The October jobs report exceeded consensus expectations for job growth, yet the labor market’s rebound continues to slow. Higher frequency data from weekly jobless claims confirm the slowdown, as the level of new jobless filings is not falling as quickly in recent months. COVID-19 cases are on the rise and there is increasing likelihood of a further impact on economic activity, which may trigger a corresponding increase in unemployment in impacted industries. The pandemic’s economic impacts continue to strike some industries much harder than others.

"Even as mortgage rates continue to fall and improve house-buying power, you can’t buy what’s not for sale, and it’s also likely you won’t buy if you don’t have a job."

The Beveridge Curve – Labor Supply and Demand

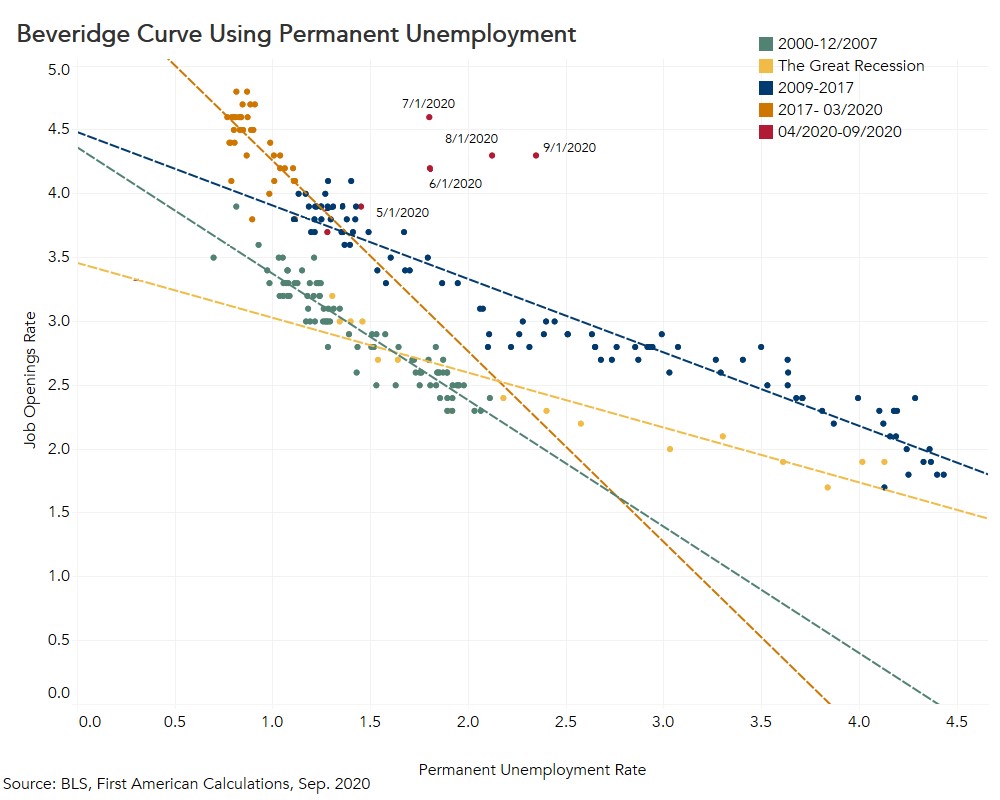

To gain a better understanding of how the labor market may be changing, we turn to the Beveridge Curve, following an analysis recently done by Tim Duy at the University of Oregon. The Beveridge Curve is a graphical representation of the “supply and demand” relationship between unemployment (demand for jobs) and the job vacancy rate (supply of jobs) in the labor market. This relationship slopes downward, as a higher rate of unemployment (signaling more demand for jobs) typically coincides with a lower rate of vacancies (less supply of jobs).

In addition to showing the supply and demand relationship in the labor market, the Beveridge Curve can shift, reflecting longer run structural changes caused by rising uncertainty and changes in the efficiency of matching labor demand to labor supply. In particular, skill mismatching, when a large share of unemployed workers lack the appropriate skills for a large share of the job supply, can cause the Beveridge curve to shift right, meaning there are more job openings for any level of unemployment because employers are struggling to find workers with the skills needed to perform the jobs that are available. A rising skill mismatch may indicate structural problems in the labor market that can slowdown or prolong labor market recovery.

Has the pandemic created or accelerated a skill mismatch in the labor market? We know that the hardest hit industries in the recession employed lower-wage, less-skilled workers, while many of the more resilient industries, where labor demand remains strong, are seeking to hire higher skilled workers.

To identify if a skill mismatch existed before the pandemic and how the pandemic has influenced the skill mismatch, we have constructed a Beveridge Curve in the figure below to look at the job openings rate vs. the permanent unemployment rate across five time periods.

- December 2000-December 2007

- January 2008-June 2009 (The Great Recession)

- July 2009-April 2017 (Recovery)

- May 2017-March 2020 (Pre-Pandemic)

- April 2020-September 2020 (Pandemic)

This Beveridge Curve has been shifting right since the Great Recession. The recovery and pre-pandemic eras appear to be indicating increasing structural changes in the labor market, which seem to have been exacerbated by the pandemic. However, it’s important to highlight that jobs data during the COVID-19 pandemic remains sparse, and several months do not yet make a trend. If the shift seen here persists, there seems to be a stronger case for a structural mismatch between employers and workers in this pandemic economy.

What does this mean for the housing market?

It is difficult to forecast the path of the labor market recovery because of the uniqueness of what caused the decline, the pandemic. A shift in the curve isn’t necessarily a sign of a rise in structural unemployment, but it could be interpreted as a warning signal. Research indicates that skill mismatches could create challenges for the pace of the economic recovery.

Because this is a service sector-driven recession, the labor market decline has disproportionately hurt low-wage, less skilled workers that are more likely to be renters, leaving potential home buyers and existing homeowners, who are more likely to remain employed in high wage jobs, in a relatively better position. While the housing market is one of the only major sectors to display a V-shaped recovery, a longer-term slowdown in the labor market could pose a risk. Even as mortgage rates continue to fall and improve house-buying power, you can’t buy what’s not for sale, and it’s also likely you won’t buy if you don’t have a job. While this is not the story today, a long-term economic decline resulting in structural unemployment could begin to impact the one sector that has thus far proven resilient to the economic impacts of the virus.