Why Free-and-Clear Homeowners Hold the Key to Unlocking More Housing Supply

By

Odeta Kushi on February 17, 2023

As mortgage rates rose rapidly last year, the golden handcuffs of low mortgage rates, otherwise known as the rate lock-in effect, was frequently cited as a primary culprit for the ongoing housing supply shortage. And, rightfully so, as according to third-quarter 2022 Federal Housing Finance Agency data, 84 percent of all outstanding mortgages have ...

Read More ›

Why Mortgage Rates Hold the Key to Improved Affordability in 2023

By

Ksenia Potapov on February 3, 2023

By all respects, 2022 was a tumultuous year for the housing market. Annual house price appreciation remained at a double-digit pace for most of the year, mortgage rates increased by nearly 4 percentage points in less than 12 months and, as a result, affordability plummeted. By October, housing affordability had declined by a record 68 percent ...

Read More ›

House Prices Declining Fastest in Overvalued Markets

By

Mark Fleming on January 31, 2023

In November 2022, the Real House Price Index (RHPI) increased by 60 percent on an annual basis. This rapid annual decline in affordability was driven by two factors -- a 7.6 percent annual increase in nominal house prices and a 3.7 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. Even though ...

Read More ›

Why Housing Market Potential Increased for the Second Straight Month

By

Mark Fleming on January 20, 2023

Housing market potential closed 2022 on a two-month upswing, increasing by 3.0 percent relative to November. Despite the second consecutive month-over-month uptick, housing market potential remained down 17 percent compared with December of last year, a decline of 1,065,000 potential existing-home sales. The steep annual decline in market ...

Read More ›

What to Expect from the 2023 Housing Market

By

Odeta Kushi on January 10, 2023

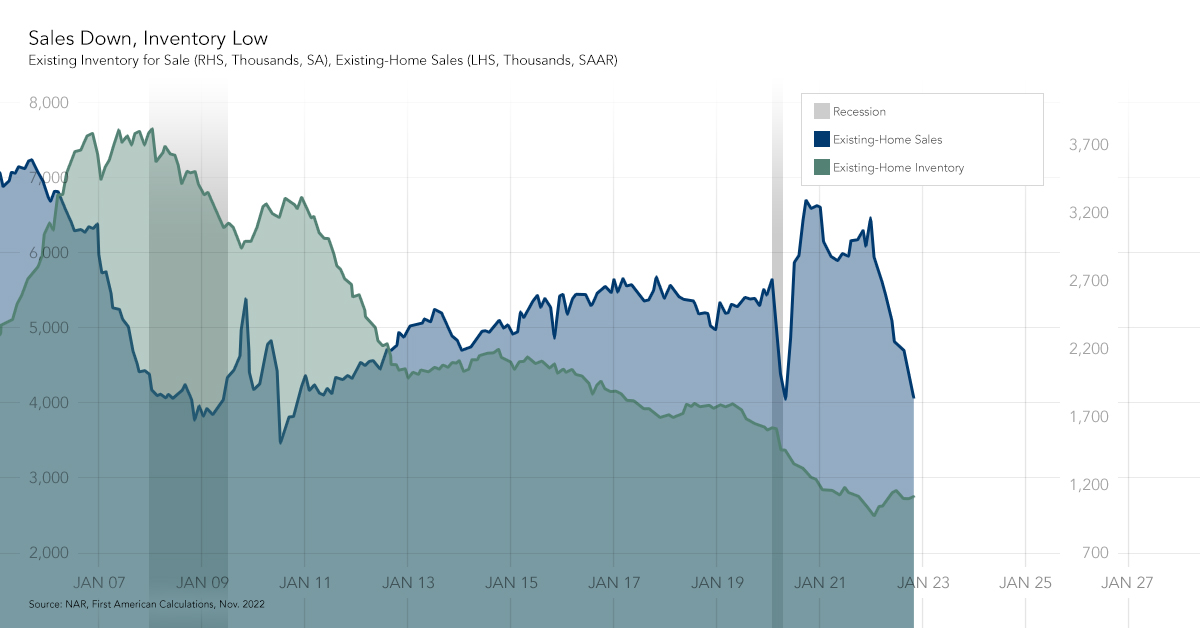

Since the beginning of the pandemic, the housing market has experienced a series of highs and lows. The housing market was already strong prior to 2020, but the pandemic redefined the role of a home, creating a surge in demand which, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records ...

Read More ›

Why Housing Affordability May Rebound in 2023

By

Mark Fleming on December 26, 2022

Affordability continued to suffer in October 2022, as the Real House Price Index (RHPI) jumped up by 68 percent on an annual basis. This rapid annual decline in affordability was driven by a 12 percent annual increase in nominal house prices and a 3.8 percentage point increase in the average 30-year, fixed mortgage rate compared with one year ago. ...

Read More ›

.jpg)

.jpg)