Important, but easy to overlook shifts in investment trends may be contributing to our current era of low interest rates. An excess supply of global savings relative to the demand for that money for investments is driving down interest rates, which can be thought of as the price of money. The neutral rate of interest, which is monitored by the Federal Reserve as it considers changes to monetary policy, represents the equilibrium point for the price of money and is largely determined by the supply and demand for savings (i.e., income that is not used for immediate consumption and that can be invested back into the economy).

“As services continue to play a more central role in the U.S. economy, more spending on intellectual property will be the new normal, resulting in a long-term reduction in spending on more traditional forms of business investment.”

Today, the neutral rate of interest is at historically low levels because of the excess of savings relative to the demand for that money for investments. The lack of investment in recent periods has received much attention this year. Investment that businesses make is called capital expenditure. Capital expenditures, or investments in property, equipment, products and technology, by a company facilitates a company’s growth and productivity, and ultimately broader economic growth. The U.S. economy is booming, yet capital expenditures declined in 2019. In the midst of the longest economic expansion in recent history, why is capital expenditure declining?

A Short History

In November 2017, the Tax Cuts and Jobs Act was introduced, with the intent that it would boost business investment upon becoming law. After the law took effect in the first half of 2018, companies in the S&P 500 increased capital expenditures by nearly 20 percent. Business spending on fixed investment (machinery, buildings and equipment) increased 11.5 percent and 8.7 percent during the first and second quarters of 2018, respectively.

However, by the second quarter of 2019, U.S. corporate investment in buildings and equipment fell by 0.7 percent, the first quarterly decline since the beginning of 2016. The overall slowdown in capital expenditures was not just limited to the U.S. Global corporate capex expenditures grew at a marginal rate of 2 percent last year, compared with 6 percent in 2017. Could it be that there’s a long-term structural change in business investment that is leading to the slowdown in capital expenditures and contributing to the dynamics that are keeping interest rates low?

Capital Expenditure Efficiency

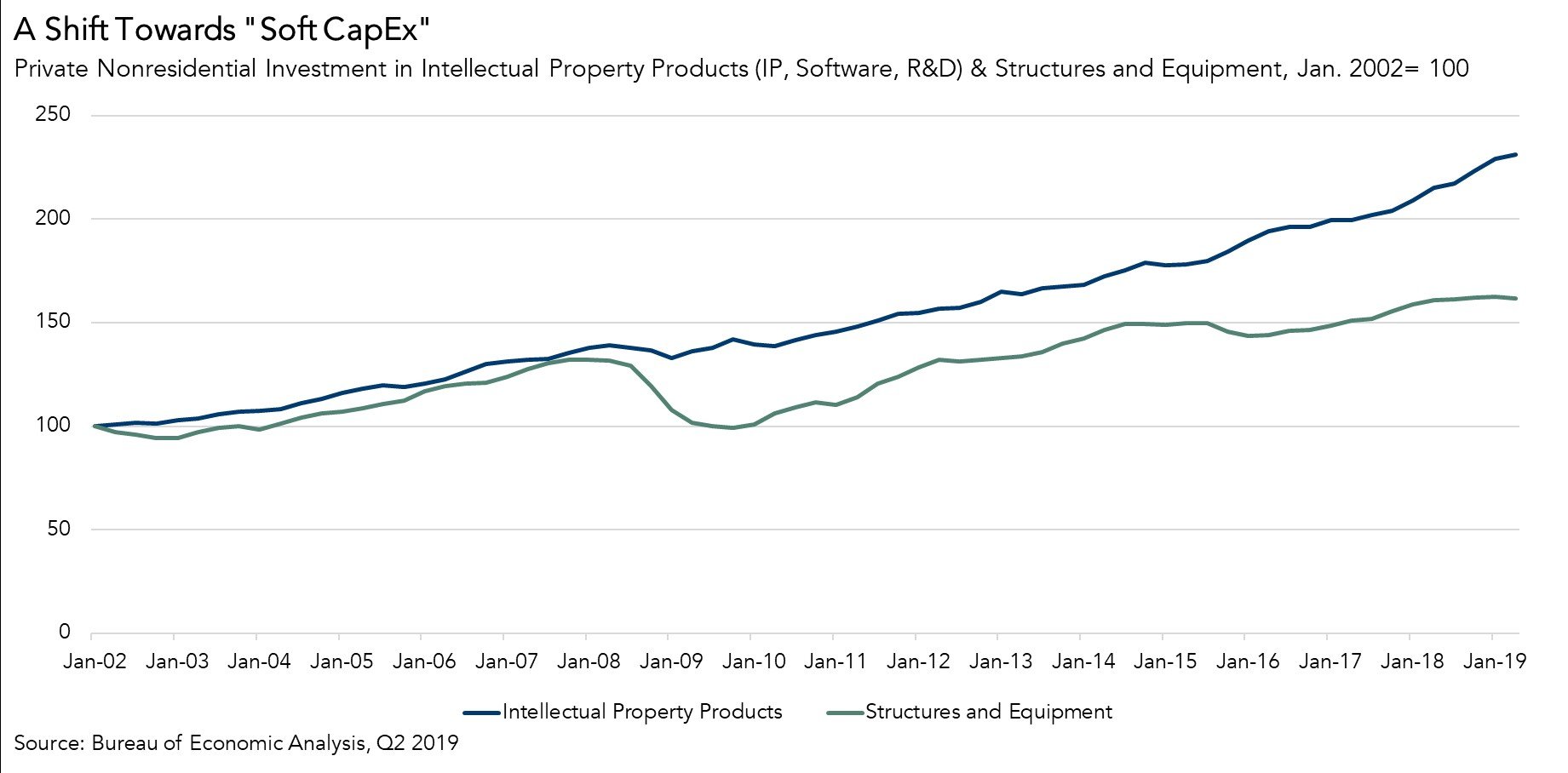

Services play a much greater role in today’s economy than manufacturing, which means there is more demand for “soft assets,” such as intellectual property, software, and R&D, than there is for “hard assets,” such as equipment and structures. In fact, in the second quarter of 2019, intellectual property investment totaled nearly $1 trillion, compared to only $421 billion in the second quarter of 2002 – this is growth of over 128 percent. During that same time period, investment in hard assets only increased approximately 66 percent, nearly half the growth of investment in soft assets. While hard asset capital expenditures remain the dominant form of investment overall, it’s clear that investment in soft assets is increasing more quickly. This reflects the transition in our economy to businesses that are less hard asset capital intensive.

Additionally, in today’s modern economy many firms are moving from a capital expenditure model to an operating expense model. Take cloud computing, for example. In a world where technology is evolving rapidly, it is difficult to predict and manage a company’s IT infrastructure needs. So, rather than spending a large amount of capital to host, manage and maintain large amounts of IT infrastructure, firms are opting to “pay as they go,” renting the capacity they need at the moment, and scaling as their needs change. This reduces the hard capital expenditures and improves the efficiency of the expenditure.

With something like a cloud IT infrastructure, a company does not have to build and maintain an infrastructure to accommodate peak demand. Since services can be purchased as needed, utilization is optimized effectively making each expense dollar more efficient or “productive.” The result? Less investment dollars are going further. Obviously, the providers of cloud computing services are investing heavily in IT infrastructure, but the collective utilization by all their customers is much higher than if each customer did it alone. Therefore, less IT infrastructure is needed overall to support the economy’s computational needs.

Increasing investment in soft assets and the transition to operating expense models are reflecting the continuing transition in our economy toward services and more efficient utilization of production assets. While more efficient investment in highly utilized hard assets will continue, as services play a more central role in the U.S. economy than manufacturing, growth in capital expenditures will be driven more by money spent on intellectual property. Intelligent business investment drives productivity growth, but the increased focus on soft expenditures, in combination with more efficient utilization of hard capital expenditures, means less can actually be more.