Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Will the Super-Sellers' Market Continue to Impact Affordability in 2021?

By

Mark Fleming on December 28, 2020

The housing market prior to the pandemic could have been characterized as a sellers’ market, with a shortage of supply relative to demand. With the current supply of homes for sale even tighter relative to demand, it can only be characterized as a super-sellers’ market today. The pandemic has intensified a sense of home as refuge and falling ...

Read More ›

What Will Drive Housing Market Potential in 2021?

By

Mark Fleming on December 21, 2020

The housing market continues to impress, even as it enters the colder months, which is traditionally real estate’s slow season. After falling to a near-decade low in May due to pandemic-driven pressures, existing-home sales hit a 14-year high in October. In November, our measure of the market potential for existing-home sales increased 10 percent, ...

Read More ›

Why the Big Short in Housing Supply Will Remain in 2021

By

Mark Fleming on December 3, 2020

As the housing market has recovered from the initial impacts of the pandemic, nominal house price appreciation has soared, but affordability actually improved until recently due to the house-buying power benefit from historically low mortgage rates. However, for the second month in a row, the Real House Price Index (RHPI) increased, indicating ...

Read More ›

Interest Rates Real House Price Index Affordability Housing supply

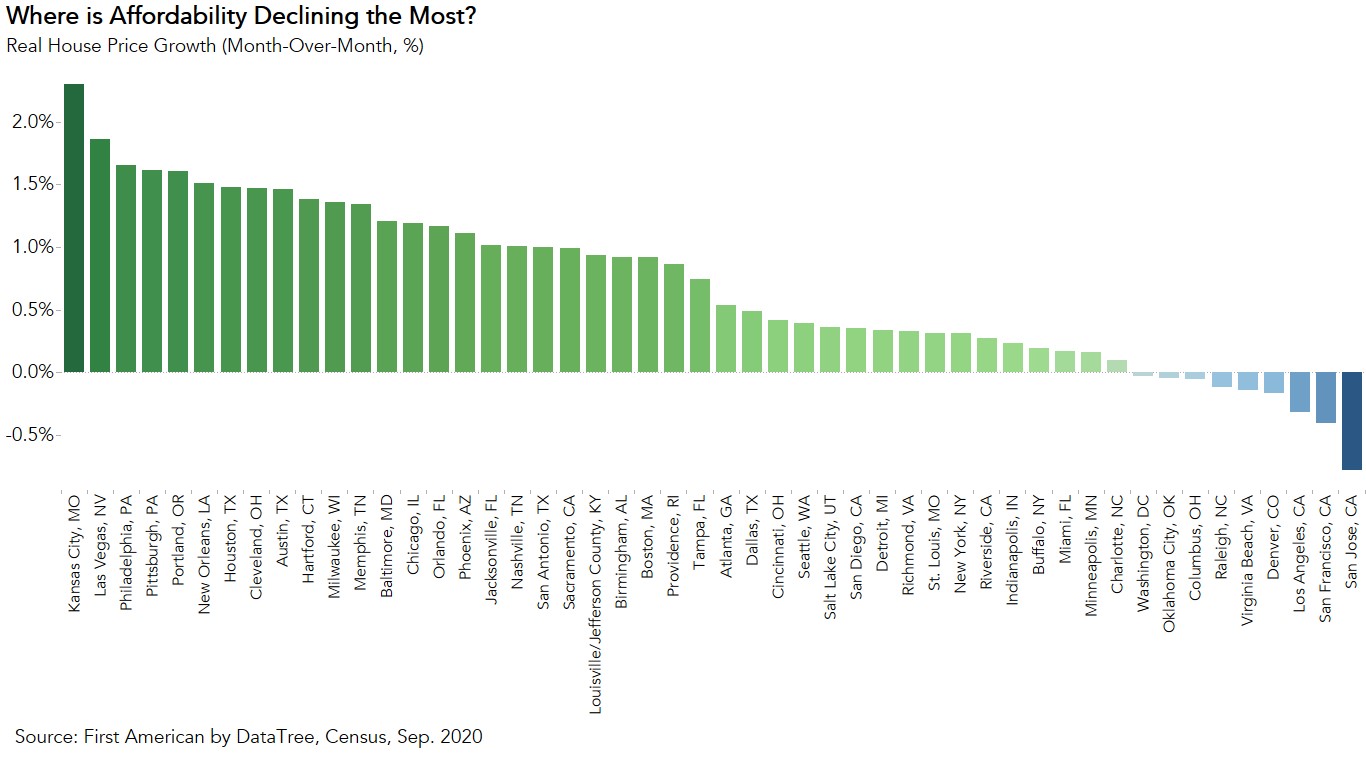

The Five Cities Where Affordability Declined the Most

By

Mark Fleming on November 23, 2020

Affordability declined month over month in September for the second month in a row, even as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability. The 30-year, fixed-rate mortgage fell by 0.05 percentage points and household income increased 0.2 percent ...

Read More ›

What Does the Housing Market’s Historic Pandemic Rebound Mean for 2021?

By

Mark Fleming on November 18, 2020

The housing market’s historic rebound since bottoming in the spring has been nothing short of amazing. After falling to a near-decade low in May, existing-home sales hit a 14-year high in September. In October, our measure of market potential for existing-home sales increased 9.0 percent compared with one year ago to a 5.98 million seasonally ...

Read More ›

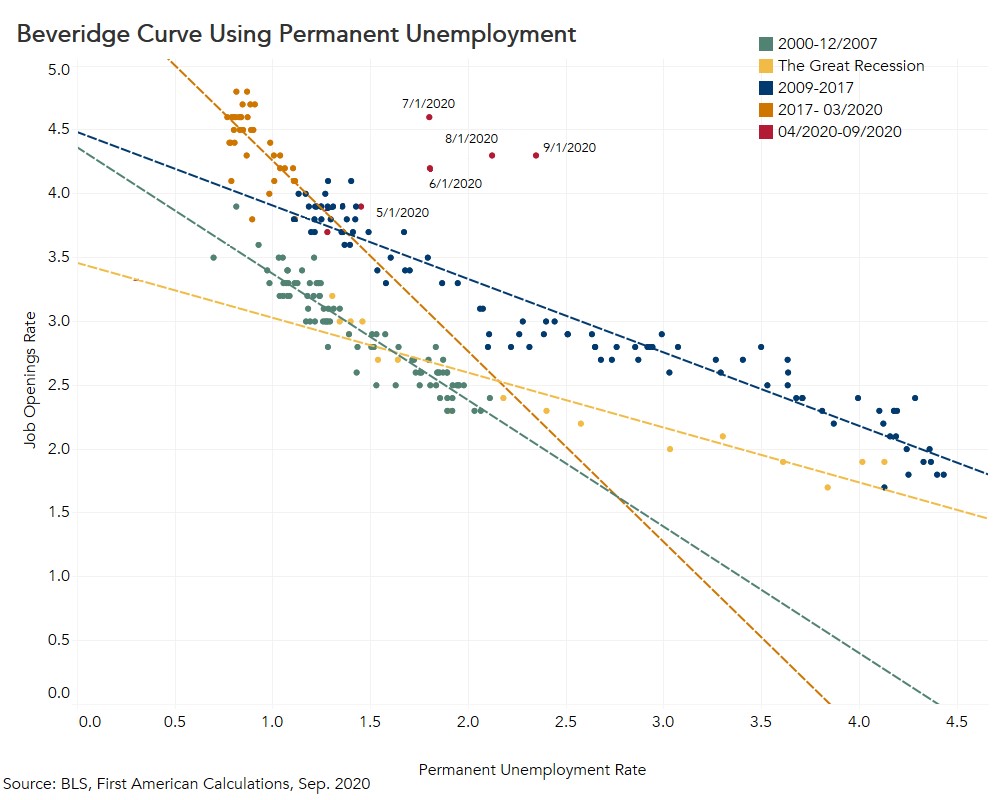

What a Pandemic-Driven Shift in the Labor Market Could Mean for Housing

By

Mark Fleming on November 12, 2020

The October jobs report exceeded consensus expectations for job growth, yet the labor market’s rebound continues to slow. Higher frequency data from weekly jobless claims confirm the slowdown, as the level of new jobless filings is not falling as quickly in recent months. COVID-19 cases are on the rise and there is increasing likelihood of a ...

Read More ›