For the second consecutive month, all three key drivers of the Real House Price Index (RHPI), household income, mortgage rates, and the unadjusted house price index, increased compared with a year ago. The 30-year, fixed-rate mortgage and the unadjusted house price index increased by 0.9 percentage points and 7.3 percent respectively. Even though household income increased 3.0 percent since October 2017 and boosted consumer house-buying power, the Real House Price Index increased 16.2 percent compared with last October, the highest yearly growth rate since 2014.

“The tug-of-war between rising mortgage rates and increasing household income doesn’t necessarily mean that house prices will decline. In fact, history tells us otherwise.”

How a Strong Economy Can Slow the Housing Market

In 2018, the housing market has largely been a victim of the economy’s success. The Federal Reserve is trying to keep inflation in check by increasing short-term interest rates and reducing their holdings of Treasury bonds and mortgage-backed securities. The Fed’s moves have pressured mortgage rates higher and made buying a home more expensive. Meanwhile, the healthy economy and robust labor market in 2018 has supported home buyer demand.

Rising mortgage rates impact both housing supply and demand, limiting supply by reducing the propensity of sellers to sell and flattening demand by reducing consumer house-buying power. For home buyers, the only way to mitigate the loss of affordability caused by a higher mortgage rate is with an equivalent, if not greater, increase in household income.

The increase in mortgage rates since last October has reduced house-buying power by $41,000. Over the same period, household income growth increased consumer house-buying power by nearly $11,000. The net result is overall consumer house-buying power fell by $30,000 in October compared with a year ago. At the moment, rising mortgage rates are winning the buying power tug-of-war with rising household incomes – the pace of household income growth is not sufficient to fully offset the change in mortgage rates.

Do Rising Mortgage Rates Always Lead to Falling House Prices?

Increasing mortgage rates have been a defining feature of the 2018 housing market. Many people may expect house prices to decline when rates rise, but their effect on home prices may not be as straightforward as you think.

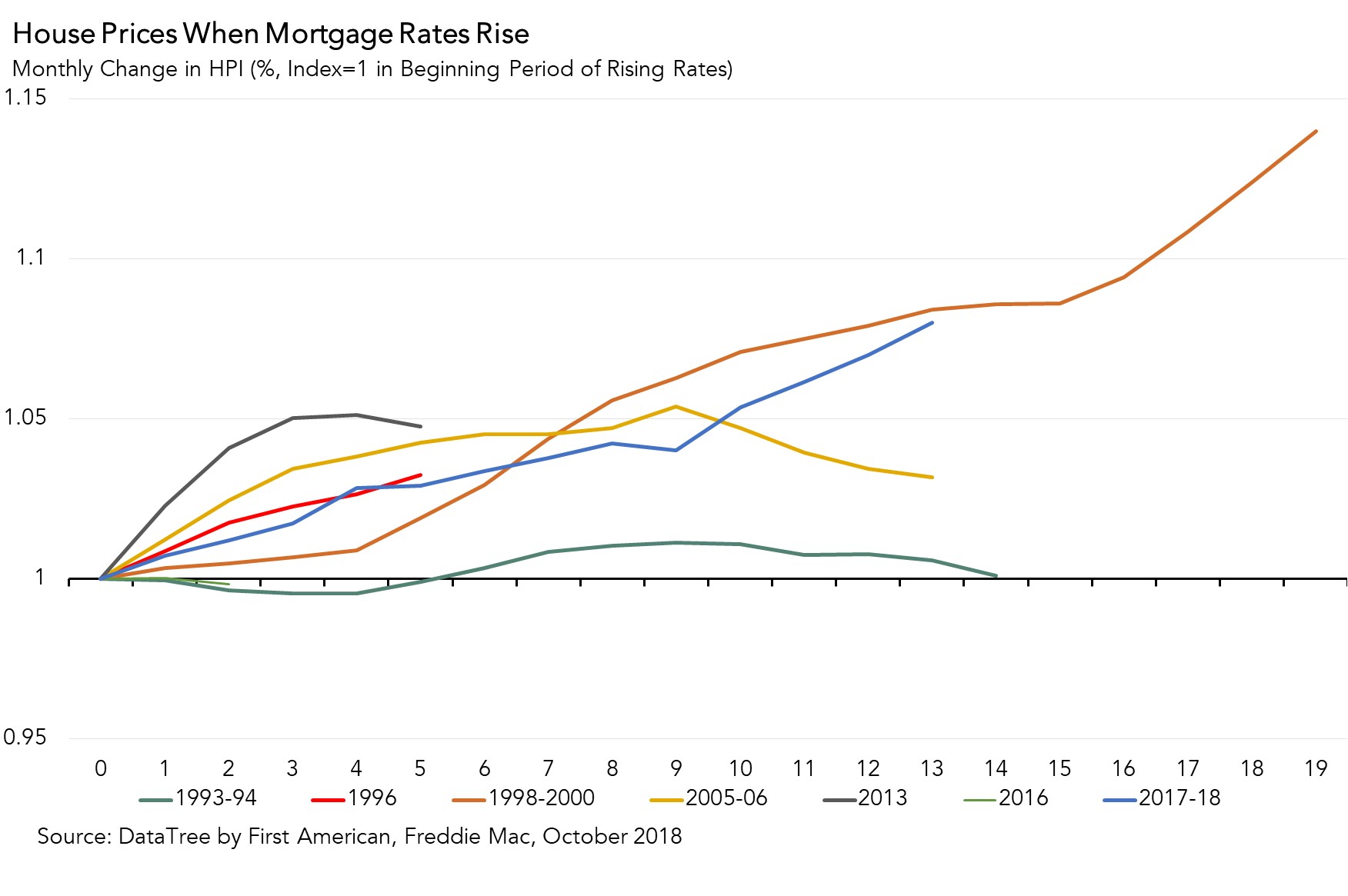

The graph below shows unadjusted house prices in seven rising mortgage rate eras over the past 25 years. The trend is clear – house prices are resistant to rising mortgage rates. Apart from the 1993-94 rising-rate period, when house prices declined slightly and briefly, they have always ended the rising-rate era higher than when it started.

In the longest rising mortgage rate era, 1998-2000, nominal house prices increased nearly 15 percent in just 19 months as the economy expanded rapidly. At the time, the economy was defined by tight labor markets and low inflation, all contributing to a healthy housing market.

Today, as mortgage rates increase, house prices are rising at a pace similar to the 1998-2000 era. Over the last 13 months, nominal house prices have increased by 8.0 percent. This compares to the first 13 months of the 1998-2000 rising mortgage-rate era, when house prices increased 8.4 percent.

Economic Environment More Influential than Mortgage Rates

The lesson? House prices are often resilient to rising mortgage rates, but just how resilient depends on the economic environment. Ultimately, rising interest rates are indicative of a growing economy, which benefits consumers and increases home buyer demand. The tug-of-war between rising mortgage rates and increasing household income doesn’t necessarily mean that house prices will decline. In fact, history tells us otherwise.

For the full analysis of affordability, the top five states and markets with the greatest increases and decreases in real house prices, and more, please visit the Real House Price Index.

The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of January 28, 2019.

Sources: