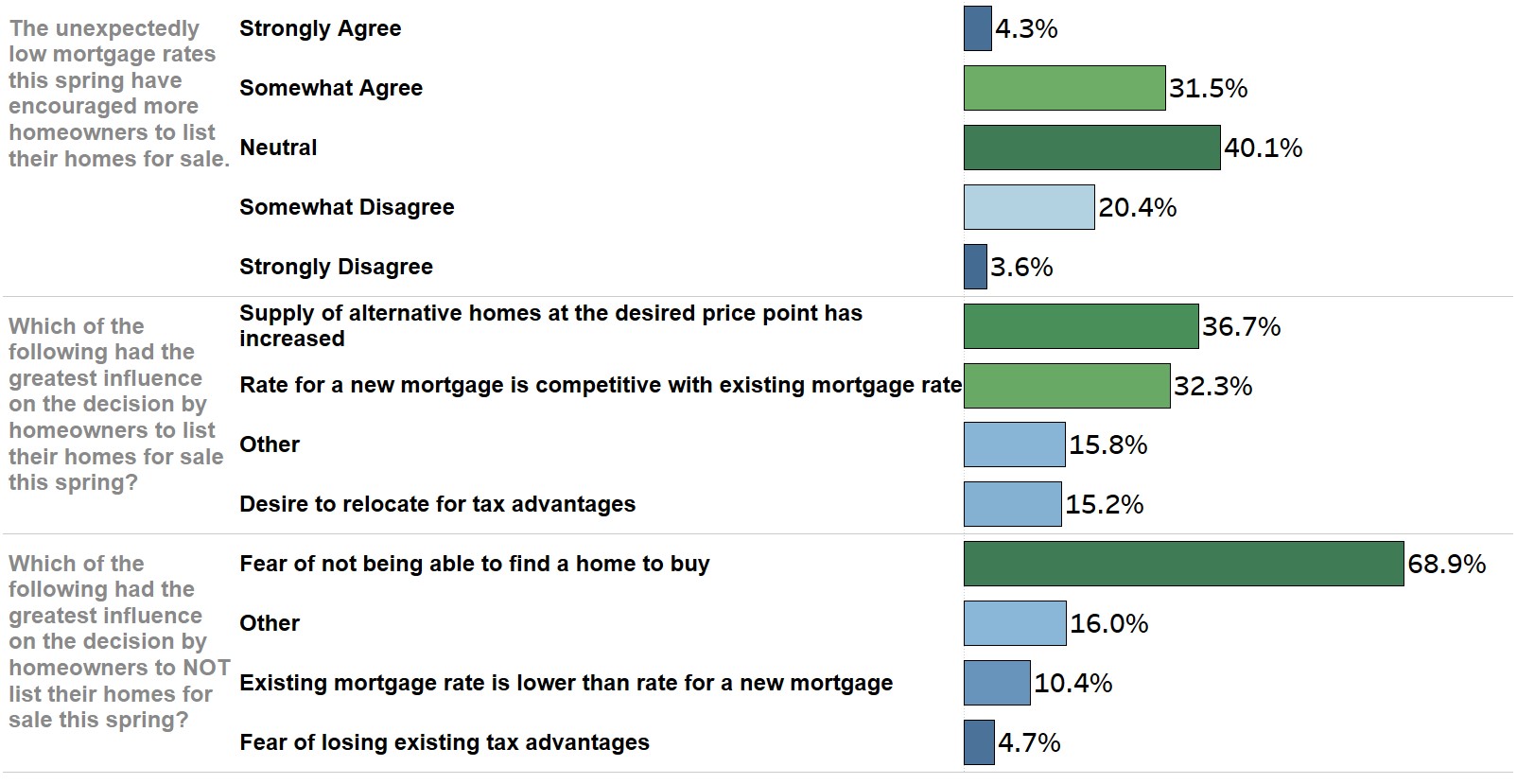

Not only have concerns over limited supply eased as an obstacle to homeownership, homeowners appear to be more willing to list their homes for sale because they are more confident in finding a home to buy, according to our survey of title insurance and real estate professionals. When asked what had the greatest influence on the decision by homeowners to list their homes for sale this spring, most title agents and real estate professionals (37 percent) indicated the supply of alternative homes at the desired price point has increased.

Survey respondents also cited that the rate for a new mortgage is competitive with existing mortgage rates (32 percent), creating another crack in the prisoner’s dilemma for homeowners. In the first quarter of 2019, mortgage rates fell to 4.37 percent. While still higher than one year ago, that is a significant decline from the fourth quarter 2018 rates of 4.78 percent. Mortgage rates have fallen even further during the second quarter of 2019. As the spread between homeowners’ existing rates and new mortgage rates narrows, the less “rate-locked” homeowners are.

However, even though there are some signs that homeowners are more willing to list their homes for sale, supply constraints remain the biggest concern for homeowners by a wide margin, according to our survey findings. When asked what was the greatest influence on the decision by homeowners to not list their homes for sale this spring, the biggest reason was the fear of not being able to find a home to buy (69 percent).

Feeling less ‘rate-locked’ has encouraged more homeowners to sell, but many still fear not being able to find something better to buy. To sell, or not to sell. This is the dilemma that existing homeowners face.

Millennials Dominate the First-Time Home Buyer Market

The millennial generation, those between the ages of 23 to 38, have been the primary drivers of homeownership growth since 2018. Title agents and real estate professionals surveyed confirmed this data, with 87 percent of respondents indicating first-time home buyers were in the prime home-buying age of 26-35. This is consistent with our survey findings from the spring of 2018, indicating millennials remain the primary source of first-time home buyers in 2019. Indeed, we expect millennials to continue driving the housing market for the foreseeable future.

Purchase and Refinance Market Outlook Improve

Title agents and real estate professionals had a positive outlook for the overall purchase market in the second quarter of 2019, likely due to declining mortgage rates and a strong labor market As might be anticipated, unexpectedly lower mortgage rates boosted the outlook for growth in refinance transactions compared with one year ago.

Title agents and real estate professionals are more optimistic about price appreciation growth now than they were at the end of 2018, but slightly less optimistic than a year ago. Survey respondents expect residential house prices to increase by 3.8 percent in the next year. The outlook for price appreciation is up 1.7 percentage points from the fourth quarter of 2018, and down 0.4 percentage points from the previous year.

Changes to house prices in part reflect the relationship between supply and demand. As demand increases relative to supply, price appreciation increases. Slower house price appreciation and declining mortgage rates in 2019 have increased affordability and boosted demand. Housing supply, however, has been slower to respond. Increased demand and limited supply will likely result in faster house price appreciation again in 2019.

Second Quarter 2019 Real Estate Sentiment Index

The First American Real Estate Sentiment Index (RESI) showed that in the second quarter of 2019:

- Overall, confidence in residential purchase volume growth over the next 12 months decreased 5.0 percent compared with a year ago.

- Confidence in refinance transaction volume growth over the next 12 months increased 72.5 percent compared with a year ago.

- Residential property prices are expected to increase by 3.8 percent over the next 12 months.

- Residential price expectations are 0.4 percent lower than they were one year ago.

Overall, optimism among title agents and real estate professionals increased this quarter compared to the fourth quarter of 2018, likely due to declining mortgage rates and the slowdown in house price appreciation. In fact, the unexpectedly low mortgage rates fueled the largest yearly growth in refinance sentiment since the inception of the survey.

Additional Findings

- The outlook for residential purchase volume growth increased 52.1 percent over the fourth quarter 2018 survey.

- The outlook for residential refinance volume growth increased more than 100 percent over the fourth-quarter 2018 survey.

- The outlook for residential property price growth increased to 3.8 percent for the next 12 months, which is 1.6 percentage points higher than the fourth-quarter 2018 survey findings.

Next Release

The next release of the First American Real Estate Sentiment Index will be posted in December 2019.

What do the RESI number values mean?

Title insurance agents and real estate professionals are experts in their local real estate markets and have valuable insight. First American’s proprietary Real Estate Sentiment Index is based on a quarterly survey of independent title agents and other real estate professionals, providing a unique gauge on the real estate market using the crowd-sourced wisdom and expertise of real estate experts.

Methodology

The First American Real Estate Sentiment Index (RESI) measures title agent sentiment on purchase and refinance transaction volume and price changes across multiple property types, as well as title agent sentiment on current industry issues. The RESI is calculated for each question as the sum of the positive responses minus the sum of the negative responses divided by two and times the total number of responses plus 50, resulting in an index that varies from 0 (all negative sentiment) to 50 (neutral sentiment) to 100 (all positive sentiment). A RESI value above 50 indicates increasingly positive sentiment and a RESI value below 50 indicates increasingly negative sentiment. Aggregated purchase and refinance sentiment indices are created by using a property-type, stock-weighted average of each underlying sentiment index.

The overall national sentiment index is a loan purpose market share-weighted average of the aggregate purchase and refinance sentiment indices. Aggregated national price expectations are property-type, state-stock weighted. Results are only reported when a sufficient number of survey responses are available to produce valid results.

Disclaimer

Opinions, estimates, forecasts and other views contained in this page are those of First American’s Chief Economist, do not necessarily represent the views of First American or its management, should not be construed as indicating First American’s business prospects or expected results, and are subject to change without notice. Although the First American Economics team attempts to provide reliable, useful information, it does not guarantee that the information is accurate, current or suitable for any particular purpose. © 2019 by First American. Information from this page may be used with proper attribution.