Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Has Rising House-Buying Power Accelerated House Price Appreciation?

By

Mark Fleming on November 26, 2019

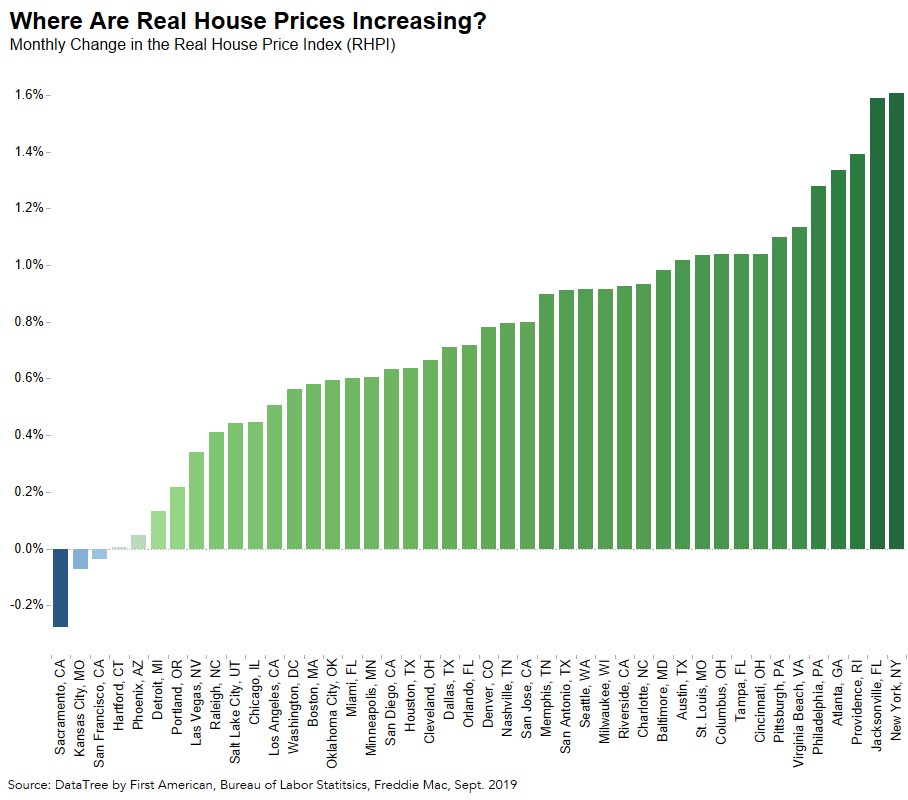

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, modestly swung in favor of increased affordability in September, yet affordability declined month over month. The 30-year, fixed-rate mortgage fell by 0.01 percentage points and household income increased 0.03 percent compared with August 2019. ...

Read More ›

What Do Rising Rates and Tenure Length Mean for Housing Market Potential in 2020?

By

Mark Fleming on November 20, 2019

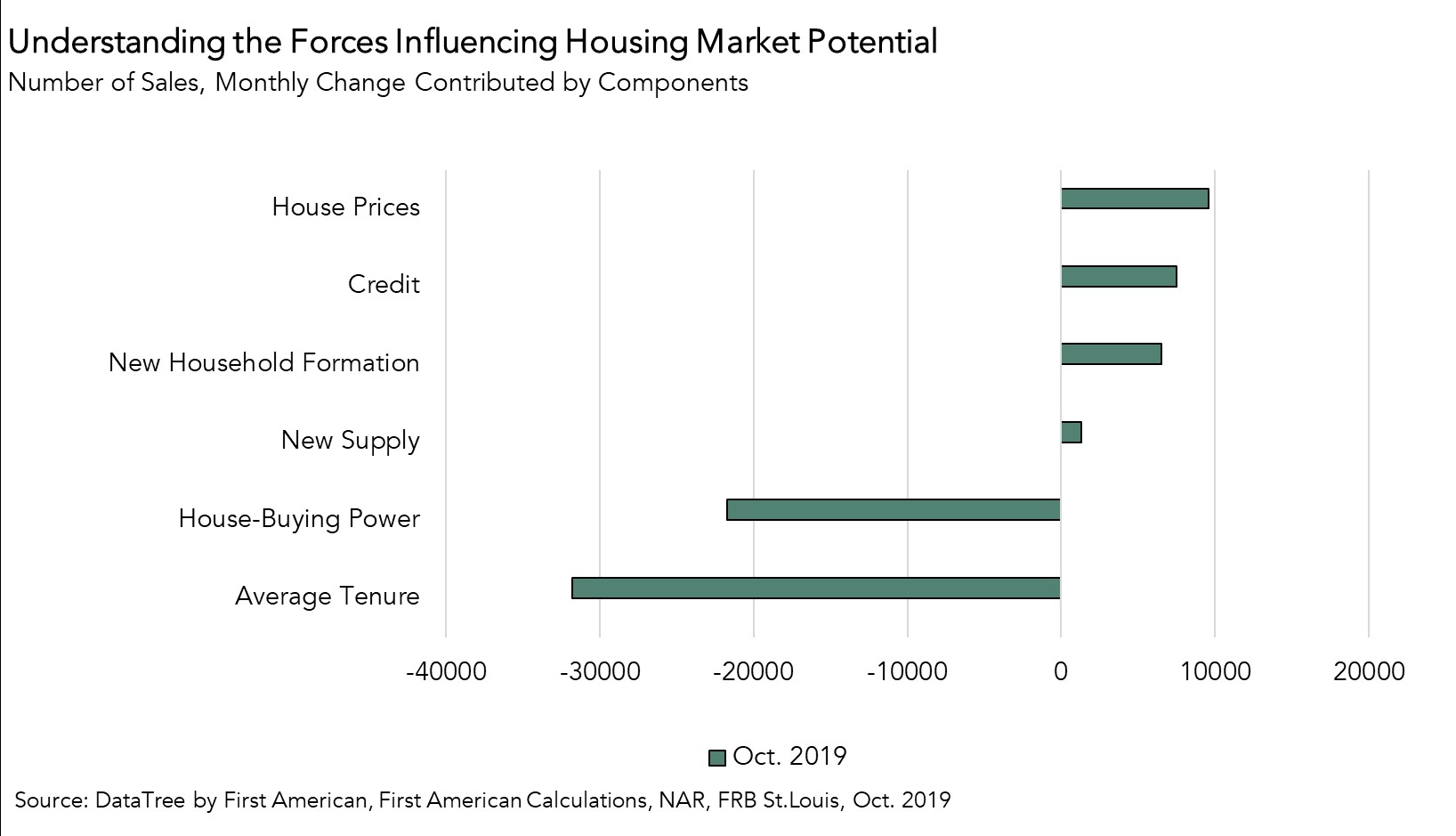

In October 2019, the housing market exceeded its potential, as actual existing-home sales exceeded market potential by 4.6 percent, or an estimated 239,000 seasonally adjusted annualized sales. Housing market potential decreased relative to last month, but increased 0.6 percent compared with October of last year.

Read More ›

Why Has Defect Risk Reached a Multi-Year Low Point?

By

Mark Fleming on October 31, 2019

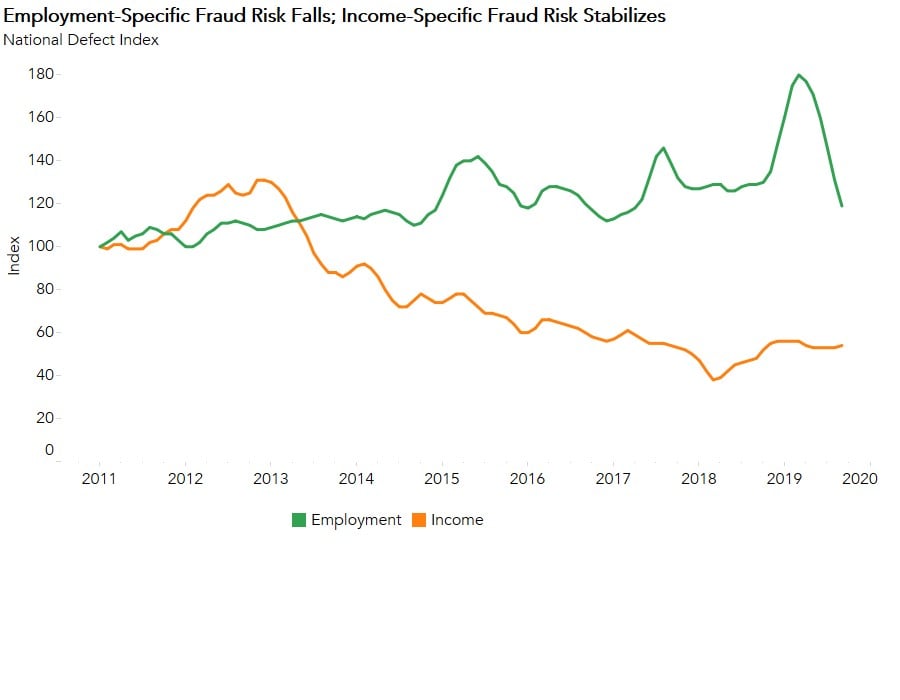

Declining for the sixth consecutive month, the Loan Application Defect Index for purchase transactions fell 2.6 percent in September compared with August. The Defect Index for refinance transactions also fell, declining 4.5 percent compared with the previous month. The overall Defect Index, which includes both purchase and refinance transactions, ...

Read More ›

The Dynamic Forces that Re-Shaped Housing Affordability in 2019

By

Mark Fleming on October 28, 2019

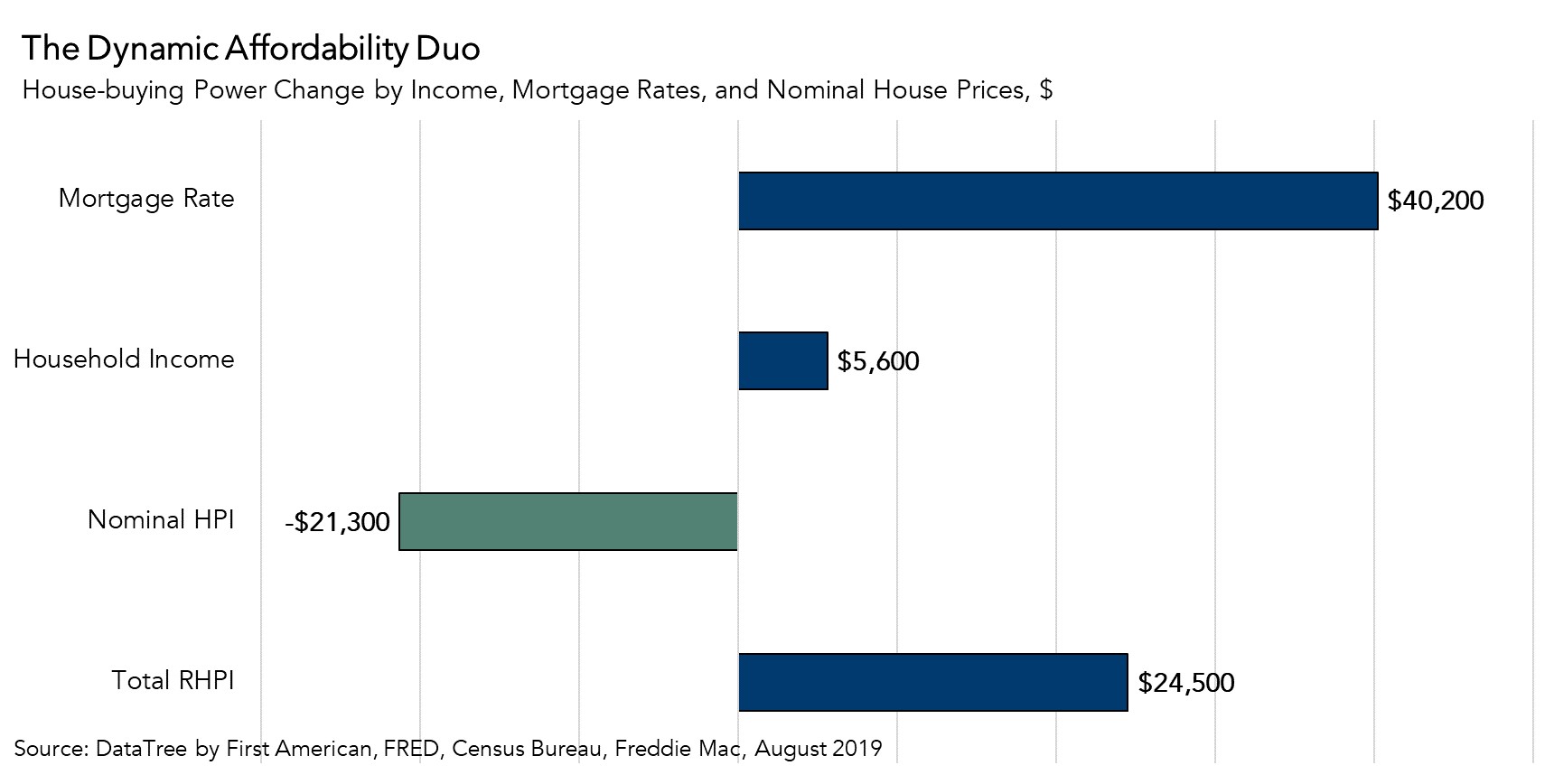

Understanding the dynamics that influence consumer house-buying power, how much home one can buy based on changes in income and interest rates, provides a helpful perspective on the housing market. When incomes rise, consumer house-buying power increases. When mortgage rates or nominal house prices rise, consumer house-buying power declines. Our ...

Read More ›

What’s the Outlook for Housing Market Potential for the Rest of 2019?

By

Mark Fleming on October 18, 2019

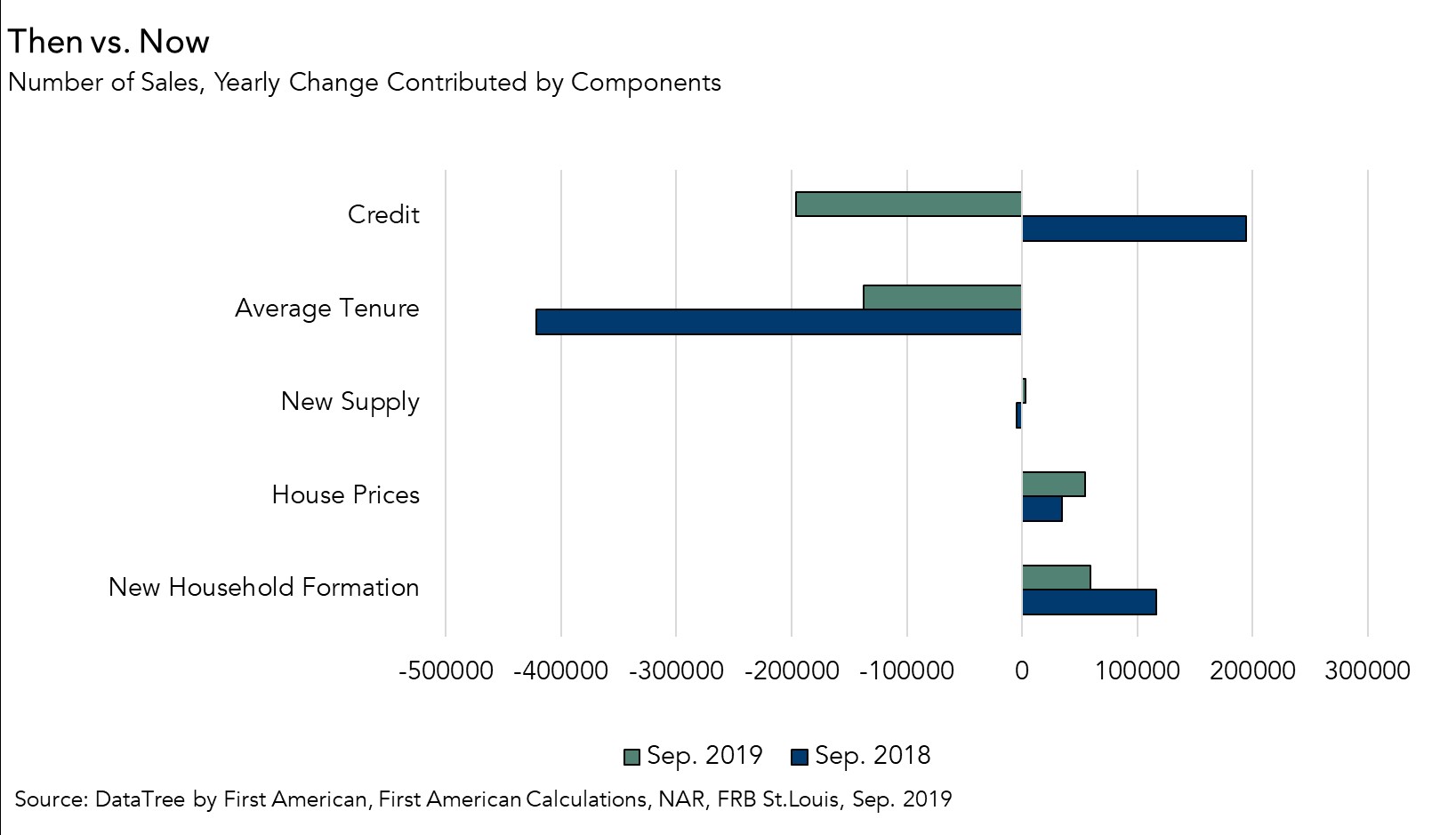

In September 2019, the housing market performed to its potential, as actual existing-home sales were a marginal 0.04 percent, or an estimated 2,340 seasonally adjusted annualized sales, below market potential. Housing market potential decreased relative to last month, but increased 3.8 percent compared with September of last year. Indeed, in ...

Read More ›

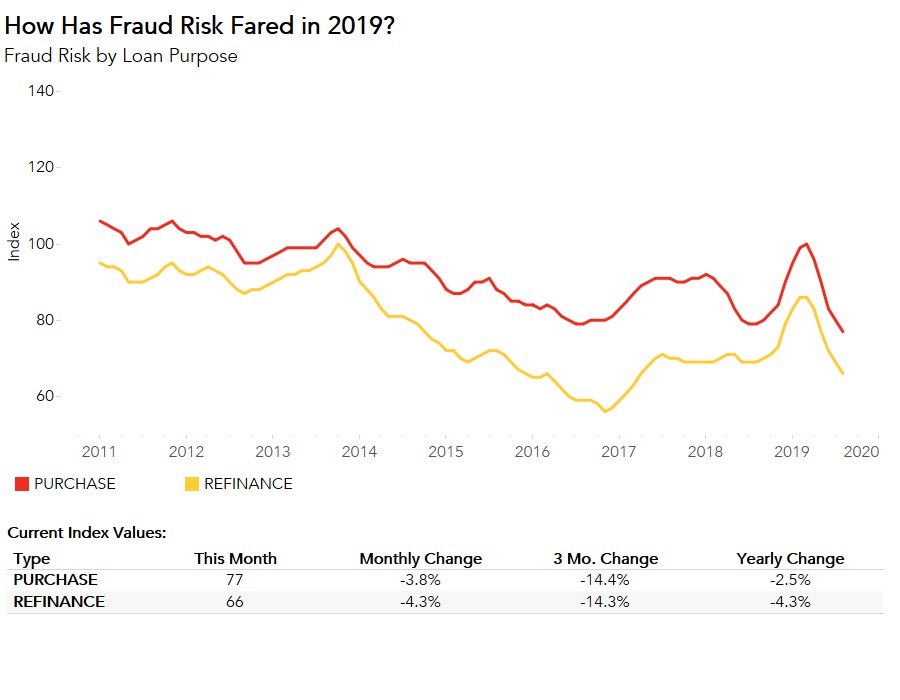

How 2019 Became the Year of Declining Fraud Risk

By

Mark Fleming on September 26, 2019

Declining for the fifth consecutive month, the Loan Application Defect Index for purchase transactions continued its downward trend, falling 3.8 percent in August compared with July. The Defect Index for refinance transactions also fell, declining 4.3 percent compared with the previous month. The overall Defect Index, which includes both purchase ...

Read More ›