For Potential First-Time Home Buyers, it May Be Memphis or Bust

By

Odeta Kushi on June 26, 2024

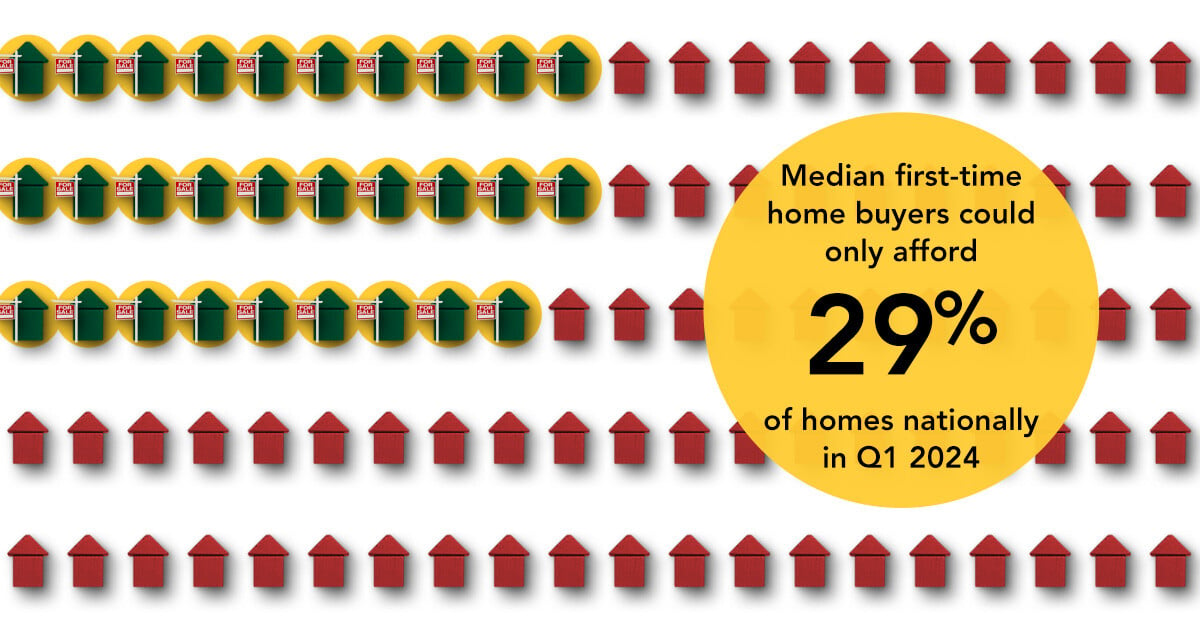

As National Homeownership Month comes to a close, it’s important to examine the current challenges facing the housing market. Nationally, housing affordability has declined compared with one year ago, especially for potential first-time home buyers. According to our First Time Home Buyer Outlook Report, the median renter, who can also be ...

Read More ›

Housing First-Time Homebuyer First-Time Home Buyer Outlook Report Mortgage Rates

Twin Market Dynamics Continue to Stifle Existing-Home Sales

By

Odeta Kushi on June 14, 2024

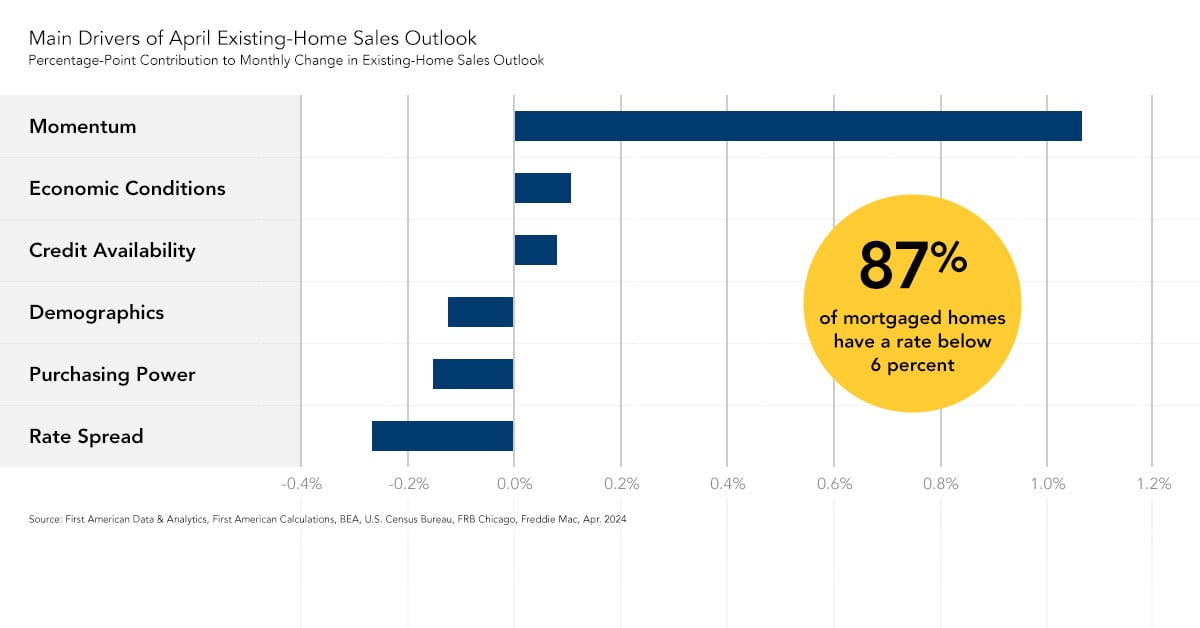

The housing market is struggling to gain momentum with mortgage rates above their levels from a year ago. Higher rates have a dual impact on sales – pricing out buyers who lose purchasing power and keeping some potential sellers rate-locked in. Our Existing-Home Sales Outlook Report ‘nowcasts’ existing-home sales based on the historical ...

Read More ›

Affordability Challenges Prompt a House Price Slowdown

By

Mark Fleming on May 28, 2024

Mortgage rates continued their spring surge in April 2024, rising to the highest level in five months and helping drag affordability down by 1.5 percent compared with March, according to the Real House Price Index (RHPI). On an annualized basis, affordability decreased by 9 percent. Two factors drove the year-over-year decline in affordability – a ...

Read More ›

More Homes for Sale Sparks Uptick in Housing Market Activity

By

Odeta Kushi on May 20, 2024

In the housing market, the seller and the buyer are, in many cases, the same. To buy a new home, you must sell the home you already own. For several years, a persistent and historic lack of supply has restrained the housing market, but a recent uptick in inventory is poised to boost sales activity as the spring home-buying season peaks. Our ...

Read More ›

An Overvalued Housing Market May Be Returning

By

Mark Fleming on April 29, 2024

In March 2024, mortgage rates increased and affordability fell modestly by 0.1 percent compared with February, according to the Real House Price Index (RHPI). On an annualized basis, affordability decreased by approximately 5 percent. Two factors drove the year-over-year decline in affordability – a 6.2 percent annual increase in nominal house ...

Read More ›

Sales Activity Driven by the Five Ds Amid Persistent Market Headwinds

By

Odeta Kushi on April 10, 2024

Our Existing-Home Sales Outlook Report ‘nowcasts’ existing-home sales based on the historical relationship between sales, demographic trends, house-buying power, and the prevailing financial and economic conditions. Based on our nowcast, we expect March existing-home sales to rise 1.7 percent compared with February, but remain approximately 16 ...

Read More ›

Interest Rates Federal Reserve Mortgage Rates Existing-Home Sales