As the housing market has recovered from the initial impacts of the pandemic, nominal house price appreciation has soared, but affordability actually improved until recently due to the house-buying power benefit from historically low mortgage rates. However, for the second month in a row, the Real House Price Index (RHPI) increased, indicating declining affordability. The reason? Rapid nominal house price appreciation has finally outpaced the house-buying power benefit from historically low mortgage rates. The low rates have helped fuel the surge in demand since April in a housing market that is desperate for supply, which is Econ 101 for faster house price appreciation that out-competes rising house-buying power. But, just how big a short is the supply shortage? Historic.

“Despite the best intentions of home builders to provide more housing supply, the big short in housing supply will continue into 2021 and likely keep house price appreciation flying high.”

What’s Supply Got to Do With It?

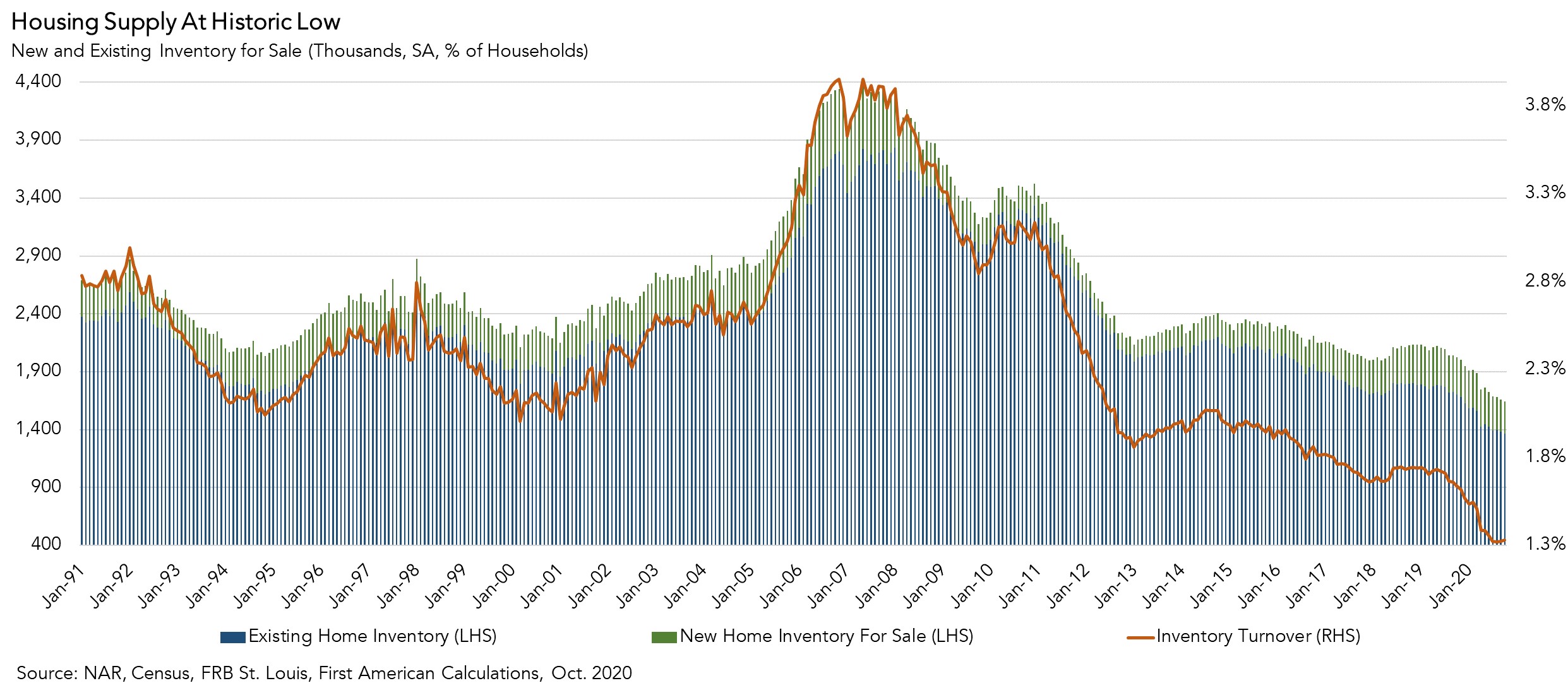

Inventory turnover – the total supply of homes for sale nationwide as a percentage of occupied residential inventory – was low prior to the pandemic, but began to drop precipitously starting in April. Since 1991, on average, 2.5 percent of the stock of homes are for sale in any single month. Throughout 2019 and preceding the pandemic, average inventory was 1.65 percent, but the pandemic-induced supply contraction further reduced average inventory to nearly 1.4 percent in April. Since then, average inventory has steadily declined to 1.3 percent. That means only 130 homes in every 10,000 are for sale, compared with almost double that amount in normal times.

Existing-home sales make up approximately 90 percent of all home sales and in October the seasonally-adjusted months’ supply for existing homes hit a historic low of 2.5 months. As existing homeowners have withdrawn supply, average tenure length – the amount of time someone lives in their home – has soared to a historic high of approximately 10.5 years. Ultimately, rising tenure length means there are fewer homes on the market and as demand has surged the competition among home buyers for the small amount of homes for sale drives prices up.

Homebuilders to the Rescue?

If there aren’t enough existing-homes available for sale to meet demand, then can home builders build more homes and add more inventory? Homebuilders have responded to the supply shortage. In October, housing starts increased 14 percent compared with a year ago, and new home sales were approximately 1 million (SAAR) in September and October. This is a positive sign of potential new supply under construction, but it’s unlikely to change the supply dynamic quickly. The US housing supply has been underbuilt for over a decade and it will take years of accelerated new home construction to close the gap.

Despite the challenging economic conditions for many households, for those fortunate enough to continue to have stable income, house-buying power is the highest its ever been because of historically low mortgage rates. As more and more potential home buyers rush to take advantage of sub-three percent mortgage rates in an environment of limited homes available for sale, multiple-offer bidding wars become the norm and prices are pushed higher.

Mortgage rates are expected to remain low for the foreseeable future and millennials will continue forming households, keeping demand robust, even if income growth moderates. Despite the best intentions of home builders to provide more housing supply, the big short in housing supply will continue into 2021 and likely keep house price appreciation flying high.