Yesterday, the Census Bureau released its Residential Construction report for November. Housing completions decreased 3.9 percent compared with last November and continue to fall short of the number of new housing units necessary to keep pace with household formation. Housing starts also decreased 3.6 percent in November compared with a year ago. Single-family starts declined 13.1 percent compared with last November.

The overall number of permits issued, which can signal how much construction is in the pipeline, increased by 0.4 percent compared with a year ago, and reached a seven-month high. The overall increase in permits was largely driven by multi-family homes (5 or more units), which increased 5.5 percent compared with a year ago. Permits for single-family homes (1-4 units) fell 2.0 percent compared with last year. The decline in single-family permits is reflected in the most recent homebuilder sentiment survey, which dropped to its lowest point in the last three years.

“Looking ahead to 2019, single-family homebuilding will need to increase to keep pace with rising demand from the largest generation, millennials, as they enter their prime home-buying years.”

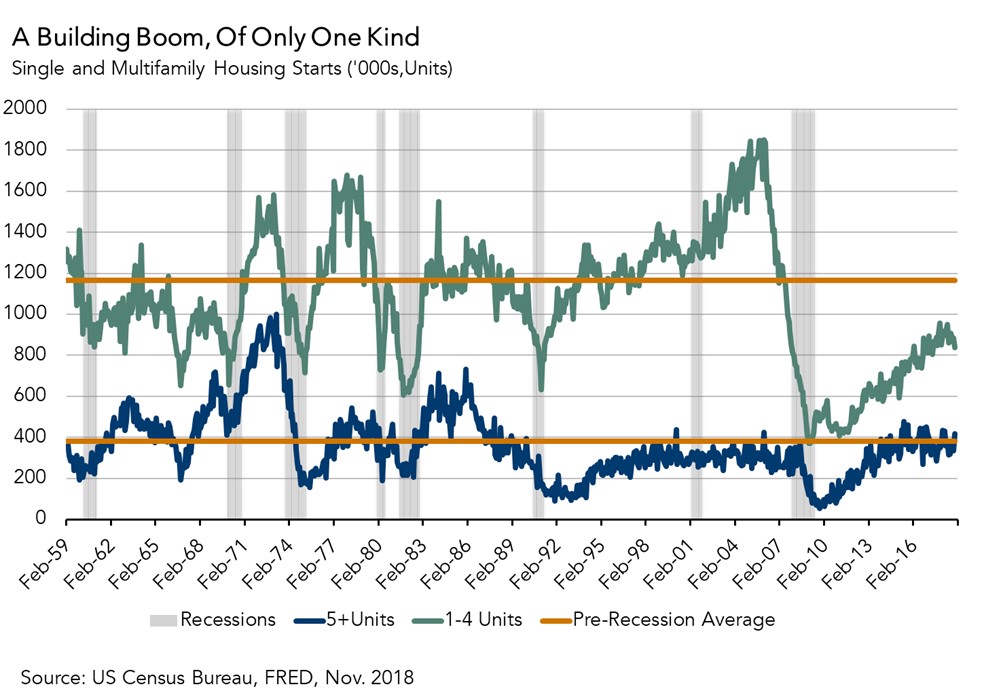

A Building Boom, Of Only One Kind

As the year ends, it seems appropriate to take stock of what’s happened to housing supply this past year. Despite underwhelming housing starts data in the past two months, there are nevertheless reasons to feel cheerful about homebuilding in 2018. Overall, average housing starts from January to November increased 4.6 percent in 2018 compared with the same period in 2017, to an average of 1.3 million units. Total completions saw a corresponding increase of 4.4 percent in 2018, with an average 1.2 million units completed. We saw particularly strong growth in multi-family starts.

As can be seen from the graph below, multi-family starts increased 7.9 percent beyond 2017’s average. This largely returns multi-family construction to historically average levels. Single-family construction, on the other hand, continues to lag the pre-recession historical average by 29.1 percent.

Looking ahead to 2019, single-family homebuilding will need to increase to keep pace with rising demand from the largest generation, millennials, as they enter their prime home-buying years.

November 2018 Housing Starts

For the month of November 2018, the new residential construction report shows that:

- The number of building permits issued, a leading indicator of housing starts, increased by 0.4 percent year over year.

- Housing starts decreased by 3.6 percent, compared with a year ago.

- The stock of housing units authorized to be built increased by 16.4 percent, and the number of housing units under construction increased by 4.0 percent on an annual basis.

- The number of completed homes, which is additional new net supply added to the housing stock, decreased by 3.9 percent compared with a year ago.

Chief Economist Analysis Highlights

- The annual decrease in completions signals a slowdown in immediate housing supply relief.

- In November, the overall pace of housing starts, at 1.26 million units, is a 3.2 percent increase from the previous month. Based on the less volatile three-month moving average, the volume of total residential (single- and multi-family) housing starts is 8,000 less than October 2018, and 5,000 units less than a year ago.

- Housing starts are an important indicator of future supply as the housing market continues to face a supply constraint challenge.

- An estimated seasonally adjusted annualized rate of 1.10 million housing units were completed in November, representing a 3.9 percent decrease from the November 2017 figure of 1.44 million.

What Insight Does Monthly Housing Start Data Provide?

Housing starts data reports the number of housing units on which construction has been started in the month reported, providing a gauge of future real estate supply levels. The source of monthly housing starts data is the “New Residential Construction Report” issued by the U.S. Census Bureau jointly with the U.S. Department of Housing and Urban Development (HUD). The data is derived from surveys of homebuilders nationwide, and three metrics are provided: building permits, housing starts and housing completions. Building permits are a leading indicator of housing starts and completions, providing insight into the housing market and overall economic activity in upcoming months. Housing starts reflect the commitment of home builders to new construction, as home builders usually don't start building a house unless they are confident it will sell upon completion. Changes in the pace of housing starts tells us a lot about the future supply of homes available in the housing market. In addition, increase in housing starts can lead to increases in construction employment, which benefits the overall economy. Once the home is completed and sold, it generates revenue for the home builder and other related industries and is added to the housing stock.