Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Why has Housing Market Potential Rebounded During the Pandemic?

By

Mark Fleming on August 20, 2020

With a July unemployment rate of 10.2 percent and roughly 30 million Americans claiming unemployment benefits, it’s clear that the domestic economy continues to feel the pain inflicted by the coronavirus pandemic. Yet the housing industry, at least for now, continues its impressive V-shaped rebound. Weekly purchase applications have surpassed ...

Read More ›

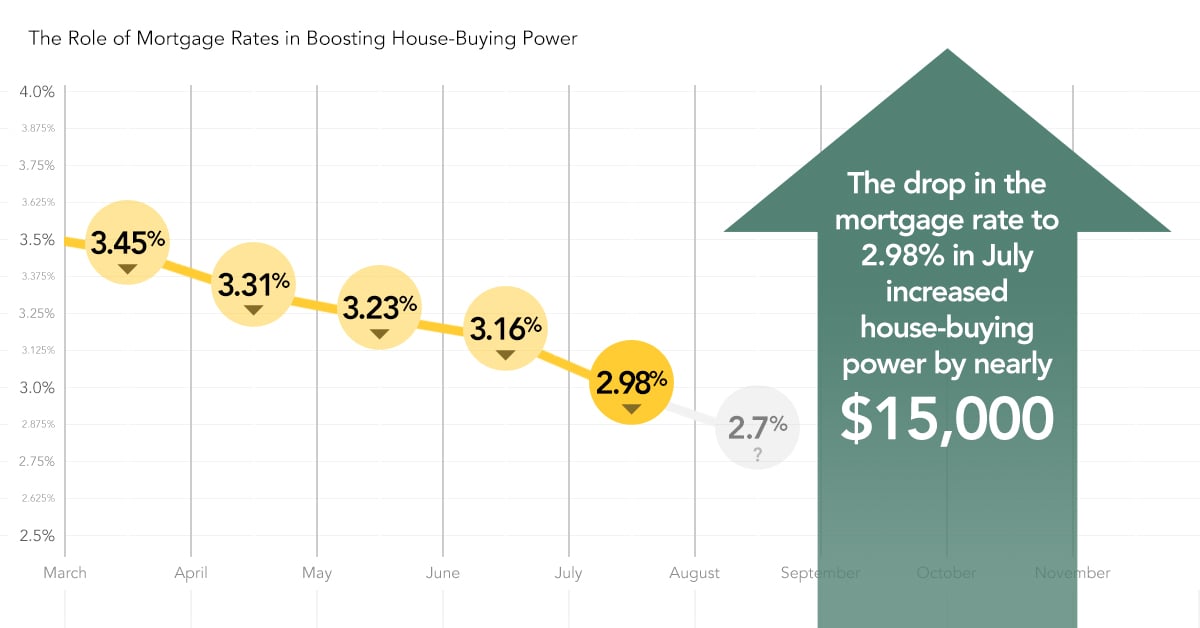

What the Historic Mortgage Rate Drop Means for Affordability

By

Mark Fleming on July 27, 2020

As the coronavirus pandemic continues to wreak havoc on global and domestic economies, housing has thus far proven resilient, managing a V-shaped recovery from the low point reached in April. The strong rebound is largely a result of two dynamics that existed before the pandemic and have continued or even gained strength in the last few months.

Read More ›

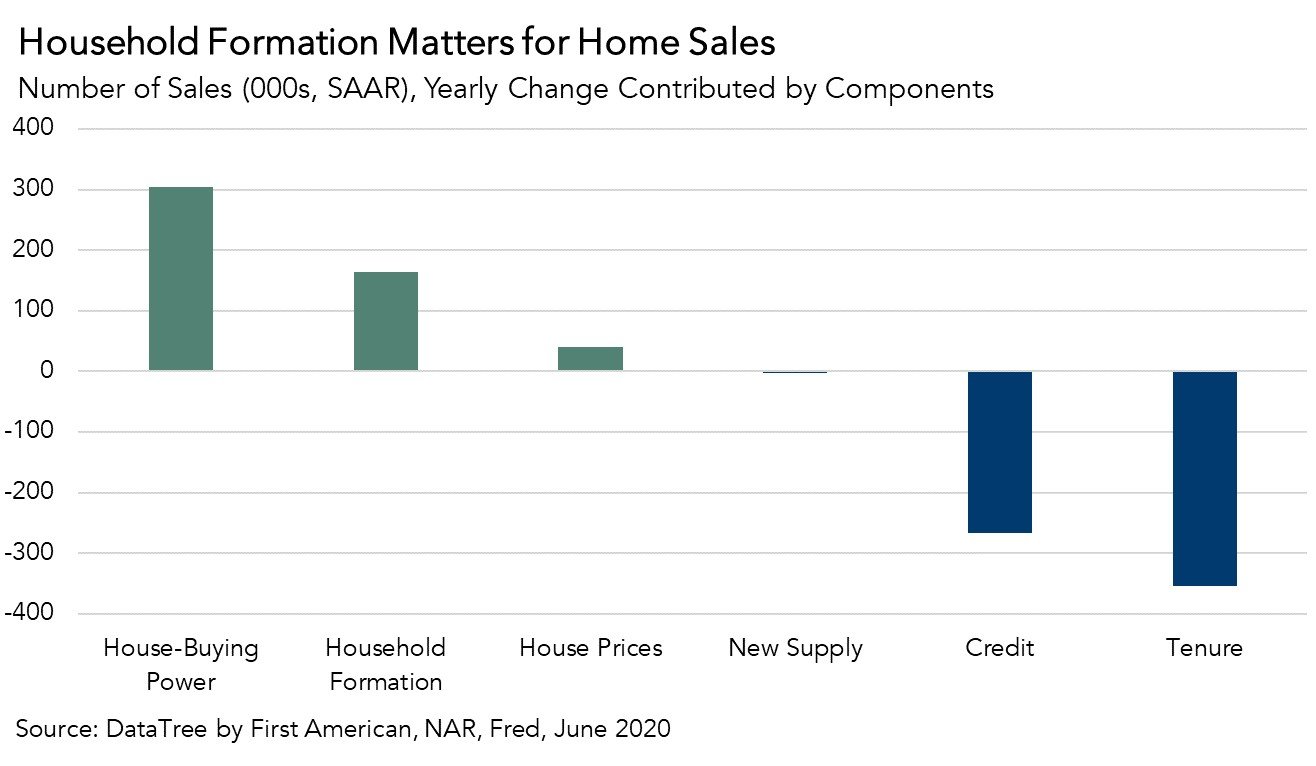

Will Household Formation Continue to Boost Housing Market Potential Amid the Pandemic?

By

Mark Fleming on July 16, 2020

The domestic and global economy continue to feel the pain inflicted by the coronavirus pandemic. Yet the housing industry, at least for now, is bucking the trend. Weekly purchase applications have surpassed their levels from one year ago for eight straight weeks, as potential buyers respond to record low mortgage rates. The market potential for ...

Read More ›

Millennial Homeownership Delayed, But Not Denied

By

Mark Fleming on July 1, 2020

As we navigate the unprecedented impact of COVID-19, home has taken on added significance and there are signs that homeownership remains one of the main tenets of the American Dream. After hitting a bottom in the second week of April, mortgage applications to purchase a home increased for nine consecutive weeks, even exceeding levels from a year ...

Read More ›

Housing Millennials Homeownership Progress Index Homeownership

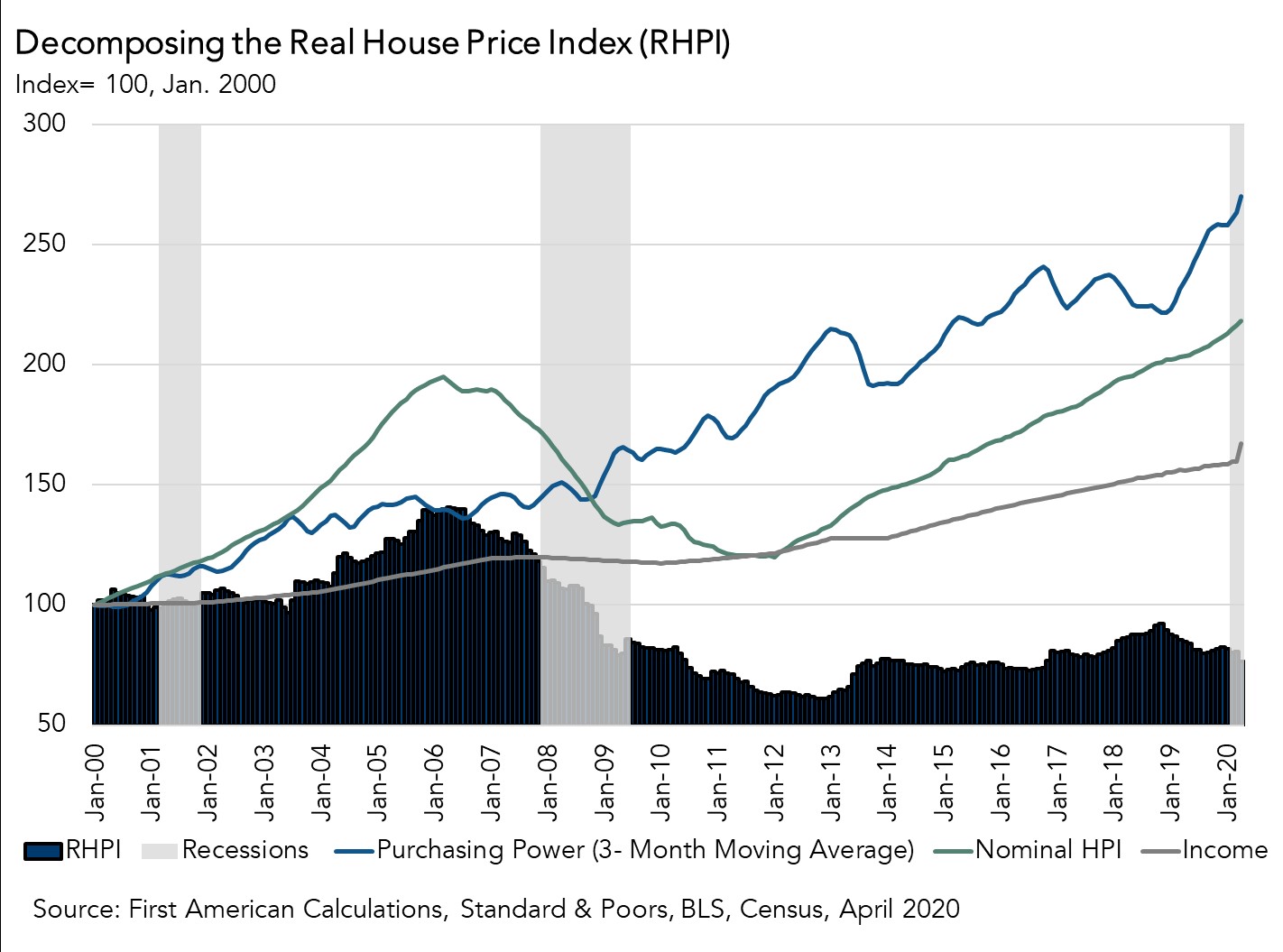

Will Low Mortgage Rates Prevent Decline in Affordability this Summer?

By

Mark Fleming on June 30, 2020

The economic fallout and impacts to the housing market from the pandemic appeared to peak in April. The number of existing-home sales fell 18 percent relative to March, housing starts fell 26 percent, and the supply of homes available for sale approached record lows. While historically low mortgage rates made it more affordable for those with ...

Read More ›

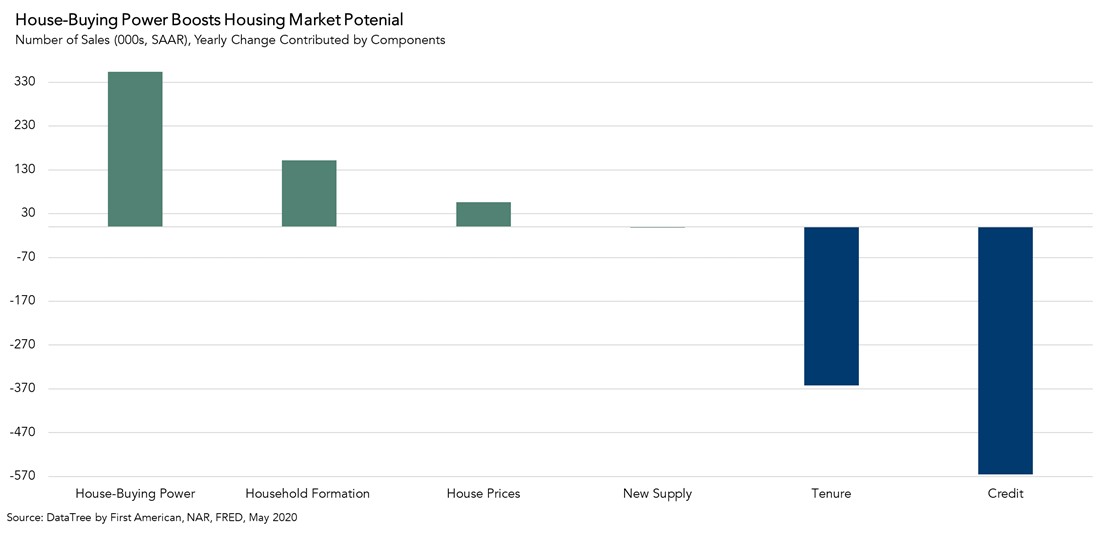

How Mortgage Rates Have Fueled Housing Market Potential Amid the Pandemic

By

Mark Fleming on June 18, 2020

The early signs of a housing market comeback that appeared in mid-April, rising weekly purchase loan applications, continued to surge through May and into June. In fact, weekly purchase loan applications have now exceeded pre-pandemic levels.

Read More ›