Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

The Unexpected Surprise Boosting Demand and Supply in 2019

By

Mark Fleming on June 18, 2019

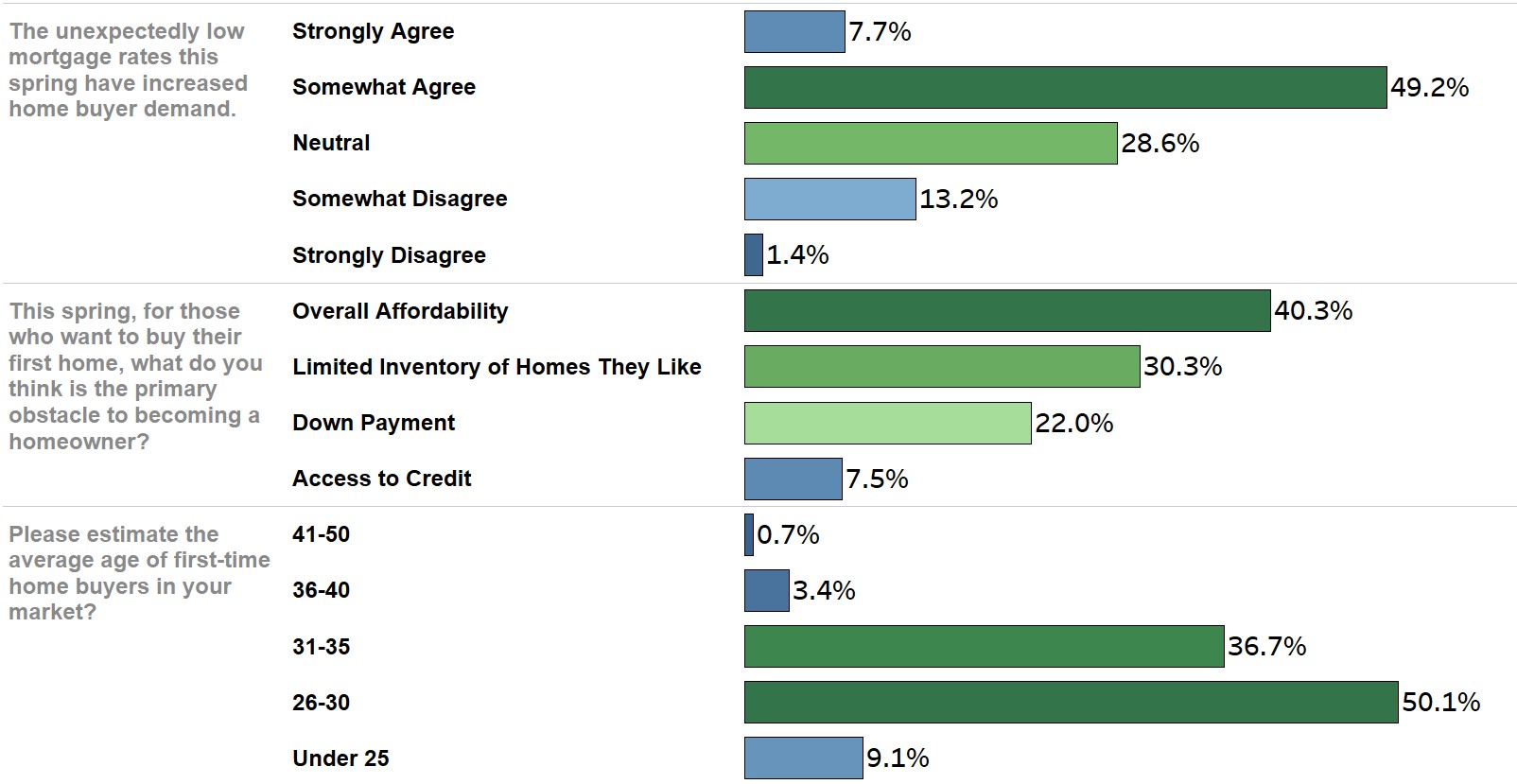

In late 2018, many experts believed the housing market in 2019 would behave very similar to the 2018 housing market, characterized by rising demand for homes and limited supply driving house price appreciation, while mortgage rates continued their steady ascent. Then, December 2018 brought a sudden drop in mortgage rates, a decline which has ...

Read More ›

Housing Interest Rates Millennials Real Estate Sentiment Index

Expect the Unexpected -- Faster House Price Appreciation

By

Mark Fleming on June 6, 2019

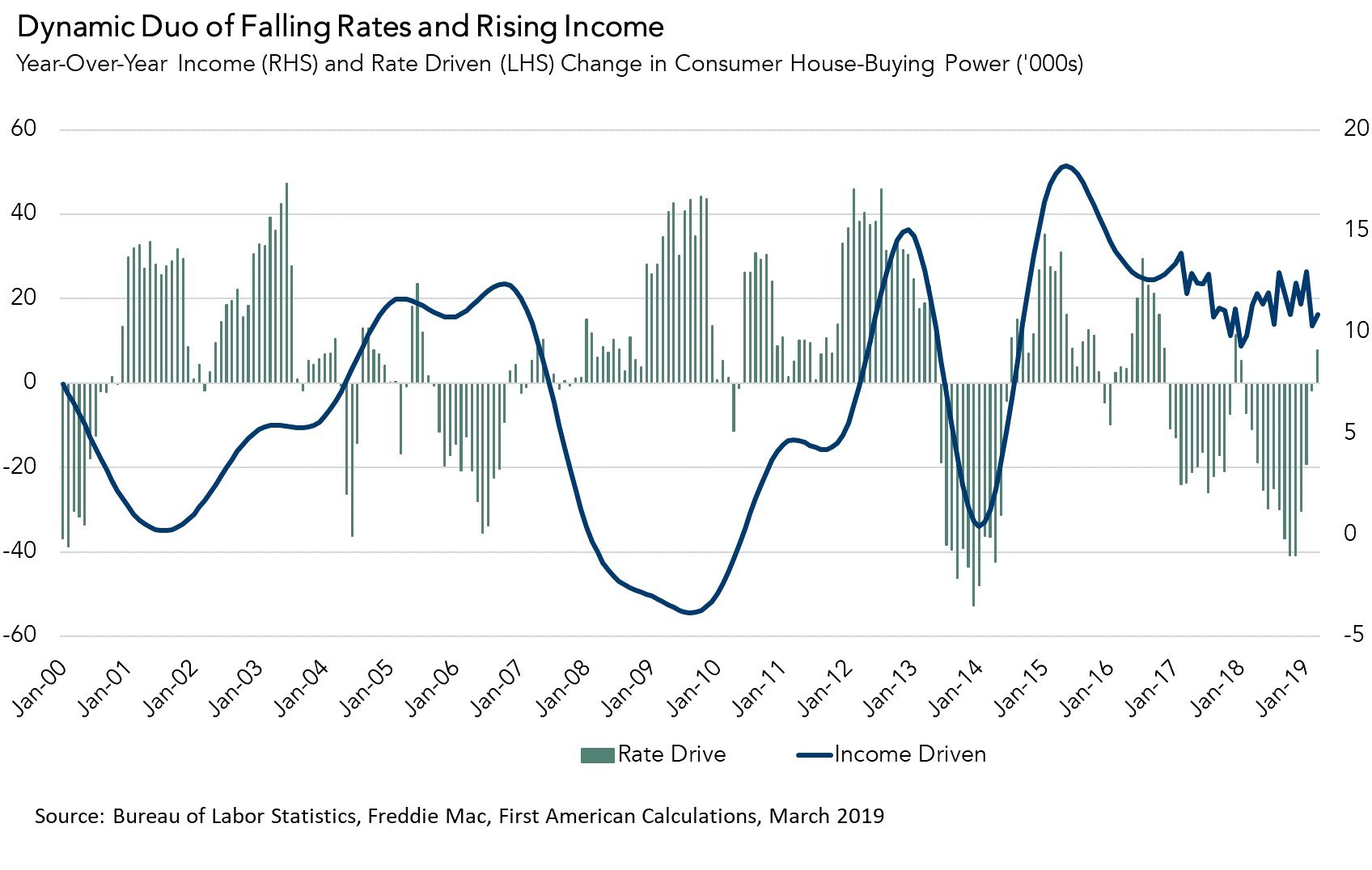

In our most recent Potential Home Sales Model analysis, we noted that the housing market’s potential improved in April because falling mortgage rates and rising household income combined to increase consumer house-buying power more than enough than to offset house price appreciation. In other words, house-buying power won the tug of war with house ...

Read More ›

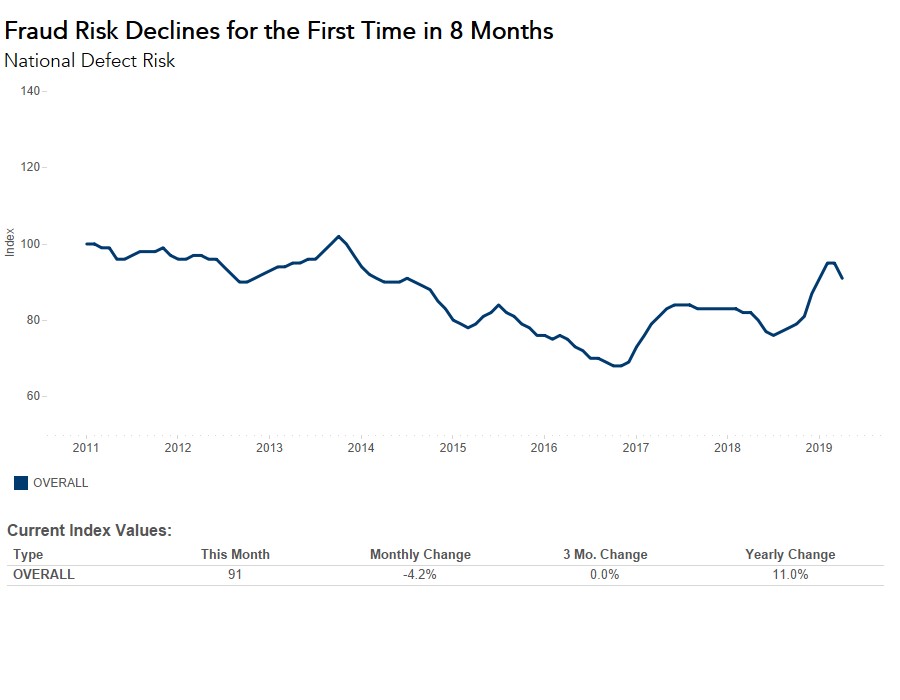

How Lower Mortgage Rates Helped Reduce Defect Risk for the First Time in Eight Months

By

Mark Fleming on May 31, 2019

The frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications declined 4.2 percent compared to last month. Notably, this marks the first month-over-month decline since July 2018, thanks to lower mortgage rates. Decreasing mortgage rates contributed to an increase in inventory, reducing the ...

Read More ›

Why Did Affordability Improve for the First Time Since 2016?

By

Mark Fleming on May 28, 2019

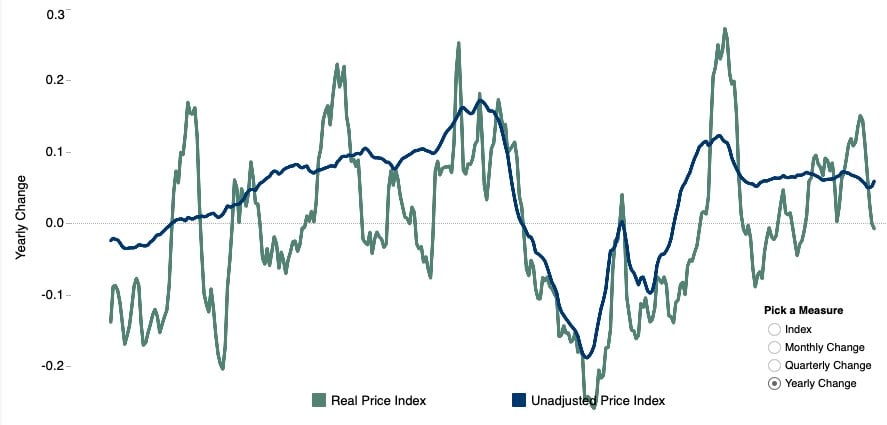

What began as a modest shift toward a buyers’ market in six cities last month has expanded into a national shift in affordability. The shift is a departure from the long-term trend in the Real House Price Index (RHPI), which had been steadily increasing throughout the rising mortgage rate environment that began in 2017 and continued until late ...

Read More ›

Why Did Housing Market Potential Improve in April?

By

Mark Fleming on May 20, 2019

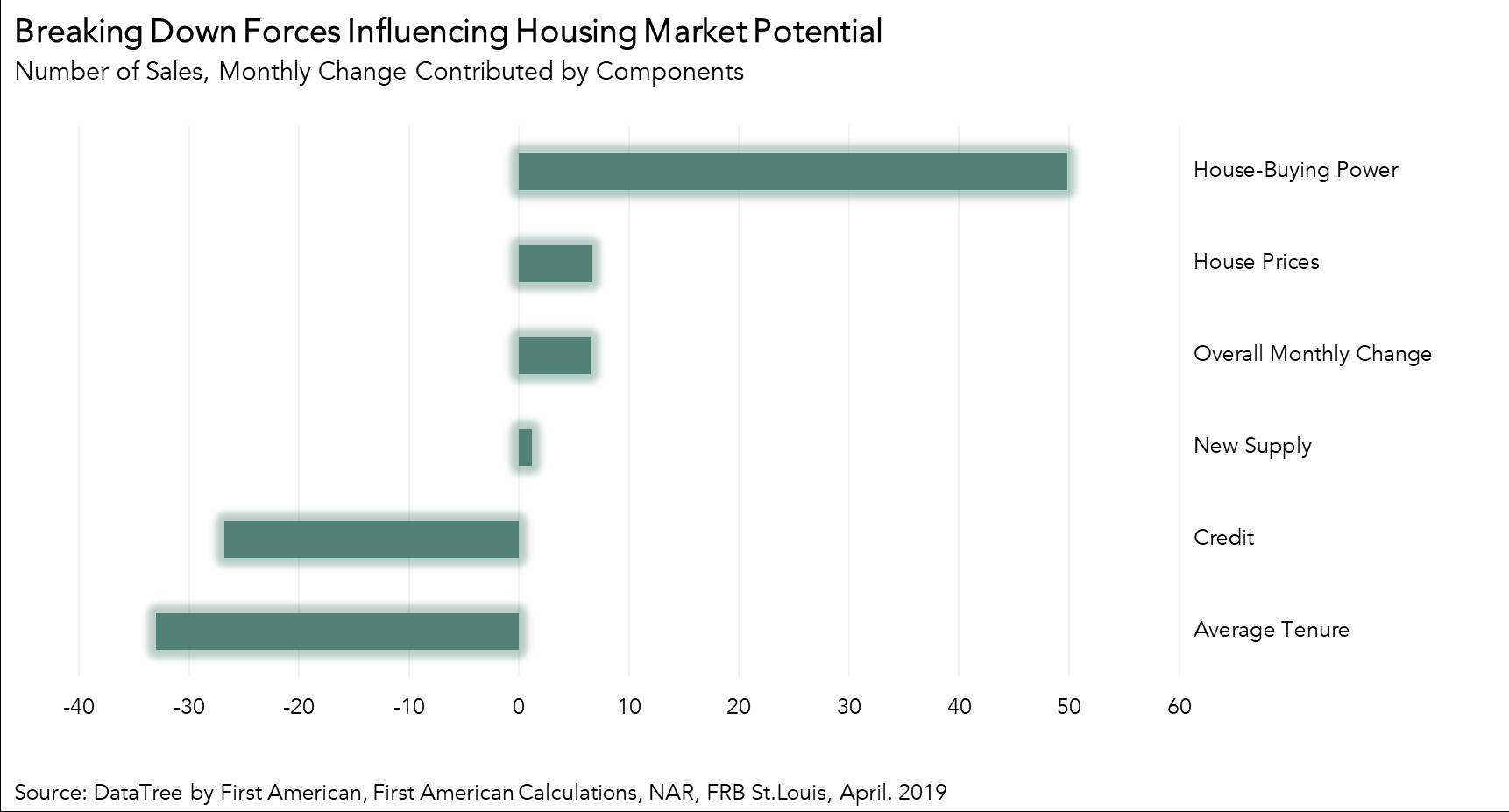

The housing market continued to underperform its potential in April 2019, but the performance gap shrank compared with March. Actual existing-home sales remain 1.3 percent below the market’s potential, but the performance gap narrowed from 2.0 percent last month, according to our Potential Home Sales model. That means the housing market has the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

The Two Competing Forces Impacting Fraud Risk

By

Mark Fleming on April 30, 2019

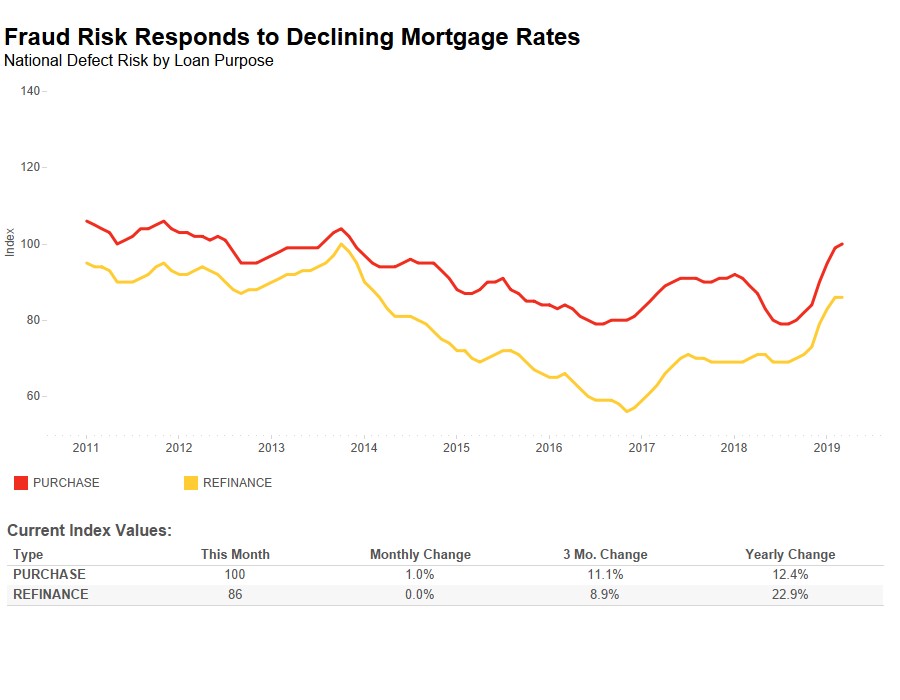

Loan application defect risk for purchase transactions continued its upward trend in March, increasing 1.0 percent month-over-month, according to the Loan Application Defect Index. Defect risk for purchase transactions has risen for seven consecutive months, however, the pace of growth slowed to its lowest point over that time span. Overall, the ...

Read More ›