In August 2021, our analysis found that owning a home was cheaper than renting in all 50 of the top U.S. markets, largely due to the ownership benefit of house price appreciation. Given house price appreciation nationally was historically strong in 2021, it’s unsurprising that owning a home made more financial sense than renting last year. Looking at 2022, consensus forecasts expect that house price growth will moderate from its 2021 peak, while rent growth is expected to remain high. So, is owning still a better financial choice than renting? One way to answer the question is to identify the tipping point at which house price appreciation makes homeownership more financially appealing than renting.

“The house price appreciation tipping point to make the monthly cost of homeownership break even with the monthly cost of rent is low.”

To compare the monthly cost of housing, we assume a hypothetical potential first-time home buyer either continues renting a residence at the median monthly rent in their market or purchases a home. The cost to rent is simply the amount of rent paid every month. The cost of owning includes taxes, repairs, homeowner’s insurance and the monthly mortgage principal and interest payments. Our analysis assumes the hypothetical first-time home buyer is taking out a 30-year, fixed-rate mortgage, with a 5 percent down payment on a home at the 25th percentile sale price in their market in the fourth quarter of 2021. We also factor in the potential benefit of equity accumulation via house price appreciation.

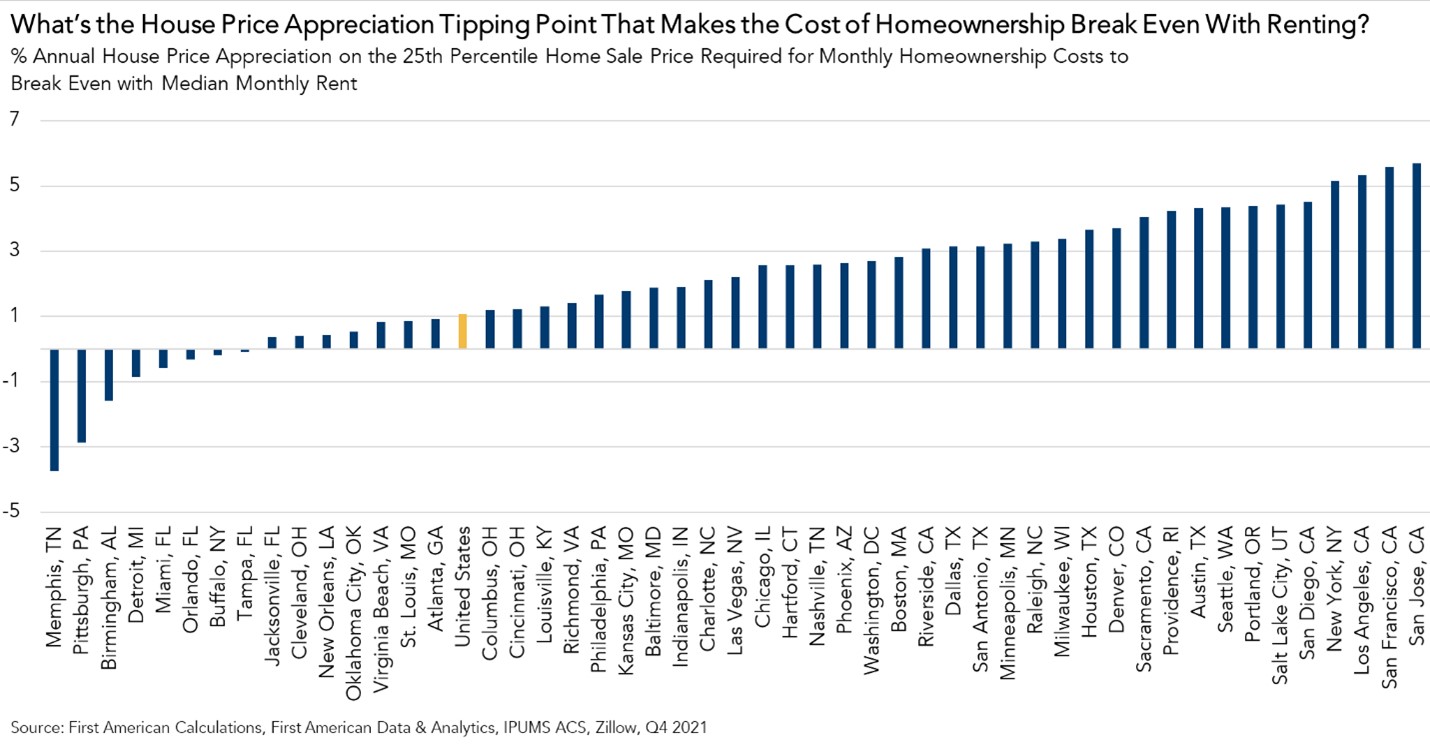

What’s the House Price Appreciation Tipping Point that Makes the Cost of Owning Break Even with Renting?

Take a hypothetical first-time home buyer in Houston purchasing the 25th percentile home at $245,000 in the fourth quarter of 2021. While the average 30-year, fixed-rate mortgage was 3.1 percent in the fourth quarter, mortgage rates have soared over the last few months. To align with current economic conditions more closely, this analysis assumes the home buyer purchases the home with a mortgage rate of 5 percent . In this example, the home buyer pays $1,250 monthly in principal and interest and another $760 in taxes, repairs, private mortgage insurance, and homeowner’s insurance costs. The total monthly cost of ownership adds up to $2,010, while the median monthly rent in the home buyers’ market is $1,260, $750 less than the monthly cost of ownership. In this scenario, it would only require house price appreciation of 3.7 percent, or an additional $9,000 in equity, over the following year for the cost of homeownership to break even with the cost of renting.

The list below shows the five cities with the lowest and highest house price appreciation tipping points.

Five Cities with the Lowest House Price Appreciation Tipping Points:

- Memphis, Tenn. (-3.7 percent)

- Pittsburgh (-2.9 percent)

- Birmingham, Ala. (-1.6 percent)

- Detroit (-0.9 percent)

- Miami (-0.6 percent)

Five Cities with the Highest House Price Appreciation Tipping Points:

- San Jose, Calif. (5.7 percent)

- San Francisco (5.6 percent)

- Los Angeles (5.3 percent)

- New York (5.2 percent)

- San Diego, Calif. (4.5 percent)

In smaller markets that have traditionally been more affordable to first-time home buyers, including Memphis, Tenn. and Pittsburgh, it’s better to own than rent even if house prices decline modestly. On the other hand, in expensive coastal markets like New York, Los Angeles and San Francisco, house prices would have to rise by approximately 6 percent or more to provide the owner with enough equity gains to make owning cheaper than renting. As of January, year-over-year appreciation in these three markets was 14 percent, 19 percent, and 15 percent, respectively, so the equity benefit of homeownership last year significantly exceeded the tipping point to make owning cheaper than renting.

House Price Appreciation Tipping Point is Low

While house price growth is expected to moderate from the rapid pace of 2021, strong home buyer demand against a backdrop of historically tight inventory of homes for sale will likely keep appreciation positive in the coming year. Meanwhile, rents continue to rise across all major markets. According to our analysis, the house price appreciation tipping point to make the monthly cost of homeownership break even with the monthly cost of rent is low.

Methodology

The rent-versus-buy analysis compares renting with the cost of ownership in the 50 largest U.S. metropolitan areas. Median rent is derived from the 2020 American Community Survey microdata, the latest year available, and extrapolated to Q4 2021 using the Zillow Observed Rent Index. Home sale prices, and property tax rates by market are derived from First American Data & Analytics data. The monthly cost of ownership is calculated for mortgage payment, interest, taxes and insurance (PITI), assuming a down payment of 5 percent and an interest rate of 5 percent. While rent and house price data refers to the fourth quarter of 2021, a higher mortgage rate is used in the analysis to align with current economic conditions. Because the down payment assumed is less than 20 percent, private mortgage insurance is added to the cost of ownership at a rate of 0.75 percent of the home value. Annual homeowner’s insurance is assumed to be 0.4 percent of the home value, and annual repair costs are assumed to be 1 percent of the home value.

.jpg)