Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Why Consumer House-Buying Power May Reach a Record in 2019

By

Mark Fleming on July 29, 2019

Later this week, the Federal Open Market Committee (FOMC) will convene and likely announce a rate cut, according to experts. The first Fed rate cut since December 2008 will trigger industry and media speculation about mortgage rates declining further. While changes to the federal funds rate don't directly influence mortgage rates, a rate cut will ...

Read More ›

Why Lower Mortgage Rates Have Not Closed the Housing Market Performance Gap

By

Mark Fleming on July 19, 2019

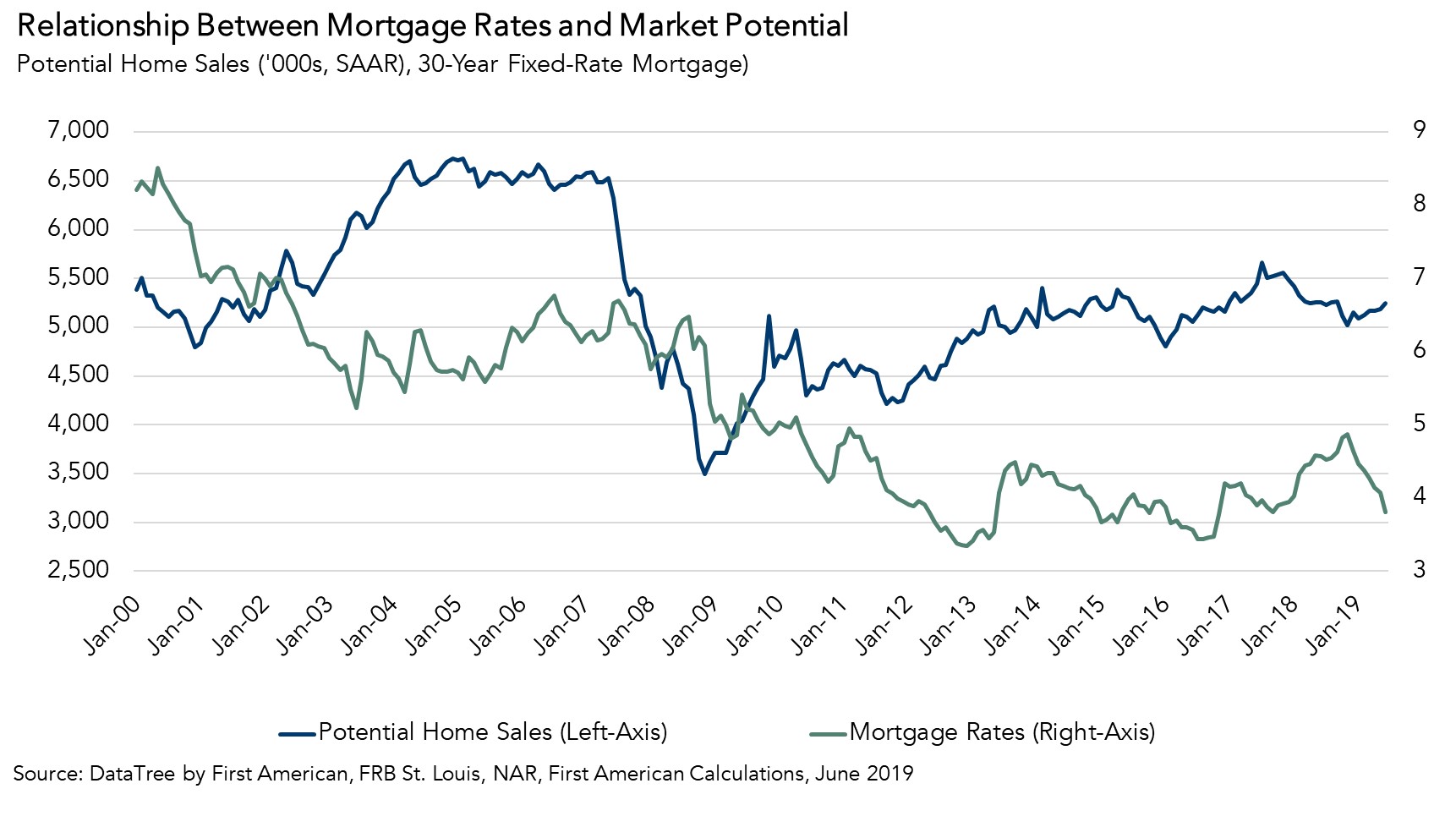

The housing market underperformed its potential in June 2019, as actual existing-home sales were 1.5 percent below the market’s potential. The market potential for existing-home sales increased 1.1 percent compared with May, according to our Potential Home Sales model.

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

What is Preventing the Homeownership Rate From Reaching its Potential?

By

Mark Fleming on July 18, 2019

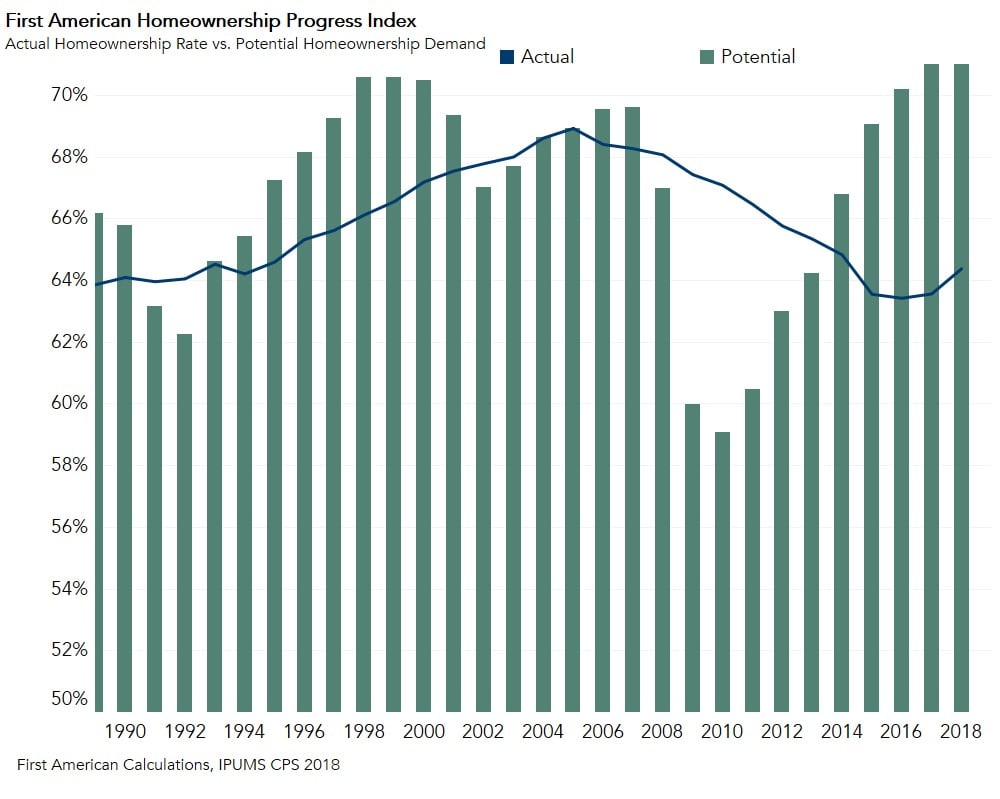

Ten years after the Great Recession, homeownership remains one of the main tenets of the American Dream. Amid the recovery from the housing crisis, the homeownership rate hit a generational low of 63 percent in 2016, but it has been steadily rising since. What’s behind the steady rise since the 2016 low point? The explanation lies in the shifts in ...

Read More ›

What’s Behind the Two-Month Decline in Fraud Risk?

By

Mark Fleming on June 28, 2019

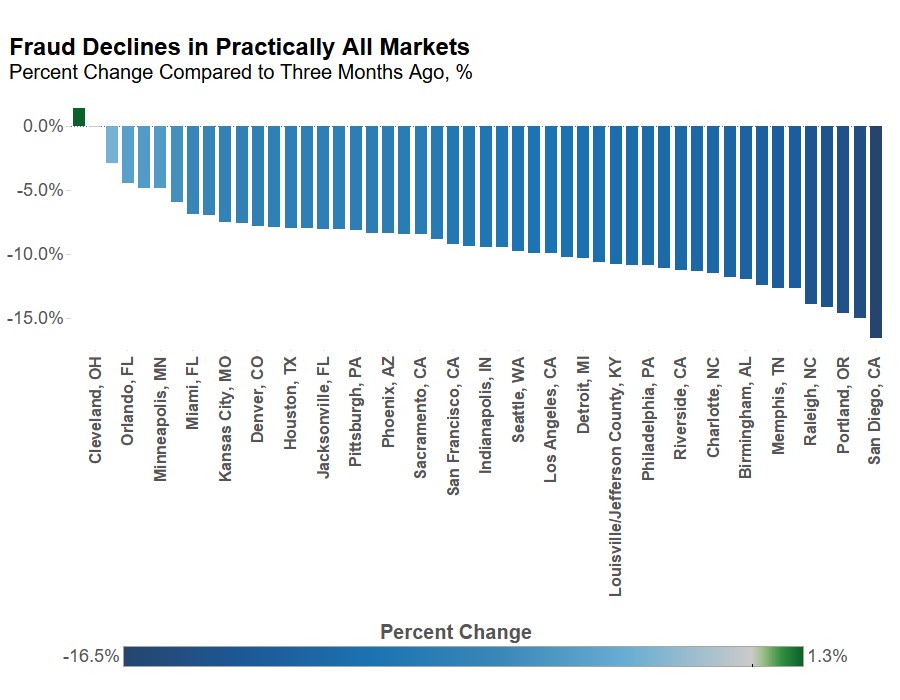

Last month, we predicted that if mortgage rates continued to fall, it may help ease the pressure on fraud risk. Indeed, the 30-year, fixed-rate mortgage fell to its lowest level since January 2018, and fraud risk has fallen alongside it. The Loan Application Defect Index for purchase transactions declined 6.3 percent in May compared with April, ...

Read More ›

The Five Cities Where Affordability Improved the Most and Why

By

Mark Fleming on June 24, 2019

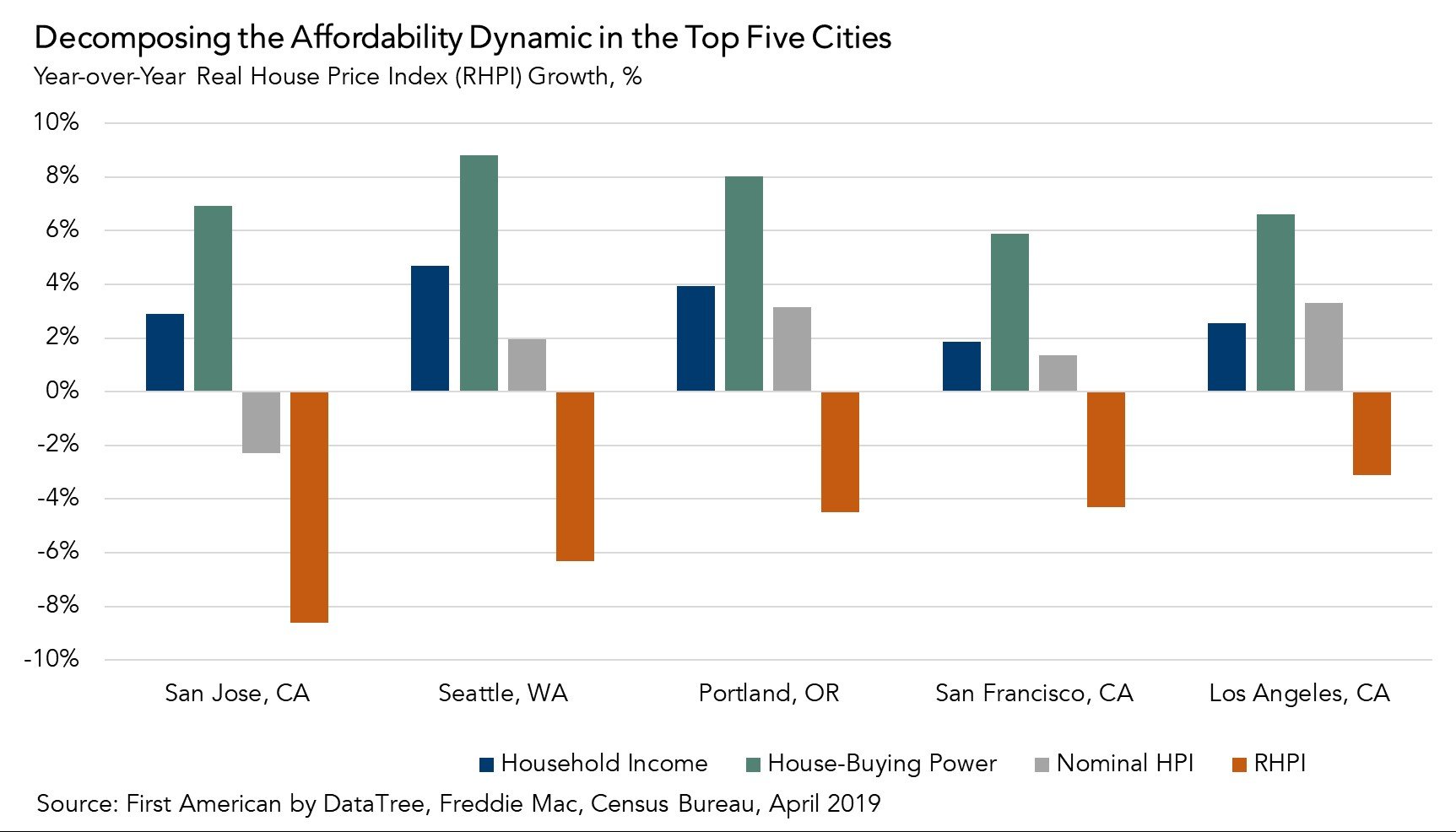

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in April. The 30-year, fixed-rate mortgage fell by 0.33 percentage points and household income increased 2.7 percent compared to April 2018. When household income rises, consumer house-buying power ...

Read More ›

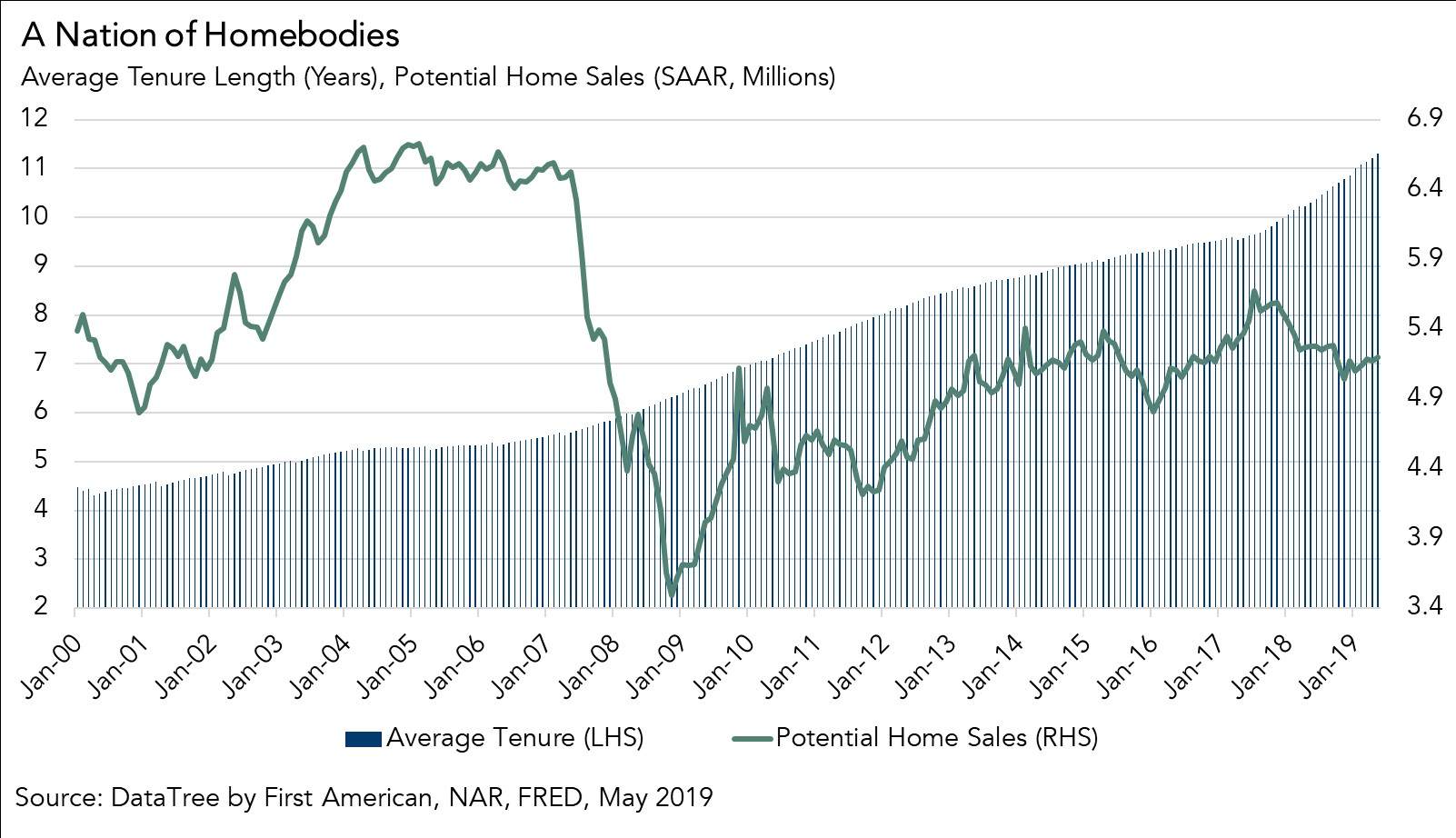

Why the Housing Market has Entered an Unprecedented Homebody Era

By

Mark Fleming on June 20, 2019

The housing market outperformed its potential in May 2019. Actual existing-home sales are 0.2 percent above the market’s current potential, according to our Potential Home Sales model. Even as mortgage rates have decreased, and household income has increased, the market is underperforming compared to it’s potential from a year ago. What are the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales