Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

How Can Existing-Home Sales Exceed Market Potential?

By

Mark Fleming on September 18, 2019

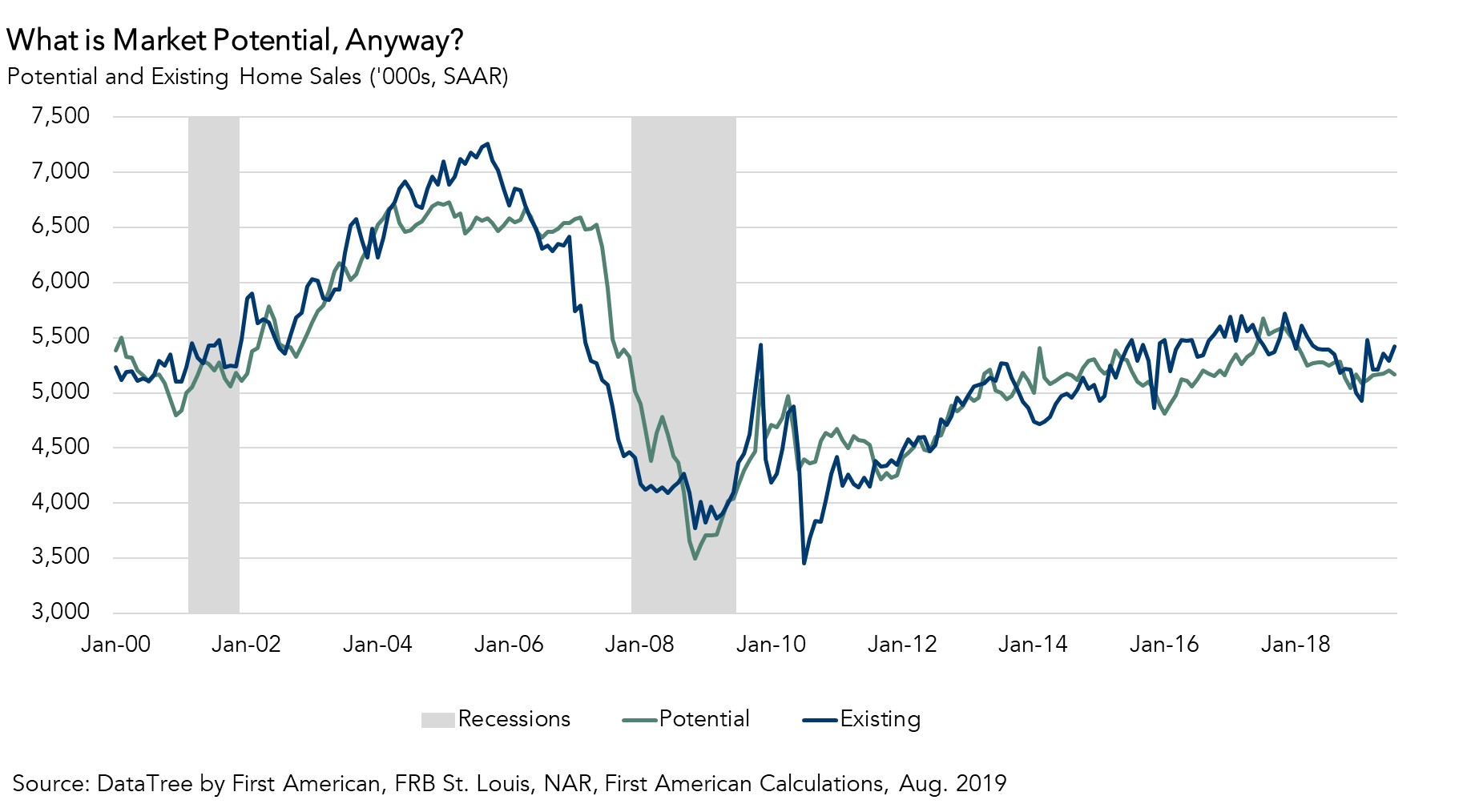

The housing market exceeded its potential in August 2019, as actual existing-home sales were 0.8 percent above the market’s potential. Housing market potential increased relative to last month, but declined 1.9 percent compared with August of last year. While down compared with a year ago, existing-home sales have slightly outperformed market ...

Read More ›

What is the Neutral Rate of Interest and How Does it Influence the Federal Reserve?

By

Mark Fleming on September 17, 2019

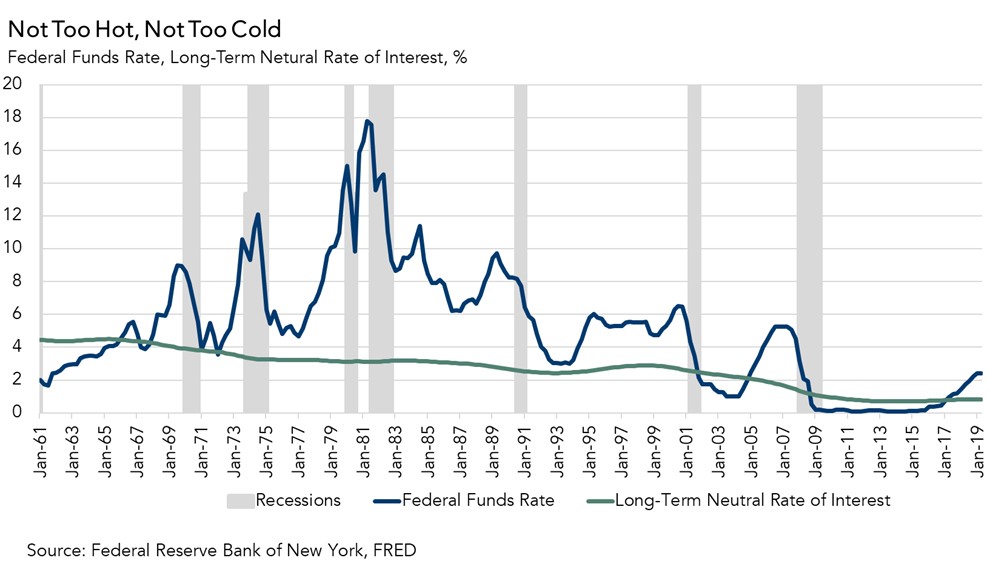

Many people understand the “natural rate of unemployment,” and if you don’t, you can probably guess what it is – the rate of unemployment when the labor market reaches equilibrium. What many people don’t know is that a similar concept exists in monetary policy.

Read More ›

What Does the Refinance Boom Mean for Fraud Risk?

By

Mark Fleming on August 29, 2019

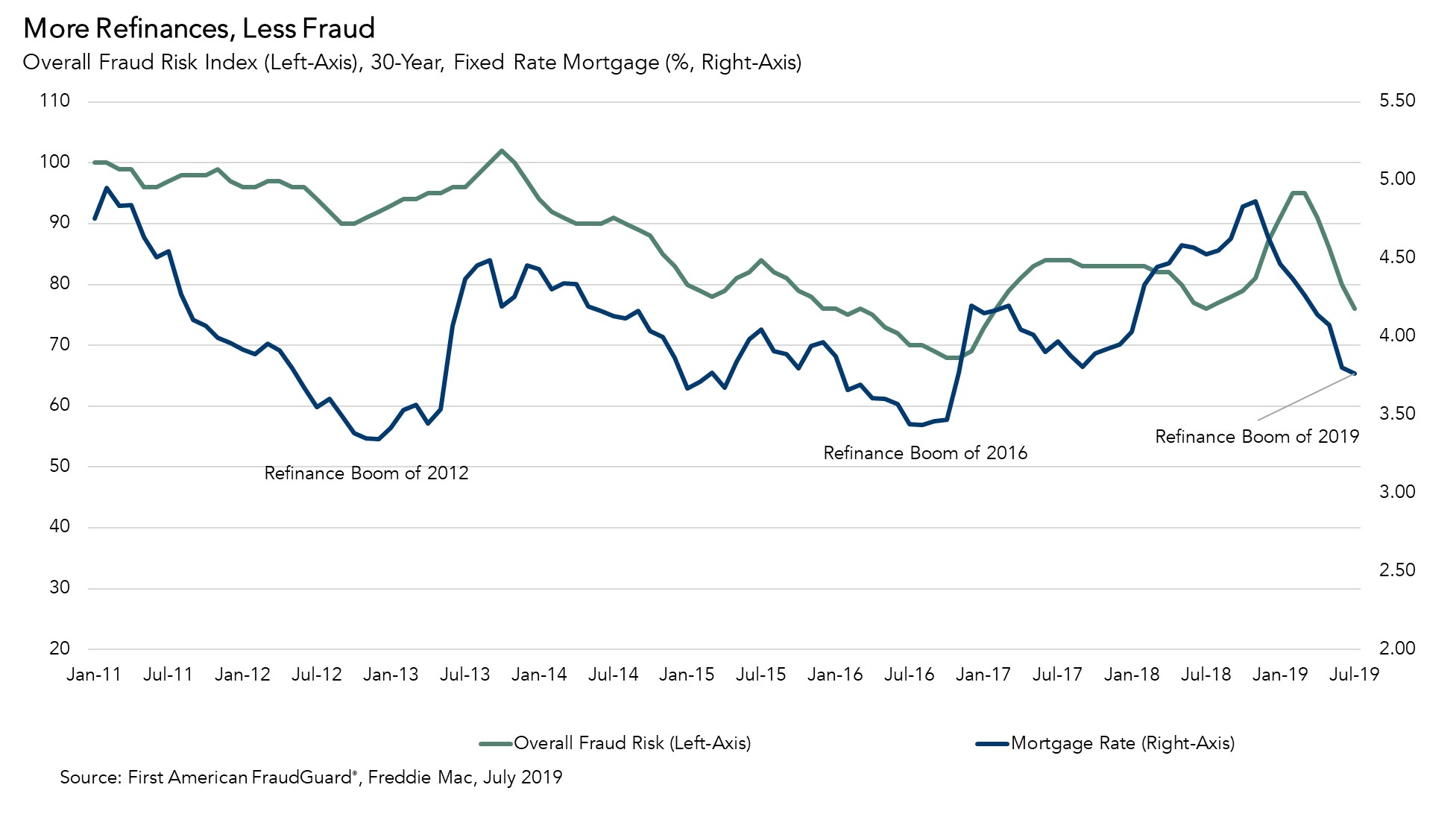

The Loan Application Defect Index for purchase transactions continued its downward trend, declining 3.6 percent in July compared with June, the fourth consecutive month defect risk in purchase transactions has fallen. The Defect Index for refinance transactions also fell 4.2 percent compared with the previous month. The overall Defect Index, which ...

Read More ›

How Can Affordability Improve When House Prices are Rising?

By

Mark Fleming on August 27, 2019

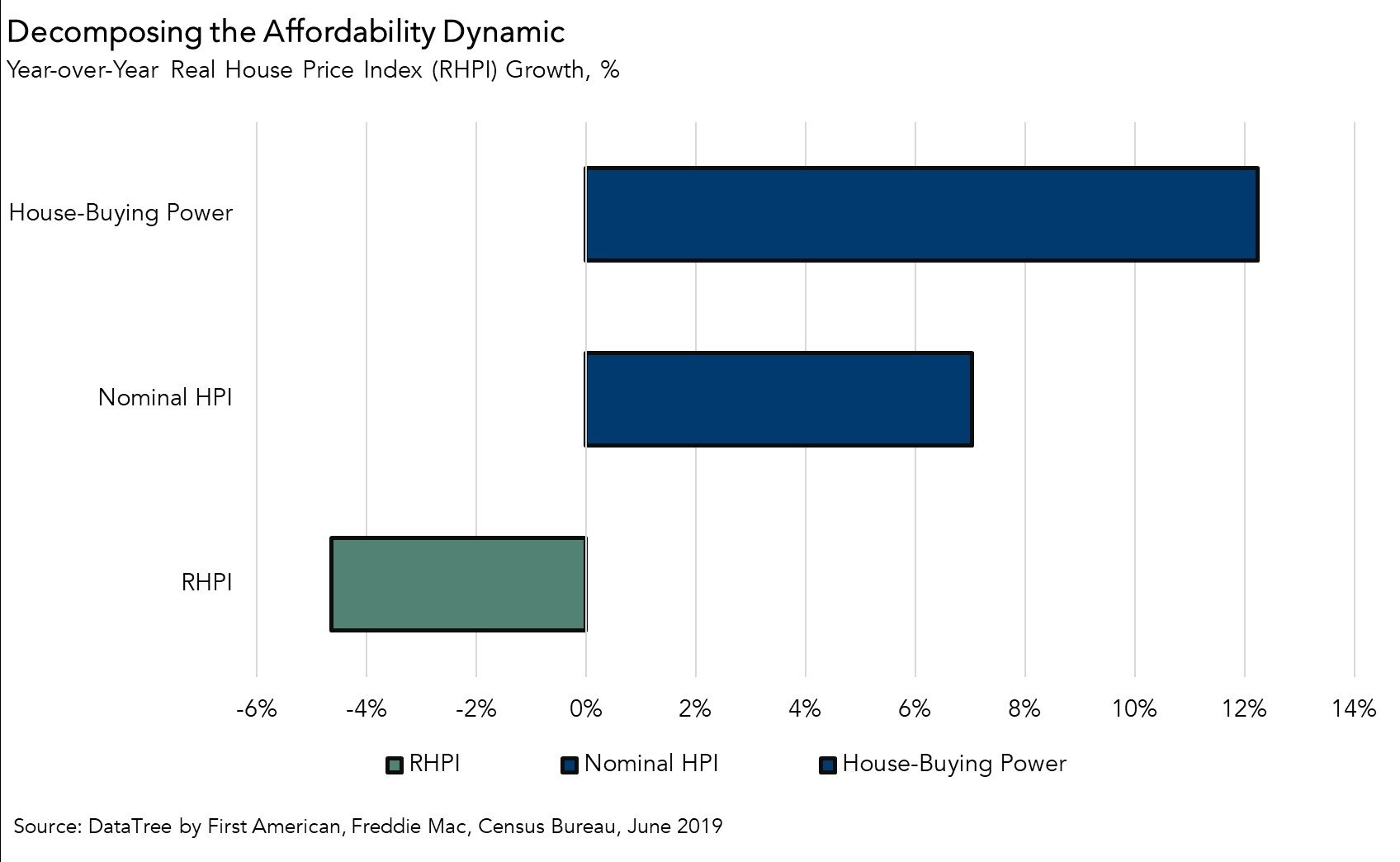

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in June. The 30-year, fixed-rate mortgage fell by 0.8 percentage points and household income increased 2.4 percent compared with June 2018. When household income rises, consumer house-buying power ...

Read More ›

What Does Increasing Tenure Length Mean for the Housing Market?

By

Mark Fleming on August 20, 2019

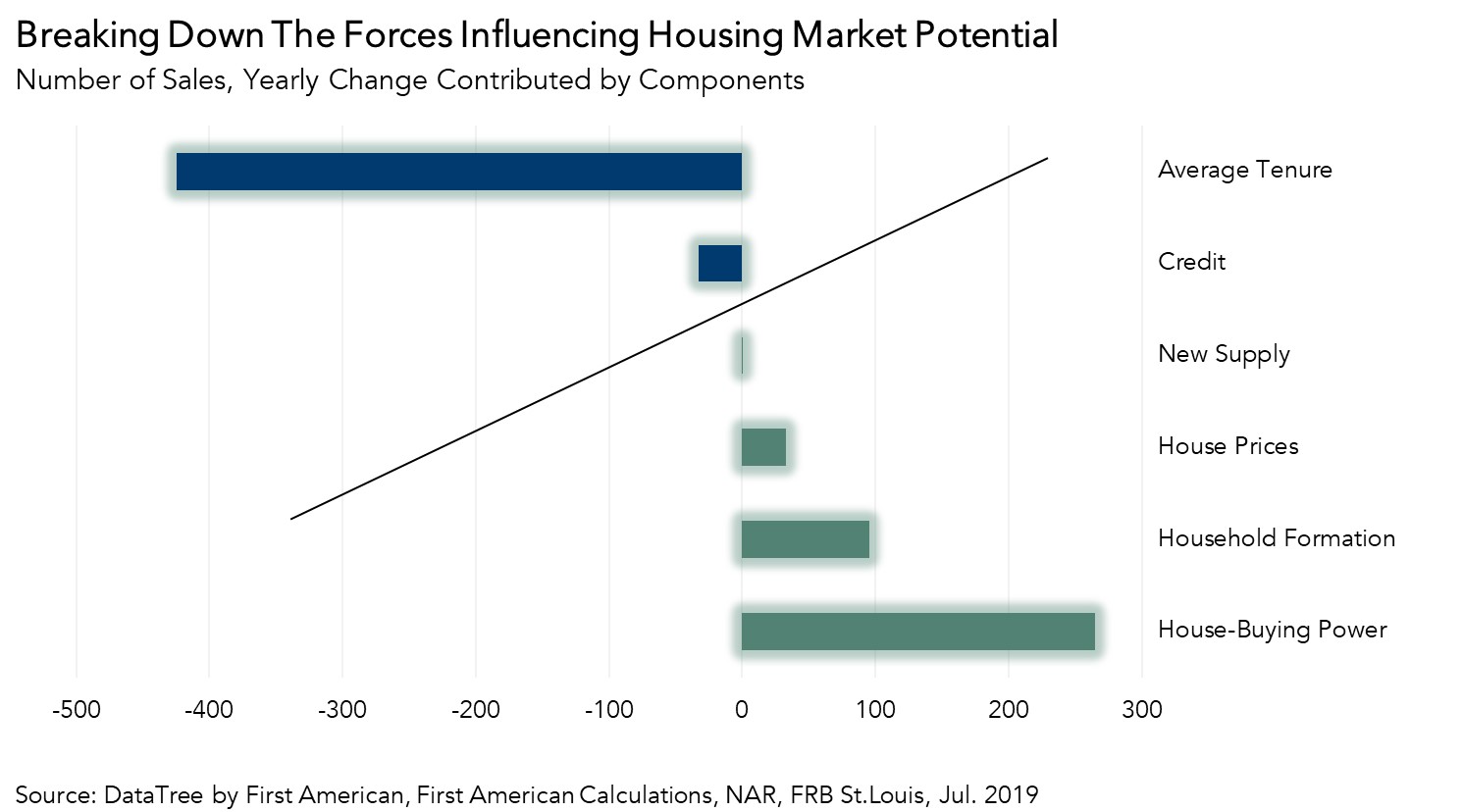

The housing market essentially reached its potential in July 2019, as actual existing-home sales were 0.05 percent above the market’s potential. Existing-home sales in 2019 are running at a pace similar to 2015, even though rates have fallen and household income has increased this year. Housing market potential benefitted from a 10.6 percent ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

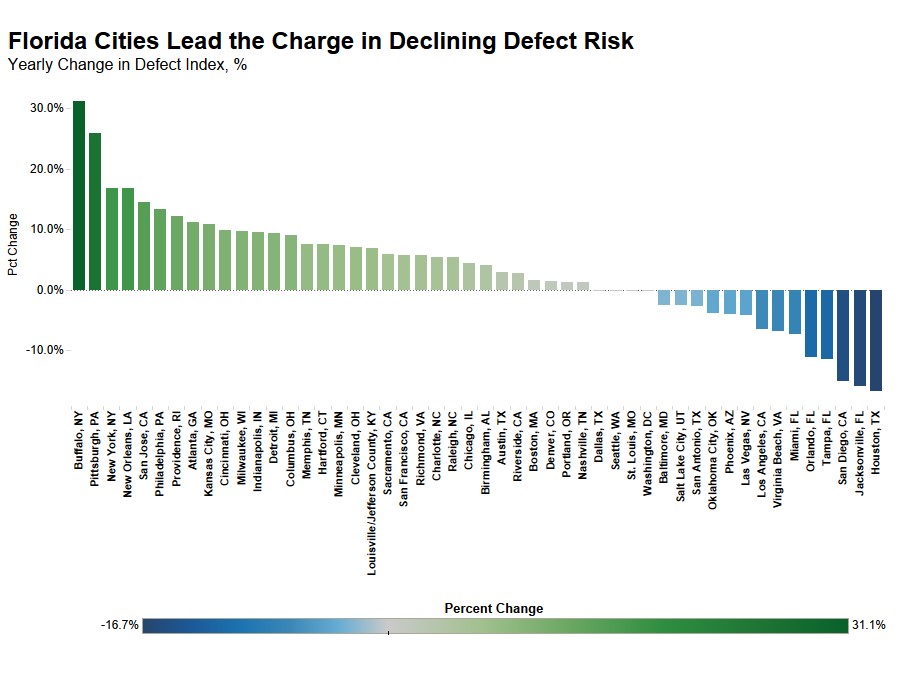

Why Florida Cities Suddenly Lead the Charge in Declining Fraud Risk

By

Mark Fleming on July 31, 2019

This month, the Loan Application Defect Index for purchase transactions continued its downward trend, declining 7.8 percent in June compared with the month before, the third consecutive month defect risk in purchase transactions has fallen. The Defect Index for refinance transactions also fell 6.5 percent compared with the previous month. The ...

Read More ›