The domestic and global economy continue to feel the pain inflicted by the coronavirus pandemic. Yet the housing industry, at least for now, is bucking the trend. Weekly purchase applications have surpassed their levels from one year ago for eight straight weeks, as potential buyers respond to record low mortgage rates. The market potential for existing-home sales reflects the accelerated activity, according to our Potential Home Sales Model.

“The pandemic has already influenced some long-term trends, like increasing tenure and limited supply, and may soon also influence other key housing market dynamics, such as household income growth and formation.”

After hitting a 2020 low point in April, the market potential for existing-home sales increased in May and again in June, reaching a 4.88 million seasonally adjusted annualized rate (SAAR), 9.2 percent better than the May and only 2.3 percent lower than one year ago. While the rebound in the potential for existing-home sales is good news, the recent surge in COVID-19 cases has caused many parts of the country to reverse or pause plans to reopen, posing additional risks to the economy and the housing market. Examining the dynamics that influence housing market potential provide insight into health of the housing market.

Breaking Down Housing Market Potential

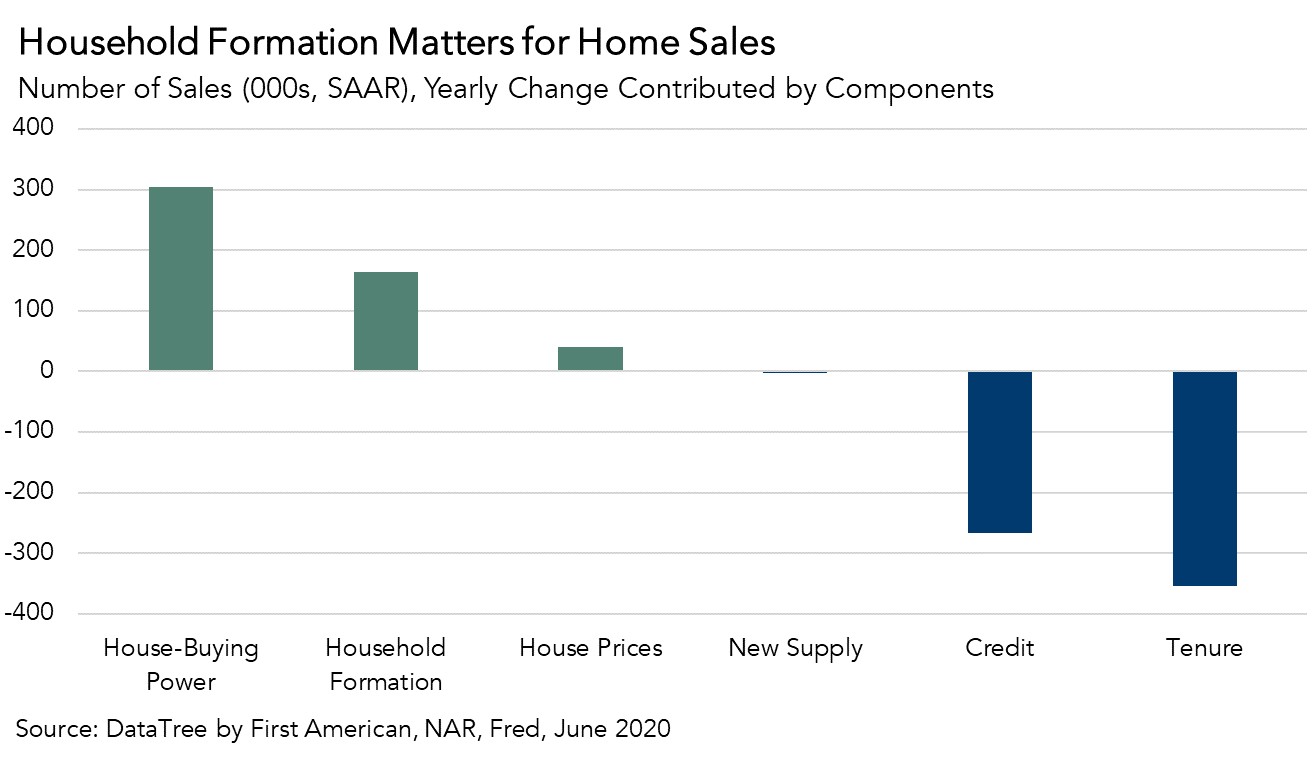

Tenure length, the average length of time someone lives in their home, has been steadily increasing for years and is one of three dynamics reducing housing market potential in June. Amid the pandemic, tenure has continued to rise and had the biggest impact on housing market potential (354,200 SAAR potential home sales) in June. Economic uncertainty has caused lenders to tighten credit standards, limiting the number of home buyers that can qualify for a mortgage and contributing to a year-over-year loss of 267,000 potential home sales. In June, the lack of new home construction further contributed to the limited supply of homes for sale and resulted in a small loss of 2,450 potential home sales relative to one year ago.

Helping offset these negative impacts to market potential are three dynamics. Record low mortgage rates have helped fuel an increase in house-buying power, contributing nearly 305,000 potential home sales. Increasing household formation and rising house prices also contributed positively, with 164,400 and 40,360 respective potential home sale gains. As mortgage rates continue to set new record lows and help fuel demand against a severely limited supply of homes, we anticipate house prices will continue to rise. Household formation, while a net positive for housing market potential in June, may suffer from pandemic-related impacts in the months ahead.

More Households, More Sales

Household formation growth boosts demand for homes, and household formation has largely been on the rise over the last decade due to millennials continuing to form households. According to a 2019 study, household formation has rebounded to more than one million per year from the 2009 low point of 534,000 reached during the Great Recession. Household formation has helped boost the potential for existing-home sales this year, but research on household formation during recessions suggests there may be cause for concern.

A study from the Federal Reserve Bank of Cleveland shows that during the Great Recession, the rate at which Americans formed households fell sharply. The study showed that younger people are less willing and able to form their own households during recessions as employment prospects are reduced. Another study showed that the likelihood that a young adult will form an independent household falls by up to 4 percentage points during times of recession. We may be seeing this playout now during the pandemic as a very recent study showed that more than 1.1 million people between the ages of 23 and 30 moved back in with their parents between February and May 2020.

Given this recession’s likely similar impact on household formation, we simulated the possible impact on the market potential home sales for June, keeping all other fundamental drivers of the potential for existing-home sales the same. If the number of households falls one percent relative to one year ago, the potential for existing-home sales would fall from its current level of 4.88 million SAAR sales to 4.71 million SAAR, a change of nearly 166,000 SAAR potential home sales. The pandemic and related economic impacts may turn household formation from a tailwind to a headwind for home sales later this year.

The Good, The Bad, and the Likely

The housing market has proven resilient in the face of the pandemic thus far. Bolstered by record low mortgage rates and demand stemming from millennials aging into their household formation years, the potential for existing-home sales has rebounded, nearing its pre-pandemic level. Yet, risks remain. House-buying power is a function of both mortgage rates and income, and the longer the labor market decline continues, the higher the risk that household incomes could fall. Similarly, the rate of household formation may slow if the labor market slowdown continues or worsens. The pandemic has already influenced some long-term trends, like increasing tenure and limited supply, and may soon also influence other key housing market dynamics, such as household income growth and formation.

Note: This month’s report includes a revision to the full history of the credit index, which may result in revised PHS values.

June 2020 Potential Home Sales

For the month of June, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales increased to a 4.88 million seasonally adjusted annualized rate (SAAR), a 9.2 percent month-over-month increase.

- This represents a 39.4 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales decreased 2.3 percent compared with a year ago, a loss of nearly 114,000 (SAAR) sales.

- Currently, potential existing-home sales is 2.11 million (SAAR), or 30.2 percent below the pre-recession peak of market potential, which occurred in February 2005.

Market Performance Gap

- The market for existing-home sales outperformed its potential by 3.8 percent or an estimated 186,850 (SAAR) sales.

- The market performance gap decreased by an estimated 442,960 (SAAR) sales between May 2020 and June 2020.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.