Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

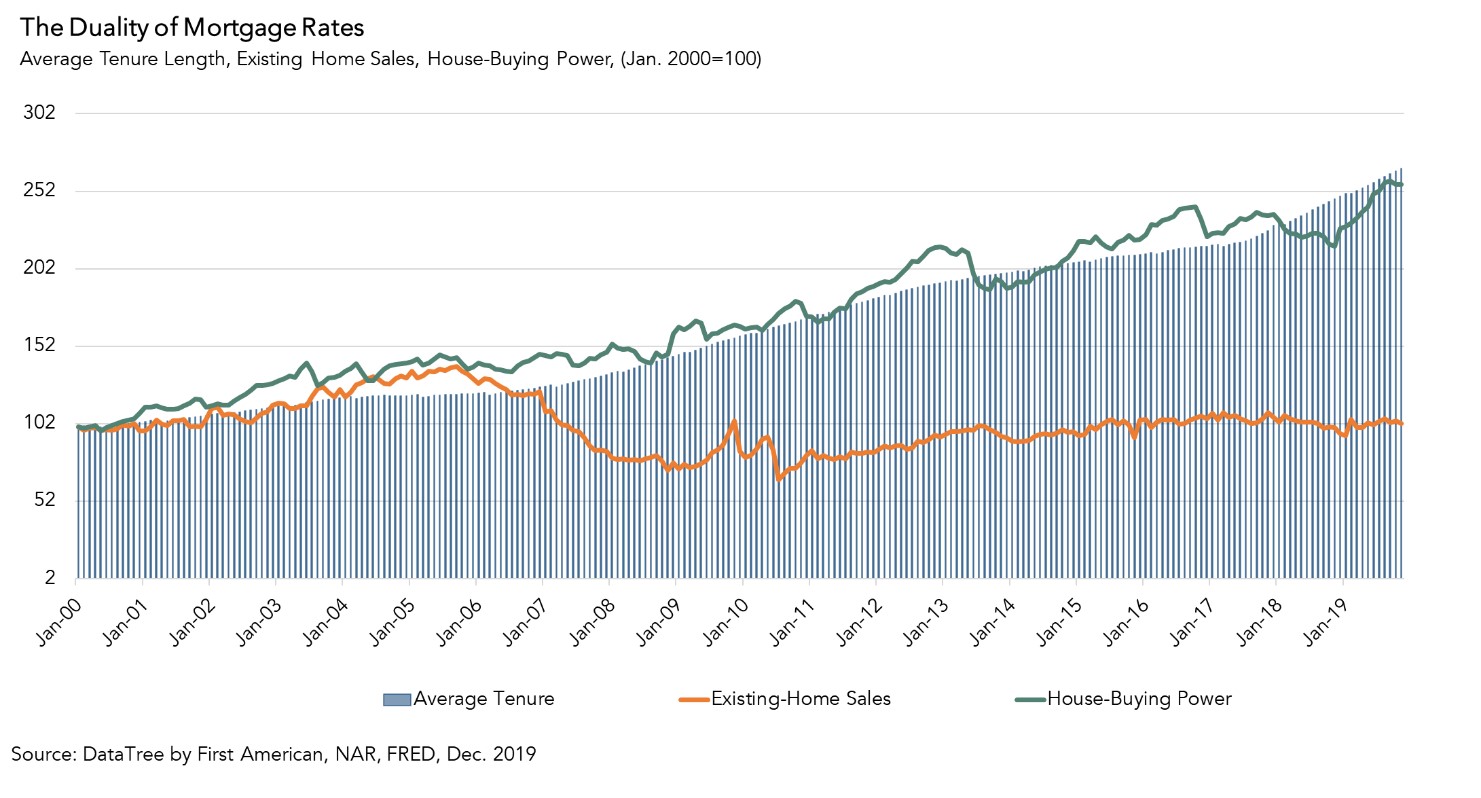

How Low Mortgage Rates Help and Hurt Housing Market Potential

By

Mark Fleming on January 22, 2020

The final month of 2019 saw actual existing-home sales exceed housing market potential by 1.2 percent, or an estimated 64,830 seasonally adjusted annualized sales. According to our Potential Home Sales Model, housing market potential increased 1.7 percent in December 2019 relative to the previous month, and grew 2.6 percent year over year, an ...

Read More ›

What Global Uncertainty Means for the Housing Market

By

Mark Fleming on January 10, 2020

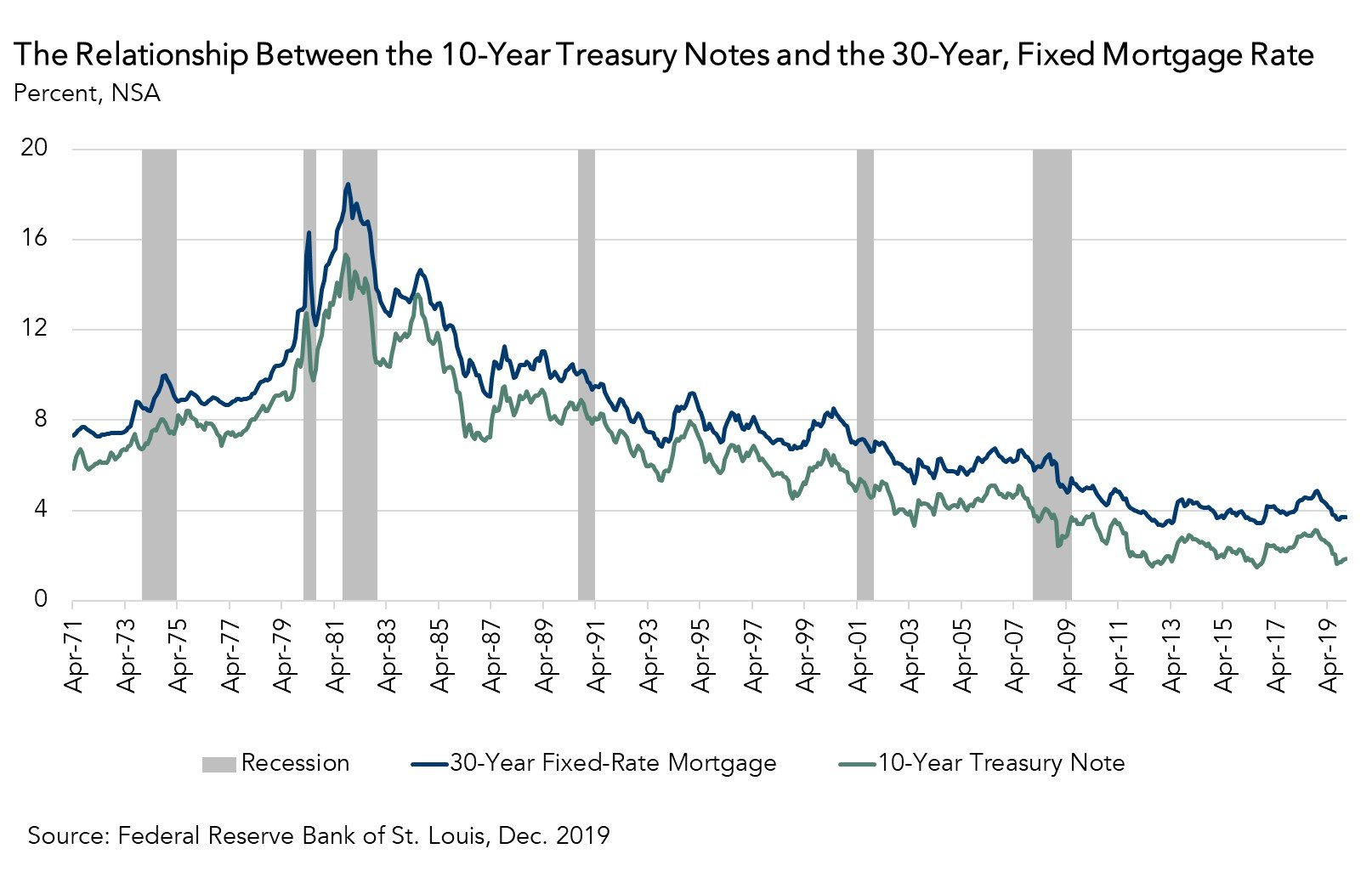

Global events and uncertainty, such as the conflict between the U.S. and Iran, clearly impacts geopolitical relations, but also impacts the U.S. economy, and more specifically, the U.S. housing market. How? Against a backdrop of uncertainty, investors worldwide look for a safe place to put their money. U.S. bonds, backed by the full faith and ...

Read More ›

Interest Rates Real House Price Index Federal Reserve Affordability

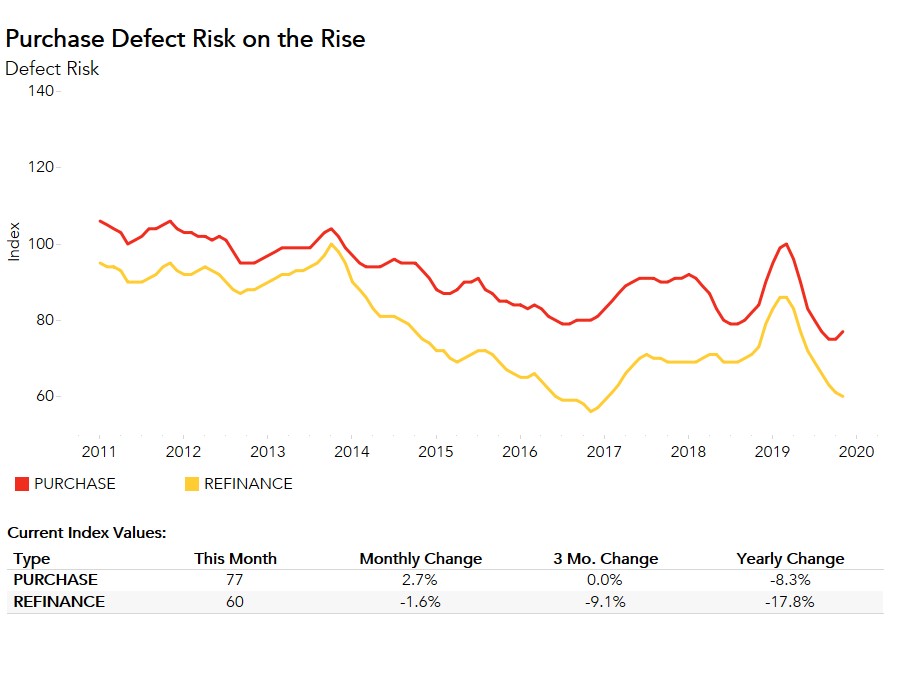

Why Did Defect Risk for Purchase Transactions Rise for the First Time Since March?

By

Mark Fleming on December 27, 2019

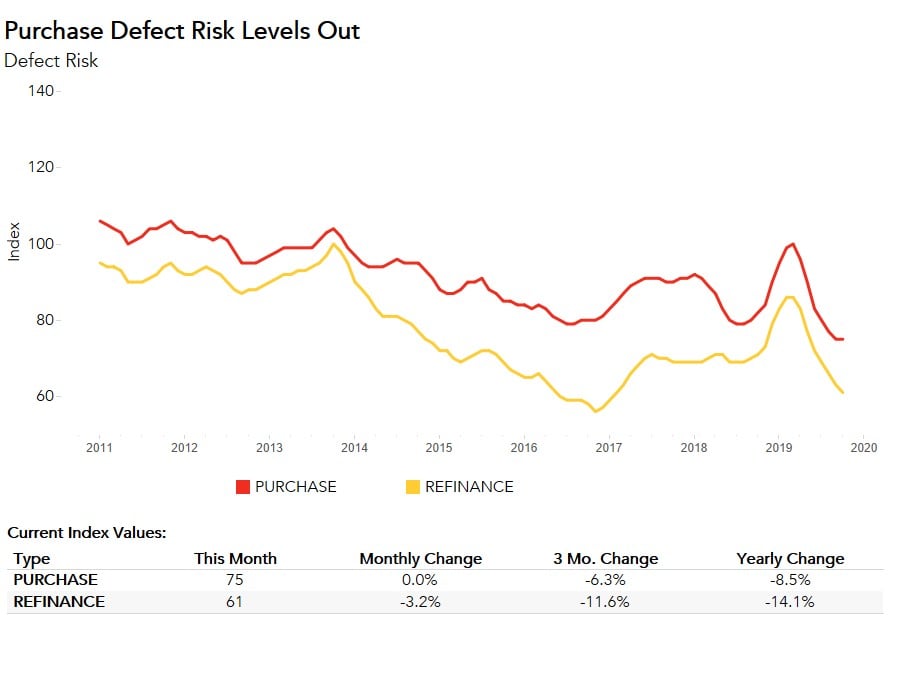

As we predicted last month, the Loan Application Defect Index for purchase transactions reached a turning point in November. After falling since March, the Defect Index for purchase transactions increased 2.7 percent compared with October, while the Defect Index for refinance transactions fell by 1.6 percent, its eighth straight month of declining ...

Read More ›

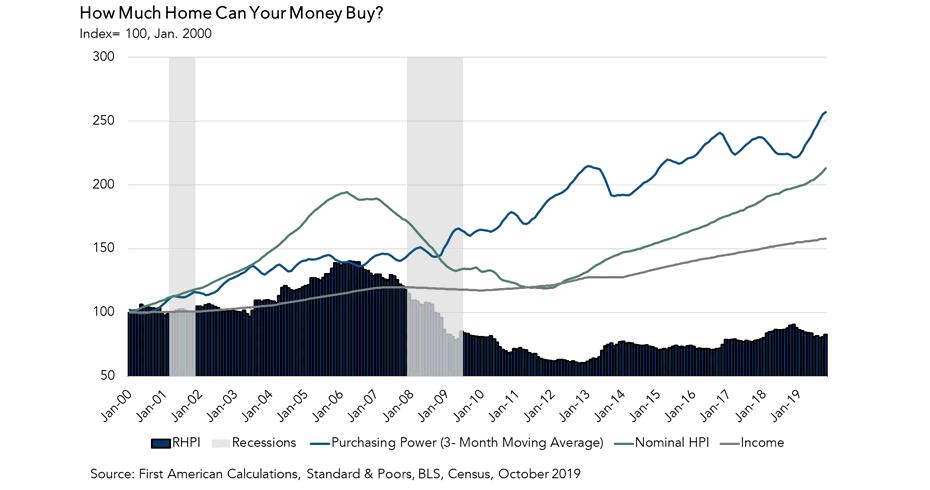

What Will Drive House-Buying Power in 2020?

By

Mark Fleming on December 20, 2019

Affordability improved in October as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, modestly swung in favor of increased affordability relative to one year ago. The 30-year, fixed-rate mortgage fell by 1.1 percentage points and household income increased 2.6 percent compared with October ...

Read More ›

Will Housing Market Potential in 2020 Exceed 2019?

By

Mark Fleming on December 18, 2019

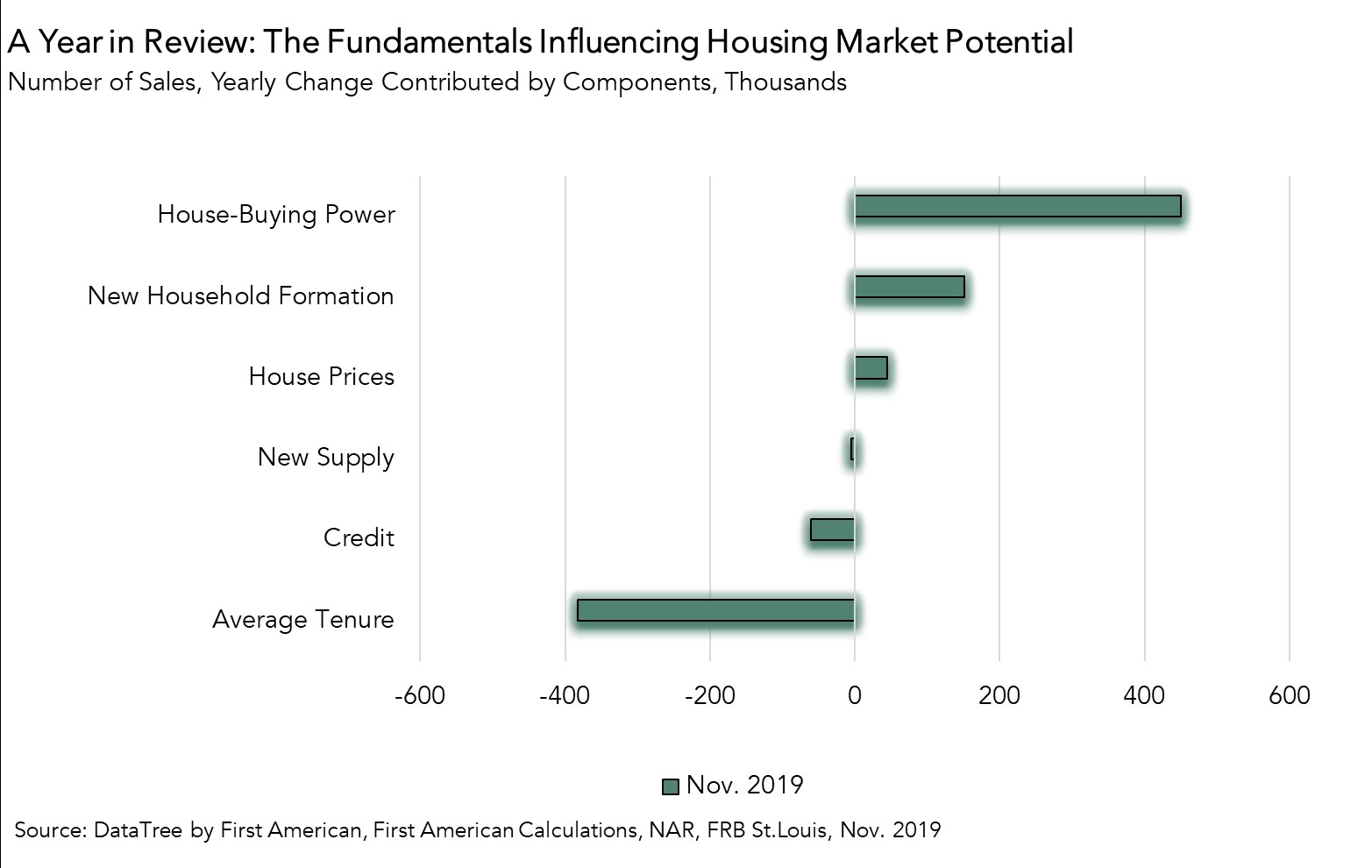

In November 2019, the housing market outperformed its potential, as actual existing-home sales exceeded market potential by 2.8 percent, or an estimated 146,340 seasonally adjusted annualized sales. Housing market potential increased 1.4 percent relative to last month and 3.9 percent compared with November of last year, an increase of 196,480 ...

Read More ›

Has Defect Risk for Purchase Transactions Reached a Turning Point?

By

Mark Fleming on November 27, 2019

Based on our analysis, if mortgage rates continue to fall, the pressure on fraud risk may weaken. This has played out throughout most of 2019, as the 30-year, fixed mortgage rate has been falling since December 2018, and overall fraud risk alongside it. Fraud risk began declining in March 2019 and reached a historical low in October. The Loan ...

Read More ›