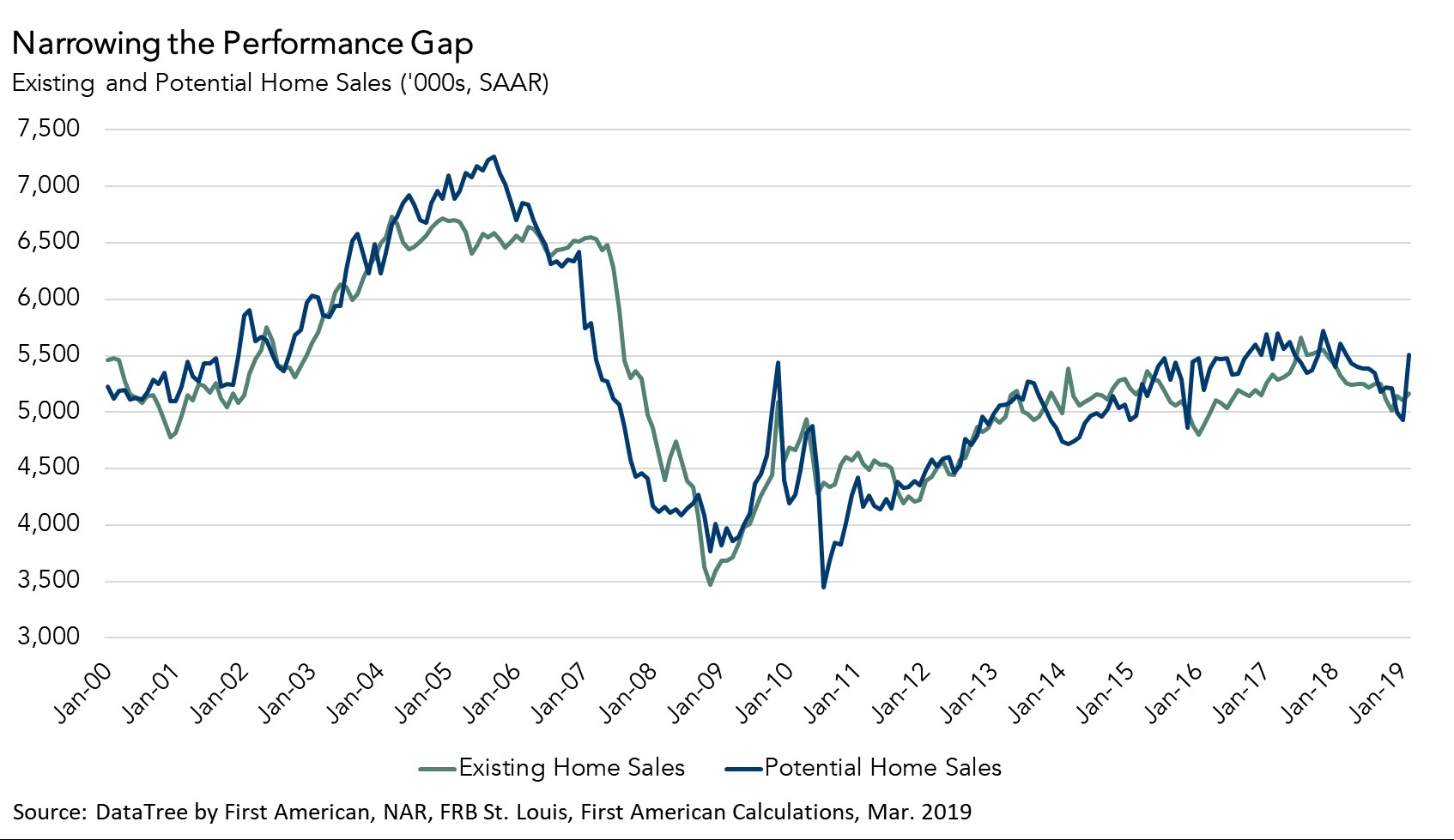

While the housing market continued to underperform its potential in March 2019, the green shoots of spring home buying have emerged. Actual existing-home sales are 2.3 percent below the market’s potential, narrowing the gap from last month, according to our Potential Home Sales model. That means the housing market has the potential to support 121,000 more home sales at a seasonally adjusted annualized rate (SAAR).

“We expect rising wages and lower mortgage rates to continue through the spring, boosting housing demand and spurring home sales.”

Ongoing supply shortages remain the main driver of the performance gap as the housing market continues to face an inventory impasse – you can’t buy what’s not for sale. However, an unexpected affordability surge, driven primarily by lower-than-anticipated mortgage rates, rising wages and favorable demographics, has boosted housing demand. The result? The start of a surprisingly strong spring home-buying season.

Dynamic Duo Drives Housing Market Potential

Two trends are driving an early spring bounce in consumer house-buying power: rising income and lower mortgage rates. In March, average hourly earnings grew at an annual rate of 3.2 percent, well above the 2.3 percent average annual pace seen over the past 10 years. The growth in average hourly earnings resulted in a 2.7 percent year-over-year increase in average household income. Rising income improves house-buying power, which boosts housing market potential.

Income isn’t the only thing contributing to rising house-buying power. The unexpected spring decline in mortgage rates has also boosted housing market potential. While mortgage rates increased throughout most of 2018, they began to trend downward in December and have continued to fall since then. The decline in mortgage rates may have encouraged some homeowners, who were “rate locked-in” by rising mortgage rates in 2018, to re-enter the market.

March boasted the lowest mortgage rate since January 2018 and, compared with last month, the 30-year, fixed-rate mortgage fell 0.1 percentage points. The month-over-month decline alone triggered a house-buying power increase of just over $4,400. Coupled with the extra $1,600 gain in house-buying power stemming from the monthly increase in income, house-buying power increased by approximately $6,000 from February to March 2019.

The increase in house-buying power directly contributed to a gain of nearly 46,000 potential home sales compared with the previous month, by far the strongest driver of market potential in our model. If the most recent 30-year, fixed mortgage rate of 4.12 percent persists for the duration of April, we expect house-buying power to boost the market potential for home sales by more than 50,000 sales in April 2019. The 2019 thaw in mortgage rates bodes well for a strong spring home-buying season.

According to the most recent Fannie Mae national consumer sentiment survey, consumers feel more positive about the overall direction of the housing market than in nearly a year. In fact, the positive impact of rising house-buying power has already begun, with purchase mortgage applications increasing 15.0 percent year-over-year in March. We expect rising wages and lower mortgage rates to continue through the spring, boosting housing demand and spurring home sales.

March 2019 Potential Home Sales

For the month of March, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales increased marginally to a 5.24 million seasonally adjusted annualized rate (SAAR), a 1.5 percent month-over-month increase.

- This represents a 56.0 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales declined by 0.3 percent compared with a year ago, a loss of 13,000 (SAAR) sales.

- Currently, potential existing-home sales is 1.5 million (SAAR), or 22.2 percent below the pre-recession peak of market potential, which occurred in March 2004.

Market Performance Gap

- The market for existing-home sales is underperforming its potential by 2.3 percent or an estimated 121,000 (SAAR) sales.

- The market performance gap decreased by an estimated 10,000 (SAAR) sales between February 2019 and March 2019.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.

.jpg)