As the coronavirus pandemic and its repercussions create challenges for all, it’s easy and important to focus on the day-to-day headlines and the information driving the news cycle at the moment. But, understanding long-term trends, even those that may be altered by the pandemic’s impacts, provides helpful insight into major decisions, like the decision to rent or own a home.

In 2020, the bulk of the millennial generation is aging into the key lifestyle decisions that drive homeownership demand, such as getting married and having children. They still need to make the decision to rent or own a home. Understanding where it is more financially prudent to own versus rent could hint at where these potential first-time home buyers will migrate when looking to purchase a home. When making their tenure choice decision, home buyers will consider the monthly cost of each option. However, many rent-versus-buy analyses do not factor in a critical benefit of homeownership, the potential for house price appreciation, which helps a homeowner build equity.

“Amid the daily turbulence and uncertainty of the coronavirus era, there’s even more to consider when deciding to rent or buy. However, it’s important to include the potential benefit of house price appreciation in the decision-making process. As the asset owner, you gain the appreciation. Own it and you will most likely get to appreciate it.”

The Impact of Appreciation on the Costs of Homeownership

The first-time home buyer makes the decision whether to continue to rent or buy a home instead. We’ve created a monthly cost-of-homeownership metric that uses a home at the lowest quarter of the price scale in each market, the prevailing 30-year, fixed mortgage rate, the most recent year’s property tax rate where the home is located, as well as a fixed percentage cost to estimate private mortgage insurance and home maintenance and repair. All together, these represent the monthly cost of owning the lowest quarter priced home in a market. To adjust for the monthly benefit of house price appreciation, the average monthly appreciation in each market in 2019 is subtracted from the monthly cost to derive an appreciation-adjusted monthly cost of owning a home. The estimated appreciation-adjusted homeownership cost is compared with the median monthly rent in the same market.

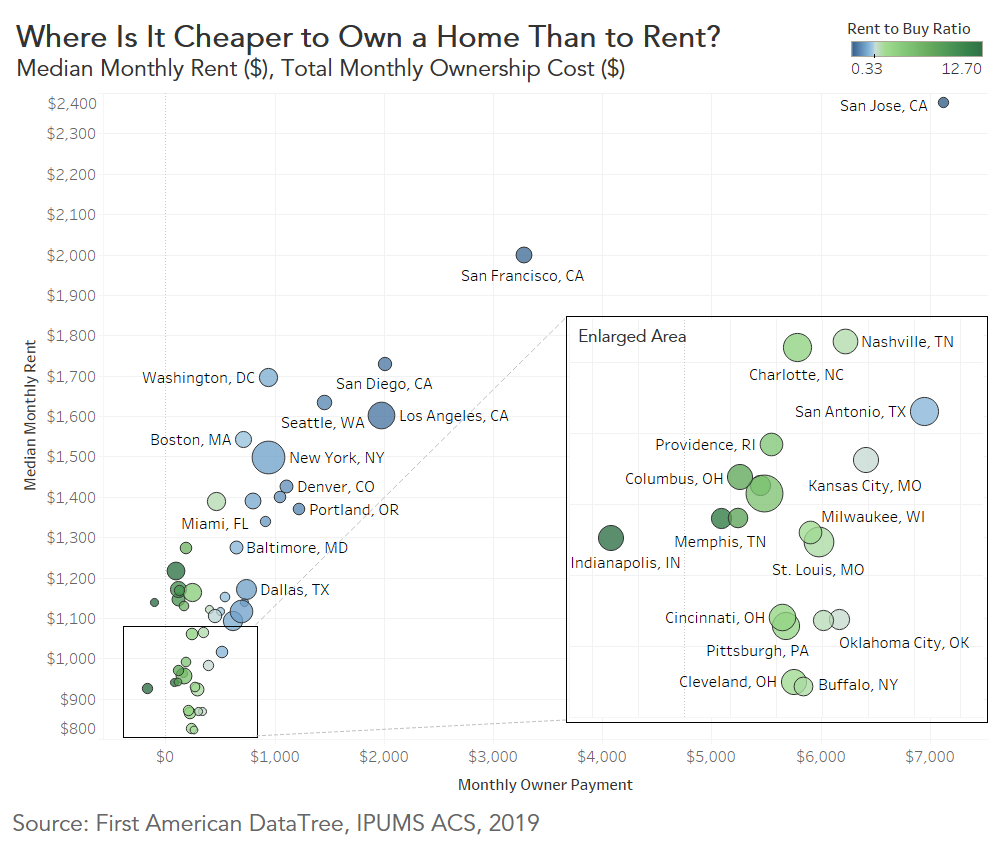

Buy in Affordable Cities, Rent in High-Cost Cities

Based on this analysis, it was cheaper to own a home in 46 of the top 50 markets in 2019 when accounting for the monthly benefit of house price appreciation. No surprise, the cities where owning a home is cheaper than renting are also some of the most affordable cities for first-time home buyers. The top 10 cities where it is cheaper to buy versus rent are:

- Indianapolis

- Salt Lake City

- Memphis, Tenn.

- Atlanta

- Birmingham, AL

- Tampa, Fla.

- Columbus, Ohio

- Phoenix

- Las Vegas

- Jacksonville, Fla.

In Indianapolis, the top city on the list, the median monthly rent in 2019 was $926, far exceeding the monthly appreciation-adjusted cost of homeownership. In fact, owning a home in Indianapolis “paid” homeowners a monthly benefit of $158 over the cost of renting, due to appreciation. House price appreciation in the area, 9.7 percent in 2019, was higher than all combined monthly costs – the benefit of appreciation came out to $1,082 per month, while monthly ownership costs totaled $924. So, once adjusted for appreciation, owning a home in Indianapolis in 2019 “paid” you.

Conversely, renting was more prudent compared with owning in San Jose, Calif., where monthly median rent in 2019 was $2,376, while the total monthly appreciation-adjusted homeownership cost was $7,122. Three other California markets claimed the remaining top spots where it is cheaper to rent instead of own, as housing scarcity remains an issue and drives up both home and rental prices.

Affordability Boost from House Price Appreciation

The tipping point to own in many cities came from the added benefit of house price appreciation. Without accounting for appreciation, buying was cheaper than renting in only 22 cities. For example, a home at the lowest quarter of the price scale in Nashville cost $191,080 in 2019 and the monthly payment, including taxes, repair costs, and insurance, was $1,283 per month – more expensive than the median rent of $1,064. However, with the area’s house price appreciation averaging 5.8 percent in 2019, the monthly appreciation-adjusted homeownership cost fell to $350 per month, so owning a home was significantly cheaper than renting in Nashville.

There are many important considerations involved in the decision to rent or buy a home. Amid the daily turbulence and uncertainty of the coronavirus era, there’s even more to consider when deciding to rent or buy. However, it’s important to include the potential benefit of house price appreciation in the decision-making process. As the asset owner, you gain the appreciation. Even in today’s environment, while geographically dependent, the anticipation is that house price appreciation will slow down, rather than decline. That is because house prices are “downside sticky.” In the housing market, sellers typically withdraw supply rather than sell at lower prices. Own it and you will most likely get to appreciate it.

Methodology

The rent versus buy analysis compares rent with the cost of ownership in the 50 largest U.S. metropolitan areas. Median rent is derived from the 2018 American Community Survey microdata, the latest year available, and grown to 2019 using the Zillow Rent Index. Home sale prices, as well as property tax rates and house price appreciation by market, are derived from First American DataTree. The monthly cost of ownership is then calculated using PITI, assuming a down payment of 5 percent and an interest rate of 3.94 percent. Other homeownership costs included are private mortgage insurance at a rate of 0.75 percent, annual homeowner’s insurance assumed at 0.4 percent of home value, and annual repair costs assumed at 1 percent of home value. Comparing rent to ownership cost produces a rent-to-buy ratio. If the ratio is greater than one, it is cheaper to buy. Less than one, it is cheaper to rent.

Ksenia Potapov contributed to this blog post.