Why Home Buyers May Find More Opportunities with New Homes this Spring

By

Mark Fleming on March 21, 2023

The spring season is typically the busiest time of the year for the housing market. According to data from First America Data & Analytics, historically approximately 36 percent of existing-home sales for the year occur from March through June. The housing market’s seasonal pattern is driven by factors such as weather, holidays and the ...

Read More ›

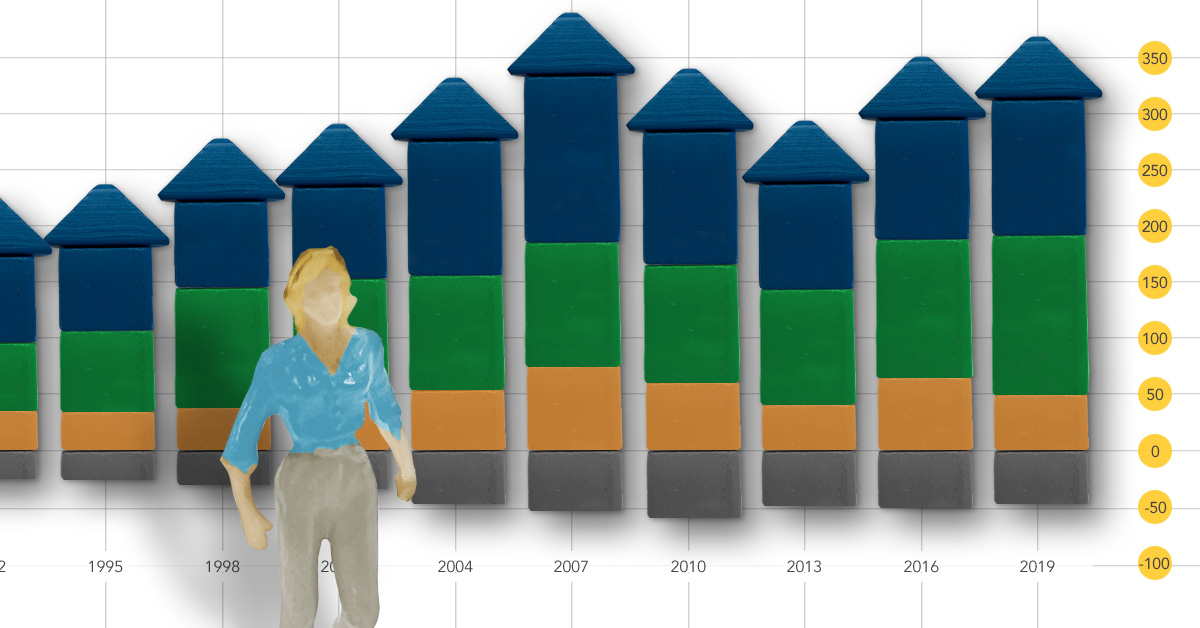

For Single Women, Housing Remains Largest Component of Wealth Creation

By

Ksenia Potapov on March 10, 2023

As we celebrate International Women’s Day and Women’s History Month, it’s important to reflect on the progress that women, and single women in particular, have made in achieving one of the main tenets of the American Dream – homeownership. Since 2019, the number of single, female-headed households (including widowed, separated, or divorced) has ...

Read More ›

Housing Affordability Improved for Second Consecutive Month in December

By

Mark Fleming on February 28, 2023

While affordability has fallen 48 percent since December 2022, as measured by the Real House Price Index (RHPI), affordability has improved for two straight months. Nominal house price appreciation has slowed dramatically in response to dampened demand. Nationally, annual nominal house price growth peaked in March at 21 percent but has since ...

Read More ›

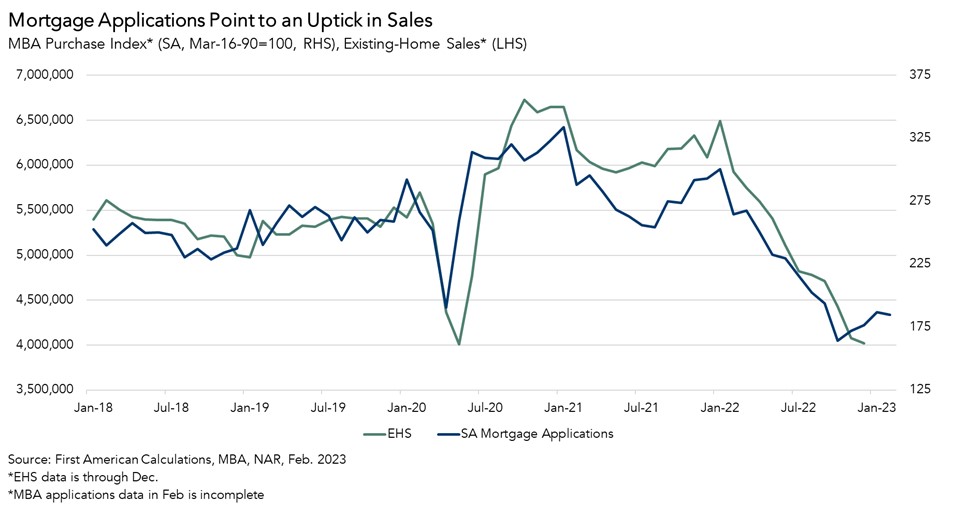

How Will Recent Uptick in Mortgage Rates Impact Spring Home-Buying?

By

Mark Fleming on February 22, 2023

There’s no question that the housing market fell into a deep freeze in the second half of 2022. Excluding the early months of the pandemic, the pace of existing-home sales fell below 5 million seasonally adjusted sales for the first time since 2014. Yet, signs have emerged that sales activity may pick up in the months ahead. Purchase mortgage ...

Read More ›

Why Free-and-Clear Homeowners Hold the Key to Unlocking More Housing Supply

By

Odeta Kushi on February 17, 2023

As mortgage rates rose rapidly last year, the golden handcuffs of low mortgage rates, otherwise known as the rate lock-in effect, was frequently cited as a primary culprit for the ongoing housing supply shortage. And, rightfully so, as according to third-quarter 2022 Federal Housing Finance Agency data, 84 percent of all outstanding mortgages have ...

Read More ›

Why Mortgage Rates Hold the Key to Improved Affordability in 2023

By

Ksenia Potapov on February 3, 2023

By all respects, 2022 was a tumultuous year for the housing market. Annual house price appreciation remained at a double-digit pace for most of the year, mortgage rates increased by nearly 4 percentage points in less than 12 months and, as a result, affordability plummeted. By October, housing affordability had declined by a record 68 percent ...

Read More ›

.jpg)

.jpg)