Why Did Defect Risk for Purchase Transactions Rise for the First Time Since March?

By

Mark Fleming on December 27, 2019

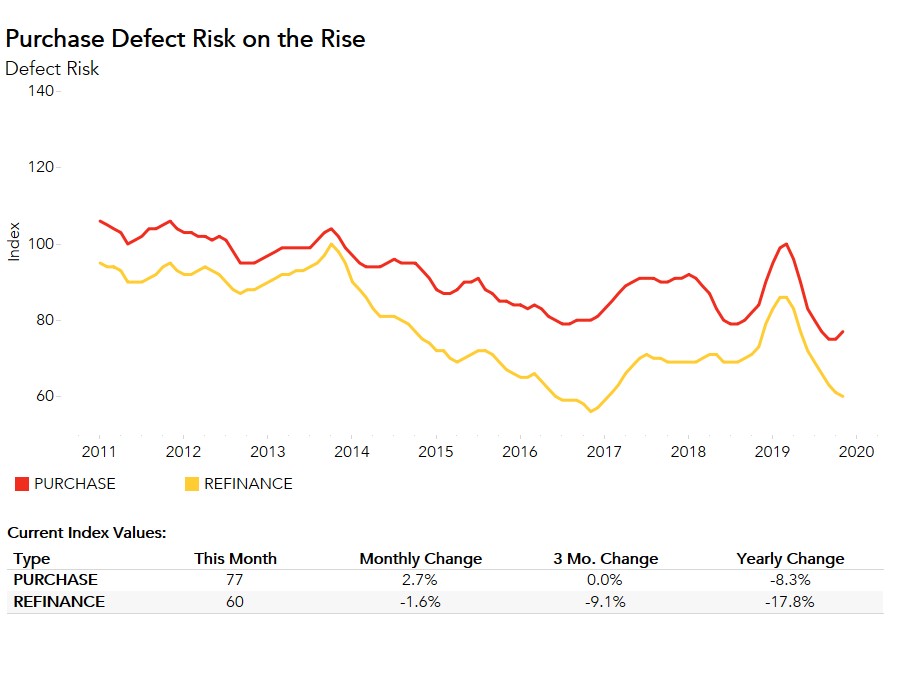

As we predicted last month, the Loan Application Defect Index for purchase transactions reached a turning point in November. After falling since March, the Defect Index for purchase transactions increased 2.7 percent compared with October, while the Defect Index for refinance transactions fell by 1.6 percent, its eighth straight month of declining ...

Read More ›

Interviews on CNBC and Yahoo! Finance: 2020 Housing Outlook – Why Persistently Low Mortgage Rates May Help and Hurt Home Buyers

By

FirstAm Editor on December 23, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Yahoo! Finance last week, discussing the 2020 outlook for the housing market and how persistently low mortgage rates may both help and hurt home buyers in the year ahead.

Read More ›

What Will Drive House-Buying Power in 2020?

By

Mark Fleming on December 20, 2019

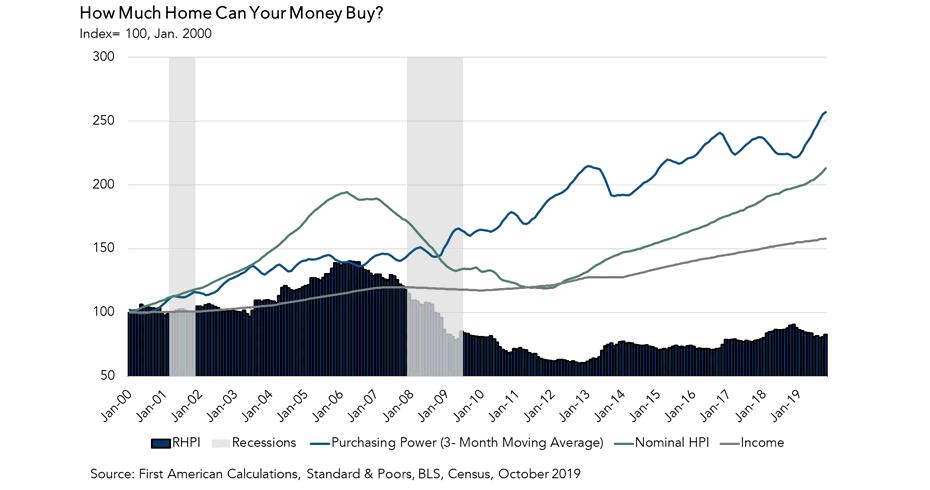

Affordability improved in October as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, modestly swung in favor of increased affordability relative to one year ago. The 30-year, fixed-rate mortgage fell by 1.1 percentage points and household income increased 2.6 percent compared with October ...

Read More ›

Will Housing Market Potential in 2020 Exceed 2019?

By

Mark Fleming on December 18, 2019

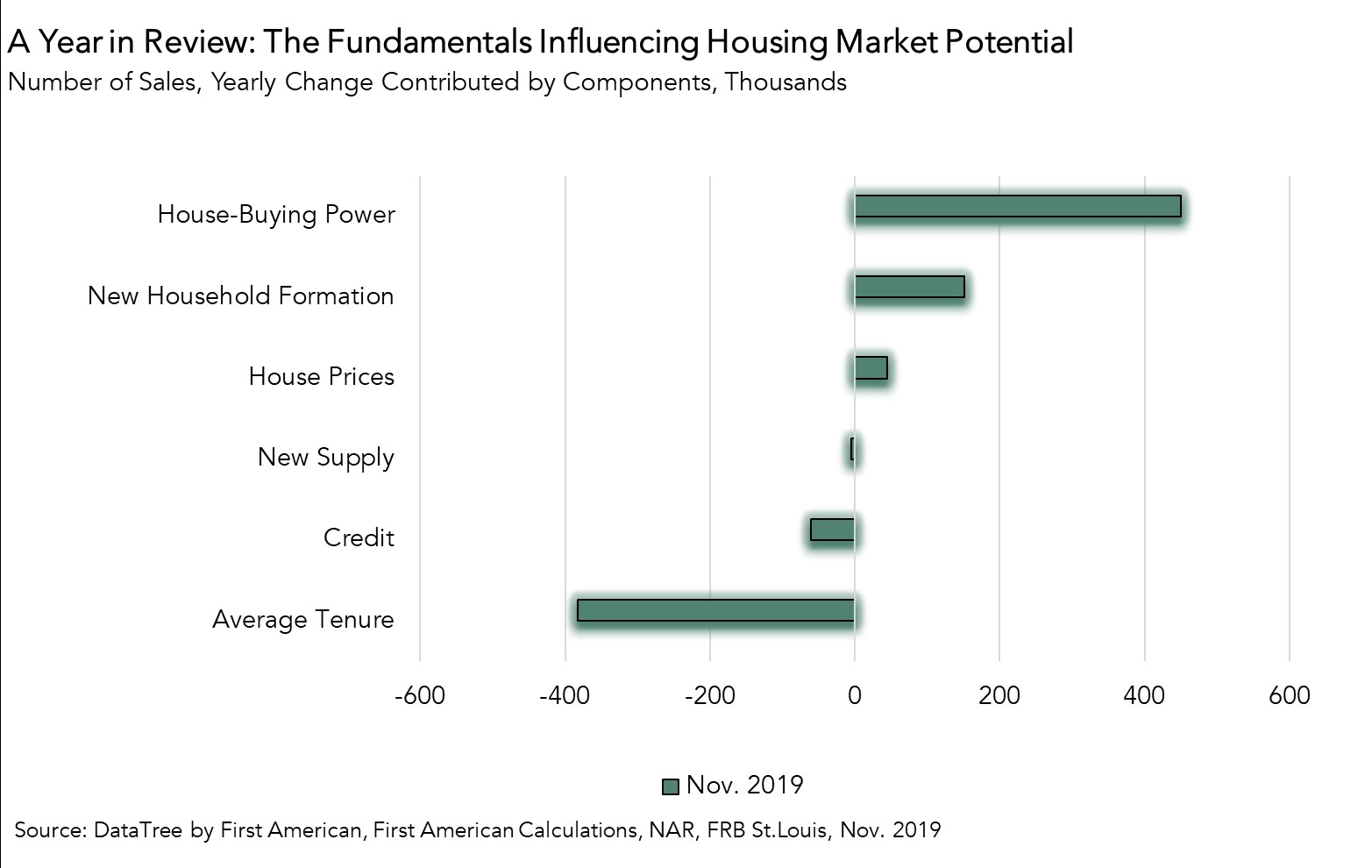

In November 2019, the housing market outperformed its potential, as actual existing-home sales exceeded market potential by 2.8 percent, or an estimated 146,340 seasonally adjusted annualized sales. Housing market potential increased 1.4 percent relative to last month and 3.9 percent compared with November of last year, an increase of 196,480 ...

Read More ›

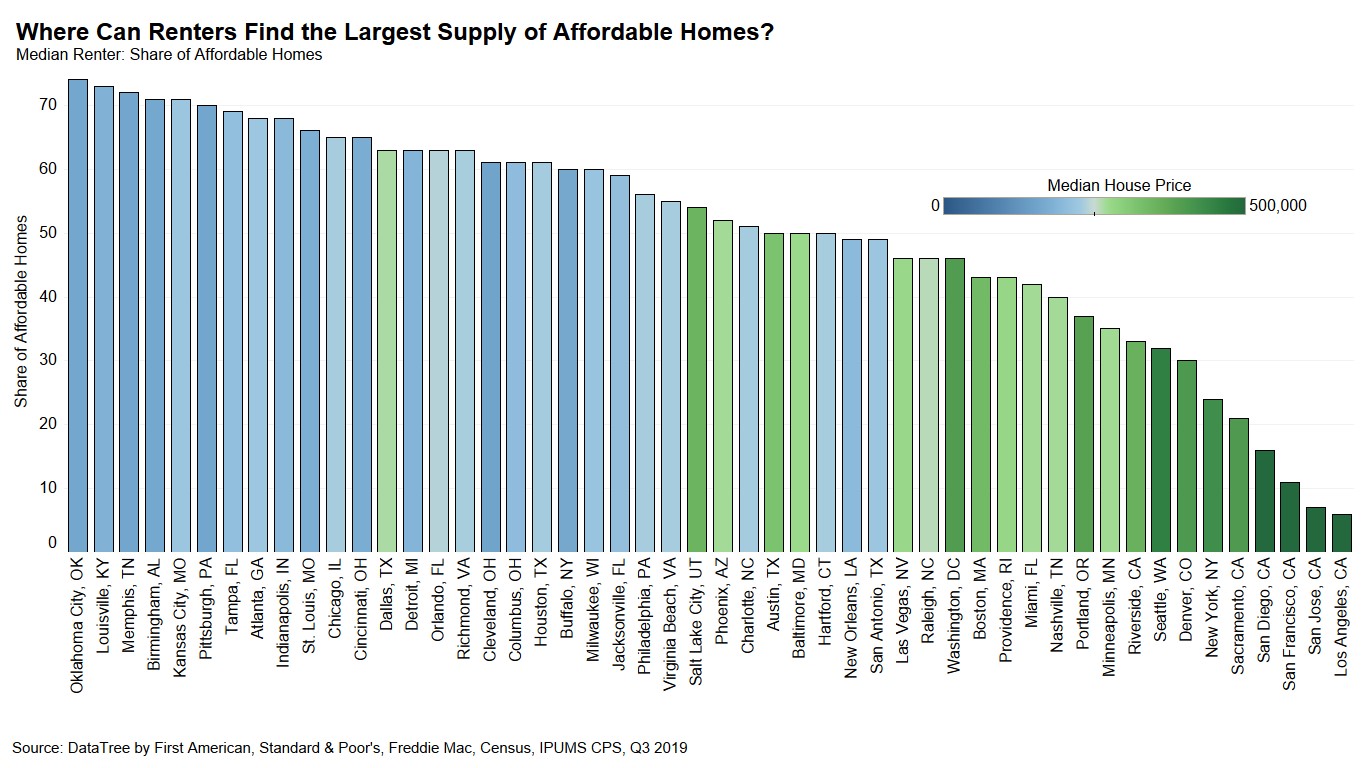

Where Lower-Income Renters Can Pursue the Dream of Homeownership

By

Odeta Kushi on December 12, 2019

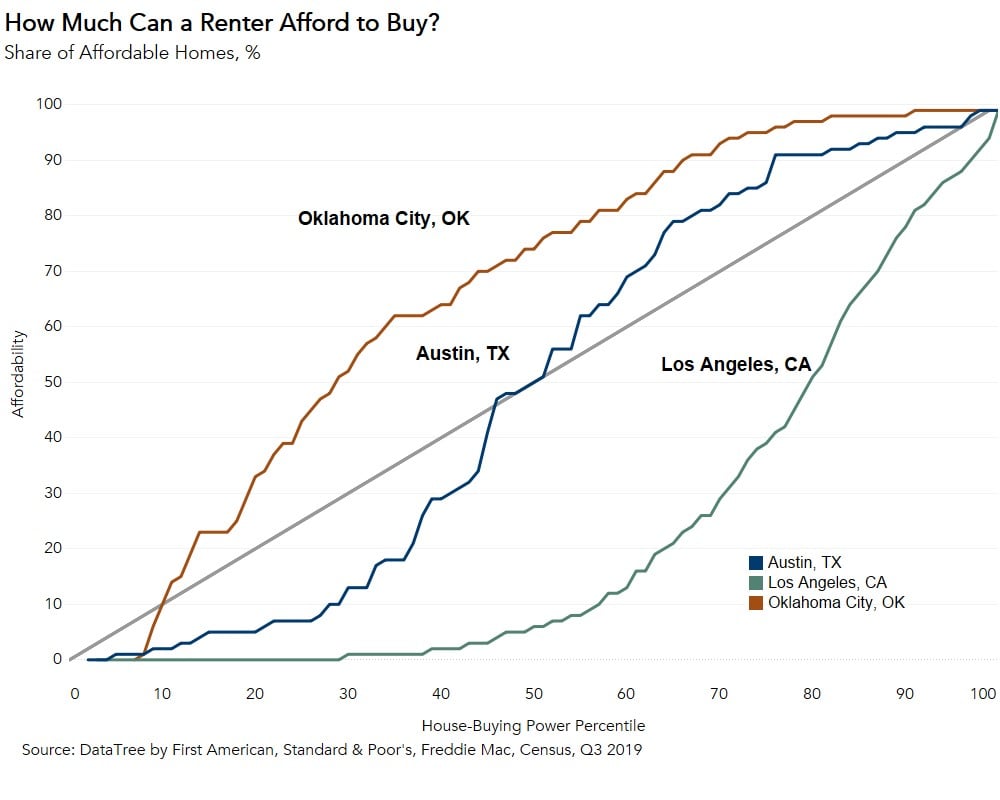

In 2019, the growth in consumer house-buying power outpaced house price appreciation for the median renter trying to buy the median priced home. But, there are many renters with household incomes below the median income in their cities. We can measure affordability for all renter households based on their household income and the share of homes ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

What Cities Are the Most Affordability Friendly for First-Time Home Buyers?

By

Odeta Kushi on December 10, 2019

Housing affordability, or the lack thereof, continued to generate discussion and headlines in 2019. That’s unlikely to change in 2020, as strong demand, driven by low mortgage rates and wage growth, collides with limited housing supply. However, it’s easy to overlook that nearly two-thirds of Americans already own homes so, generally speaking, ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report