Housing affordability, or the lack thereof, continued to generate discussion and headlines in 2019. That’s unlikely to change in 2020, as strong demand, driven by low mortgage rates and wage growth, collides with limited housing supply. However, it’s easy to overlook that nearly two-thirds of Americans already own homes so, generally speaking, they can already afford a home. Affordability concerns are greatest among potential first-time home buyers, who are typically renters. Many of these first-time home buyers are millennials. As the oldest millennials enter their early to mid-thirties, get married and have children, they are pursuing homeownership too. But what cities offer potential first-time home buyers the largest supply of affordable homes to buy?

“Smaller cities, such as Oklahoma City, Louisville, or Memphis are “affordability friendly” because the median renter’s house-buying power in these cities allows first-time home buyers to consider a much larger selection of homes to buy.”

Renter House-Buying Power Surges 14 percent in One Year

From the perspective of a potential first-time home buyer, affordability is driven by their house-buying power, the prevailing mortgage rate and their household income, and the share of affordable homes available for sale in a particular city. In the third quarter of 2019, mortgage rates hit their lowest level since the third quarter of 2016, while nominal household income for renters reached its highest point in over two decades. These two factors propelled renter house-buying power nationally to $257,600, a 14 percent increase in just one year. Comparing the national house-buying power for renters nationally with the set of homes sold in the U.S. in the third quarter of 2019 shows that the median renter could afford 55 percent of the homes for sale in the nation.

The Top 10 First-Time Home Buyer Friendly Cities

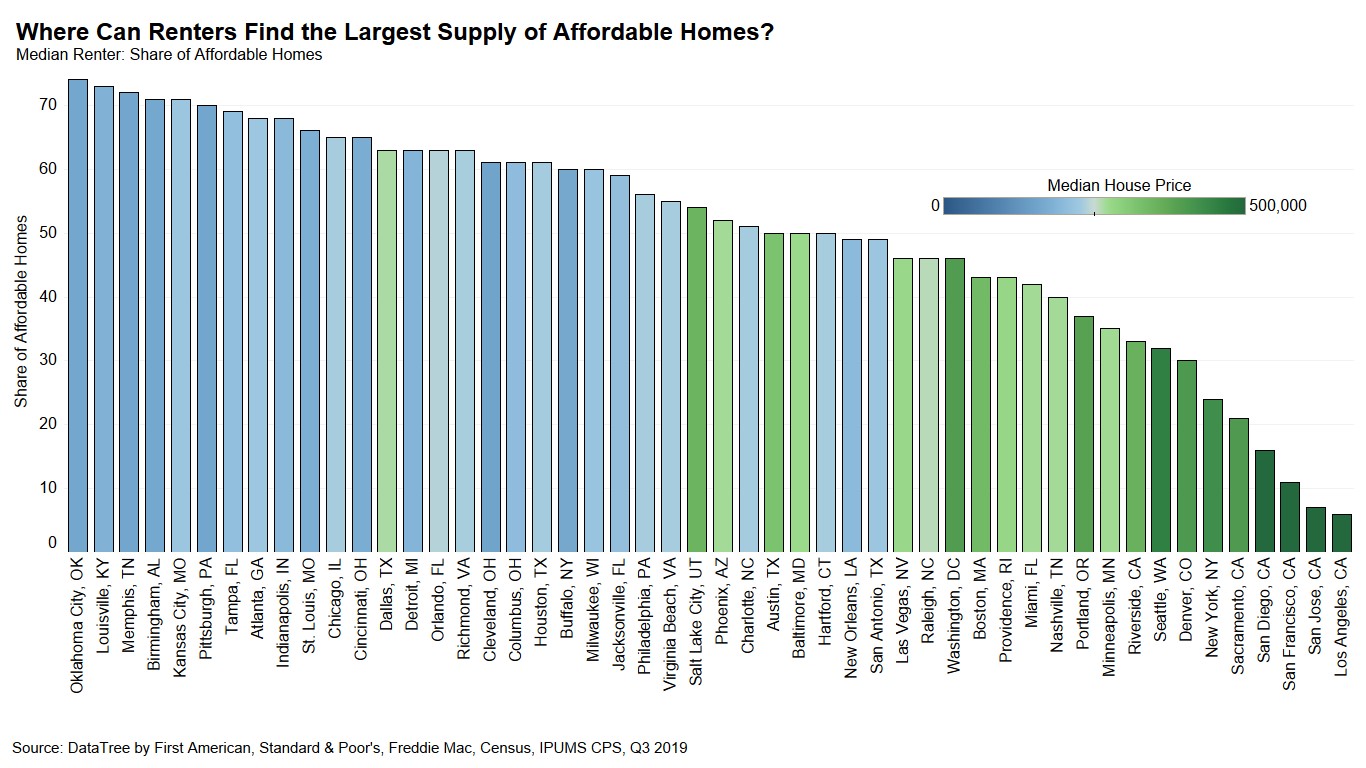

Of course, real estate is local. House-buying power varies significantly city to city because median household incomes and nominal house prices each vary, sometimes dramatically, in each city. We examined how many homes the median renter can afford in each of the 50 largest metropolitan areas in the country and found that the median renter could afford the median priced home in 30 of the 50 largest markets we track in the third quarter of 2019, which is an increase from the second quarter total of 24 markets.

Below are the 10 cities where the median renter can find the largest supply of affordable homes and the share of homes that are affordable in those cities:

- Oklahoma City: 74 percent

- Louisville, Ky.: 73 percent

- Memphis, Tenn. : 72 percent

- Birmingham, Ala.: 71 percent

- Kansas City, Mo.: 71 percent

- Pittsburgh: 70 percent

- Tampa, Fla.: 69 percent

- Atlanta: 68 percent

- Indianapolis: 68 percent

- St. Louis: 66 percent

Among the 50 largest cities, Oklahoma City remained the most affordable city for median renters looking to buy their first home in the third quarter of 2019. The median renter in Oklahoma City, with a household income of $37,070 and a house-buying power of $230,099, could afford 74 percent of the homes for sale. Move that same renter with the same household income and house-buying power to Los Angeles, and the renter could only afford less than 2 percent of homes for sale in the third quarter of 2019.

Conversely, the least affordable city in this analysis is Los Angeles, where the median house price in the third quarter of 2019 was $645,666. The median renter in Los Angeles, with a household income of $50,592 and a house-buying power of approximately $314,961, could only afford 6 percent of the homes sold in Los Angeles in the third quarter of 2019.

Timely Affordability Surge for Millennial First-Time Home Buyers

In 2019, lower mortgage rates and rising income created broad-based affordability gains across the nation. The timing for this affordability surge is a boost to the housing market, as more and more millennials decide they want to be homeowners. More than half of all mortgage loans originated by the government sponsored enterprises (Fannie Mae and Freddie Mac) are now for first-time home buyers (most likely millennials).

While expensive markets like San Francisco, Los Angeles and Boston, are attractive destinations for many reasons, there are attractive alternatives for millennial first-time home buyers. Smaller cities such as Oklahoma City, Louisville, or Memphis are “affordability friendly” because the median renter’s house-buying power in these cities allows first-time home buyers to consider a much larger selection of homes to buy.

Data Sources:

About the First-Time Home Buyer Outlook Report

Housing affordability is often measured as the median household income relative to the income needed to purchase the median-priced home. And it is often the case that the relative rates of change in house prices and income is synonymous with a change in affordability. This overlooks what matters to potential buyers – their house-buying power, or how much they can afford to buy. First American’s proprietary First-Time Home Buyer Outlook Report examines first-time home buyer house-buying power by considering how mortgage rates, renter income levels, PMI, and property taxes influence the amount one can afford to buy and the share of homes for sale that are affordable at each point in the house-buying power distribution.

First-time home buyer house-buying power is based on median renter’s income, the prevailing 30-year, fixed mortgage rate, the most recent year’s property tax rate for the geography of the renter, and assumes a fixed cost for private mortgage insurance, a 5 percent down payment and that one-third of their pre-tax income is used for the mortgage. First-time home buyer house-buying power can then be used to identify the share of the homes for sale the first-time home buyer could afford to buy. As a measure of affordability, the higher the share of homes for sale that first-time home buyers can afford to buy, the more affordable the market.