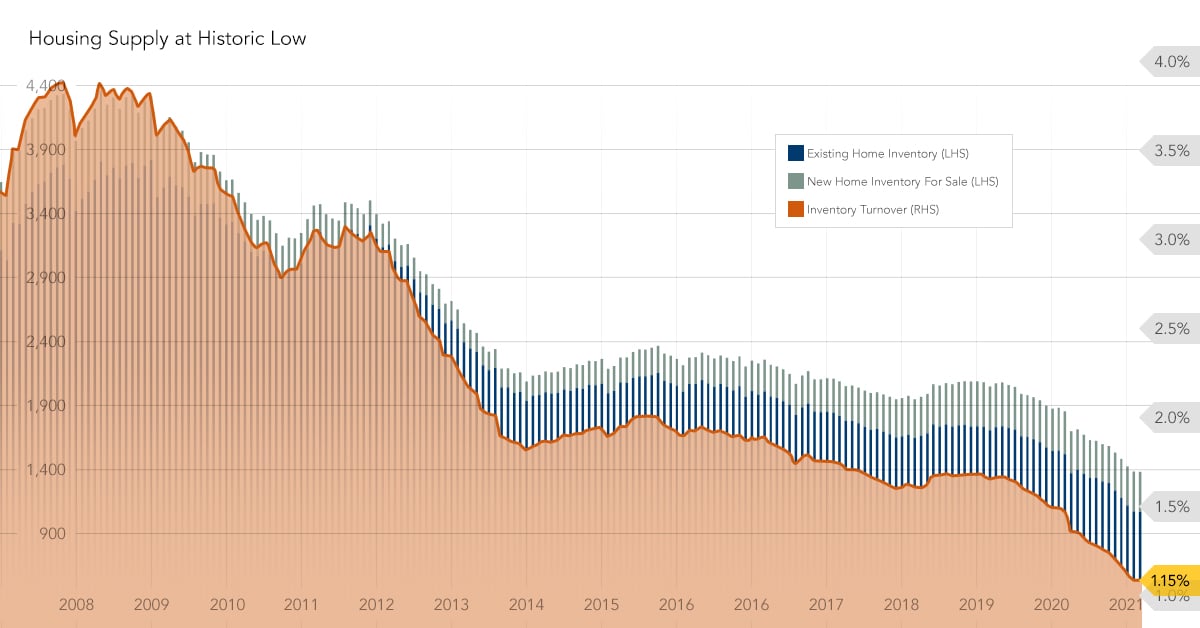

Has the Great Housing Supply Crash Bottomed Out?

By

Mark Fleming on May 19, 2021

More than a year into the pandemic, the housing market continues to run hot. The supply and demand imbalance brewing before the pandemic boiled over in the past year, resulting in record low levels of housing inventory and, consequently, the fastest pace of annual house price appreciation since 2005. With the arrival of the spring home-buying ...

Read More ›

Will the End of Forbearance Trigger a Wave of Foreclosures?

By

Odeta Kushi on May 4, 2021

Following the rapid contraction in U.S. economic activity because of the outbreak of COVID-19, millions of Americans took advantage of payment suspension and mortgage forbearance programs. At the peak in June 2020, approximately 4.3 million homeowners were in forbearance plans. A year into the pandemic, and that number has declined to ...

Read More ›

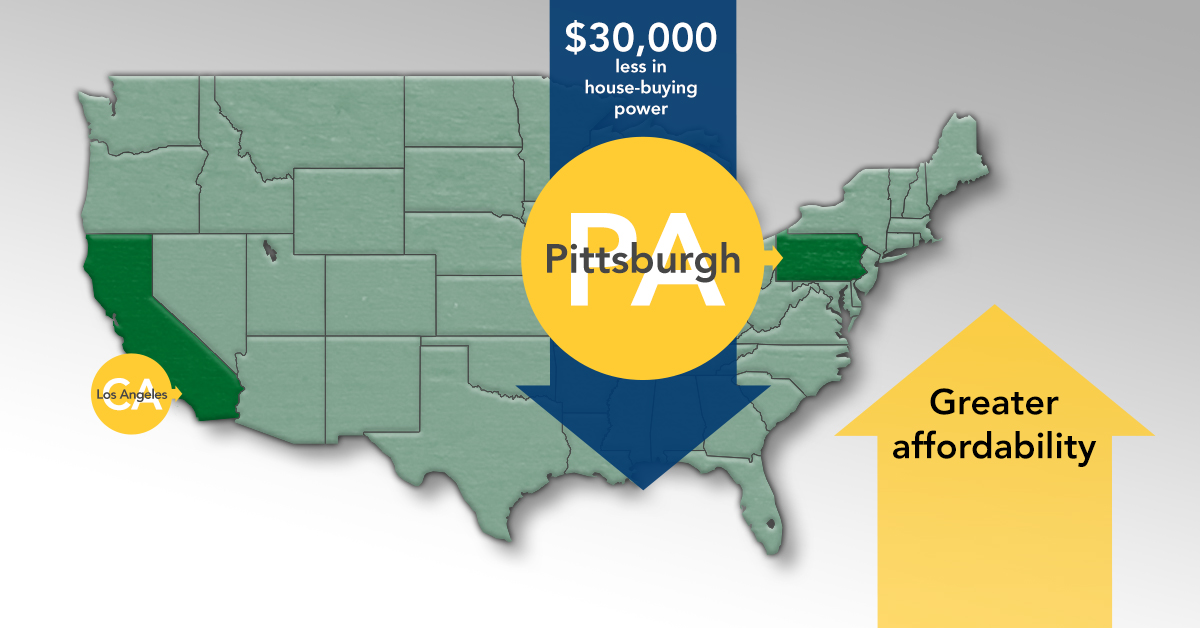

Will Rising Equity Levels Mean More Homeowners Will List Their Homes for Sale?

By

Mark Fleming on April 27, 2021

The three components of the Real House Price Index (RHPI) are household income, mortgage rates and a nominal house price index. The RHPI adjusts nominal house prices according to changes in income and interest rates, which together make up consumer house-buying power. When incomes rise, house-buying power rises as well. However, when mortgage ...

Read More ›

Rising Rates Unlikely to Substantially Cool Hot Spring Home-Buying Season

By

Mark Fleming on April 16, 2021

After hitting its highest point since 2007 last month, housing market potential fell modestly in March, according to our Potential Home Sales Model. Housing market potential remains near the 13-year high point, but the severely limited supply of homes for sale and an uptick in mortgage rates pulled market potential for existing-home sales off its ...

Read More ›

Top Five Cities for Lower-Income Renters to Pursue the Dream of Homeownership

By

Odeta Kushi on April 14, 2021

In the fourth quarter of 2020, the median renter experienced a 10 percent boost to their house-buying power relative to one year ago, but the share of homes they could afford to buy declined by 4 percentage points due to rising house prices, according to the First-Time Home Buyer Outlook Report. However, while we recently examined affordability ...

Read More ›

Homeownership First-Time Home Buyer Outlook Report Renter Affordability

Interview with CNBC: How Rising Rates May Impact Housing Affordability As Spring Home-Buying Season Ramps Up

By

FirstAm Editor on April 8, 2021

First American Deputy Chief Economist Odeta Kushi was interviewed on CNBC yesterday, discussing the outlook for housing affordability amid rising mortgage rates and expectations for the spring home-buying season.

Read More ›