Dispelling the Myth of the 20 Percent Down Payment

By

Odeta Kushi on August 6, 2019

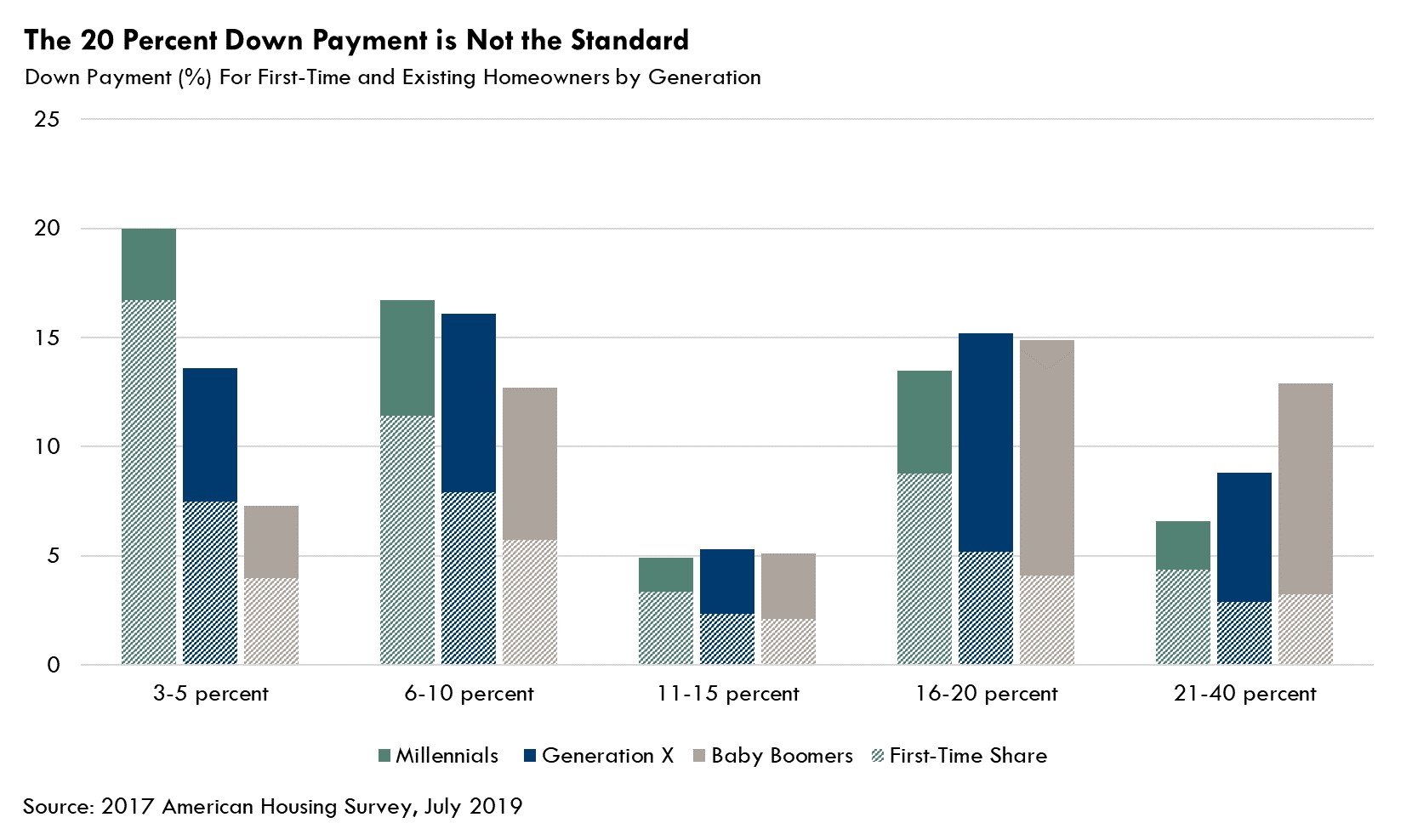

Since hitting a low point of 63 percent in 2016, the homeownership rate has rebounded, largely driven by millennial households purchasing their first homes. Many surveys, like one by Bank of the West, indicate that millennials are no different from previous generations – they view homeownership as a main tenet of the American Dream.

Read More ›

Why Lower Mortgage Rates Have Not Closed the Housing Market Performance Gap

By

Mark Fleming on July 19, 2019

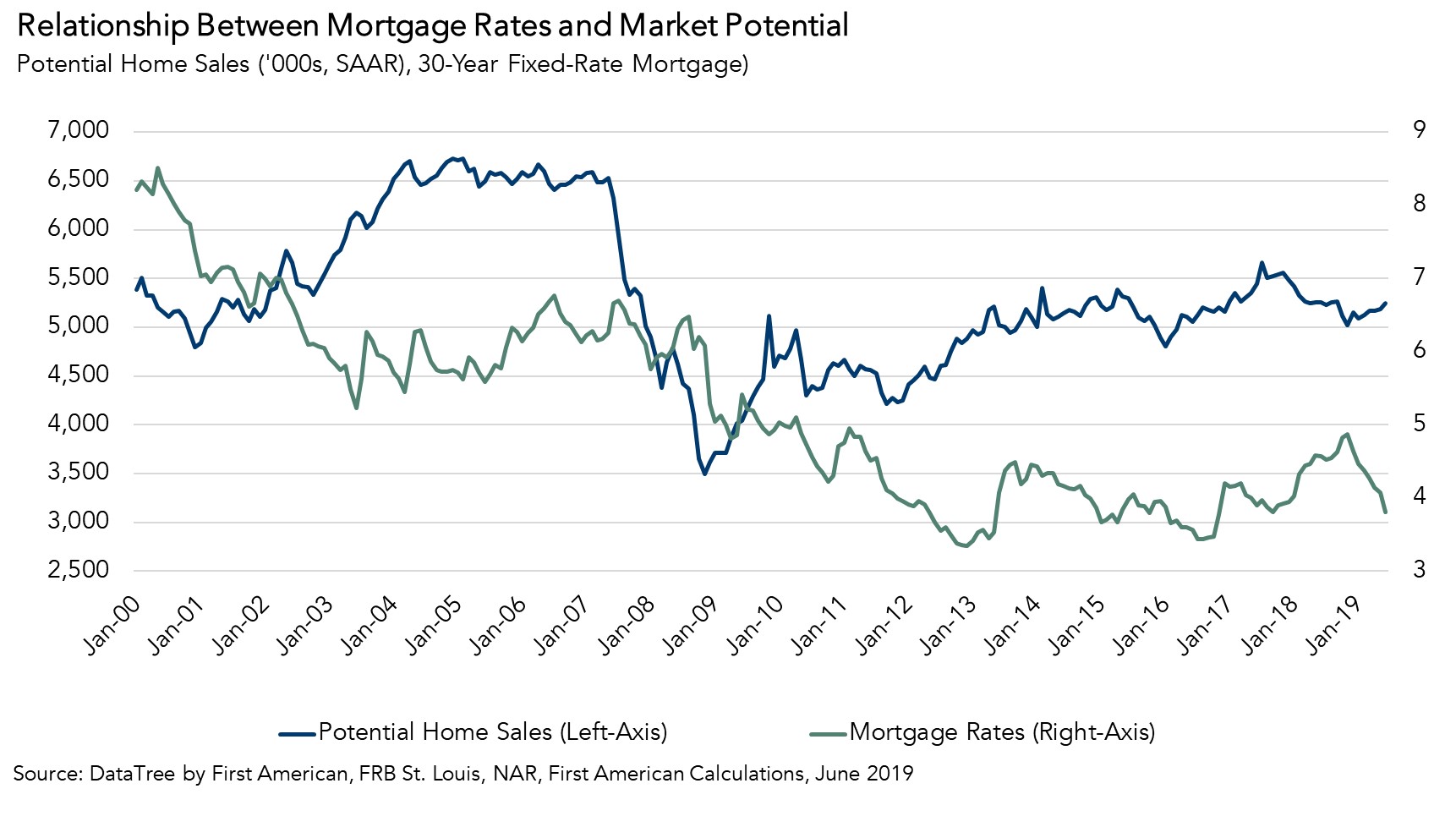

The housing market underperformed its potential in June 2019, as actual existing-home sales were 1.5 percent below the market’s potential. The market potential for existing-home sales increased 1.1 percent compared with May, according to our Potential Home Sales model.

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

How Has the Housing Market Changed Since the End of the Great Recession?

By

Odeta Kushi on July 3, 2019

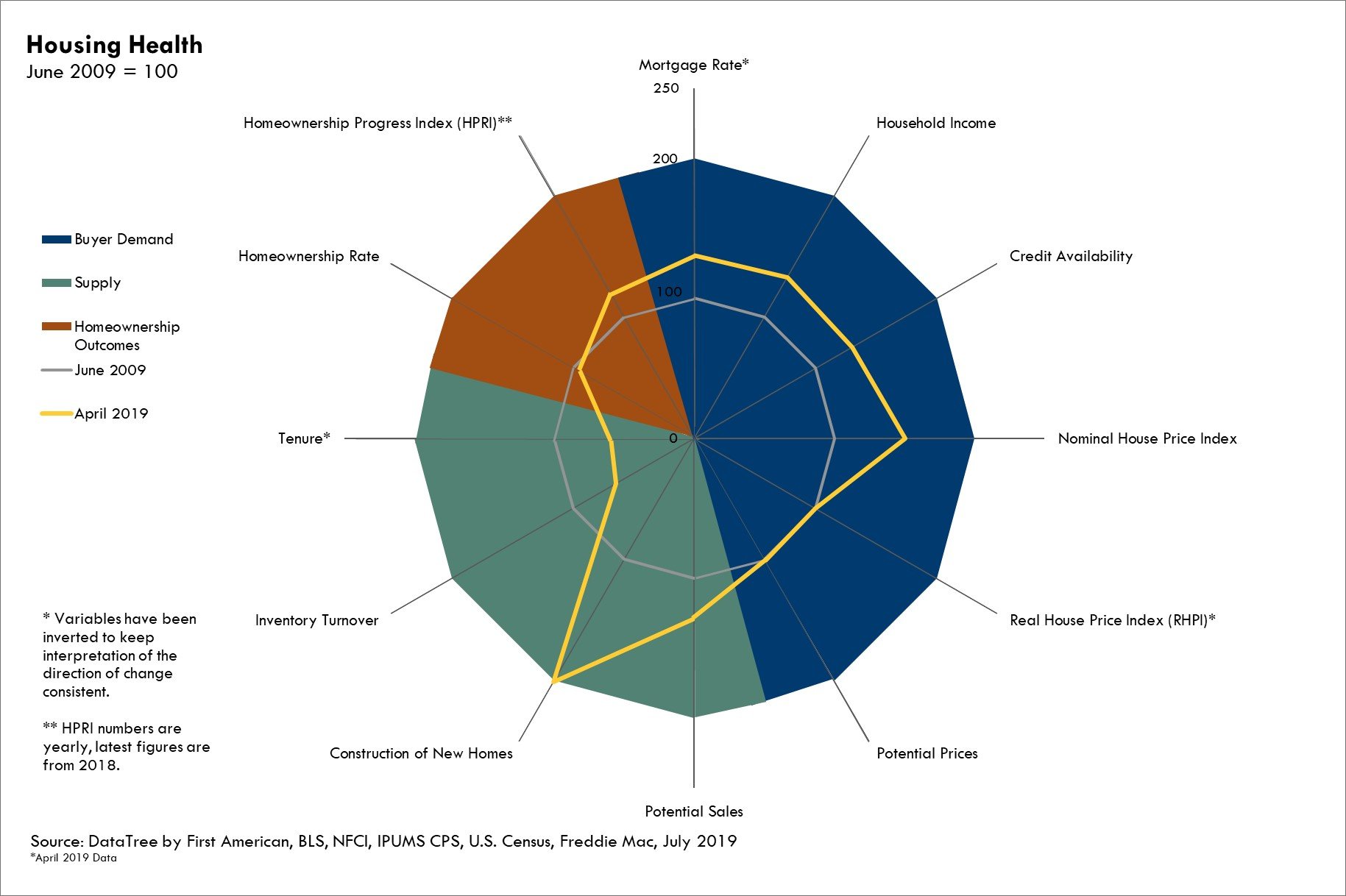

June marked the 10-year anniversary of the end of the Great Recession. Amid Independence Day celebrations, assessing how the American dream of homeownership has fared since the recession can provide helpful context for the health of today’s housing market. We have assembled a set of housing metrics and compared their values today with what those ...

Read More ›

Homeownership Progress Index Real House Price Index Affordability Homeownership

Why the Housing Market has Entered an Unprecedented Homebody Era

By

Mark Fleming on June 20, 2019

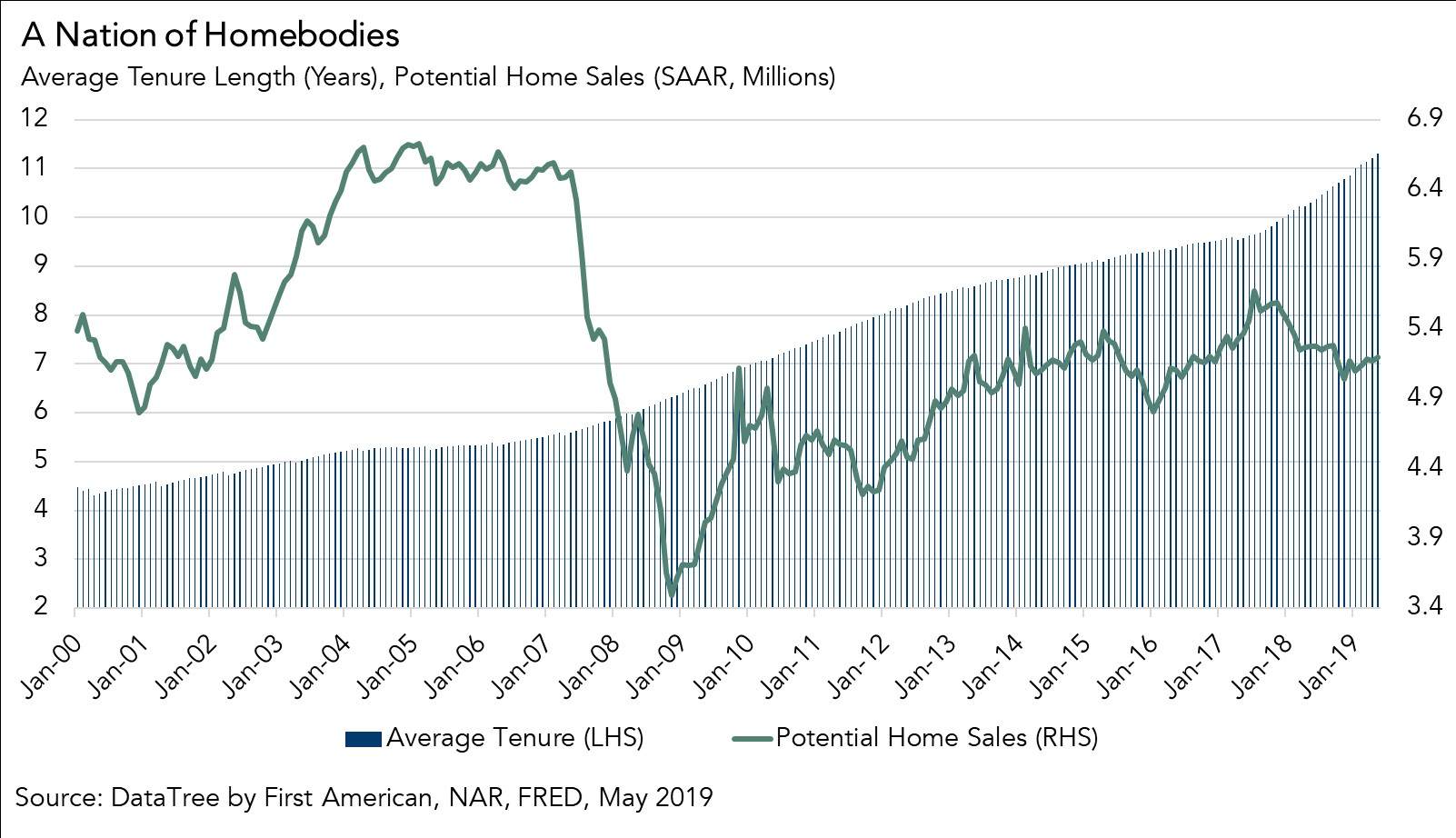

The housing market outperformed its potential in May 2019. Actual existing-home sales are 0.2 percent above the market’s current potential, according to our Potential Home Sales model. Even as mortgage rates have decreased, and household income has increased, the market is underperforming compared to it’s potential from a year ago. What are the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

Why Did Housing Market Potential Improve in April?

By

Mark Fleming on May 20, 2019

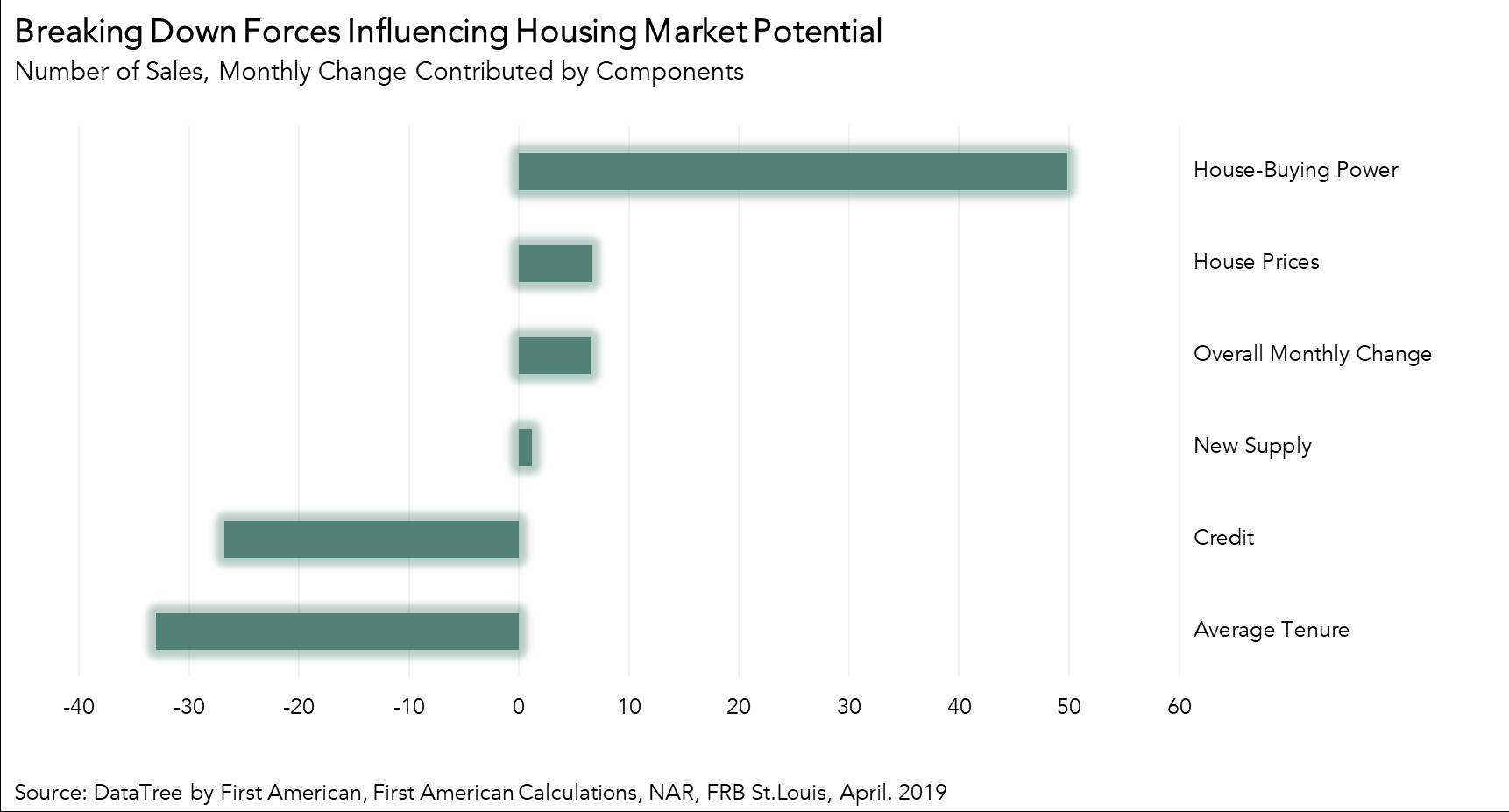

The housing market continued to underperform its potential in April 2019, but the performance gap shrank compared with March. Actual existing-home sales remain 1.3 percent below the market’s potential, but the performance gap narrowed from 2.0 percent last month, according to our Potential Home Sales model. That means the housing market has the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

How Have the 2017 Tax Law Changes Impacted Real Estate Prices?

By

Odeta Kushi on May 13, 2019

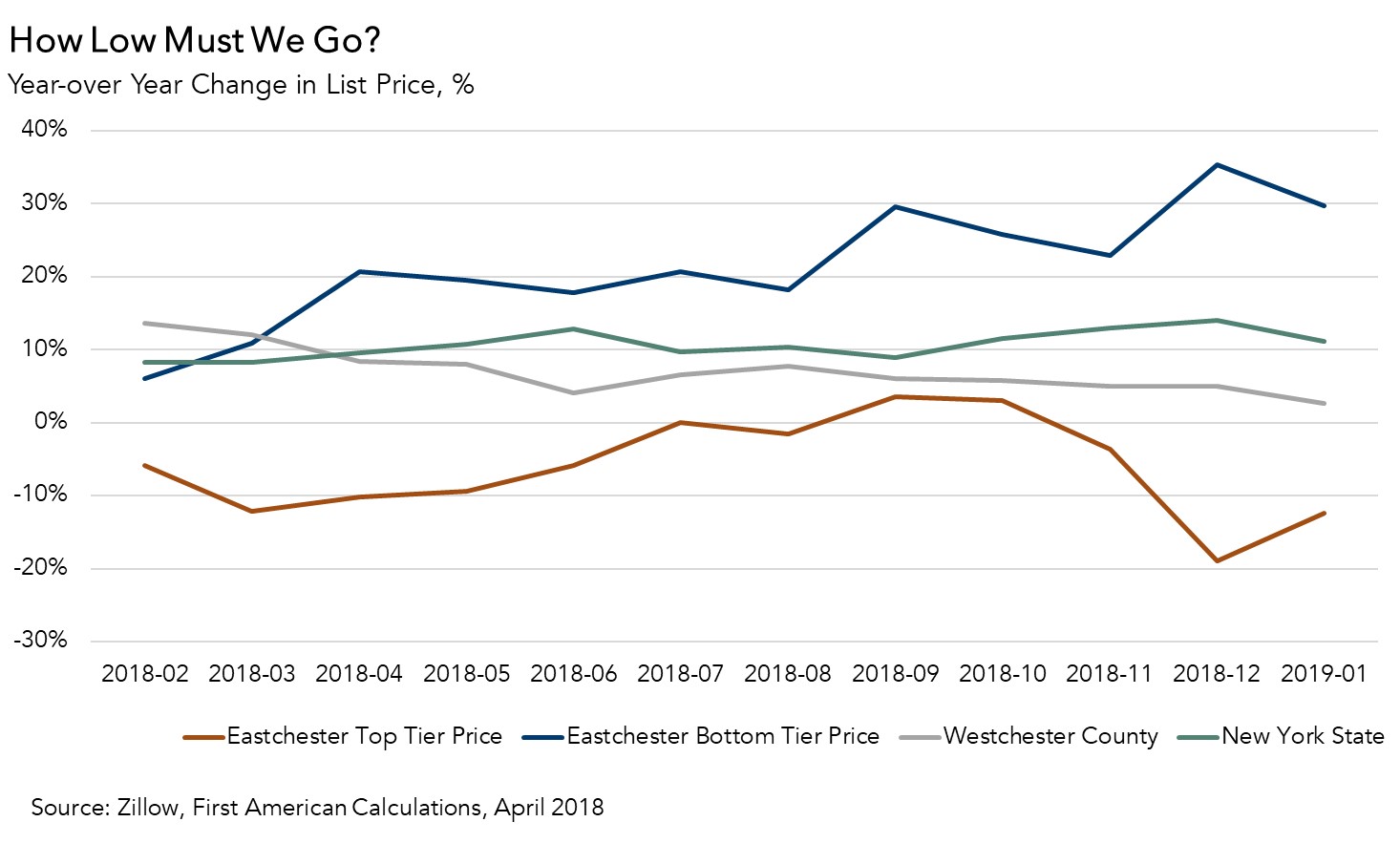

Enacted in 2017, the Tax Cuts and Jobs Act reduced tax breaks for homeowners. At the time, many in the real estate industry expected the changes to negatively impact the housing market, particularly in high-priced neighborhoods. The industry concern primarily focused on two specific changes included in the bill: the mortgage interest deduction was ...

Read More ›