Why Affordability Improved Amid Soaring House Prices

By

Mark Fleming on March 31, 2021

Soaring nominal house prices dominate recent headlines and for good reason. It is true that nominal house prices are the highest they have ever been, over 22 percent higher than the housing boom peak in 2006, according to the First American Data & Analytics House Price Index. The acceleration in the pace of annual house price growth began in ...

Read More ›

Where Can Potential First-Time Home Buyers Find the Largest Supply of Affordable Homes?

By

Odeta Kushi on March 23, 2021

In 2020, a combination of record low mortgage rates and millennials aging into homeownership boosted demand against a very limited supply of homes for sale, resulting in rapid house price appreciation. The nearly two-thirds of American households who already own homes saw their equity increase, while potential first-time home buyers, who are ...

Read More ›

The Good, the Bad and the Maybe Ahead of Spring Home Buying

By

Mark Fleming on March 19, 2021

In February 2021, housing market potential increased to its highest level since 2007, despite the largest month-over-month jump in mortgage rates since October 2019. Housing market potential rose 1.3 percent in February relative to the previous month, and 12.2 percent year-over-year. While rising average tenure length was the largest drag on ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

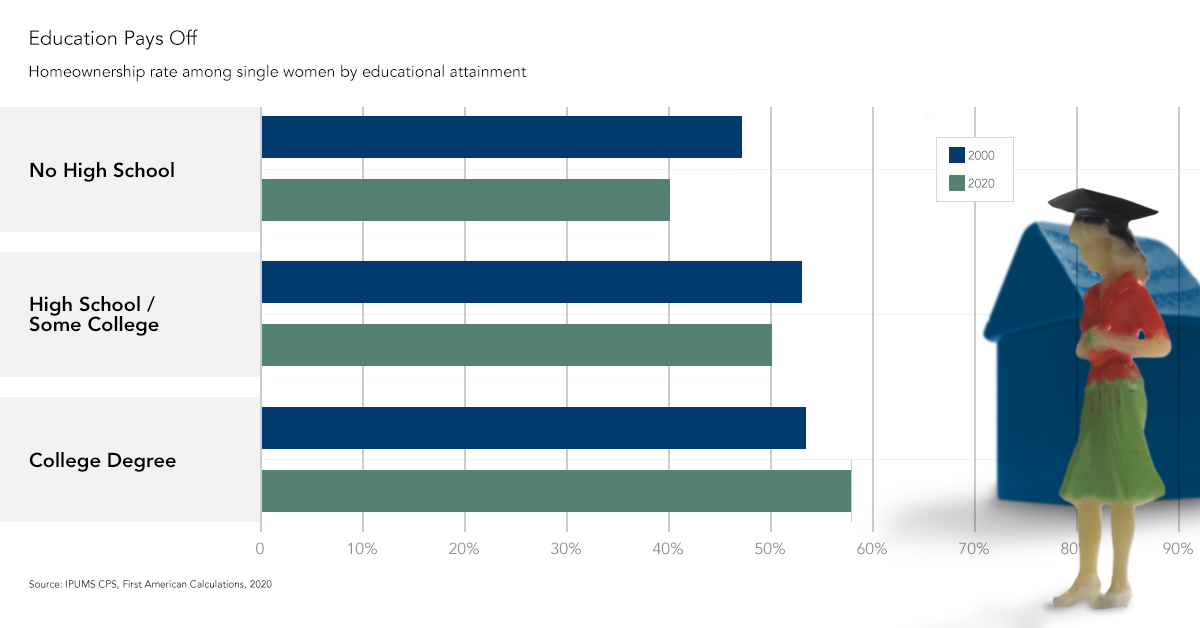

Will the Pandemic “She-cession” Derail Growth in Homeownership Among Single Women?

By

Odeta Kushi on March 11, 2021

During Women’s History Month, it’s important to reflect on the progress that single women have made in achieving one of the main tenets of the American Dream - homeownership. According to our analysis of anonymized household-level survey data, following an overall decline in the homeownership rate among single women in the aftermath of the Great ...

Read More ›

Interview with Yahoo! Finance: “Single Women are Clearly Embracing Wealth Creation Through Home Buying”

By

FirstAm Editor on March 8, 2021

First American Deputy Chief Economist Odeta Kushi was interviewed on Yahoo! Finance earlier this month, explaining why women homeownership rates are on the rise and the outlook for the housing market in the year ahead.

Read More ›

Housing In The News Interest Rates Affordability Homeownership

House Prices Are Hot, But Is Housing Overvalued?

By

Mark Fleming on February 23, 2021

Punxsutawney Phil may have signaled six more weeks of winter, but in housing, it looks like spring (home buying) has already arrived. Typically, the housing market winds down a bit in the winter, but America’s housing market is booming, even in the colder months. The First American Data & Analytics nominal house price index indicates ...

Read More ›