House Prices Decline, But Equity Buffers Remain Robust

By

Mark Fleming on November 28, 2022

In September 2022, the Real House Price Index (RHPI) jumped up by 60.6 percent on an annual basis. This rapid annual decline in affordability was driven by two factors – a 13.5 percent annual increase in nominal house prices and a 3.2 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. Even though ...

Read More ›

Why the Housing Market May Begin to Stabilize in 2023

By

Mark Fleming on November 18, 2022

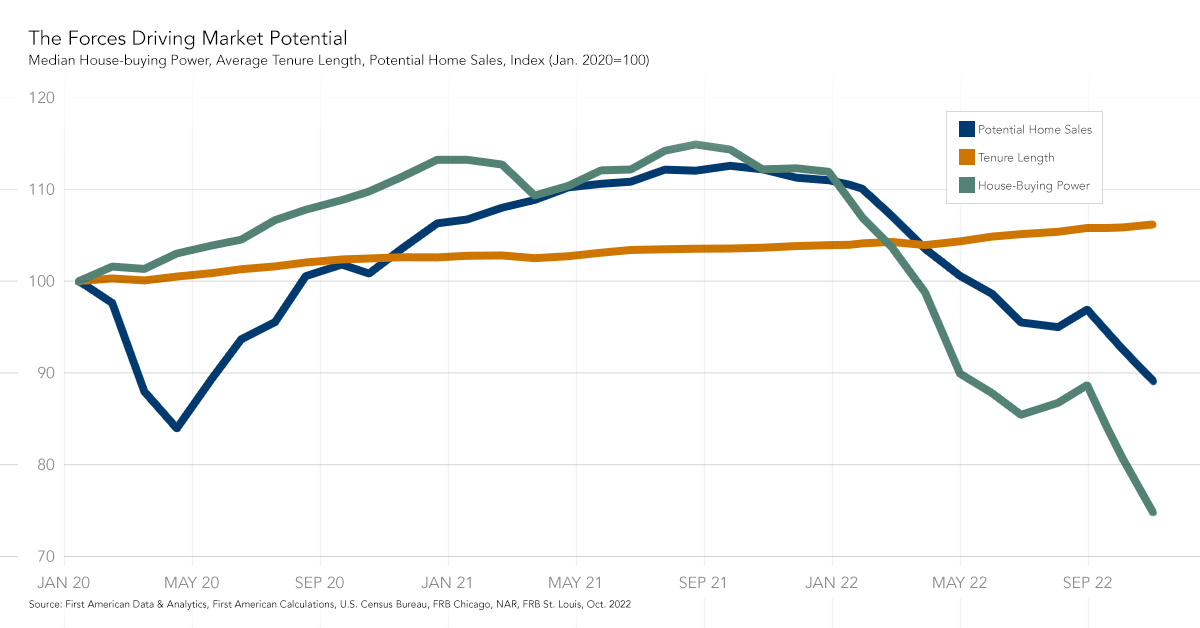

In October 2022, housing market potential fell by nearly 4 percent relative to last month and dropped 21 percent compared with October of last year, a decline of 1,334,000 potential existing-home sales. The steep annual decline in market potential was largely a result of higher mortgage rates, which discourage both buyers and sellers from jumping ...

Read More ›

Will Foreclosures Rise as the Housing and Labor Markets Cool?

By

Ksenia Potapov on November 15, 2022

The pandemic brought about both policies to protect homeowners from losing their homes – foreclosure moratoriums and forbearance programs – and concerns that a wave of foreclosures would crash upon the housing market once the protections ended. The wave did not materialize, and foreclosures remain near historic lows. Now, the Federal Reserve is ...

Read More ›

Pandemic Boom Markets Cooling the Fastest

By

Mark Fleming on October 21, 2022

Affordability continued its rapid decline in August 2022, as the Real House Price Index (RHPI) soared 49 percent on an annual basis. The ongoing and swift decline in affordability was driven by a 15 percent increase in nominal house prices and a 2.4 percentage point increase in the 30-year, fixed mortgage rate compared with one year ago. As ...

Read More ›

What’s the Outlook for Housing Market Potential for the Rest of 2022?

By

Mark Fleming on October 18, 2022

Housing market potential sagged to its lowest point since May 2020 in September, falling 3.6 percent from August to an estimated 5.38 million at a seasonally adjusted annualized rate (SAAR). Year over year, the market potential for existing-home sales is down 16.7 percent. Market dynamics and the broader economic outlook have changed dramatically ...

Read More ›

Why Educated Millennials Still Hold the Key to Future Homeownership Demand

By

Odeta Kushi on October 10, 2022

The fall usually marks the beginning of the school year, seasonally cooler weather and a seasonally cooler housing market. But, this year, the housing market’s typical autumn slowdown is more pronounced as rapidly rising interest rates discourage buyers and sellers from entering the market. The housing market is not immune to business cycles, and ...

Read More ›

.jpg)

.png)