Has Defect Risk for Purchase Transactions Reached a Turning Point?

By

Mark Fleming on November 27, 2019

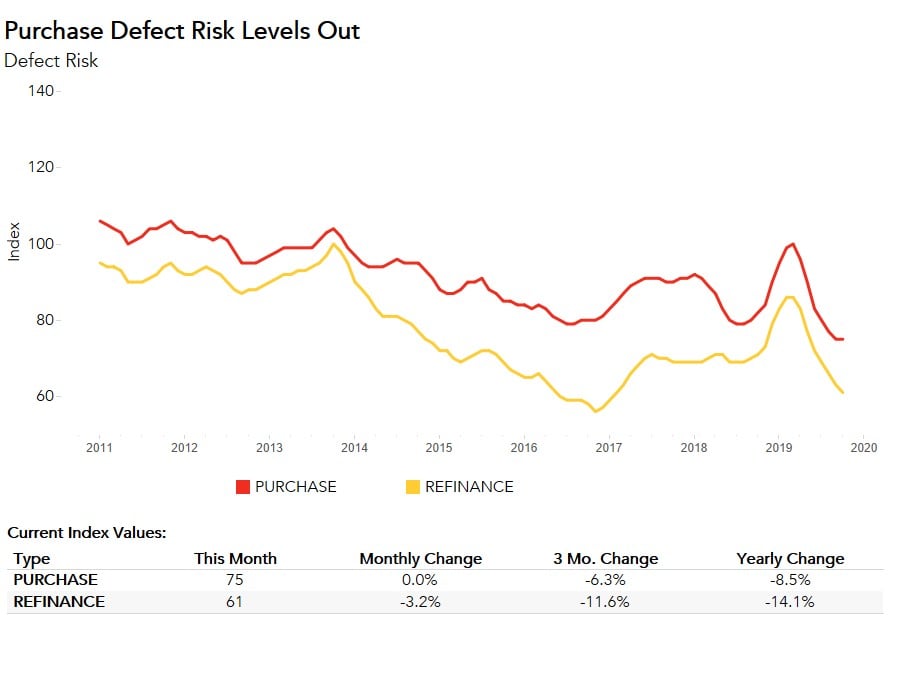

Based on our analysis, if mortgage rates continue to fall, the pressure on fraud risk may weaken. This has played out throughout most of 2019, as the 30-year, fixed mortgage rate has been falling since December 2018, and overall fraud risk alongside it. Fraud risk began declining in March 2019 and reached a historical low in October. The Loan ...

Read More ›

Has Rising House-Buying Power Accelerated House Price Appreciation?

By

Mark Fleming on November 26, 2019

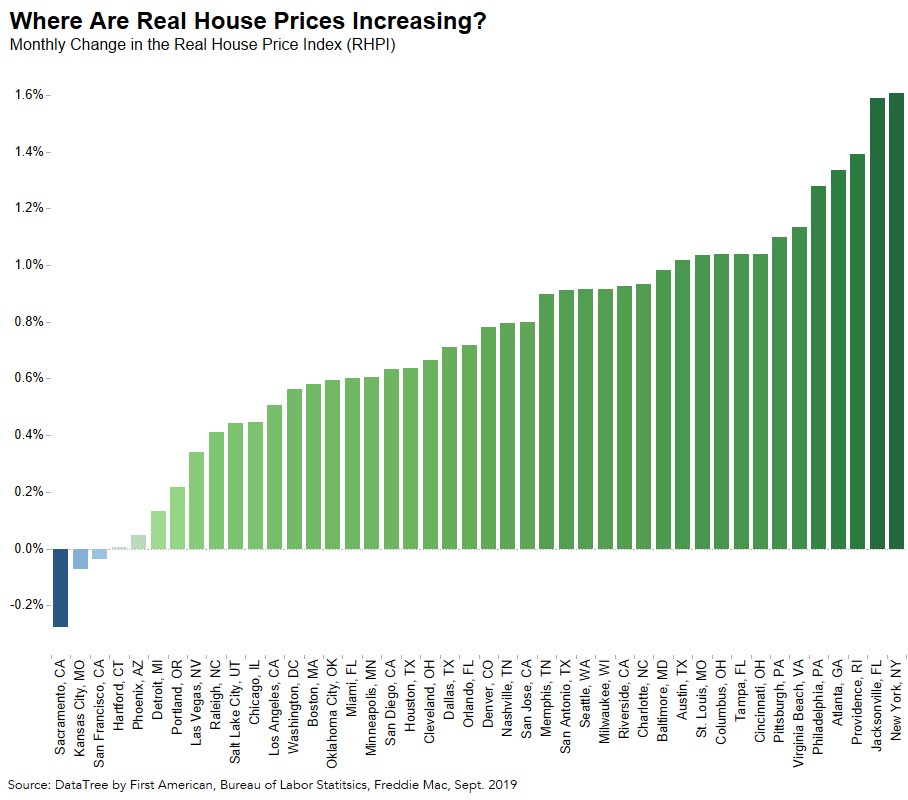

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, modestly swung in favor of increased affordability in September, yet affordability declined month over month. The 30-year, fixed-rate mortgage fell by 0.01 percentage points and household income increased 0.03 percent compared with August 2019. ...

Read More ›

What Do the Top 10 Cities for Entry-Level New Home Construction Have in Common?

By

Odeta Kushi on November 22, 2019

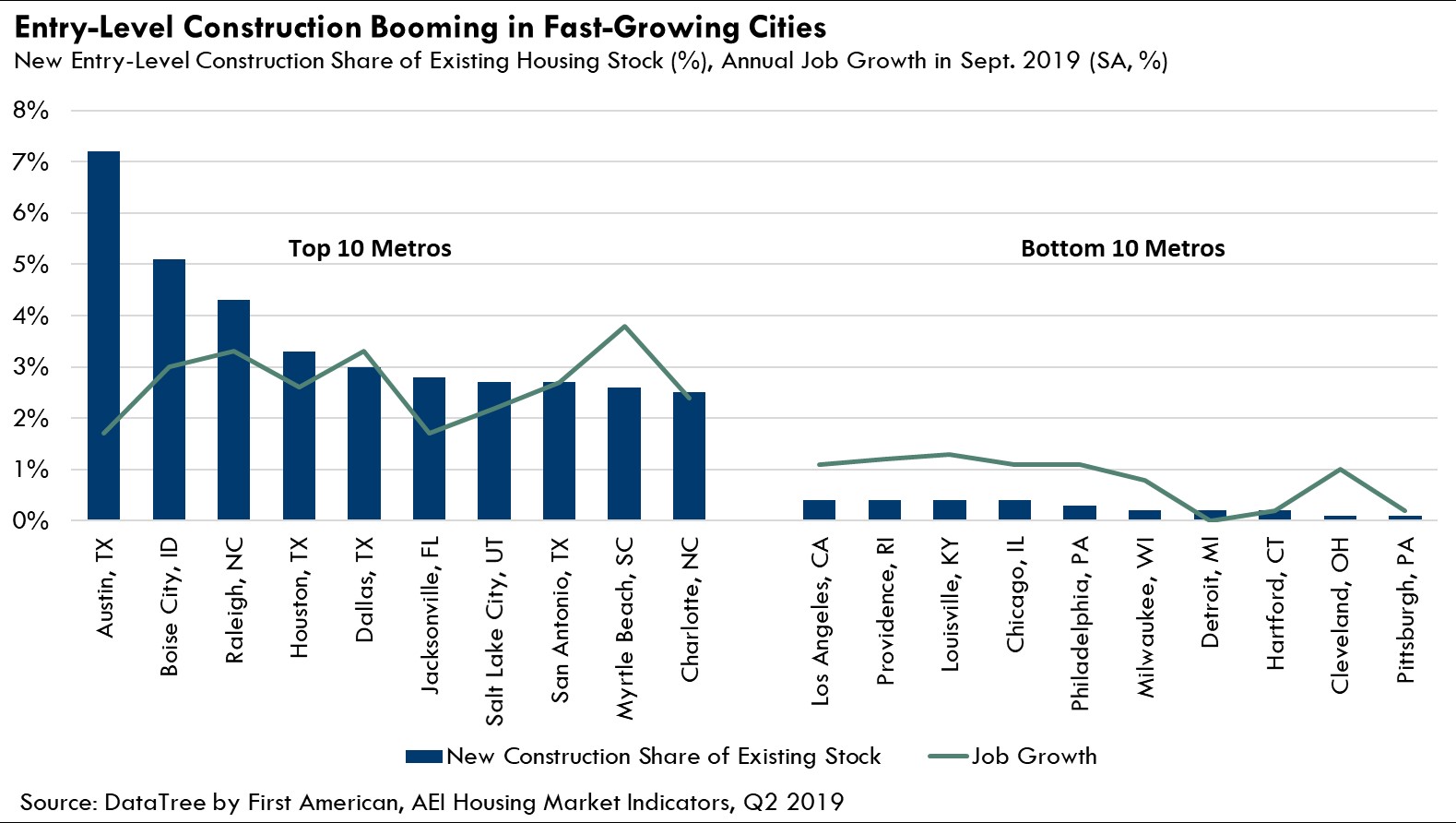

The dominant theme in the housing market nationally in 2019 has been the ongoing challenge of a dearth of housing supply amid rising demand. A natural solution to the challenge is to build more homes. Yet, nationally, supply headwinds still make it hard for builders to ramp up new construction, especially at the entry-level, where first-time home ...

Read More ›

What Do Rising Rates and Tenure Length Mean for Housing Market Potential in 2020?

By

Mark Fleming on November 20, 2019

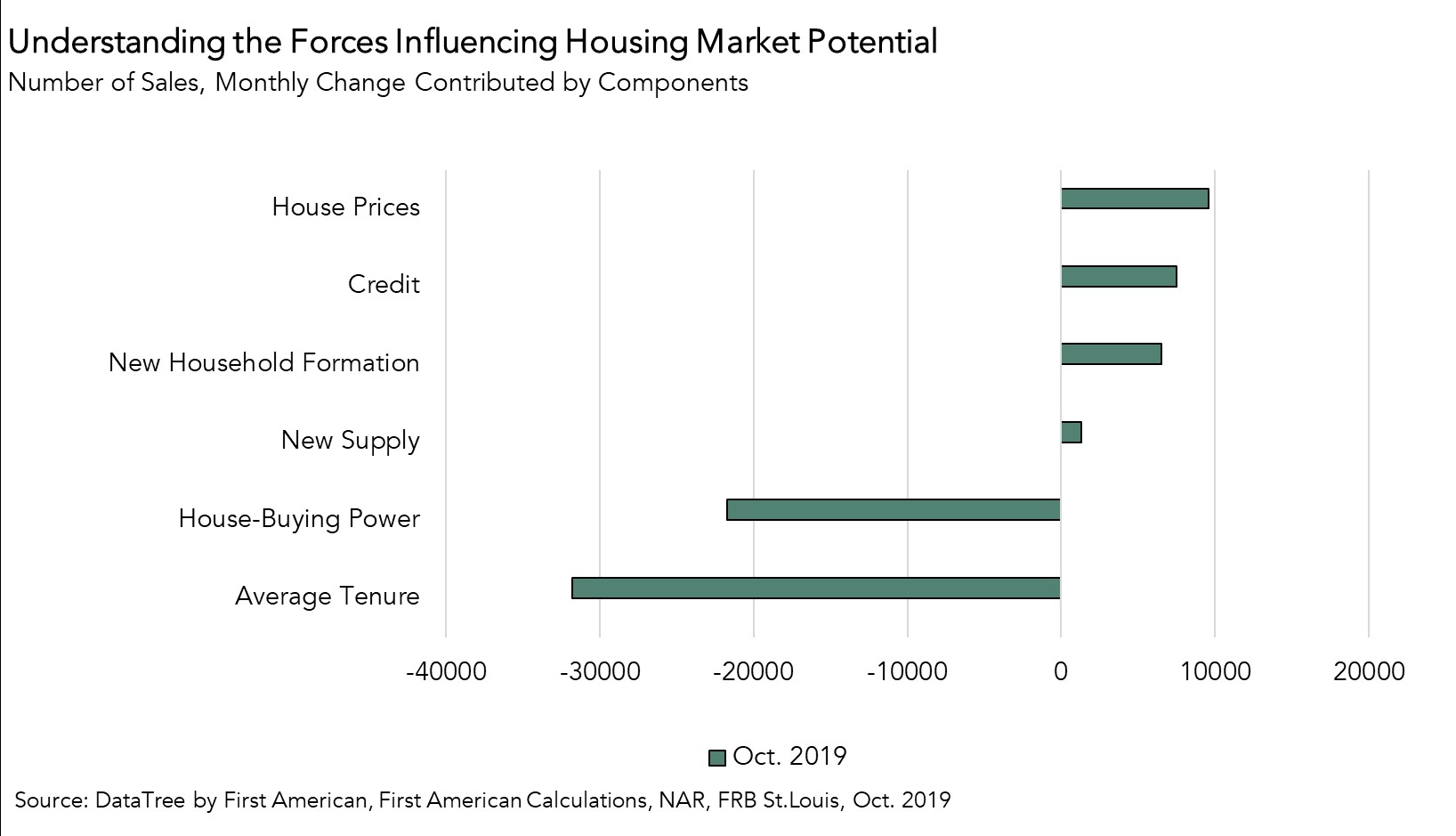

In October 2019, the housing market exceeded its potential, as actual existing-home sales exceeded market potential by 4.6 percent, or an estimated 239,000 seasonally adjusted annualized sales. Housing market potential decreased relative to last month, but increased 0.6 percent compared with October of last year.

Read More ›

Why the Time May Be Right for New Home Construction to Accelerate

By

Odeta Kushi on November 8, 2019

Thus far in 2019, the story of the housing market has been a tale of strong housing demand and limited supply. On the demand side, steadily rising house-buying power has fueled greater demand. Falling mortgage rates and rising household income sparked a nearly 12.6 percent increase in house-buying power year to date through September. The impact ...

Read More ›

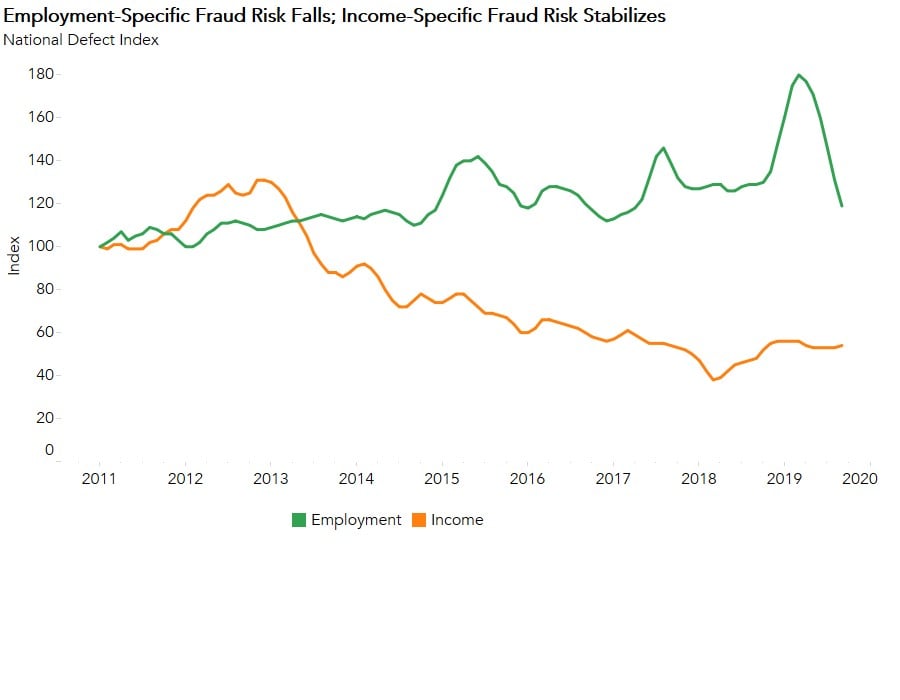

Why Has Defect Risk Reached a Multi-Year Low Point?

By

Mark Fleming on October 31, 2019

Declining for the sixth consecutive month, the Loan Application Defect Index for purchase transactions fell 2.6 percent in September compared with August. The Defect Index for refinance transactions also fell, declining 4.5 percent compared with the previous month. The overall Defect Index, which includes both purchase and refinance transactions, ...

Read More ›