Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Has the Affordability Boost From Falling Mortgage Rates Run its Course?

By

Mark Fleming on October 27, 2020

Throughout 2020, falling mortgage rates have been the strongest influence on housing affordability trends, even helping fuel the housing market’s impressive recovery and resilience to the continuing economic fallout from the coronavirus pandemic. Mortgage rates began declining in January 2020 and even dropped below 3 percent for the first time ...

Read More ›

Why Housing Market Potential Remains at 13-Year High Point

By

Mark Fleming on October 16, 2020

The housing market’s impressive “V-shaped” recovery has thus far shown significant resilience to the economic impacts of the coronavirus pandemic. Demographically driven millennial demand has continued unabated, low rates have fueled house-buying power, and historically low inventory has increased competition, leading to rising prices.

Read More ›

How Can Housing Affordability Improve During Periods of Economic Decline When House Prices Rise

By

Mark Fleming on September 28, 2020

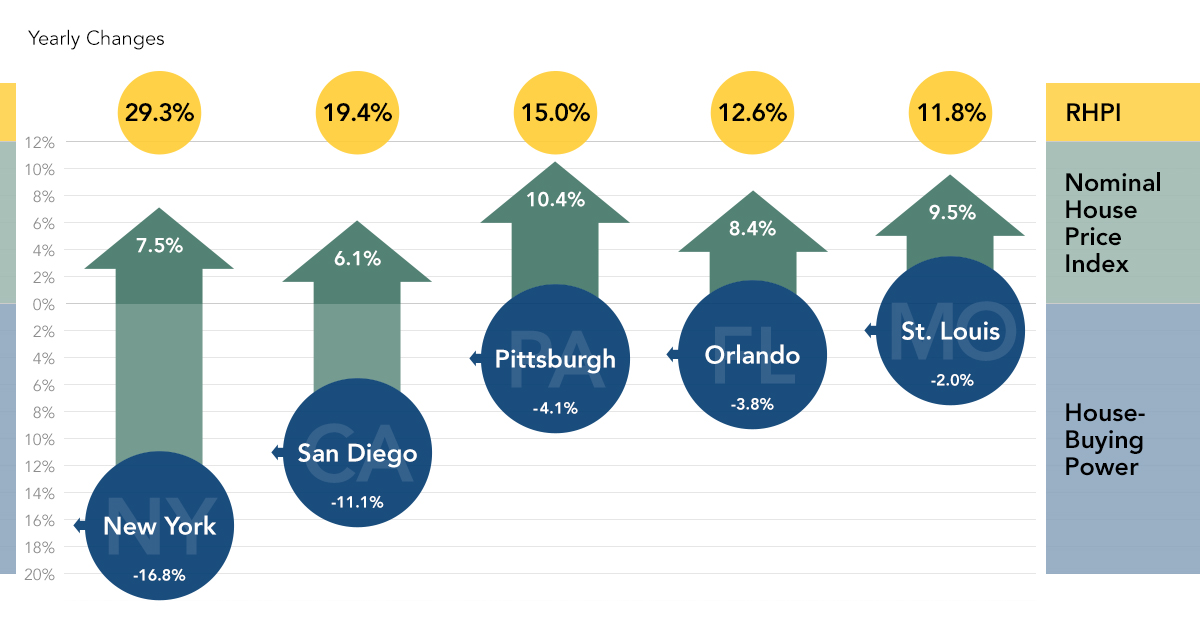

Affordability improved in July as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability, outpacing the rise in nominal house price appreciation. The average 30-year, fixed mortgage rate fell by 0.75 percentage points and household income increased 5.5 ...

Read More ›

Housing Market Potential Reaches Highest Level Since 2007

By

Mark Fleming on September 21, 2020

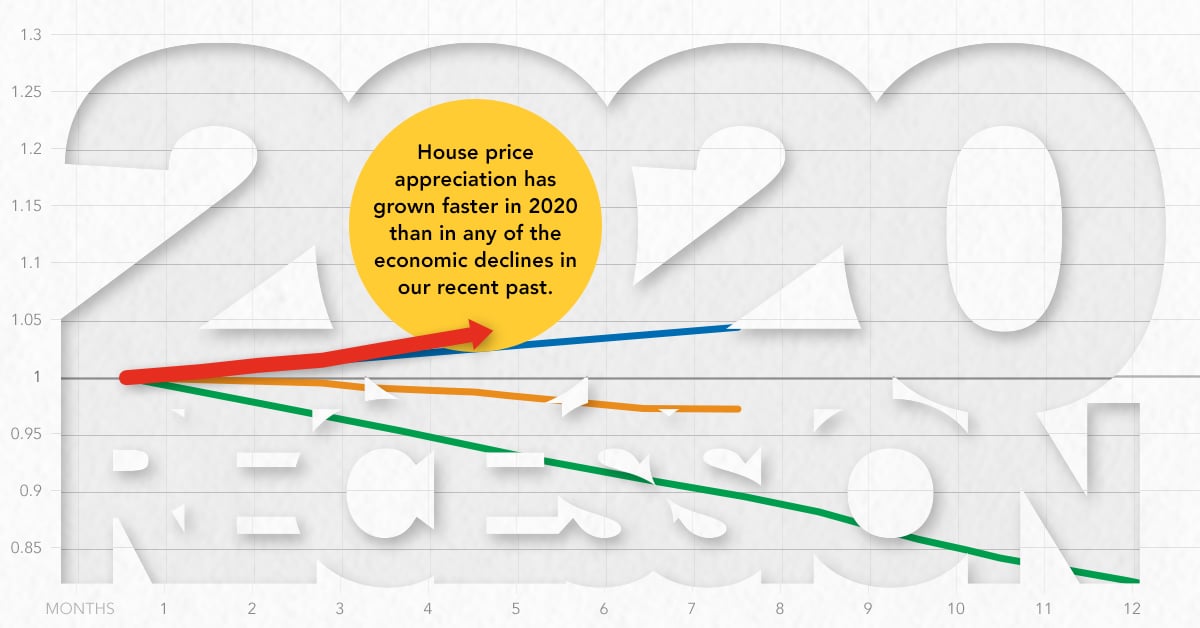

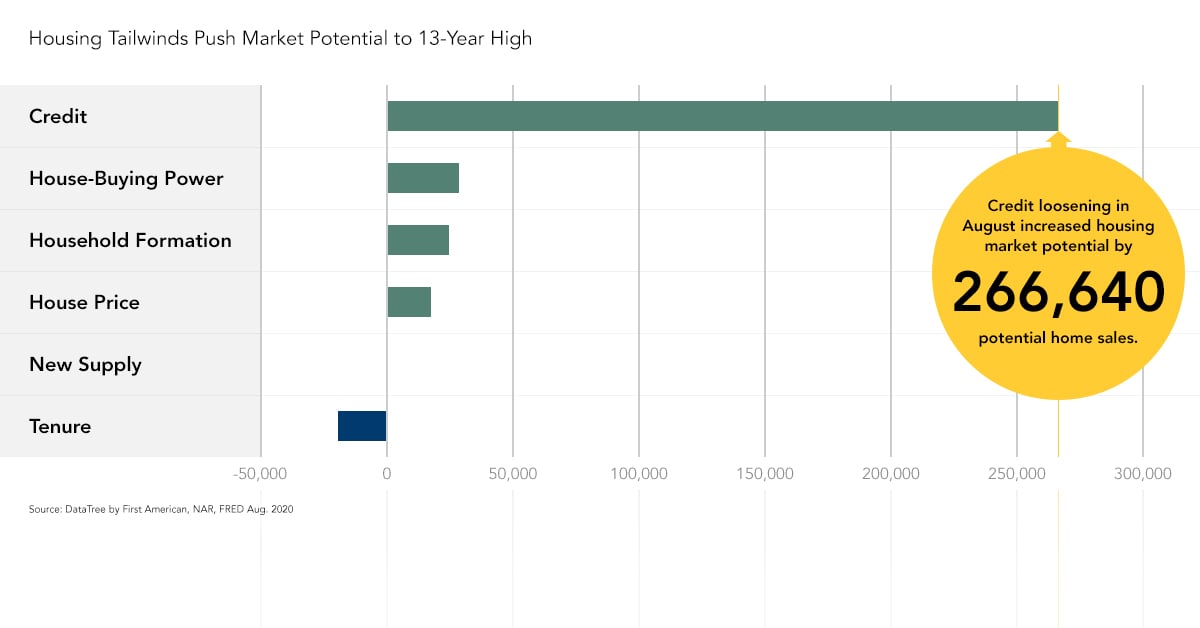

Since hitting a low point during the initial stages of the pandemic, the only major industry to display immunity to the economic impacts of the coronavirus is the housing market. Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels. This is largely because the economic distress from the pandemic has created a ...

Read More ›

Where Housing Affordability is Declining the Most

By

Mark Fleming on August 24, 2020

The coronavirus pandemic continues to wreak havoc on global and domestic economies, yet housing has thus far managed an impressive V-shaped recovery. Housing’s strong rebound has been driven by several factors that existed before the coronavirus outbreak but have continued or even gained strength amid the pandemic. Mortgage rates are even lower ...

Read More ›

Why has Housing Market Potential Rebounded During the Pandemic?

By

Mark Fleming on August 20, 2020

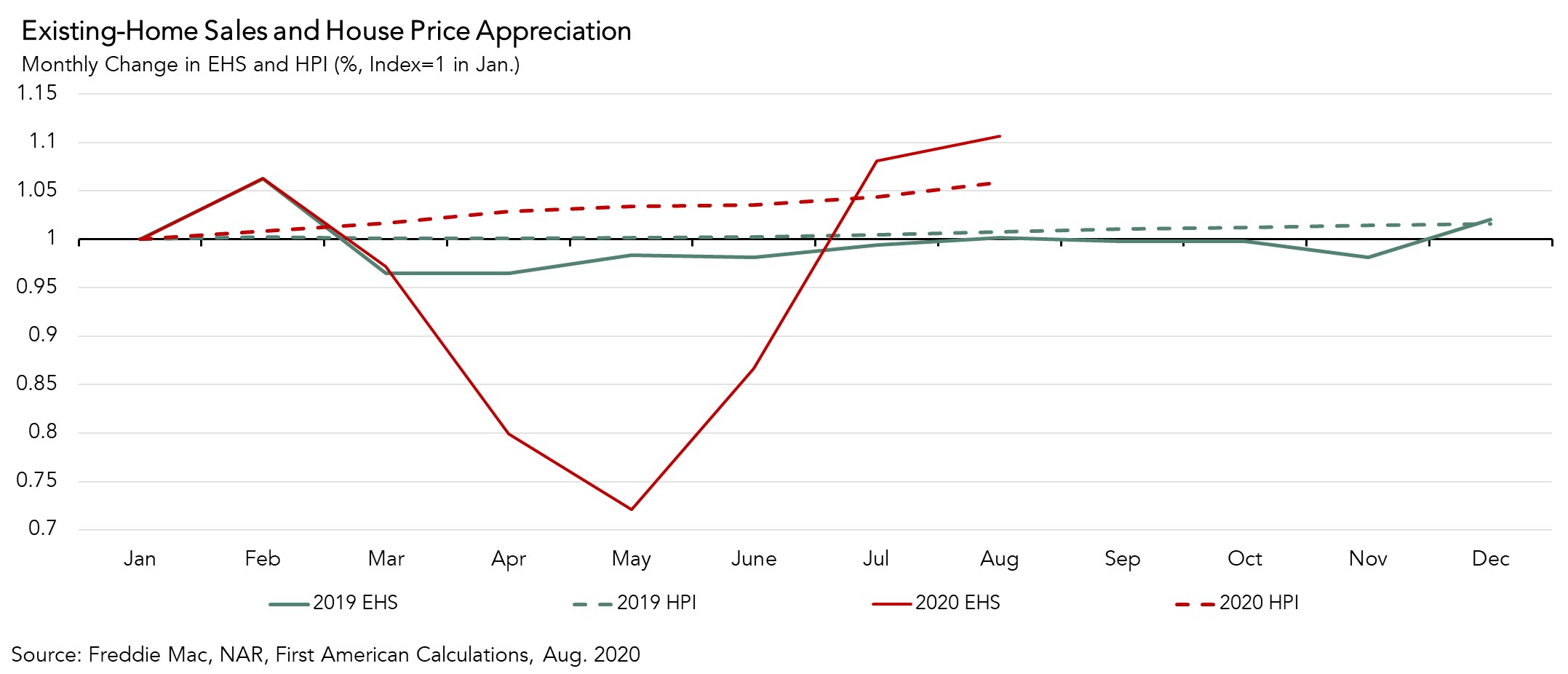

With a July unemployment rate of 10.2 percent and roughly 30 million Americans claiming unemployment benefits, it’s clear that the domestic economy continues to feel the pain inflicted by the coronavirus pandemic. Yet the housing industry, at least for now, continues its impressive V-shaped rebound. Weekly purchase applications have surpassed ...

Read More ›