Enacted in 2017, the Tax Cuts and Jobs Act reduced tax breaks for homeowners. At the time, many in the real estate industry expected the changes to negatively impact the housing market, particularly in high-priced neighborhoods. The industry concern primarily focused on two specific changes included in the bill: the mortgage interest deduction was limited to loans of $750,000 or less, down from a previous cap of $1 million, and the deduction for state and local (property) taxes was capped at $10,000.

“What we know 16 months into the change is that the highest price points of some of the highest priced housing markets may suffer as real estate is re-priced to reflect the change in the cost of owning.”

However, 16 months after the tax law took effect, the housing market remains healthy and it is difficult to find signs that the tax changes have impacted housing. Nationally, house prices have continued to rise. Median house prices have increased nearly 5 percent since the law was implemented, according to DataTree by First American data. The limited deductibility of State and Local Taxes has not impacted the housing market nationally because the cap remains high enough, so most homeowners can still deduct all of their state and local taxes.

So, at a macro-level, the tax changes have had virtually no impact to the housing market. However, zooming in on micro-markets, specifically high-priced markets where the high property prices result in property taxes that exceed the new cap on state and local tax deductions may find some impact. How far must we zoom in geographically to see an impact on house prices?

Market Level: No Discernible Impact

Limiting deductions for state and local taxes, including property taxes, to $10,000 per household were anticipated to hurt owners of expensive homes in high-tax states. However, states such as California, New York and Connecticut, that contain million-dollar-plus housing markets, have yet to see the anticipated impacts of the tax law materialize. In fact, median sales prices for existing homes in these states were higher in 2018 after the tax law took effect than they were before the tax law took effect in 2017. Even in the high-cost metropolitan areas, such Los Angeles, Boston, New York, Seattle and Washington D.C., median sale prices increased: 2.6 percent, 3.6 percent, 0.4 percent, 2.2 percent, and 3.9 percent respectively from January 2018 to January 2019. Indeed, we must zoom in further geographically to see any meaningful impact on housing from the change in the tax law.

County Level: Still No Impact

Our analysis found no signs of impact on housing at the national, state or metro level, but what if we zoom in to the county level? Using the three counties with the highest property taxes in 2019: Westchester, Rockland and Nassau counties in New York, we find that median sale prices increased 1.6 percent, 0.6 percent, and 11.5 percent respectively in January 2019 compared with one year ago. On average in 2018, the pace of appreciation is similar to the house price appreciation in these counties in 2017 and 2016.

Town Level: Some Signs Emerge

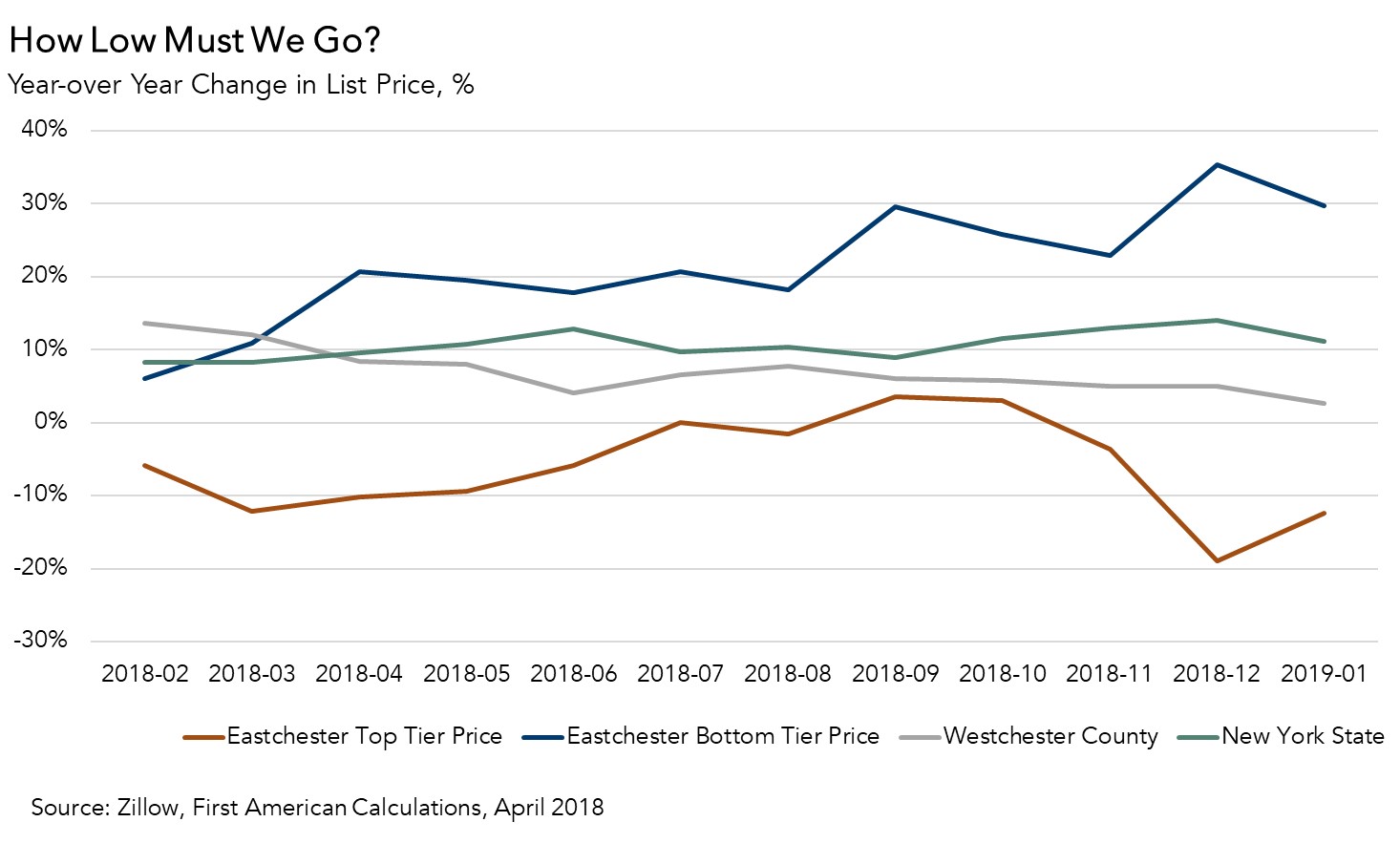

Now, let’s move zoom in to the town level. In Eastchester, a town in Westchester County, we find that homes in the bottom third of house prices increased 30 percent from January 2018 through January 2019, according to Zillow data. In that same time period, the list price of homes in the highest-priced third of the market in Eastchester declined by 12.4 percent. This analysis aligns with what real estate professionals are seeing on the ground in high-priced markets, such as the Hamptons. It seems the tax law may have reduced demand at the highest price points of high-cost markets, causing prices to fall. So, only once we zoomed in to the town level did signs emerge of any impact from the tax law change.

Location, Location, Location

Our analysis found that the 2017 tax law only impacted house prices at the highest price points of high-cost towns. It’s important to note that the 2018 housing market benefitted from a strong economy, record-low unemployment rates, and a tax cut that created more disposable income for consumers. However, the tax bill did raise the relative cost of owning versus renting in some high-cost markets.

It’s difficult to discern whether these strong macro-economic trends may have masked the effects of the tax change on housing. What we know 16 months into the change is that the highest price points of some of the highest priced housing markets may suffer as real estate is re-priced to reflect the change in the cost of owning. It appears the old adage – location, location, location – also holds true when it comes to the effects of the Tax Cuts and Jobs Act.