The economic fallout and impacts to the housing market from the pandemic appeared to peak in April. The number of existing-home sales fell 18 percent relative to March, housing starts fell 26 percent, and the supply of homes available for sale approached record lows. While historically low mortgage rates made it more affordable for those with stable incomes to buy a home, tightening credit standards and limited supply of homes for sale made it more difficult for some to obtain financing and find the home they want.

“If household income growth slows and house prices continue to rise, even today’s record low mortgage rates may not keep affordability from declining.”

Distorted Household Income Data

The RHPI this month reflects a steep increase in wages in April, which is not an accurate portrayal of how the pandemic has impacted income levels across the country. The Labor Department reported that average hourly earnings in the private sector were up 8.0 percent in April compared with one year ago. The pandemic driven-economic crisis has hit low-wage workers hardest. When the lowest earners get laid off, they’re removed from the data that the government uses to calculate earnings, causing average hourly earnings to increase. This month’s estimate does not reflect actual household income levels in April, and therefore, house-buying power and the RHPI reflect a more positive picture than actually exists. However, we can examine some potential scenarios that can provide perspective on how the drivers of the Real House Price Index impact affordability.

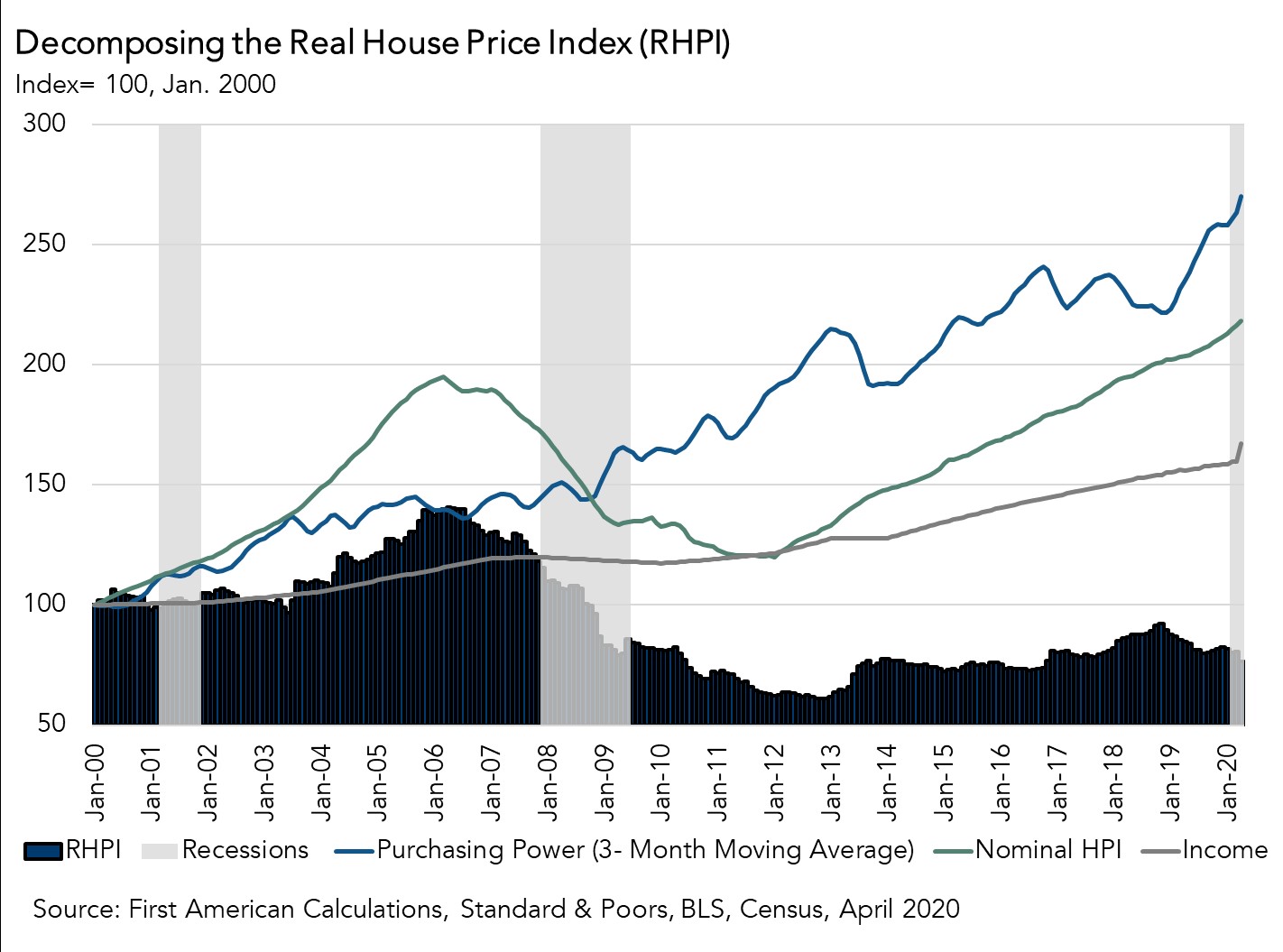

Interplay Between Rates, Income, and Nominal House Prices Drive Affordability Trends

Three driving forces – mortgage rates, household income, and unadjusted house prices – influence affordability in the housing market. In 2019 and into early 2020, affordability was improving as rising household income and falling mortgage rates boosted house-buying power, which offset the impact of rising nominal house price appreciation. In April, mortgage rates fell and house price appreciation continued to rise, but the artificial increase in average household income distorted the measure of affordability. Let’s examine the potential impact to affordability in two possible scenarios – if household income remained the same month over month in April and if household income declined 1 percent month over month in April.

Scenario 1: No Change to Household Income

If the average household income remained the same in April as it was in March (no growth), house-buying power would still have increased by nearly $8,000 compared with March, simply because the 30-year, fixed-rate mortgage declined 0.14 percentage points. In this scenario, where household income remained the same as the previous month, the RHPI still indicates nearly a 1 percent increase in affordability relative to March, even after accounting for the accelerating nominal house price appreciation in April.

Scenario 2: Household Income Declines 1 Percent

However, if the average household income in April fell one percent compared with the previous month (from $67,130 to $66,460), house-buying power would still be $3,500 higher than March due to low rates. But, the modest increase in house-buying power in this scenario is not enough to offset the nominal house price appreciation and affordability falls by 0.08 percent, according to the RHPI. It’s clear that the delicate interplay between income, rates and nominal house prices determines the outcome for affordability.

Summer May Bring Declining Affordability

The question on everyone’s mind is what will happen to house prices and affordability in the near-term? In May and into June, mortgage rates have continued to fall, even reaching a historical low of 3.13 percent. Consensus among expert forecasts expect the 30-year, fixed-rate mortgage will average around 3.2 percent for the remainder of the year – good news for potential home buyers. However, our preliminary nominal house price index for the month of May indicates increasing house price appreciation, (7.9 percent year-over-year compared with 7.1 percent in April), as pent-up demand from a spring home-buying season frozen by pandemic-related stay-at-home orders melts into the summer and is met with near record low inventory.

Our research has also found that in past recessions, house prices show their “downside stickiness,” meaning they remain flat or their growth slows during economic downturns, but often do not decline much. Because of this, in the near term, we anticipate nominal house price appreciation to accelerate this summer. Additionally, the May Employment Situation Summary points to a decline in average hourly wages, likely resulting in falling average household income. If household income growth slows and house prices continue to rise, even today’s record low mortgage rates may not keep affordability from declining.

For more analysis of affordability, please visit the Real House Price Index.

The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of July 27, 2020.

Sources:

April 2020 Real House Price Index Highlights

*NOTE: This month’s report reflects a steep increase in wages in April. The Labor Department reported that average hourly earnings in the private sector were up 8.0 percent in April compared with one year ago. The pandemic-driven economic crisis has hit low-wage workers hardest, and when the lowest earners get laid off, they’re removed from the data that the government uses to calculate earnings, causing the average to increase. This month’s estimate does not reflect actual household income levels in April, and therefore, house-buying power and the RHPI this month reflect a more positive picture than likely exists.

The First American Real House Price Index (RHPI) showed that in April 2020:

- Real house prices decreased 5.3 percent between March 2020 and April 2020.

- Real house prices declined 9.7 percent between April 2019 and April 2020.

- Consumer house-buying power, how much one can buy based on changes in income and interest rates, decreased 6.5 percent between March 2020 and April 2020, and increased 18.7 percent year over year.

- Median household income has increased 7.1 percent since April 2019 and 67.2 percent since January 2000.

- Real house prices are 23.5 percent less expensive than in January 2000.

- While unadjusted house prices are now 12.0 percent above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 45.6 percent below their 2006 housing boom peak.

April 2020 Real House Price State Highlights

- The two states with a year-over-year increase in the RHPI are: Vermont (+1.3 percent) and Oklahoma (+0.5 percent).

- The five states with the greatest year-over-year decrease in the RHPI are: New Hampshire (-9.3 percent), Louisiana (-9.3 percent), South Dakota (-8.1 percent), Illinois (-7.8 percent), and Minnesota (-7.8 percent).

April 2020 Real House Price Local Market Highlights

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, the five markets with the greatest year-over-year increase in the RHPI are: New York (+3.0 percent), Pittsburgh (+2.2 percent), Columbus, Ohio (+2.1 percent), San Diego (+1.8 percent), and Milwaukee (+1.3 percent).

- Among the Core Based Statistical Areas (CBSAs) tracked by First American, the five markets with the greatest year-over-year decrease in the RHPI are: Las Vegas (-20.4 percent), Providence, R.I. (-10.2 percent), San Francisco (-9.2 percent), Boston (-8.8 percent), and Portland, Ore. (-8.8 percent).

About the First American Real House Price Index

The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what matters to potential buyers - their purchasing power, or how much they can afford to buy. First American’s proprietary Real House Price Index (RHPI) adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

The RHPI uses a weighted repeat-sales house price index that measures the price movements of single-family residential properties by time and across geographies, adjusted for the influence of income and interest rate changes on consumer house-buying power. The index is set to equal 100 in January 2000. Changing incomes and interest rates either increase or decrease consumer house-buying power. When incomes rise and mortgage rates fall, consumer house-buying power increases, acting as a deflator of increases in the house price level. For example, if the house price index increases by three percent, but the combination of rising incomes and falling mortgage rates increase consumer buying power over the same period by two percent, then the Real House Price index only increases by 1 percent. The Real House Price Index reflects changes in house prices, but also accounts for changes in consumer house-buying power.

Disclaimer

Opinions, estimates, forecasts and other views contained in this page are those of First American’s Chief Economist, do not necessarily represent the views of First American or its management, should not be construed as indicating First American’s business prospects or expected results, and are subject to change without notice. Although the First American Economics team attempts to provide reliable, useful information, it does not guarantee that the information is accurate, current or suitable for any particular purpose. © 2020 by First American. Information from this page may be used with proper attribution.