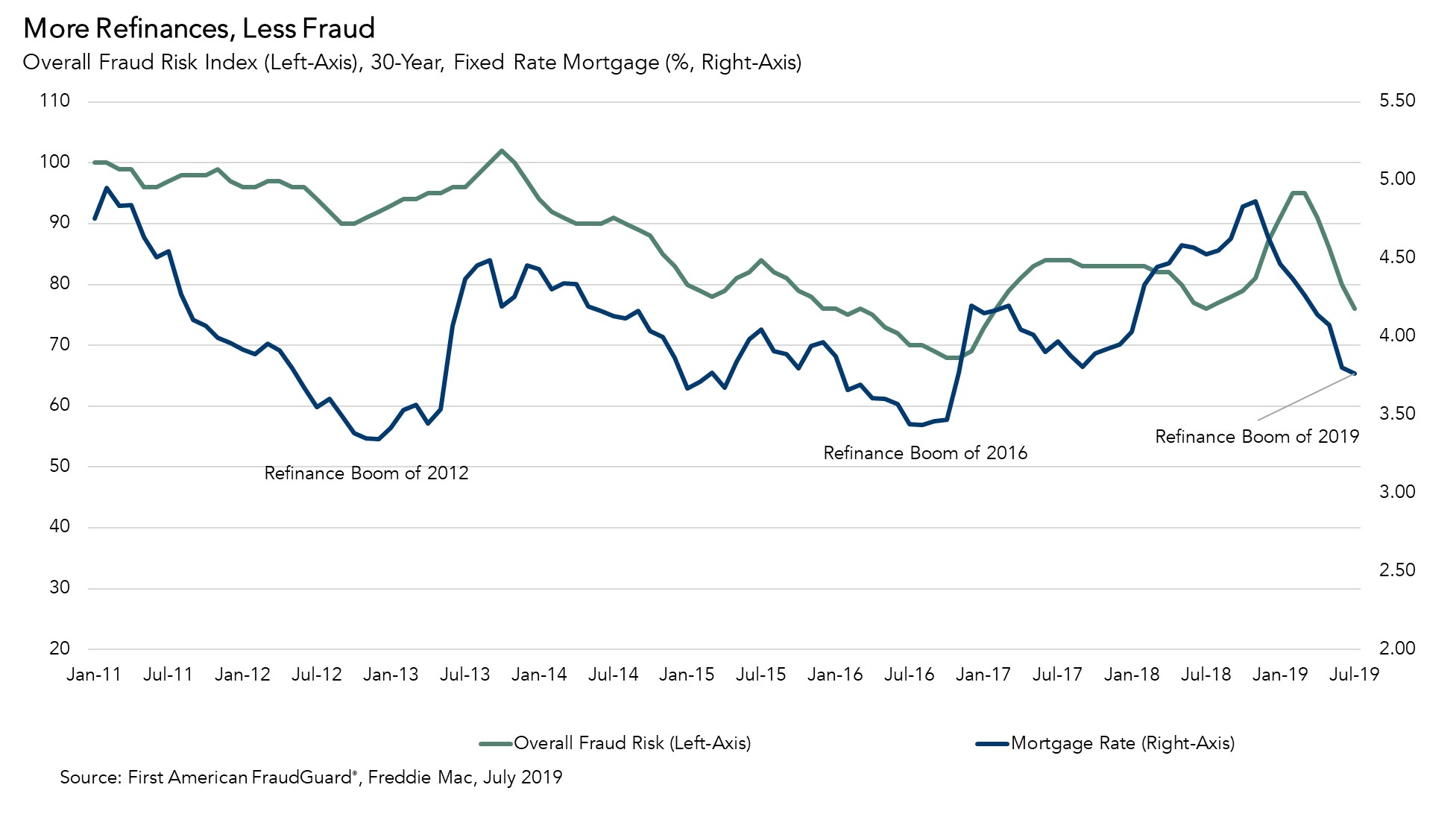

What Does the Refinance Boom Mean for Fraud Risk?

By

Mark Fleming on August 29, 2019

The Loan Application Defect Index for purchase transactions continued its downward trend, declining 3.6 percent in July compared with June, the fourth consecutive month defect risk in purchase transactions has fallen. The Defect Index for refinance transactions also fell 4.2 percent compared with the previous month. The overall Defect Index, which ...

Read More ›

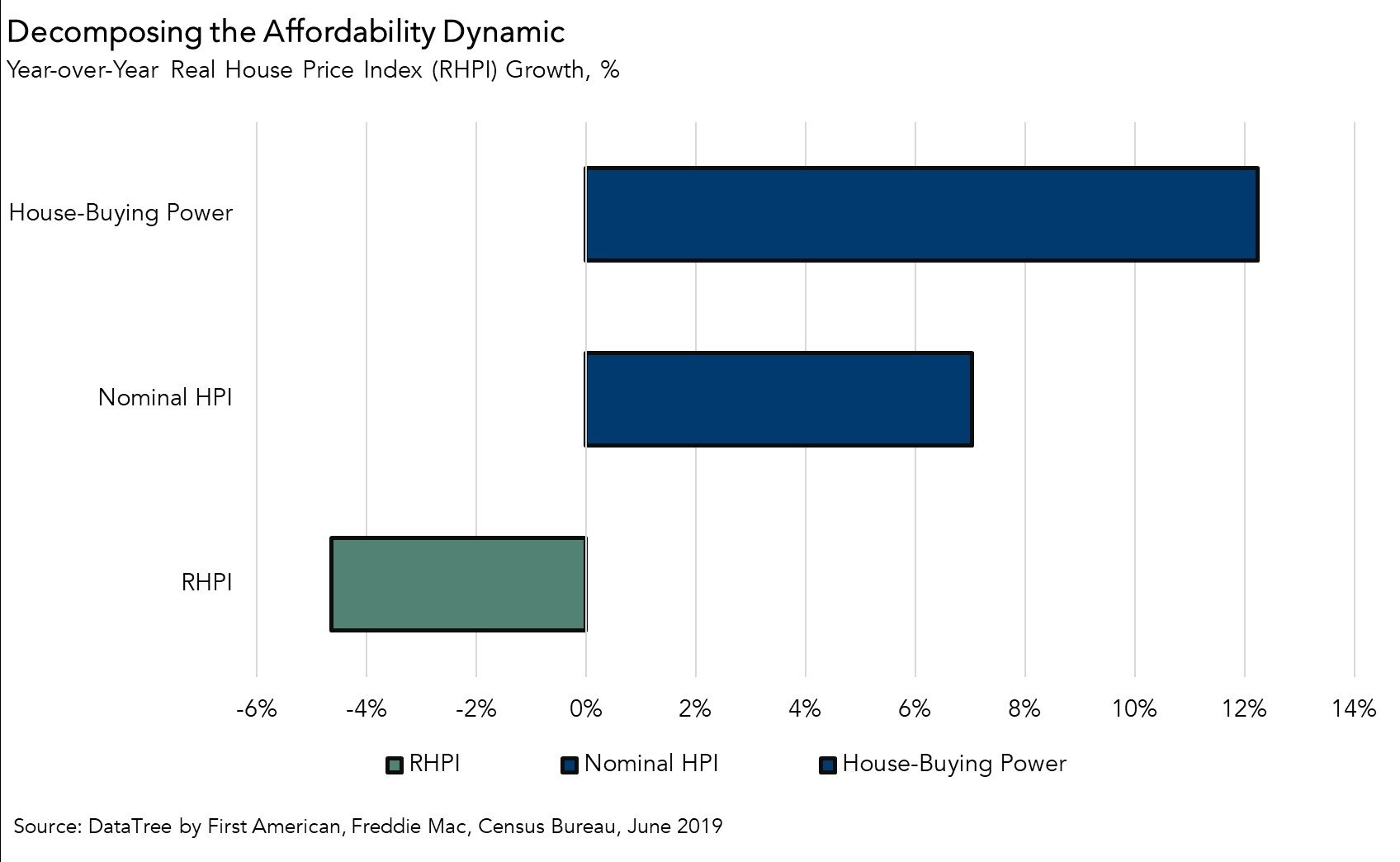

How Can Affordability Improve When House Prices are Rising?

By

Mark Fleming on August 27, 2019

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in June. The 30-year, fixed-rate mortgage fell by 0.8 percentage points and household income increased 2.4 percent compared with June 2018. When household income rises, consumer house-buying power ...

Read More ›

Interviews on CNBC and Bloomberg TV: Discussing the Impact of Historically Low Rates and the Outlook for the Housing Market and the Economy

By

FirstAm Editor on August 23, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi on Bloomberg TV earlier this week and discussed the impact of historically low rates on the housing market, and what the Fed minutes indicate about the direction of rate policy and the economy.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability

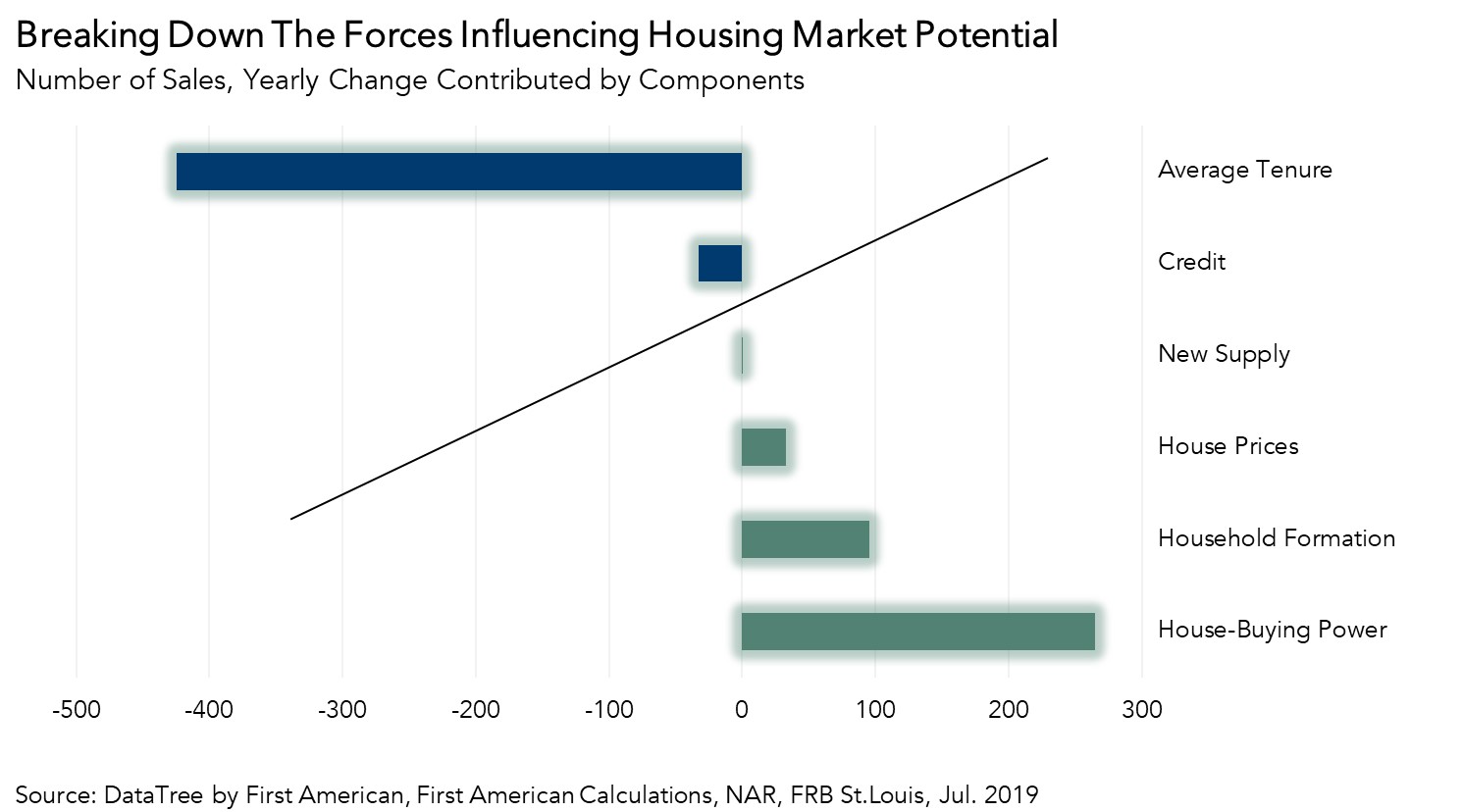

What Does Increasing Tenure Length Mean for the Housing Market?

By

Mark Fleming on August 20, 2019

The housing market essentially reached its potential in July 2019, as actual existing-home sales were 0.05 percent above the market’s potential. Existing-home sales in 2019 are running at a pace similar to 2015, even though rates have fallen and household income has increased this year. Housing market potential benefitted from a 10.6 percent ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

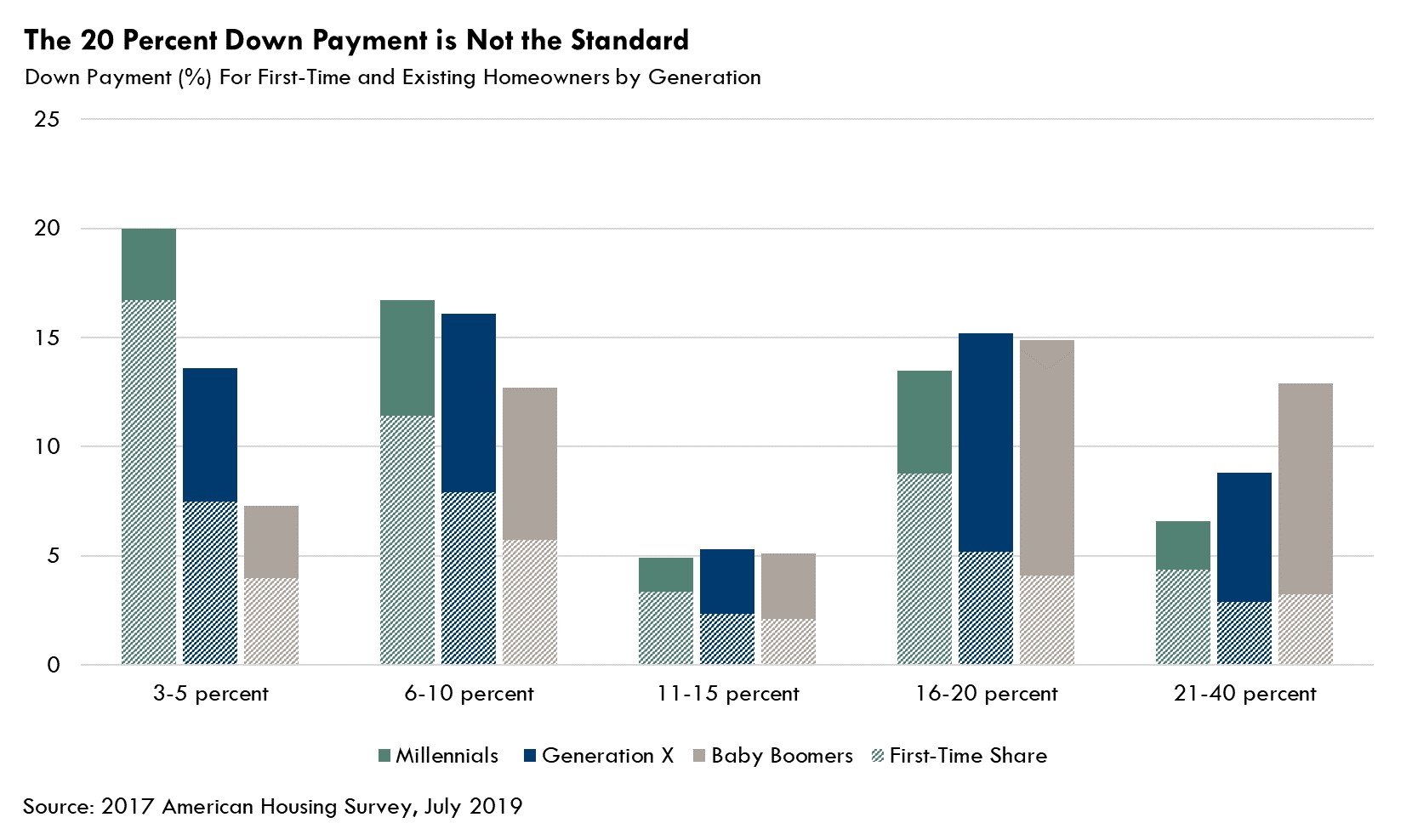

Dispelling the Myth of the 20 Percent Down Payment

By

Odeta Kushi on August 6, 2019

Since hitting a low point of 63 percent in 2016, the homeownership rate has rebounded, largely driven by millennial households purchasing their first homes. Many surveys, like one by Bank of the West, indicate that millennials are no different from previous generations – they view homeownership as a main tenet of the American Dream.

Read More ›

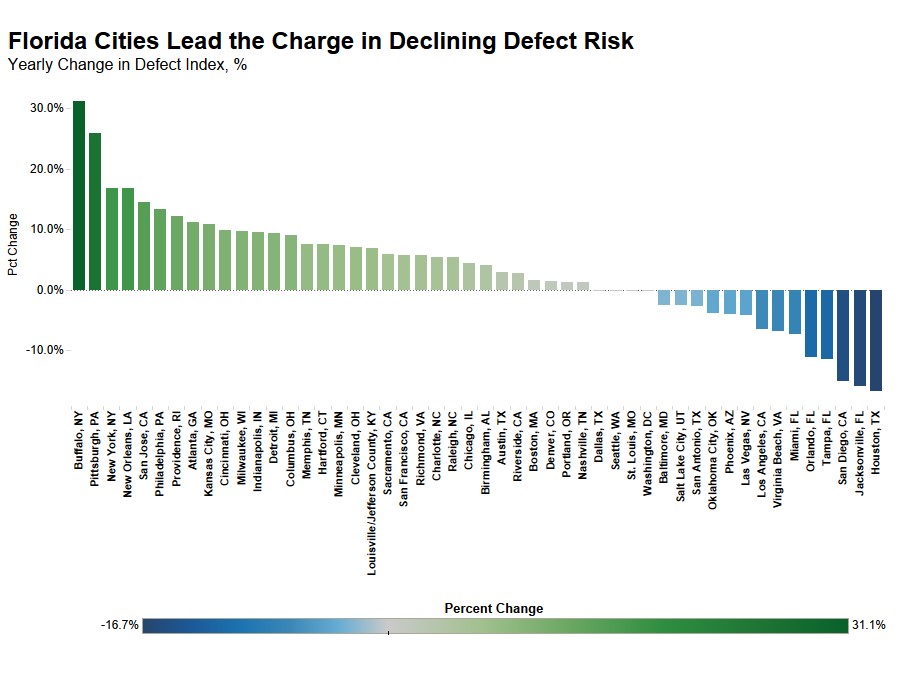

Why Florida Cities Suddenly Lead the Charge in Declining Fraud Risk

By

Mark Fleming on July 31, 2019

This month, the Loan Application Defect Index for purchase transactions continued its downward trend, declining 7.8 percent in June compared with the month before, the third consecutive month defect risk in purchase transactions has fallen. The Defect Index for refinance transactions also fell 6.5 percent compared with the previous month. The ...

Read More ›