Faced with often misleading affordability metrics and seemingly challenging housing market dynamics, many renters may underestimate their house-buying power and the supply of homes in their market that they can afford. Potential first-time home buyers can benefit from a more targeted examination of affordability, which begins by accurately tracking house-buying power for first-time home buyers.

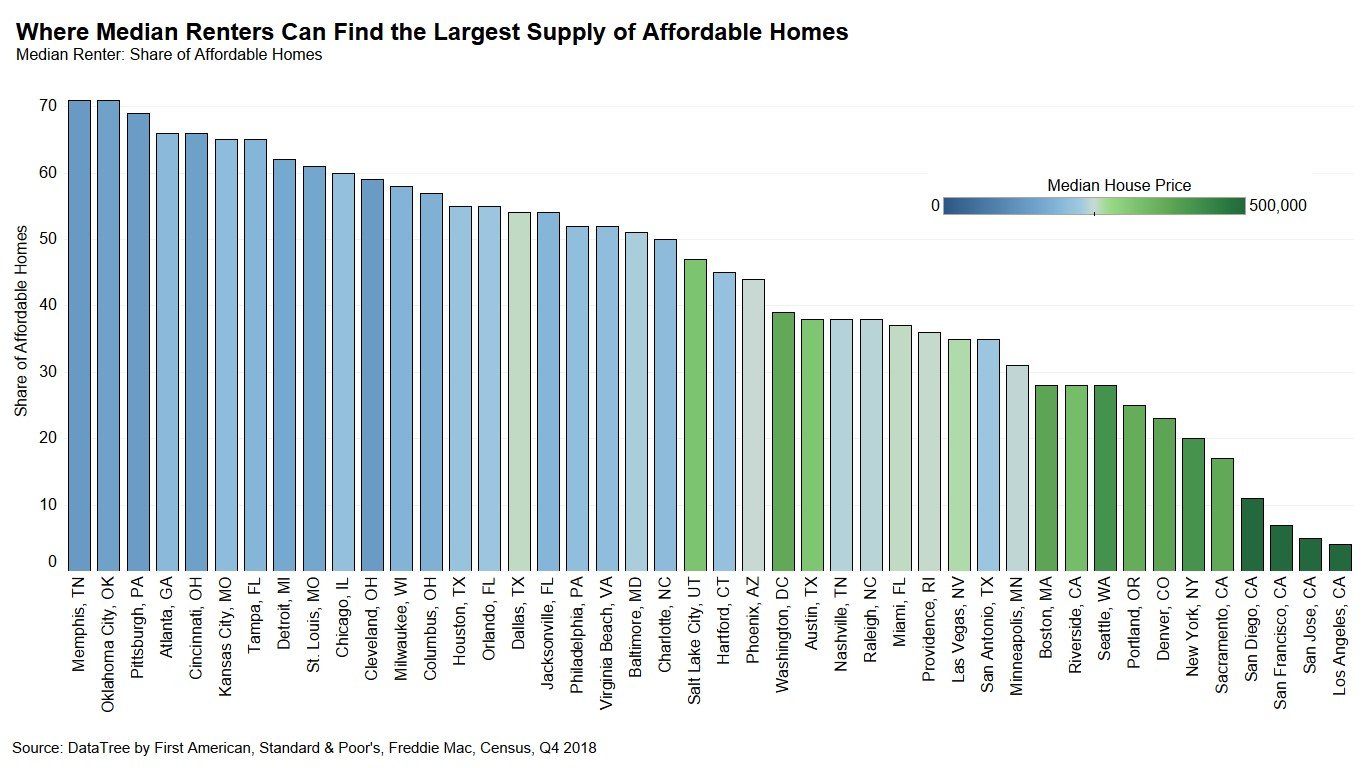

“Based on our analysis, the median renter can afford 50 percent or more of homes for sale in 21 out of the 44 markets we track, meaning less than half of the markets we track are affordable for first-time home buyers.”

Property Taxes and PMI Included – A Better Way to Track House-Buying Power for First-Time Home Buyers

Analyzing a renter’s house-buying power is the first step in understanding affordability. Since first-time home buyers are nearly certain to be currently renting, our estimate of a first-time buyer’s house-buying power is based on the median renter’s income. The renter house-buying power estimate also takes into account the prevailing 30-year, fixed mortgage rate, and assumes one-third of the first-time home buyer’s pre-tax income is used for the mortgage.

Often overlooked home-buying expenses, such as property taxes and private mortgage insurance, can mean the difference between moving forward with a home purchase or continuing to rent. Our estimate includes the most current property tax rate and assumes a 5 percent down payment since the down payment for most first-time home buyers is less than 20 percent. In fact, according to a NAR study, the median down payment in 2017 was 10 percent for all buyers, 5 percent for first-time buyers, and 14 percent for repeat buyers.

However, many lenders require buyers who have purchased a home with a down payment of less than 20 percent to pay for private mortgage insurance (PMI). A fixed PMI rate is also incorporated into our renter’s house-buying power estimates to account for this obligation.

But Affordability is More Than Just House-Buying Power

The supply of homes that are affordable to a first-time home buyer with the median renter income tells a much clearer story. The cities with the highest house-buying power are not necessarily the ones with the largest supply of affordable homes. For example, first-time home buyers in San Jose have the greatest house-buying power, but the median renter can only afford 5 percent of the homes for sale in San Jose.

House-buying power can be used to examine what share of the homes for sale the renter could afford to buy. For example, in an affordable market, the median renter should be able to afford 50 percent or more of the homes for sale. Likewise, renters in the bottom 10 percent of house-buying power should be able to afford at least 10 percent of the homes for sale in their market. In other words, affordability must consider where a first-time home buyer falls in the house-buying power distribution.

If the house-buying power of a first-time home buyer allows them to afford a large share of the homes for sale in their market, then the market is relatively affordable. In some markets, housing is only affordable for people with very high house-buying power, while in others, housing is affordable for a majority of first-time home buyers. Based on our analysis, the median renter can afford 50 percent or more of homes for sale in 21 out of the 44 markets we track, meaning less than half of the markets we track are affordable for first-time home buyers.

Top 10 Cities with the Largest Supply of Affordable Homes for First-Time Home Buyers

Using house-buying power to identify the share of homes for sale that are affordable for the median renter provides a better gauge of a first-time home buyer’s outlook for homeownership.

In the fourth quarter of 2018, the most affordable city for median renters looking to buy their first home among the largest 44 cities tracked by First American was Memphis, Tenn. The median renter in Memphis, with an income of $37,130 and a house-buying power of $202,015, could afford 71 percent of the homes for sale. However, if that same renter with the same income and house-buying power tried to buy a home in Los Angeles, they could afford less than 2 percent of the homes for sale.

Our analysis shows that cities such as Memphis, Oklahoma City, and Pittsburgh are areas where millennial first-time home buyers will have best outlook for homeownership. The top 10 cities with the largest supply of affordable homes for first-time home buyers are:

- Memphis, Tenn. : 71 percent

- Oklahoma City: 71 percent

- Pittsburgh: 69 percent

- Atlanta: 66 percent

- Cincinnati: 66 percent

- Kansas City, Mo.: 65 percent

- Tampa, Fla.: 65 percent

- Detroit: 62 percent

- St. Louis: 61 percent

- Chicago: 60 percent

First American’s full First-Time Home Buyer Outlook report, “Why Everything You Know About First-Time Home Buyer Affordability is Wrong” can be downloaded for additional insights on first-time home buyer affordability.