Where Is It Cheaper to Own a Home Than to Rent?

By

Odeta Kushi on April 10, 2020

As the coronavirus pandemic and its repercussions create challenges for all, it’s easy and important to focus on the day-to-day headlines and the information driving the news cycle at the moment. But, understanding long-term trends, even those that may be altered by the pandemic’s impacts, provides helpful insight into major decisions, like the ...

Read More ›

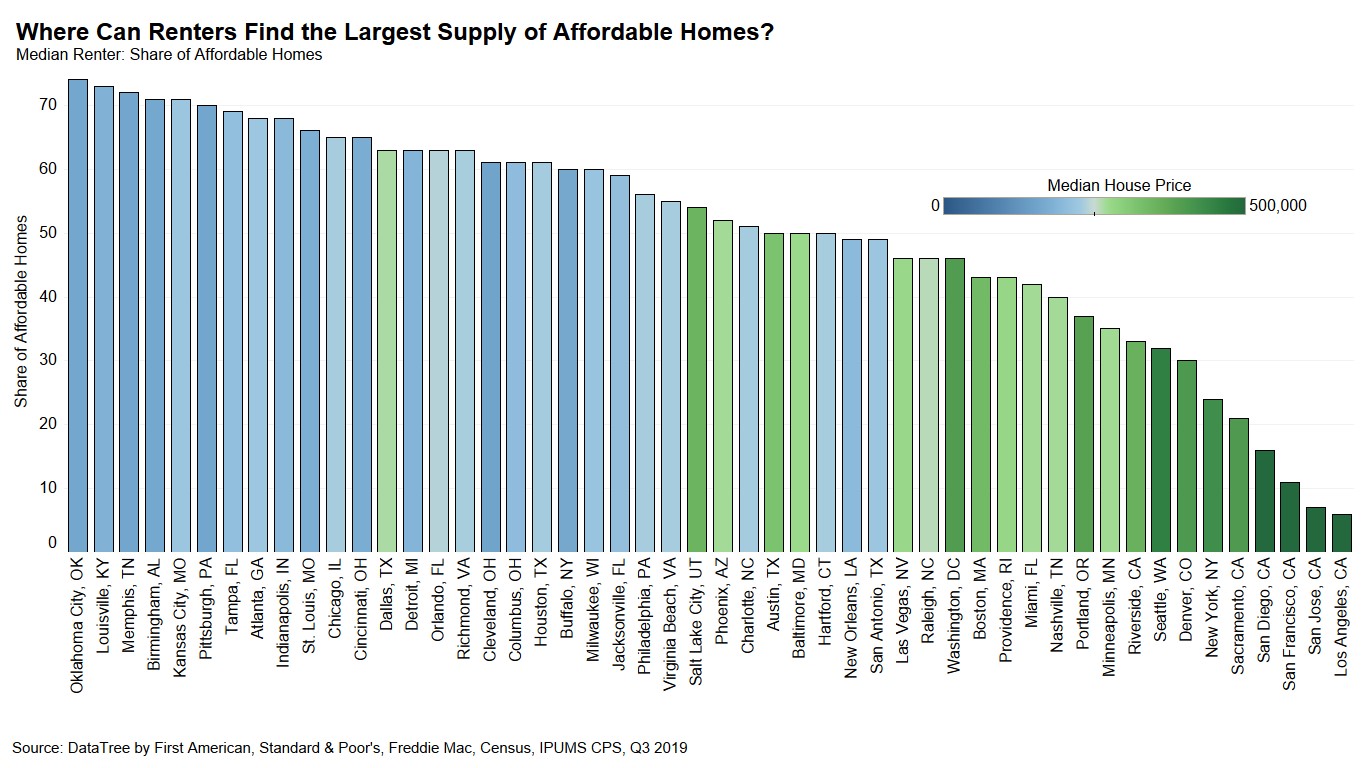

Where Lower-Income Renters Can Pursue the Dream of Homeownership

By

Odeta Kushi on December 12, 2019

In 2019, the growth in consumer house-buying power outpaced house price appreciation for the median renter trying to buy the median priced home. But, there are many renters with household incomes below the median income in their cities. We can measure affordability for all renter households based on their household income and the share of homes ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

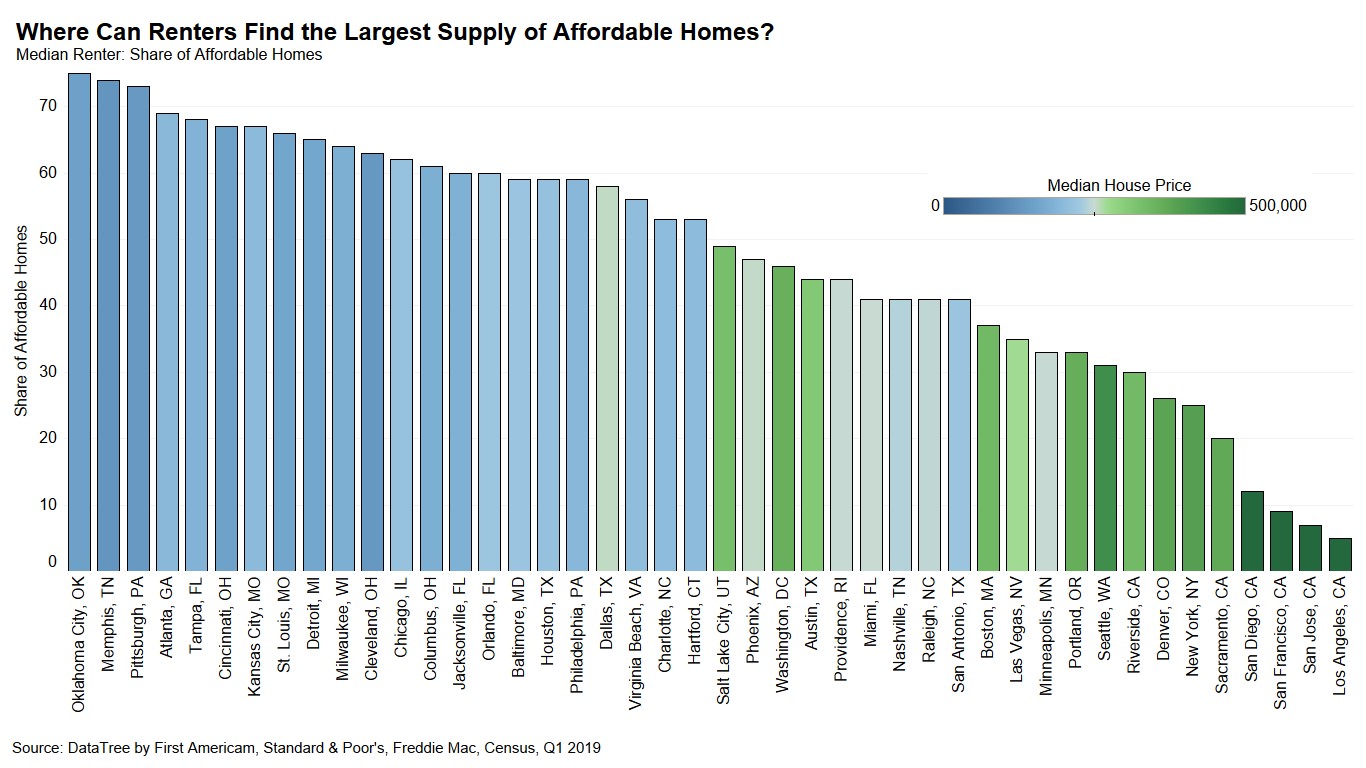

What Cities Are the Most Affordability Friendly for First-Time Home Buyers?

By

Odeta Kushi on December 10, 2019

Housing affordability, or the lack thereof, continued to generate discussion and headlines in 2019. That’s unlikely to change in 2020, as strong demand, driven by low mortgage rates and wage growth, collides with limited housing supply. However, it’s easy to overlook that nearly two-thirds of Americans already own homes so, generally speaking, ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

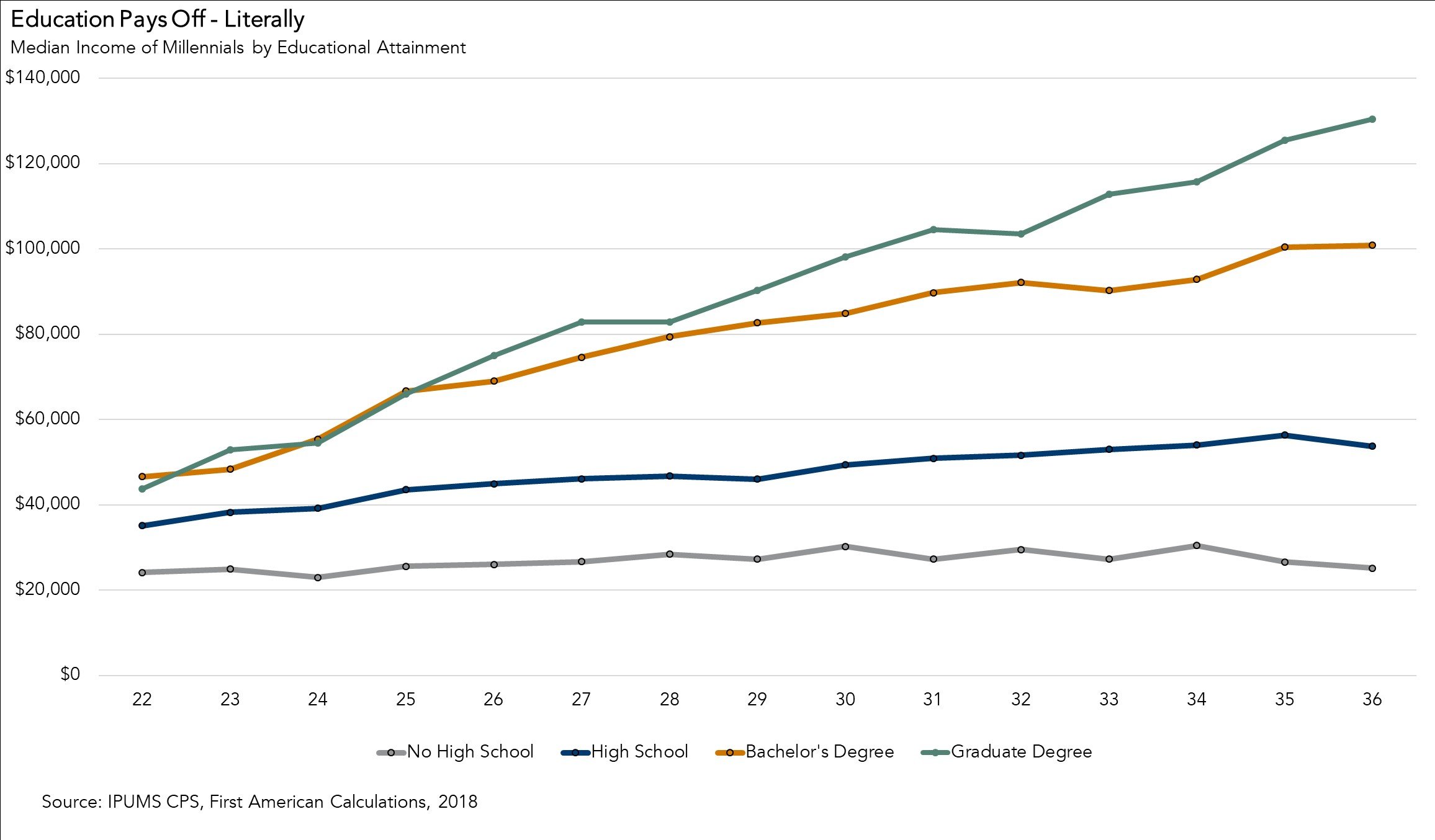

Does Education Really Lead to Greater Earning Power?

By

Odeta Kushi on September 13, 2019

Whether it’s parents shuttling their children off to elementary school or students starting their final year of college, back-to-school season is here. We generally spend a minimum of 12 years as a student, more if you pursue a college degree. Along the way, we’re told that education is critical to your ability to earn a decent living.

Read More ›

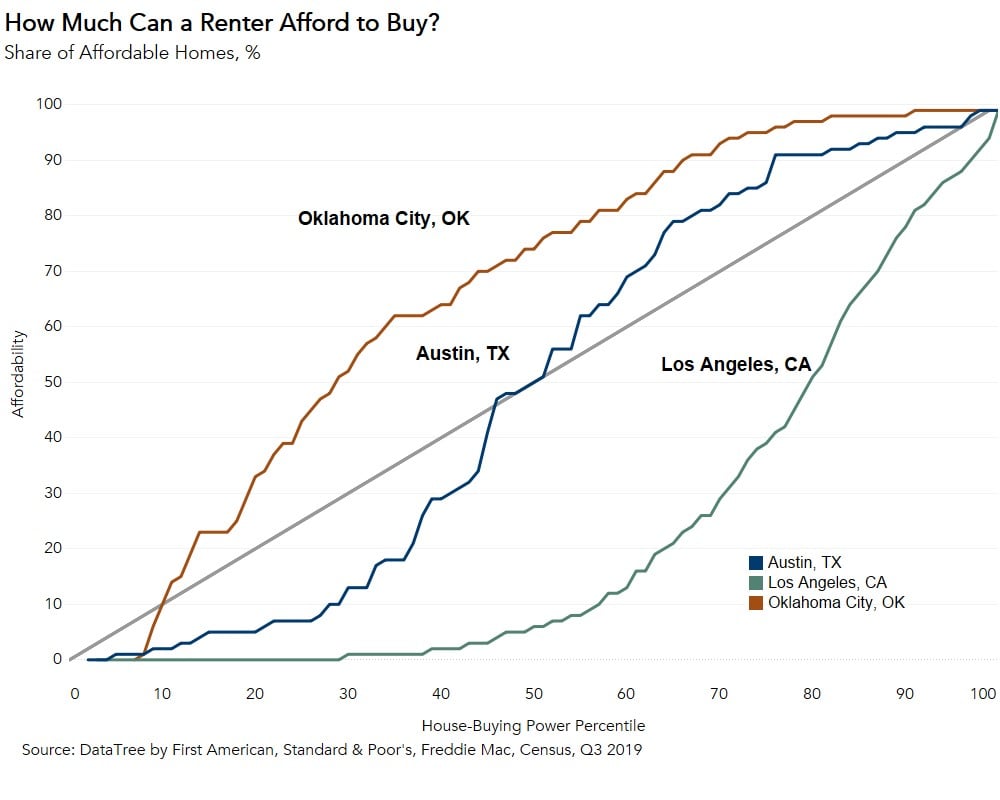

Where Do Renters Have an Edge in the Pursuit of Homeownership?

By

Odeta Kushi on September 5, 2019

Traditional measures of affordability can be misleading to potential first-time home buyers because they compare overall median household income with the income required to purchase a median-priced home. However, median household income includes existing homeowner households, which have significantly higher median income than renter households, so ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

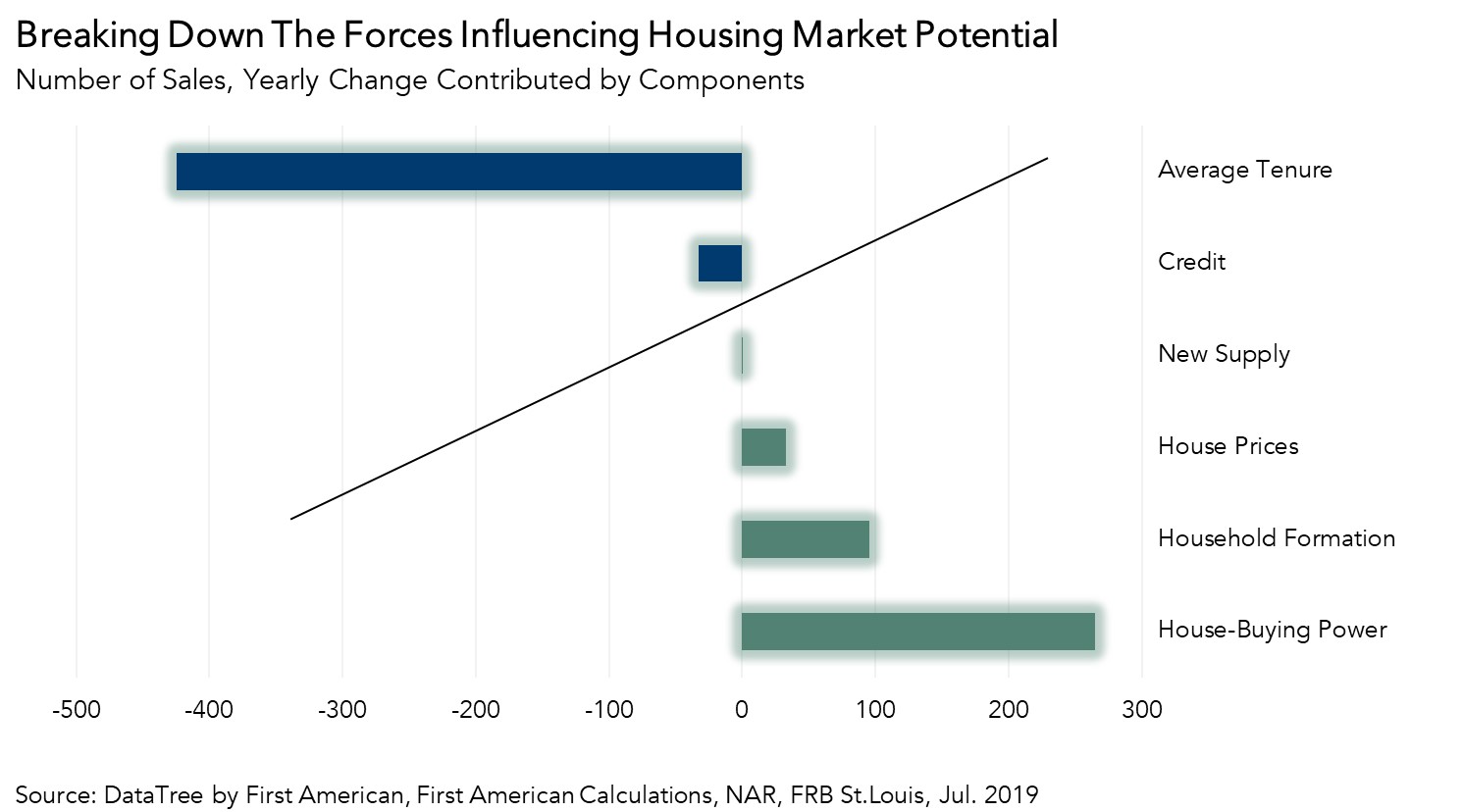

What Does Increasing Tenure Length Mean for the Housing Market?

By

Mark Fleming on August 20, 2019

The housing market essentially reached its potential in July 2019, as actual existing-home sales were 0.05 percent above the market’s potential. Existing-home sales in 2019 are running at a pace similar to 2015, even though rates have fallen and household income has increased this year. Housing market potential benefitted from a 10.6 percent ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales