Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

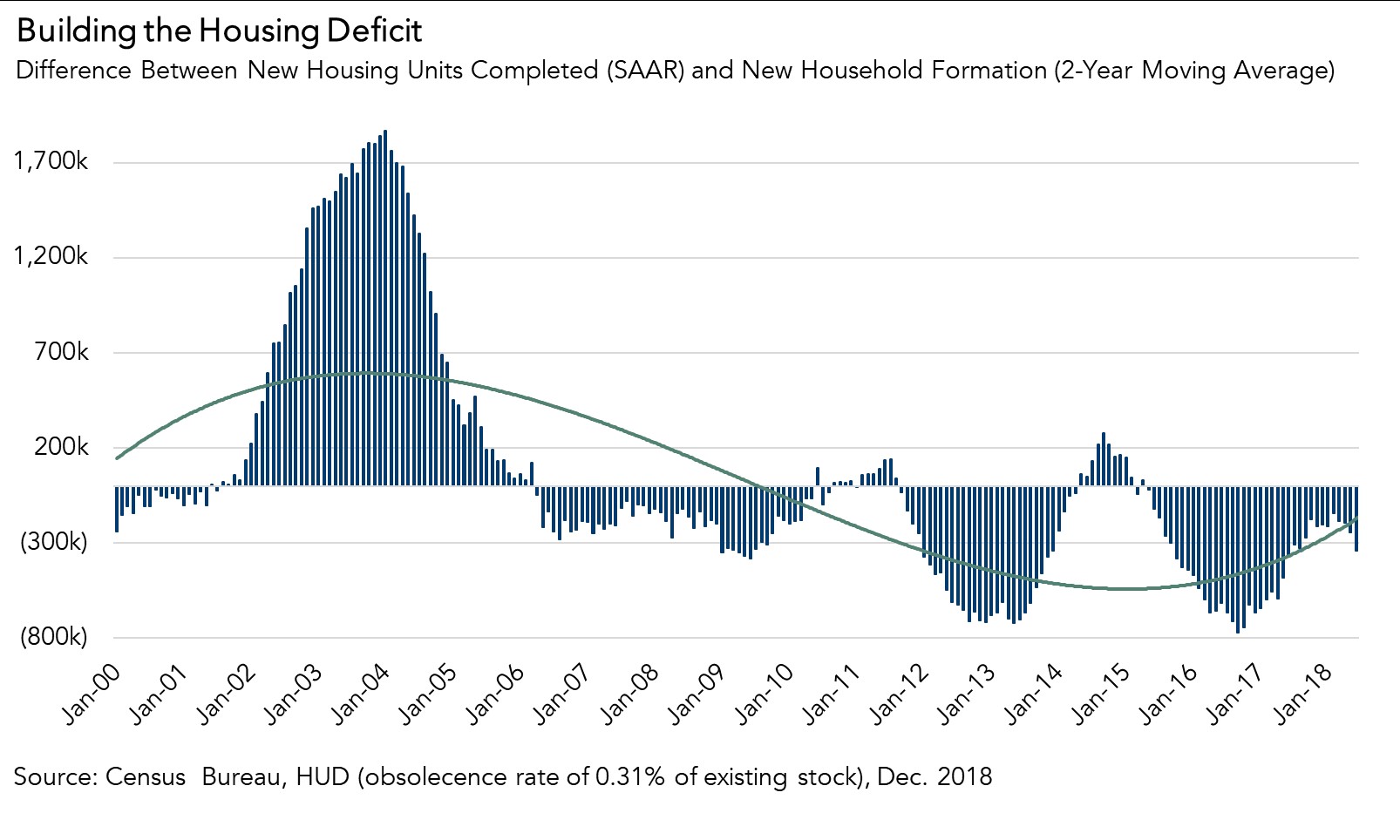

What Will it Take to Reduce the Housing Supply Deficit?

By

Mark Fleming on March 6, 2019

Last week, the Census Bureau released its Residential Construction report for December. Housing completions decreased 8.4 percent compared with last December and continued to fall short of the number of new housing units necessary to keep pace with household formation. Housing starts also decreased 10.9 percent in December compared with a year ...

Read More ›

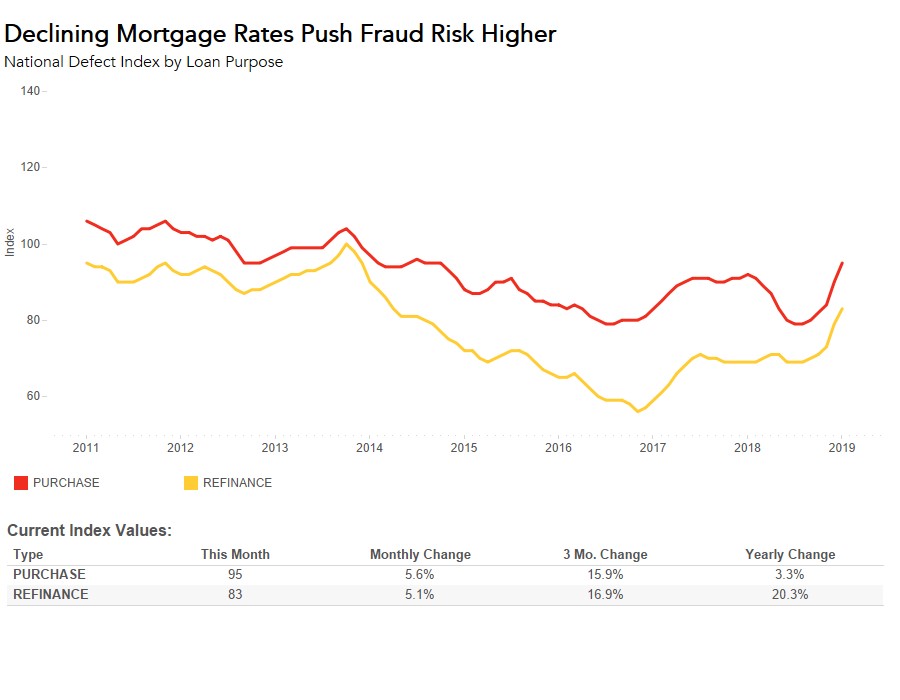

Why is Loan Application Fraud Risk Accelerating?

By

Mark Fleming on February 28, 2019

The Loan Application Defect Index for purchase transactions continued its upward trend, increasing 5.6 percent in January compared with the month before, the fifth consecutive month defect risk in purchase transactions has risen. Overall, the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan ...

Read More ›

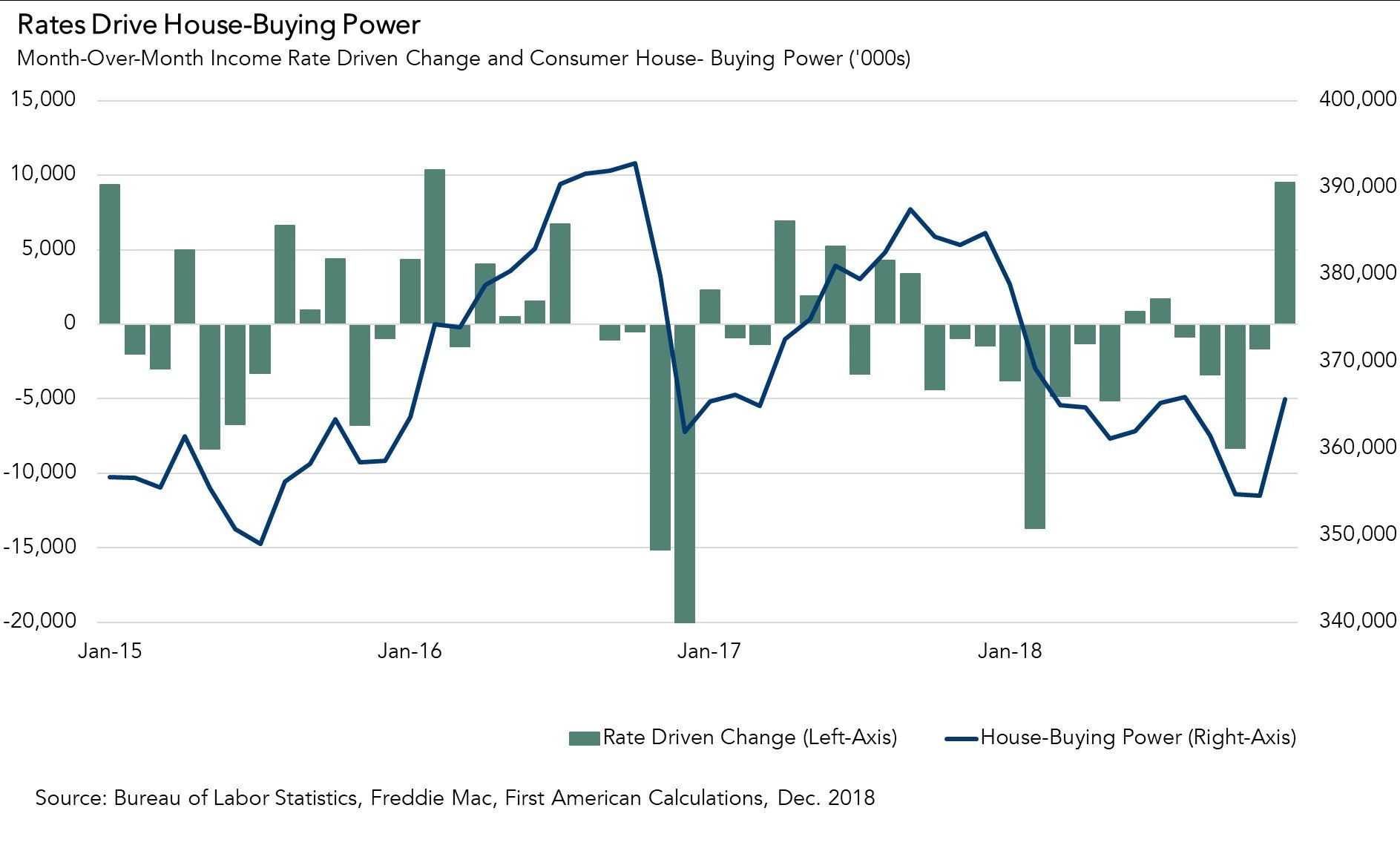

What Triggered the Biggest Increase in House-Buying Power in Five Years?

By

Mark Fleming on February 25, 2019

Housing affordability is a function of three economic drivers: nominal house prices, household income and mortgage rates. When incomes rise, consumer house-buying power increases. Declining mortgage rates or declining nominal house prices also increase consumer house-buying power. Our Real House Price Index (RHPI) uses consumer house-buying power ...

Read More ›

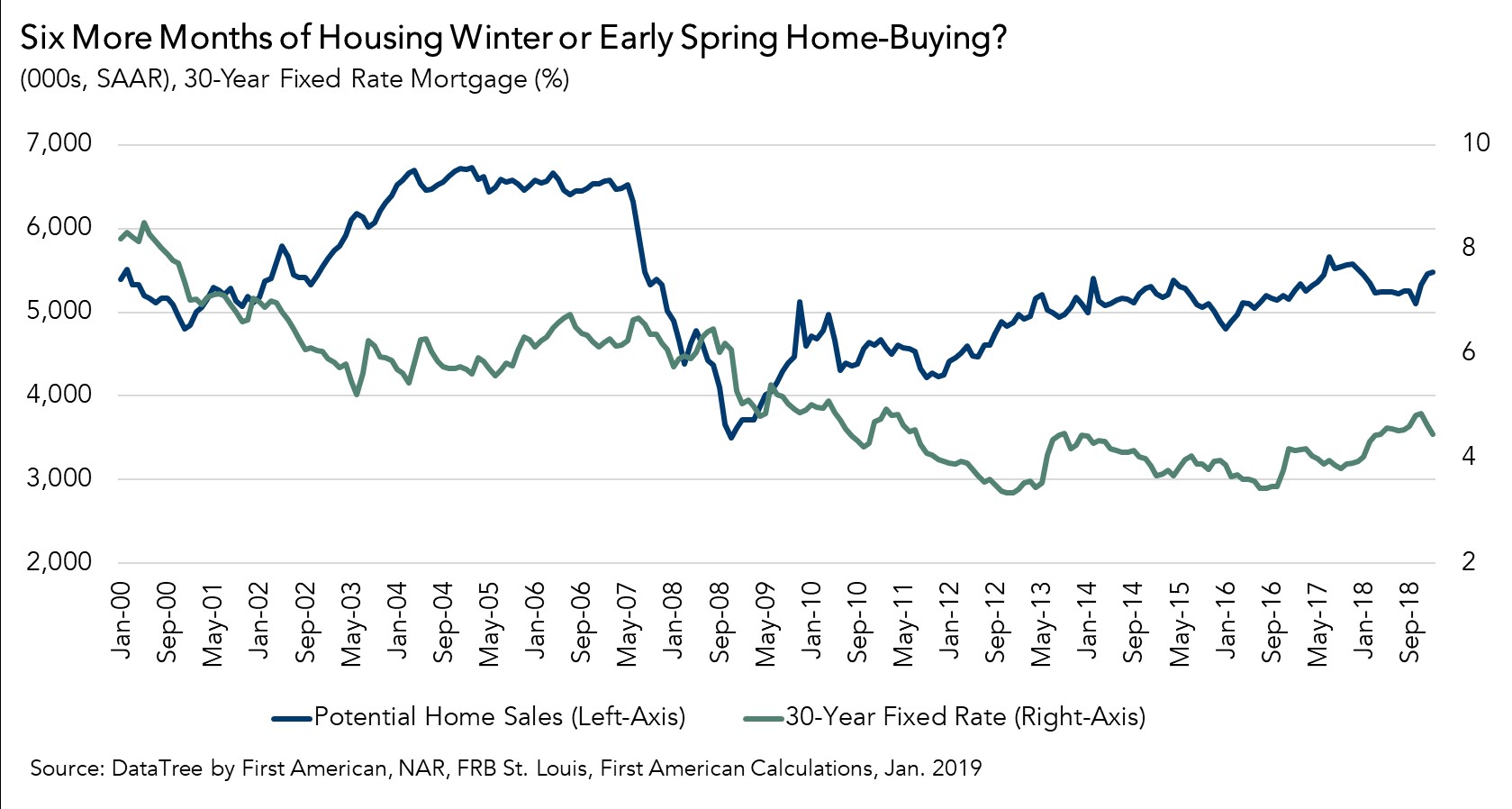

Six More Months of Housing Winter or Early Spring Home-Buying Season?

By

Mark Fleming on February 20, 2019

In the first month of the new year, the housing market continued to underperform its potential, but gave us signs of promise for the future. Actual existing-home sales are 5.3 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support 293,000 more home sales than the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

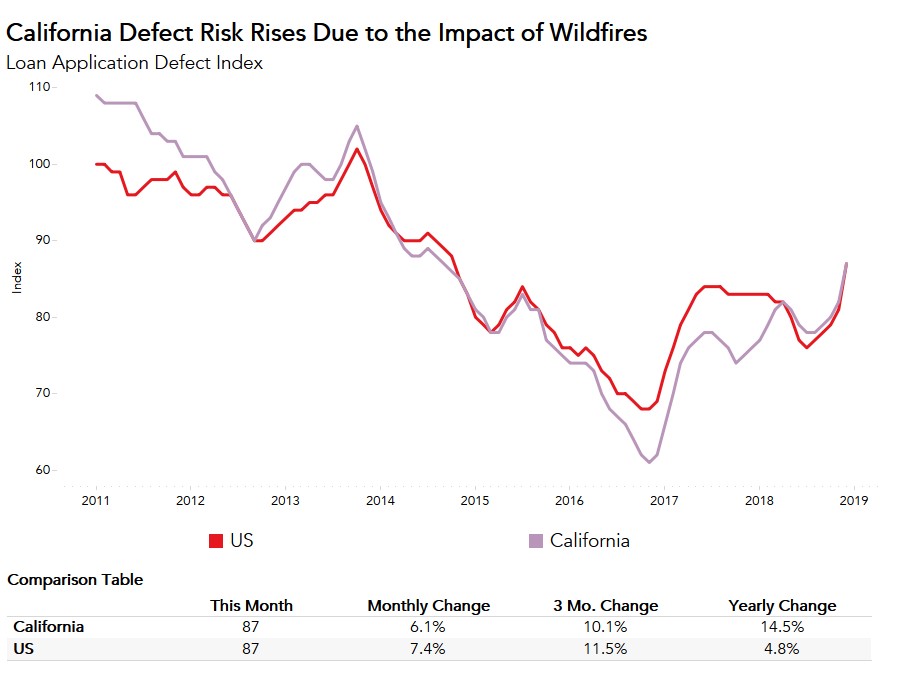

Will Loan Application Defect Risk Stabilize in 2019?

By

Mark Fleming on January 30, 2019

In December 2018, the Loan Application Defect Index for purchase transactions continued its string of month-over-month increases, rising for the fourth month in a row. Despite the upswing, the Defect Index for purchase transactions still remains 1.1 percent below its level in December 2017. The Defect Index for refinance transactions also ...

Read More ›

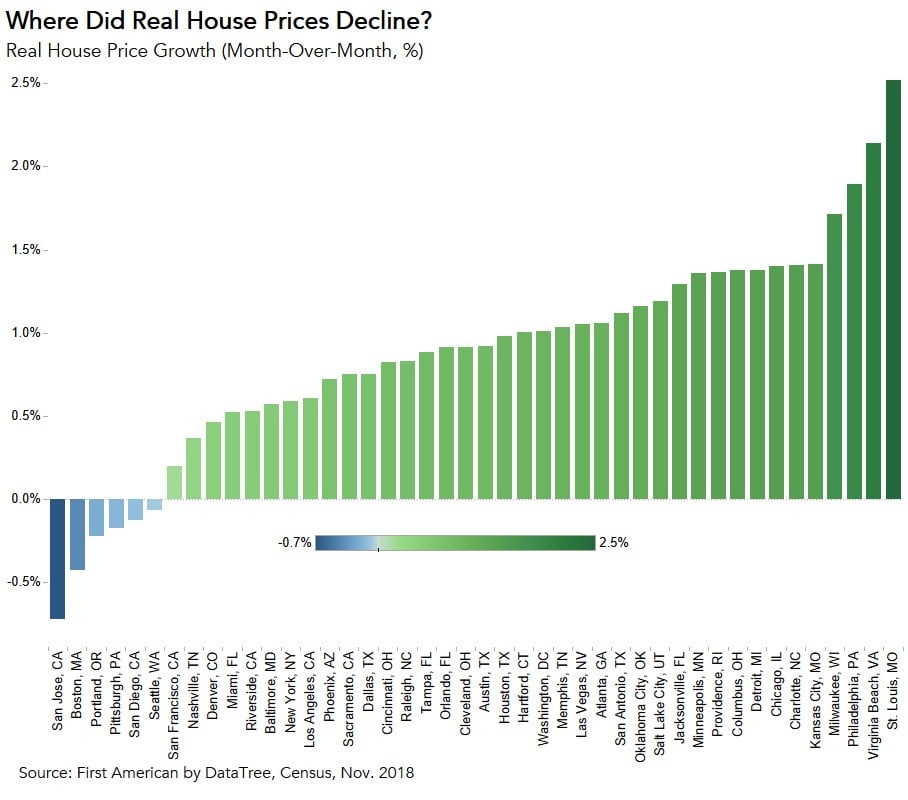

Where is the Housing Market Cooling the Most?

By

Mark Fleming on January 28, 2019

Throughout 2018, consistent growth among three driving forces – mortgage rates, household income, and unadjusted house prices – defined the housing market. These three factors are also the core metrics that comprise the Real House Price Index (RHPI). November 2018 was no exception, as household income, mortgage rates, and the unadjusted house ...

Read More ›