Two Trends Boost Home-Buyer Demand As Spring Home-Buying Season Begins

By

Mark Fleming on April 18, 2019

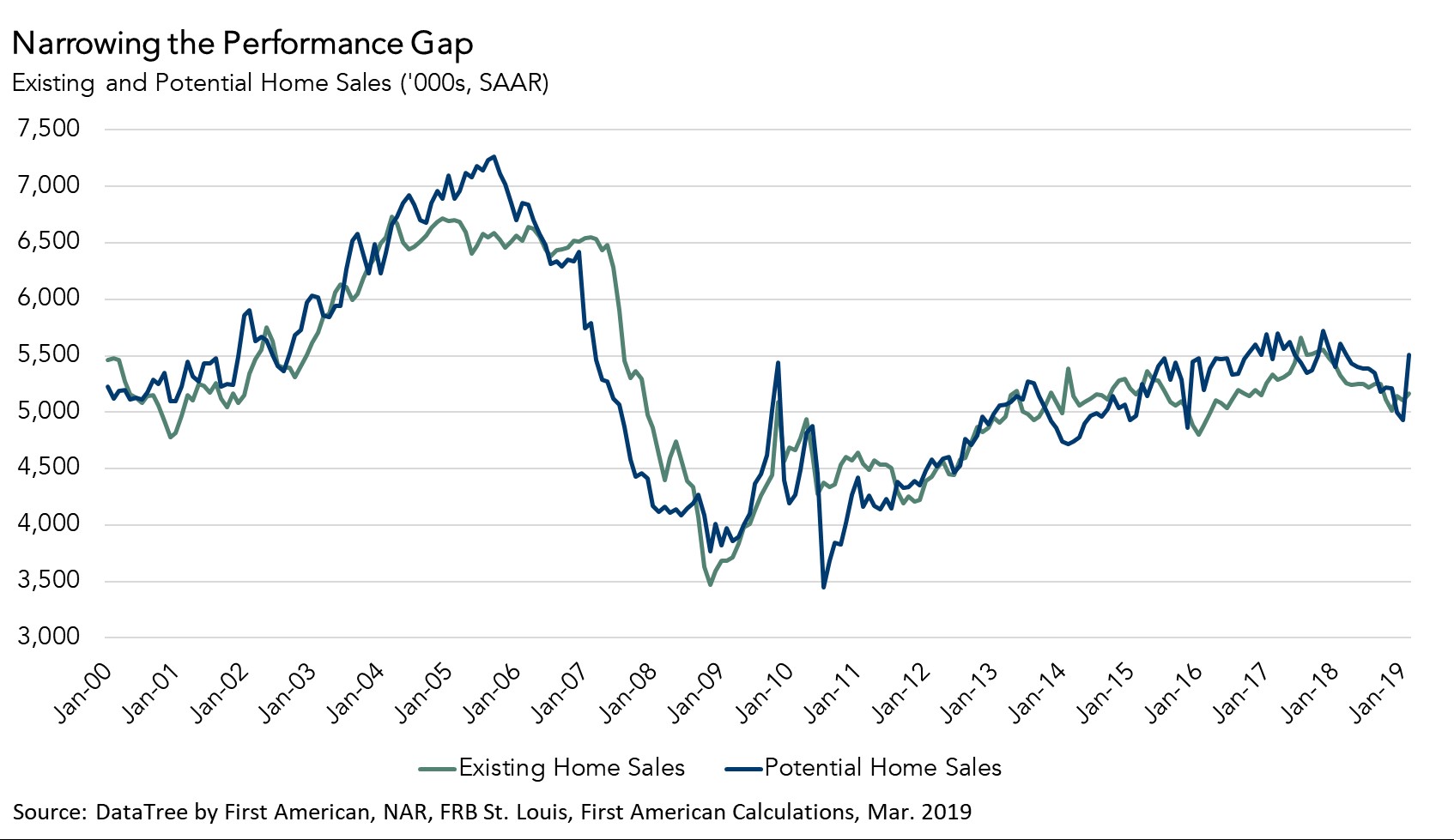

While the housing market continued to underperform its potential in March 2019, the green shoots of spring home buying have emerged. Actual existing-home sales are 2.3 percent below the market’s potential, narrowing the gap from last month, according to our Potential Home Sales model. That means the housing market has the potential to support ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

Why The Stage Is Set For A Stronger Spring Home-Buying Season

By

Mark Fleming on March 21, 2019

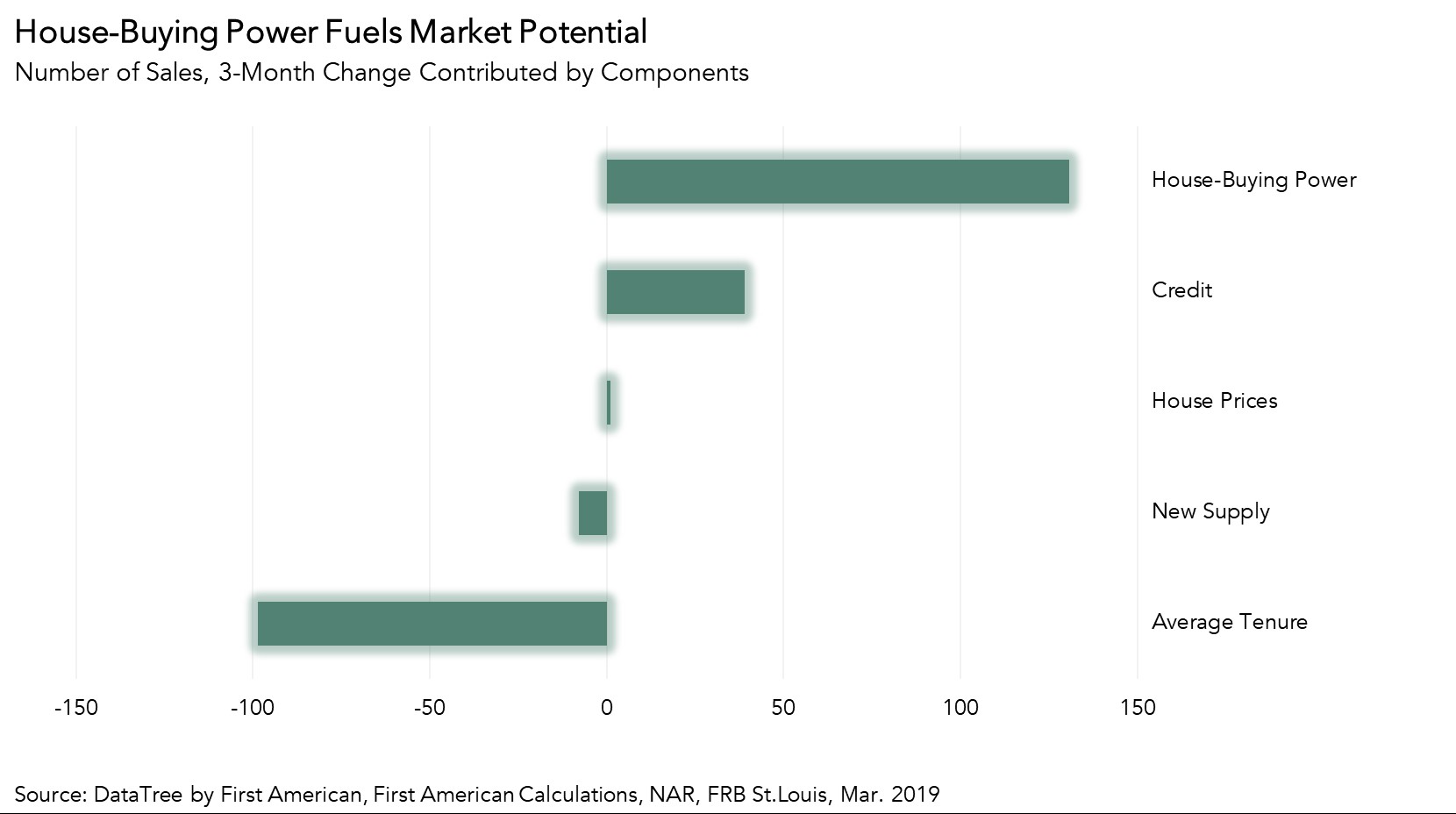

In February 2019, the housing market continued to underperform its potential, but showed signs of promise leading into the spring home-buying season. Actual existing-home sales are 2.5 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support 127,000 more home sales at a ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

How Homebodies Hold Down Home Sales

By

Odeta Kushi on March 19, 2019

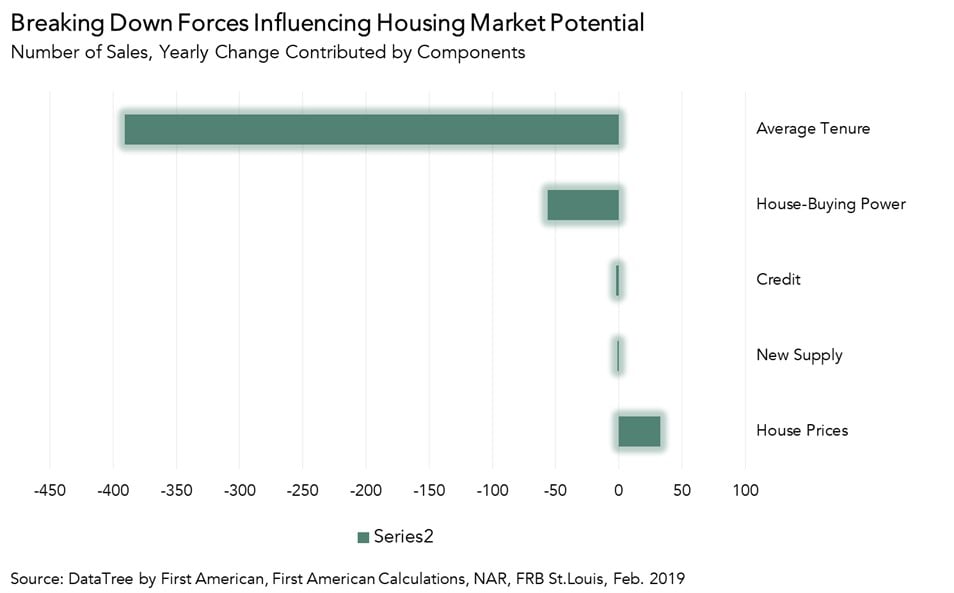

First American’s most recent Potential Home Sales model for January 2019 found a 5.7 percent decline in the market potential for existing home sales, compared to the previous year. Increasing tenure length (the length of time a homeowner stays in their home before moving) was the most prominent factor leading to this decline.

Read More ›

What Will it Take to Reduce the Housing Supply Deficit?

By

Mark Fleming on March 6, 2019

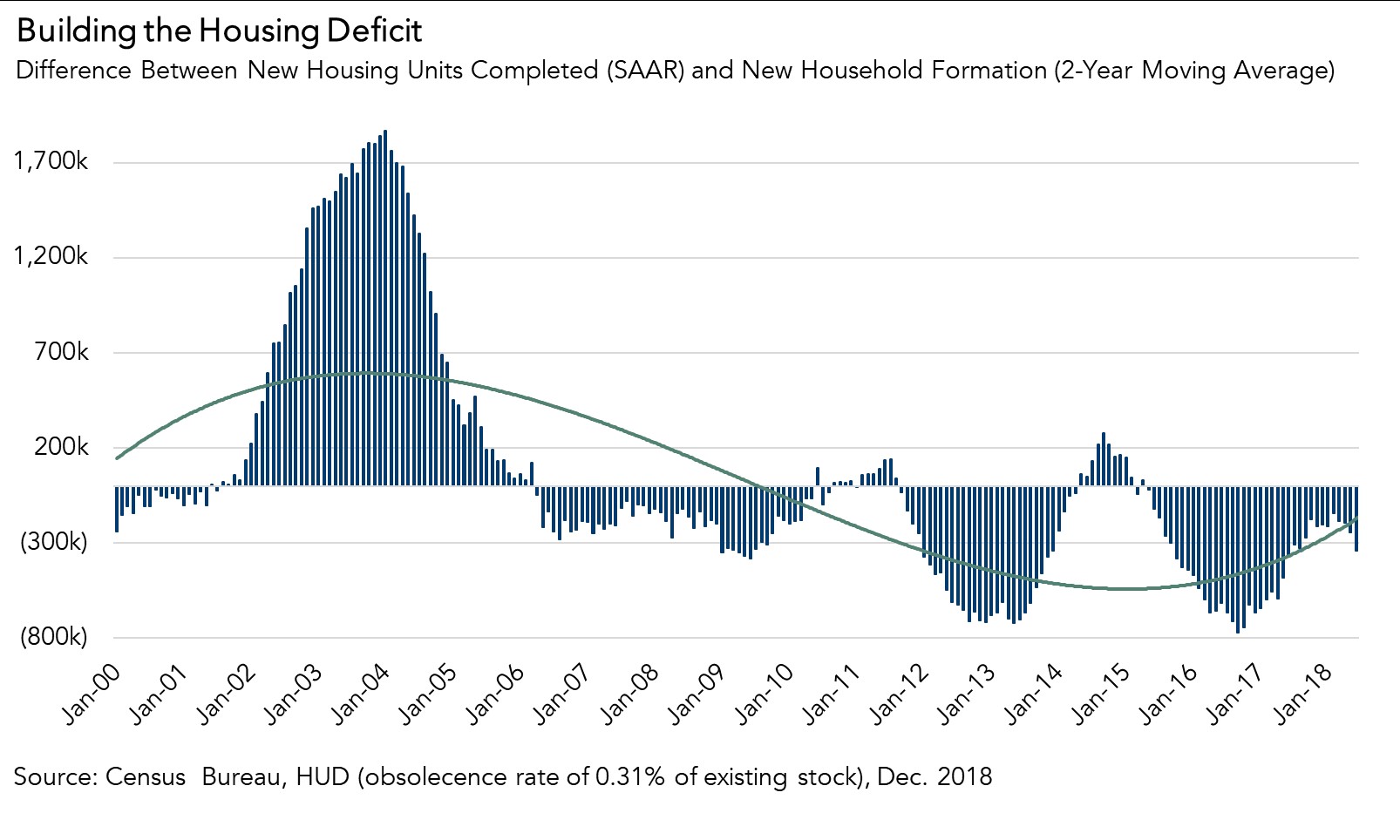

Last week, the Census Bureau released its Residential Construction report for December. Housing completions decreased 8.4 percent compared with last December and continued to fall short of the number of new housing units necessary to keep pace with household formation. Housing starts also decreased 10.9 percent in December compared with a year ...

Read More ›

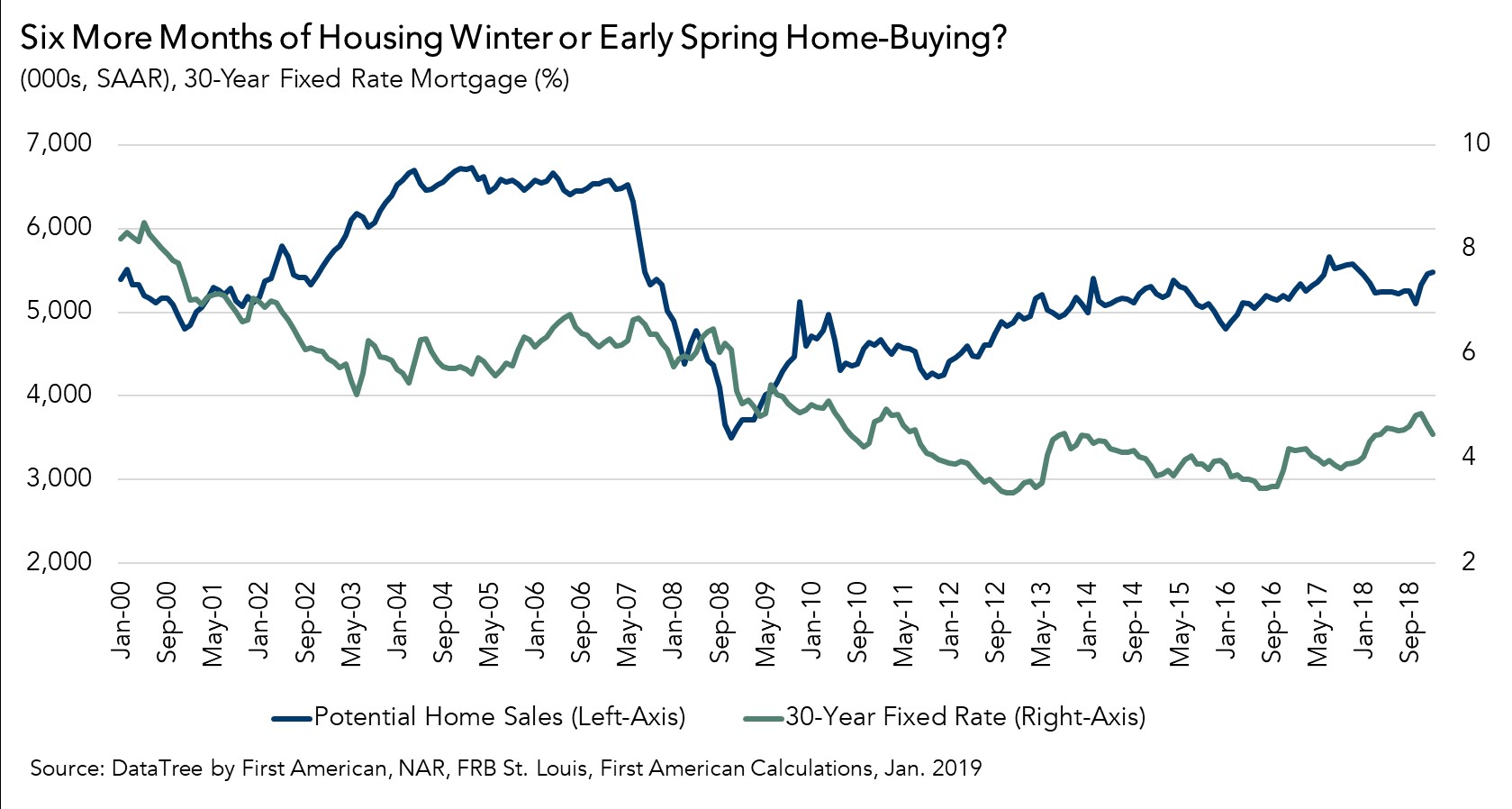

Six More Months of Housing Winter or Early Spring Home-Buying Season?

By

Mark Fleming on February 20, 2019

In the first month of the new year, the housing market continued to underperform its potential, but gave us signs of promise for the future. Actual existing-home sales are 5.3 percent below the market’s potential, according to our Potential Home Sales model. That means the market has the potential to support 293,000 more home sales than the ...

Read More ›

Interest Rates Federal Reserve Homeownership Potential Home Sales

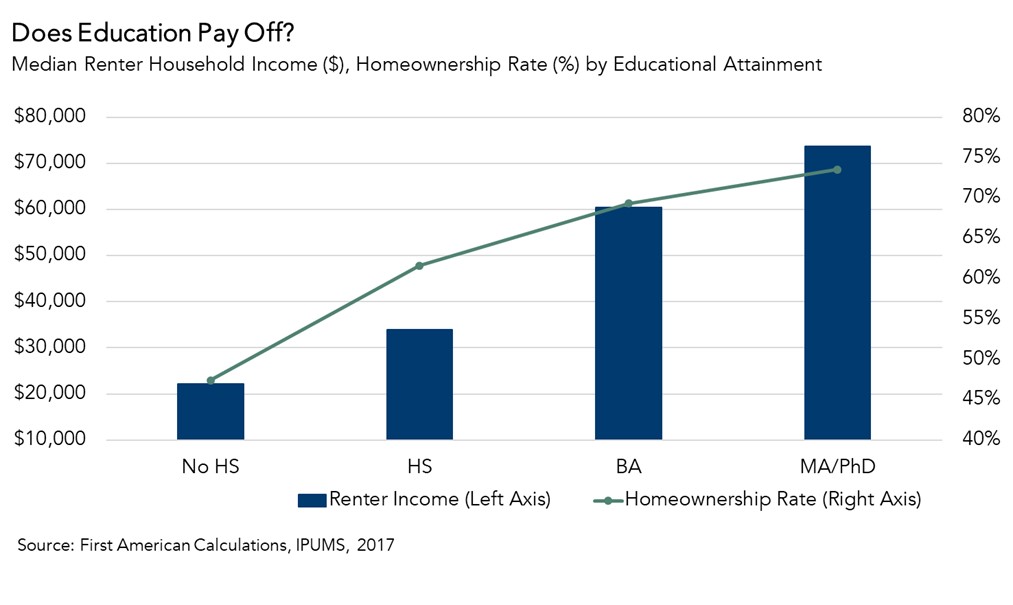

What is the Impact of Student Loan Debt on House-Buying Power?

By

Odeta Kushi on February 15, 2019

Contrary to many reports, student loan debt is not an insurmountable barrier to homeownership for millennials. Student loan debt is more likely to delay the timing of homeownership, but it does not necessarily prevent homeownership. But, this begs the questions, how does student loan debt impact house-buying power? And, is higher education a ...

Read More ›

Millennials Education Homeownership Progress Index Homeownership