The Dynamic Forces that Re-Shaped Housing Affordability in 2019

By

Mark Fleming on October 28, 2019

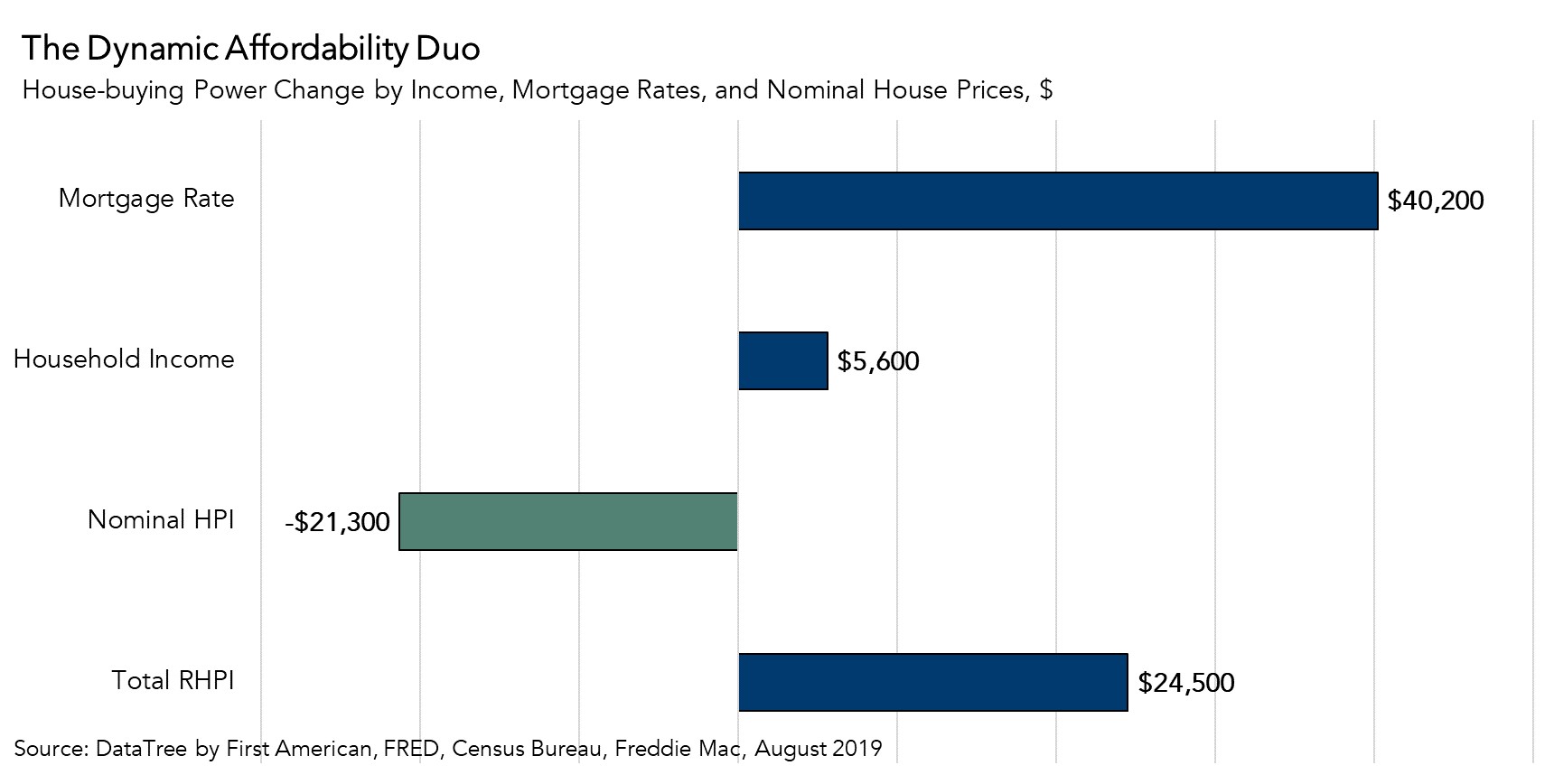

Understanding the dynamics that influence consumer house-buying power, how much home one can buy based on changes in income and interest rates, provides a helpful perspective on the housing market. When incomes rise, consumer house-buying power increases. When mortgage rates or nominal house prices rise, consumer house-buying power declines. Our ...

Read More ›

What’s the Outlook for Housing Market Potential for the Rest of 2019?

By

Mark Fleming on October 18, 2019

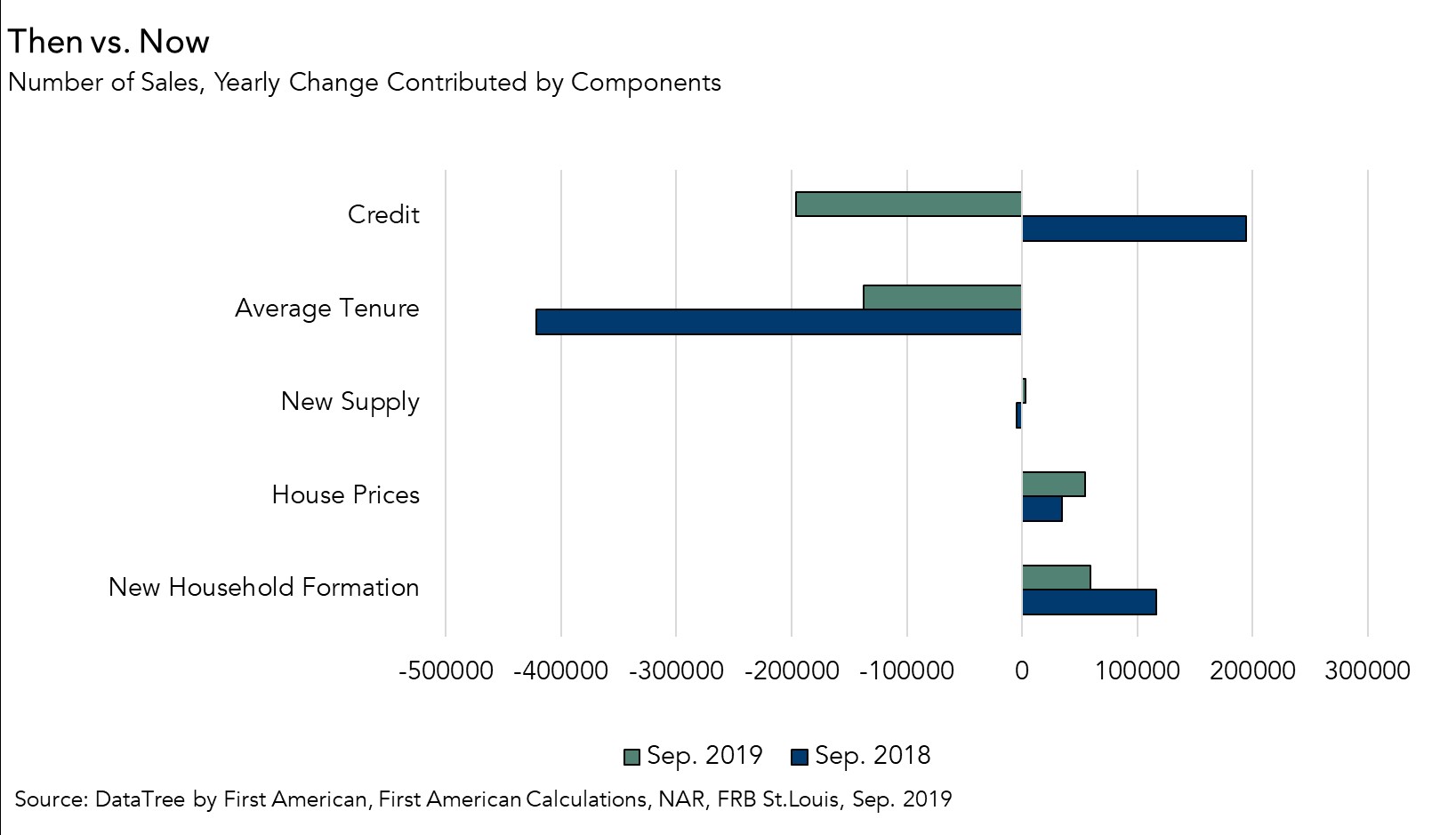

In September 2019, the housing market performed to its potential, as actual existing-home sales were a marginal 0.04 percent, or an estimated 2,340 seasonally adjusted annualized sales, below market potential. Housing market potential decreased relative to last month, but increased 3.8 percent compared with September of last year. Indeed, in ...

Read More ›

Why Our Economy Is Generating More Investment Growth in IP than IT

By

Odeta Kushi on October 16, 2019

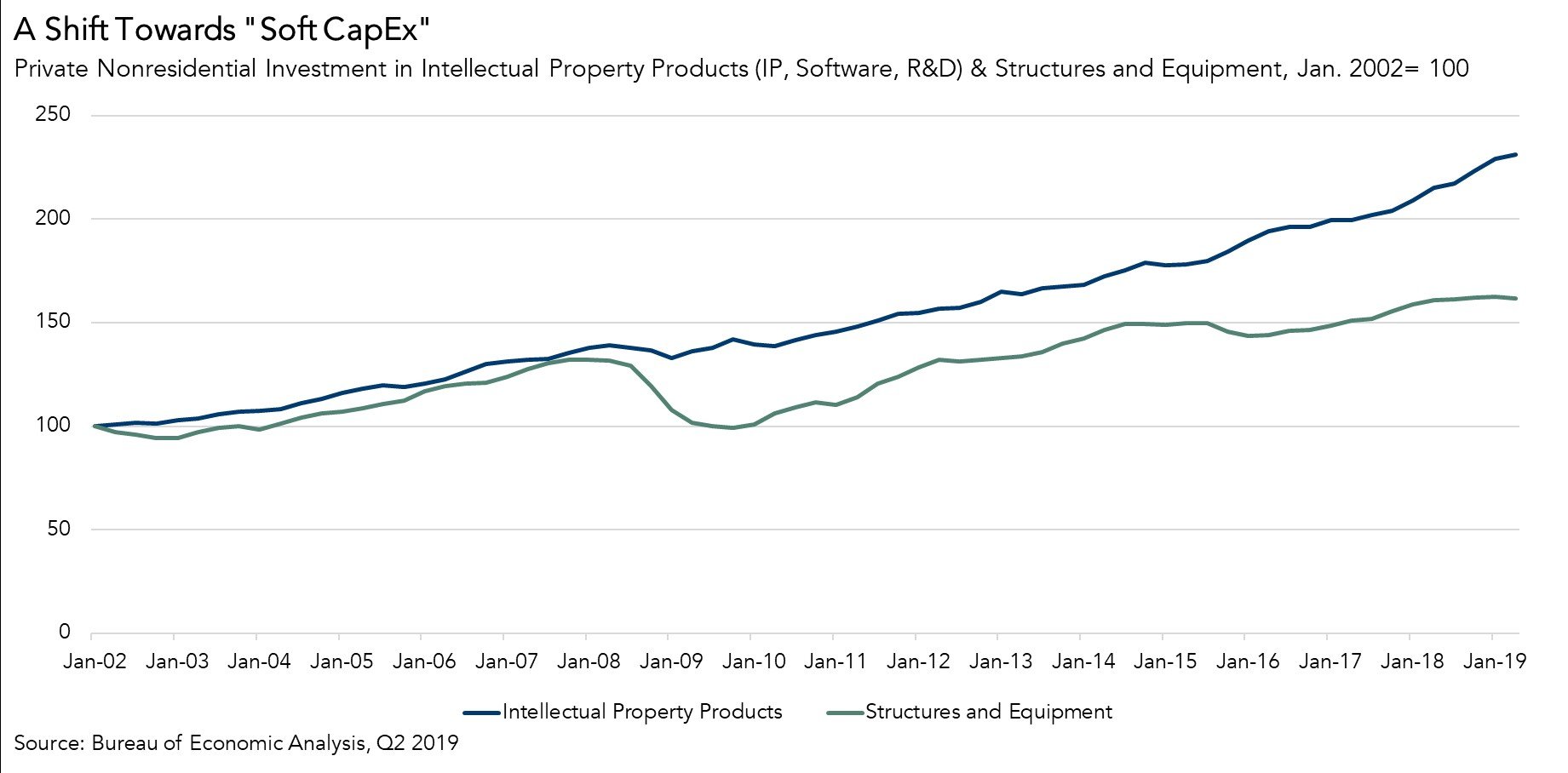

Important, but easy to overlook shifts in investment trends may be contributing to our current era of low interest rates. An excess supply of global savings relative to the demand for that money for investments is driving down interest rates, which can be thought of as the price of money. The neutral rate of interest, which is monitored by the ...

Read More ›

How 2019 Became the Year of Declining Fraud Risk

By

Mark Fleming on September 26, 2019

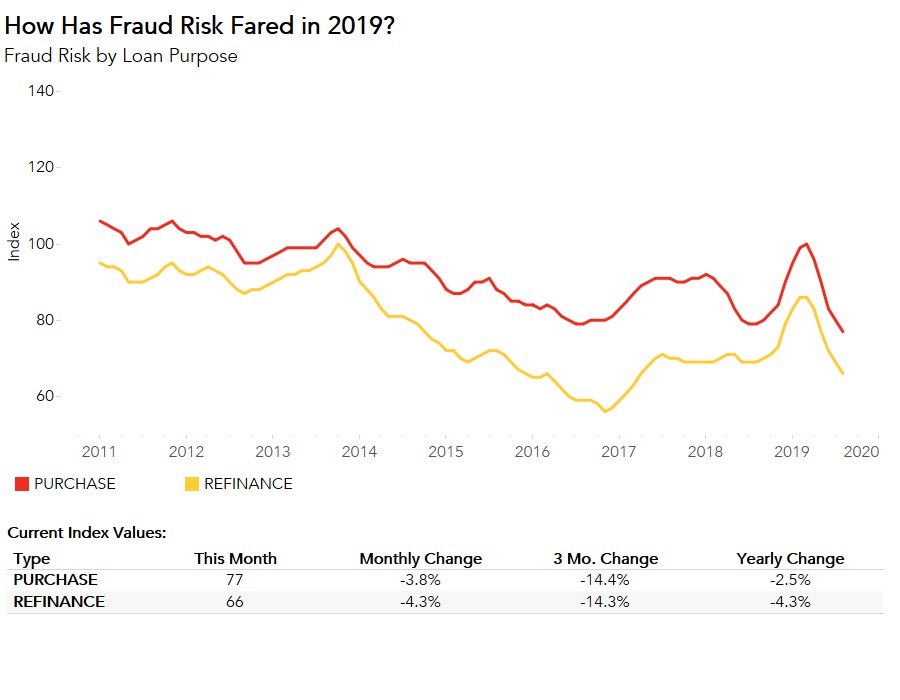

Declining for the fifth consecutive month, the Loan Application Defect Index for purchase transactions continued its downward trend, falling 3.8 percent in August compared with July. The Defect Index for refinance transactions also fell, declining 4.3 percent compared with the previous month. The overall Defect Index, which includes both purchase ...

Read More ›

Interview on Nightly Business Report: Discussing Surge in Potential Housing Supply

By

FirstAm Editor on September 24, 2019

First American Deputy Chief Economist Odeta Kushi was interviewed on Nightly Business Report last week and discussed the dramatic jump in housing starts to a 12-year high, signaling the potential for some housing supply relief in the near future.

Read More ›

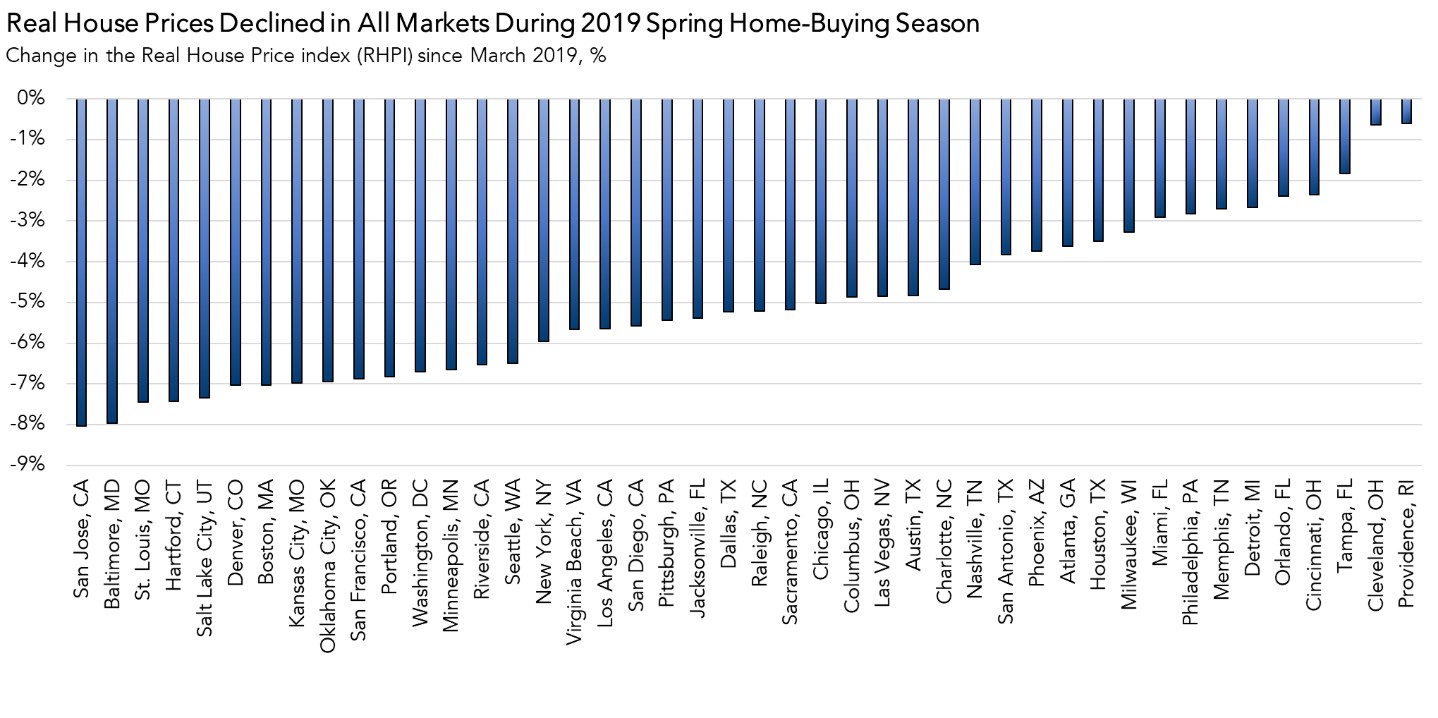

How Did Affordability Change During the Spring Home-Buying Season?

By

Mark Fleming on September 23, 2019

School bells ringing don’t just mark the beginning of a new school year, but for those in housing, they also signal the end of the typical home-buying season, which begins in March. As the school year begins, the housing market is finishing the spring home-buying season with strong marks for affordability. Indeed, two of the three key drivers of ...

Read More ›