It’s been over six years since house prices hit their trough and the housing market bottomed out. Since then, house prices have recovered nationally and reached historic highs. The price recovery has most recently been driven by a supply shortage. The availability of homes for sale is running near historic lows because single-family housing construction remains low and home builders have not built enough new homes to keep up with overall demand.

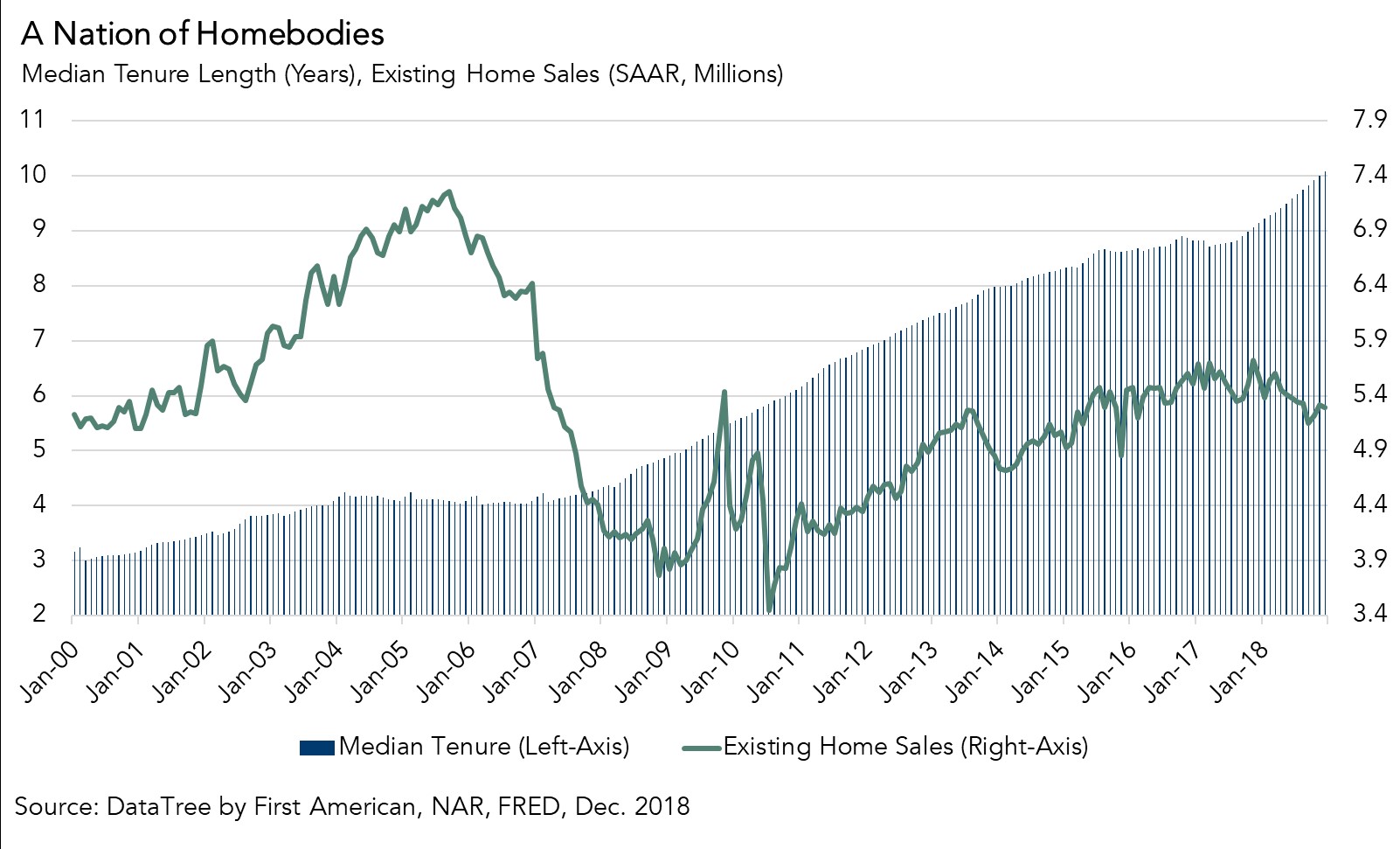

More importantly, existing homeowners have been staying in their homes longer. The increase in homeowner tenure (the length of time a typical homeowner lives in a home before moving) explains why housing supply is tight and is currently one of the main drivers of low existing home sales. It’s hard to buy what’s not for sale.

“More than half of all existing-homes are owned by baby boomers and the silent generation, who will eventually age out of homeownership. When that occurs, the problem may not be a lack of supply, but the exact opposite.”

For the three to four years before the housing market crash in 2007, the median length of time someone lived in their home was relatively stable, hovering around four years. Tenure jumped to seven years during the aftermath of the crash between 2008 and 2016, and the most recent data from December 2018 shows that the median length of time someone lives in their home has increased 10 percent compared with a year ago. This begs the questions, what drives homeowner tenure in the U.S., and have we become a land of homebodies?

Why is Tenure Length Increasing?

The long-term historical average for tenure length in the U.S. is approximately six years. Based on a joint analysis by First American and Moody’s analytics, we have identified several key drivers to homeowner tenure in the U.S. The most notable drivers of homeowner tenure are:

- Mortgage rates: The lower the interest rate homeowners have on their existing mortgage compared to the current market mortgage rate, the less incentive there is for homeowners to move, leading to higher tenure length. Why move when it will cost more each month to borrow the same amount from the bank? Those who bought their homes ten years ago likely will have refinanced into a 3.5 percent mortgage, making the most recent 4.6 percent 30-year, fixed-rate mortgage unattractive. This is commonly referred to as the rate lock-in effect.

- Supply: The lack of supply and the fear of not being able to find something to buy keeps many homeowners from selling. As the supply of homes for sale increases, the risk of not being able to find something to buy falls and homeowners become more confident in the decision to sell. Today’s significant lack of supply is preventing homeowners from selling and driving tenure length up.

- Credit standards: When lending standards are tight, it becomes more difficult to qualify for a mortgage to buy a home. Likewise, when standards are looser, it’s easier to get a mortgage and buy a home. Because a homeowner’s decision to sell is driven by their decision and ability to buy, tighter credit standards increase tenure length. When homeowners are less likely to receive mortgages for a new home, they are more likely to stay in their current home. According to survey data, loan officers consider current credit standards tight by historic standards.

- Foreclosure rates: Foreclosures, unsurprisingly, reduce homeowner tenure, as foreclosures force homeowners to move, possibly before they would otherwise want to. Naturally, low foreclosure rates lead to increase homeowner tenure. According to data from DataTree by First American, the number of foreclosures is the lowest it has been since before the housing market crash in 2007.

- Home equity: As a homeowner gains equity in their home, they are more likely to consider using the equity to purchase a larger or more attractive home. However, if equity is low, homeowners are likely to remain “equity locked-in” to their home. If a homeowner is underwater, or in a negative equity position, it is very difficult to sell without bringing cash to the closing. Even though Americans currently have the highest amount of tappable equity in history, the other drivers of tenure length are proving more influential in the homeowner’s decision to sell.

When Will the Homebody Era End?

Clearly, every homeowner’s decision to sell is different and influenced by personal and family preferences, but the influences above all factor into the decision to sell. Yet, today, we are in a near unprecedented homebody era, as increasing mortgage rates, low supply, low rates of foreclosure and tight credit have increased homeowner tenure to the highest level in 18 years.

While it is unlikely the influences that are currently driving tenure higher will change in the near term, more than half of all existing-homes are owned by baby boomers and the silent generation, who will eventually age out of homeownership. When that occurs, the problem may not be a lack of supply, but the exact opposite.