Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

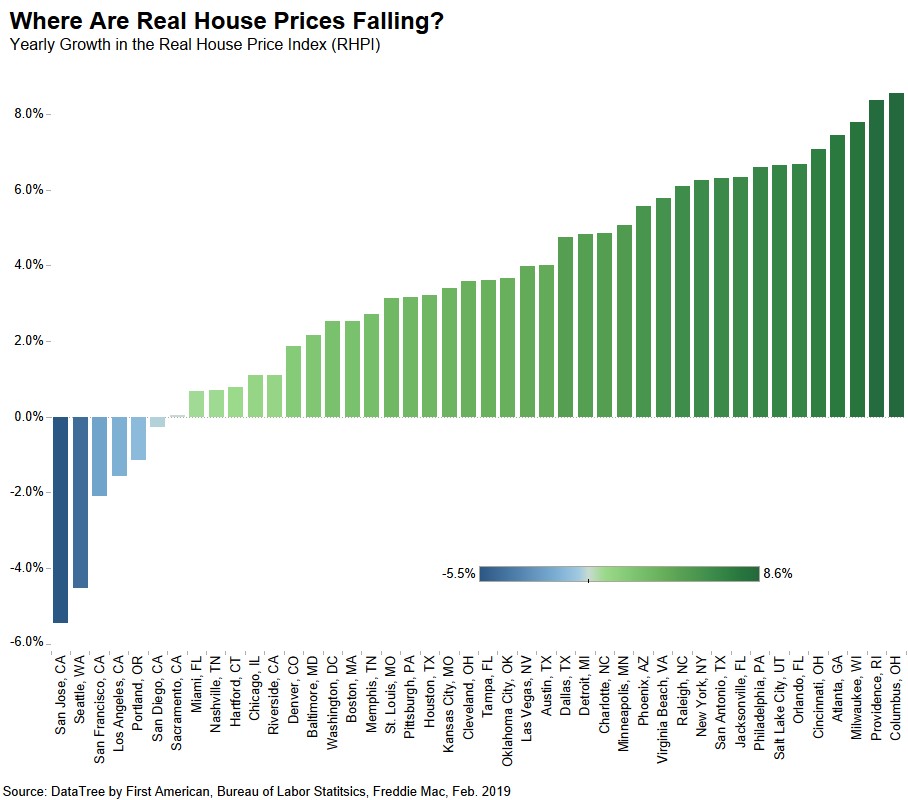

Six Cities Leading Shift Toward A Buyers' Market

By

Mark Fleming on April 29, 2019

Throughout 2018, consistent growth among three driving forces – mortgage rates, household income and unadjusted house prices – defined the housing market. These three factors are also the core elements of the Real House Price Index (RHPI). While household income rose steadily in 2018, rising mortgage rates offset any affordability benefit for home ...

Read More ›

Two Trends Boost Home-Buyer Demand As Spring Home-Buying Season Begins

By

Mark Fleming on April 18, 2019

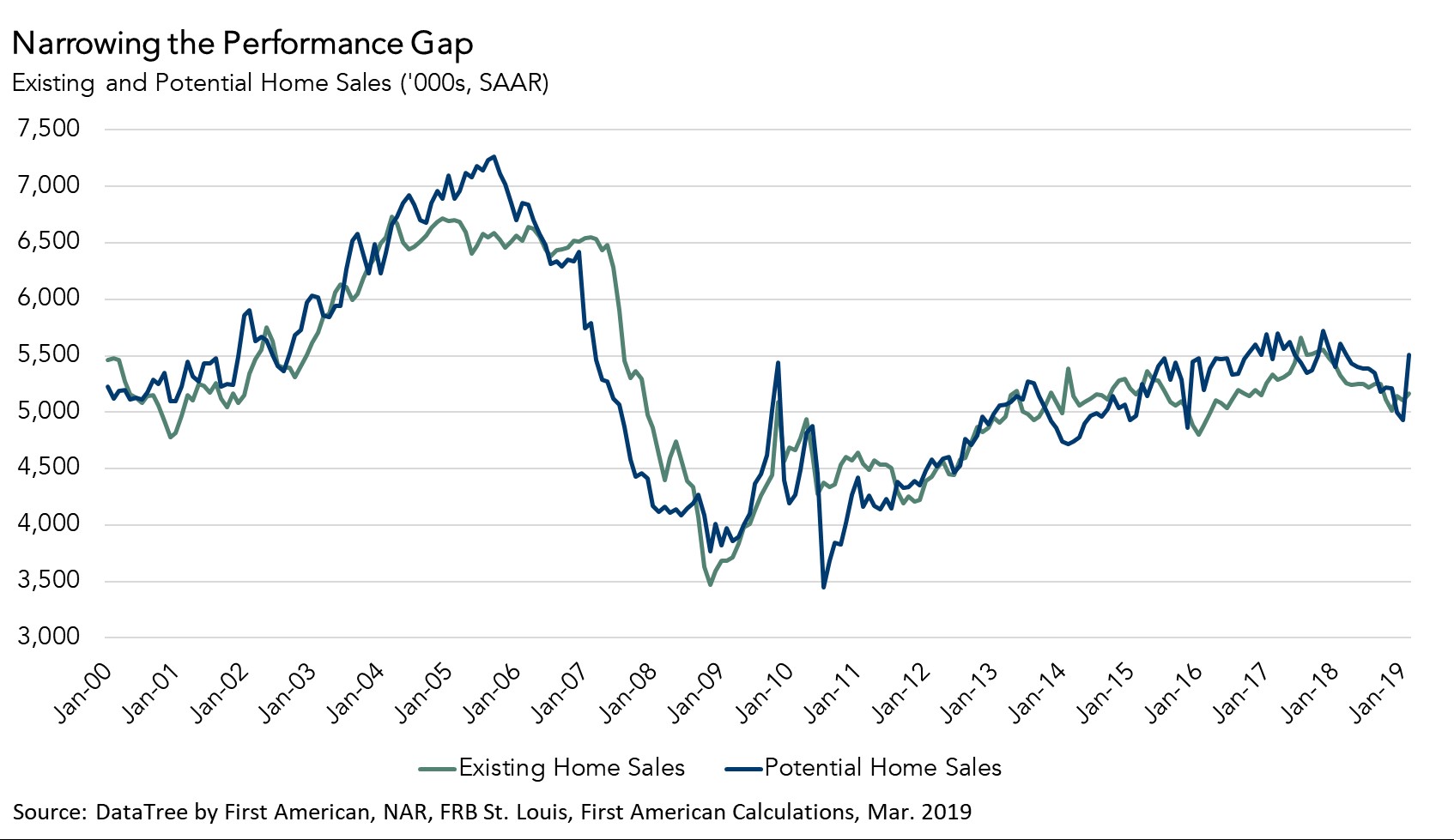

While the housing market continued to underperform its potential in March 2019, the green shoots of spring home buying have emerged. Actual existing-home sales are 2.3 percent below the market’s potential, narrowing the gap from last month, according to our Potential Home Sales model. That means the housing market has the potential to support ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

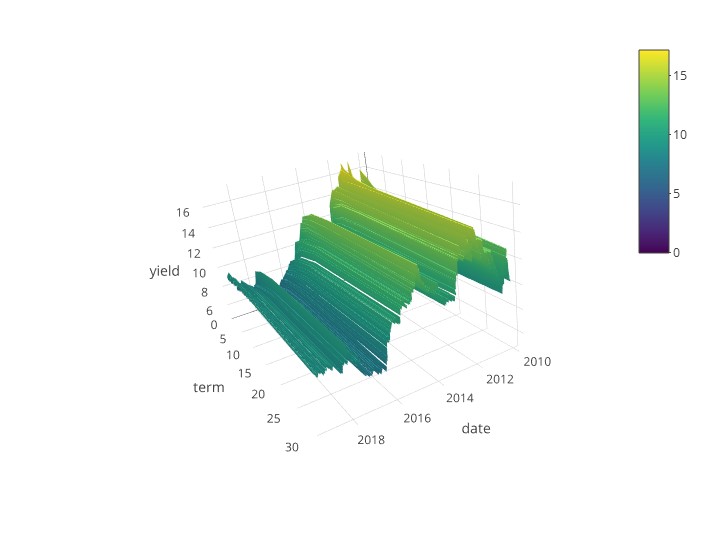

Why the Yield Curve May Have Fooled Some Experts

By

Mark Fleming on April 5, 2019

April Fools’ may be over, but that hasn’t dampened recession fears from generating headlines. Broadly speaking, the U.S. economy is performing well. Wages are increasing and we’re near full employment. So, why are some experts raising recession concerns?

Read More ›

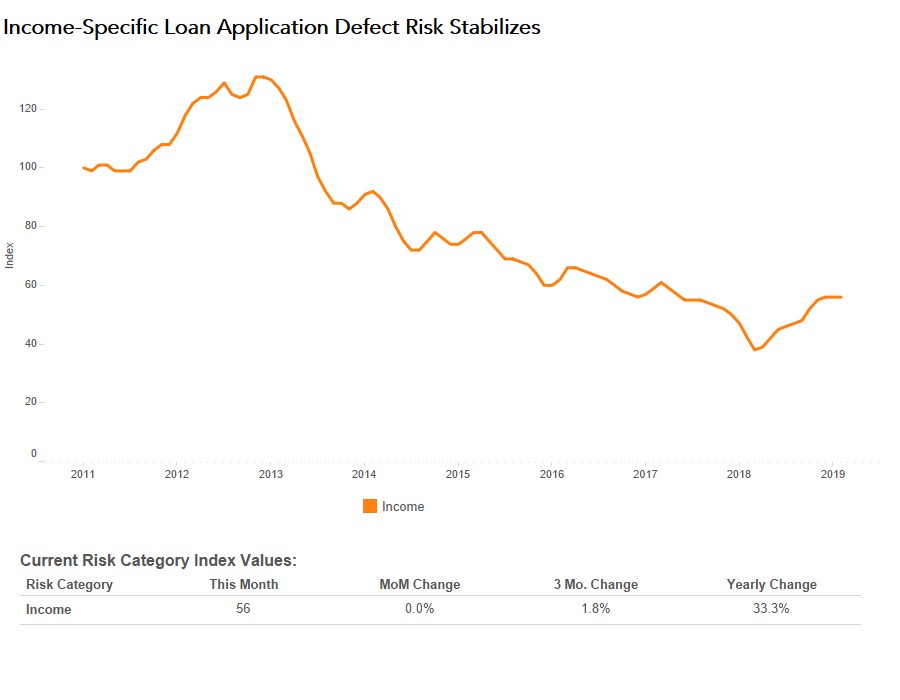

What Drives Increases in Income-Related Loan Application Defects?

By

Mark Fleming on March 29, 2019

Throughout much of 2018, home prices were high, demand was rising and bidding wars were the new normal. As a result of the competitive market, buyers were under more pressure to seek qualification for larger loans. Fraud can come in many forms, but income falsification remains one of the most likely misrepresentations. By December 2018, ...

Read More ›

Three Reasons Home Buyers Have More Power This Spring

By

Mark Fleming on March 25, 2019

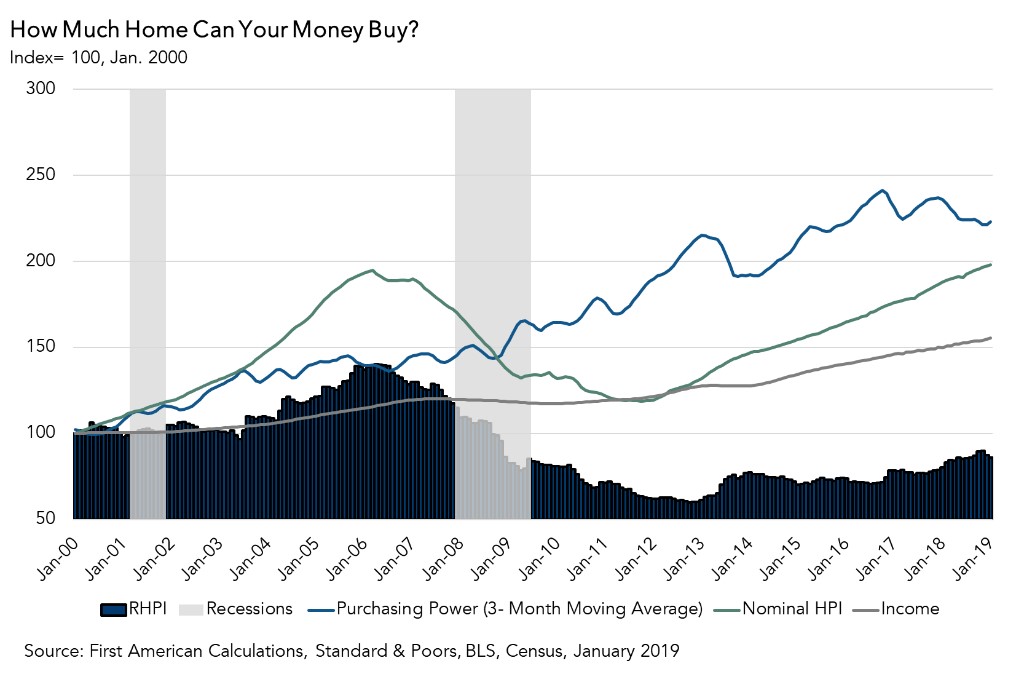

While 2018 was largely characterized by declining affordability, ending the year with a five percent yearly decline in house-buying power, this trend reversed sharply in early 2019. Moderating home prices, in conjunction with gains in household income and declining mortgage rates, boosted affordability for potential home buyers.

Read More ›

Why The Stage Is Set For A Stronger Spring Home-Buying Season

By

Mark Fleming on March 21, 2019

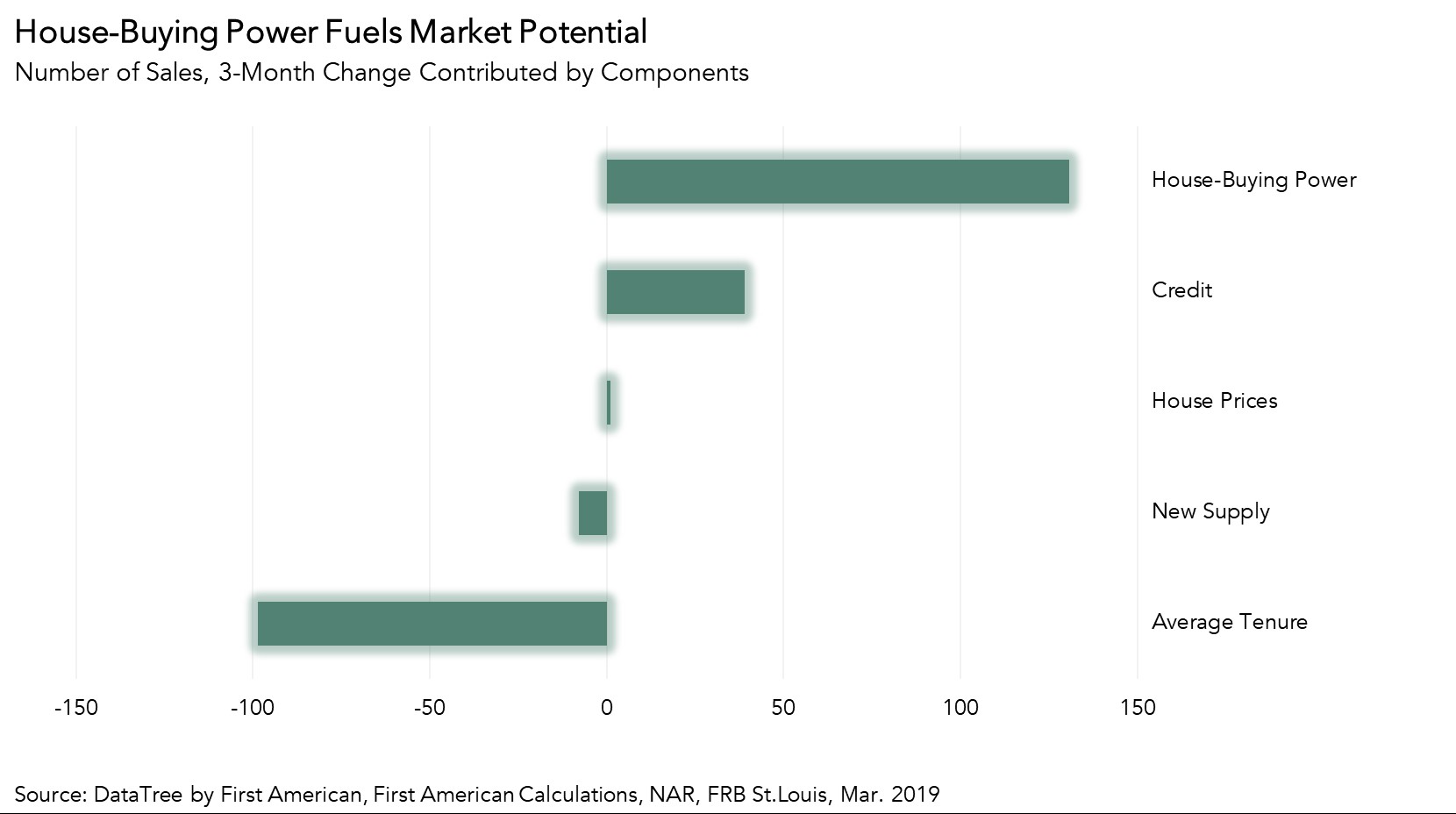

In February 2019, the housing market continued to underperform its potential, but showed signs of promise leading into the spring home-buying season. Actual existing-home sales are 2.5 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support 127,000 more home sales at a ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales