Where Do Renters Have an Edge in the Pursuit of Homeownership?

By

Odeta Kushi on September 5, 2019

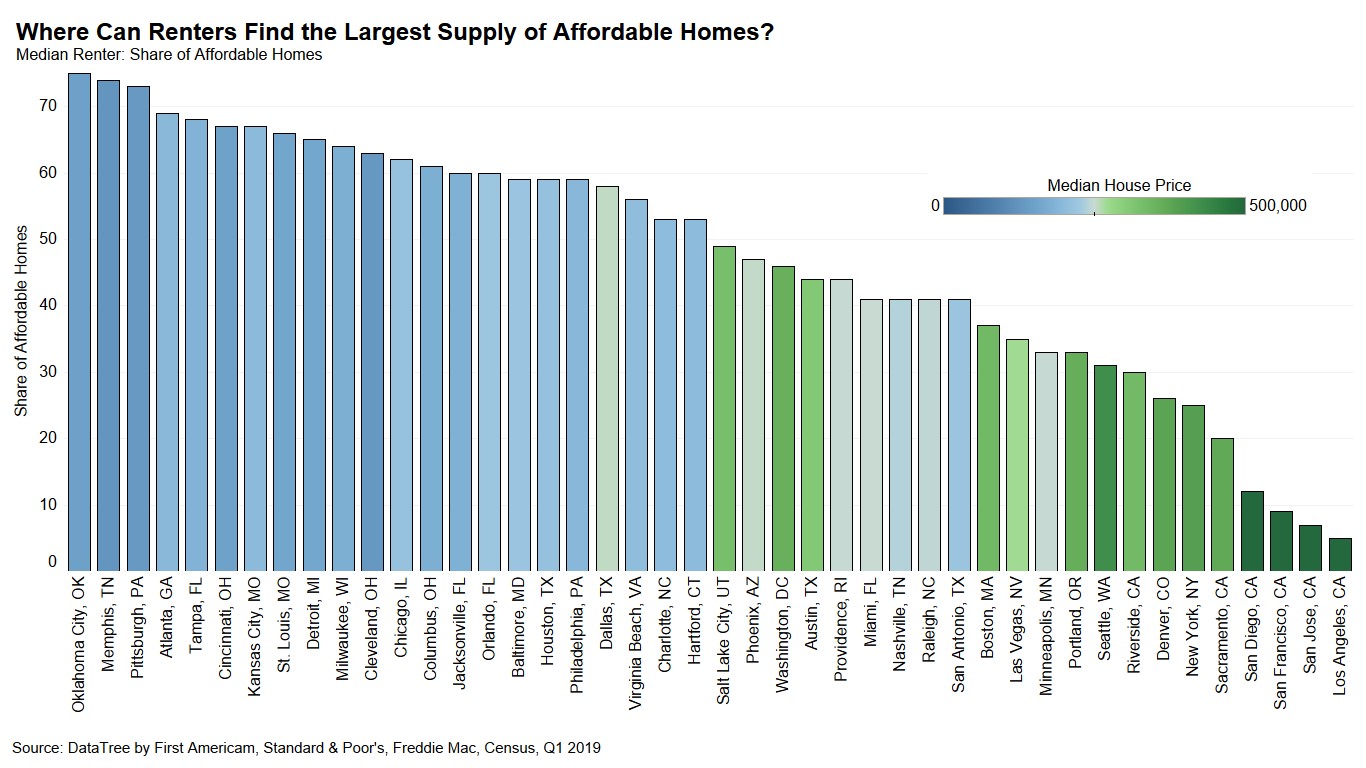

Traditional measures of affordability can be misleading to potential first-time home buyers because they compare overall median household income with the income required to purchase a median-priced home. However, median household income includes existing homeowner households, which have significantly higher median income than renter households, so ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

Interviews on CNBC and Nightly Business Report: Discussing the Refinance Boom and Tailwinds Boosting the Housing Market

By

FirstAm Editor on September 3, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi was interviewed on Nightly Business Report last week, where they discussed the refinance boom driven by low mortgage rates and the tailwinds boosting the housing market.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability

How Can Affordability Improve When House Prices are Rising?

By

Mark Fleming on August 27, 2019

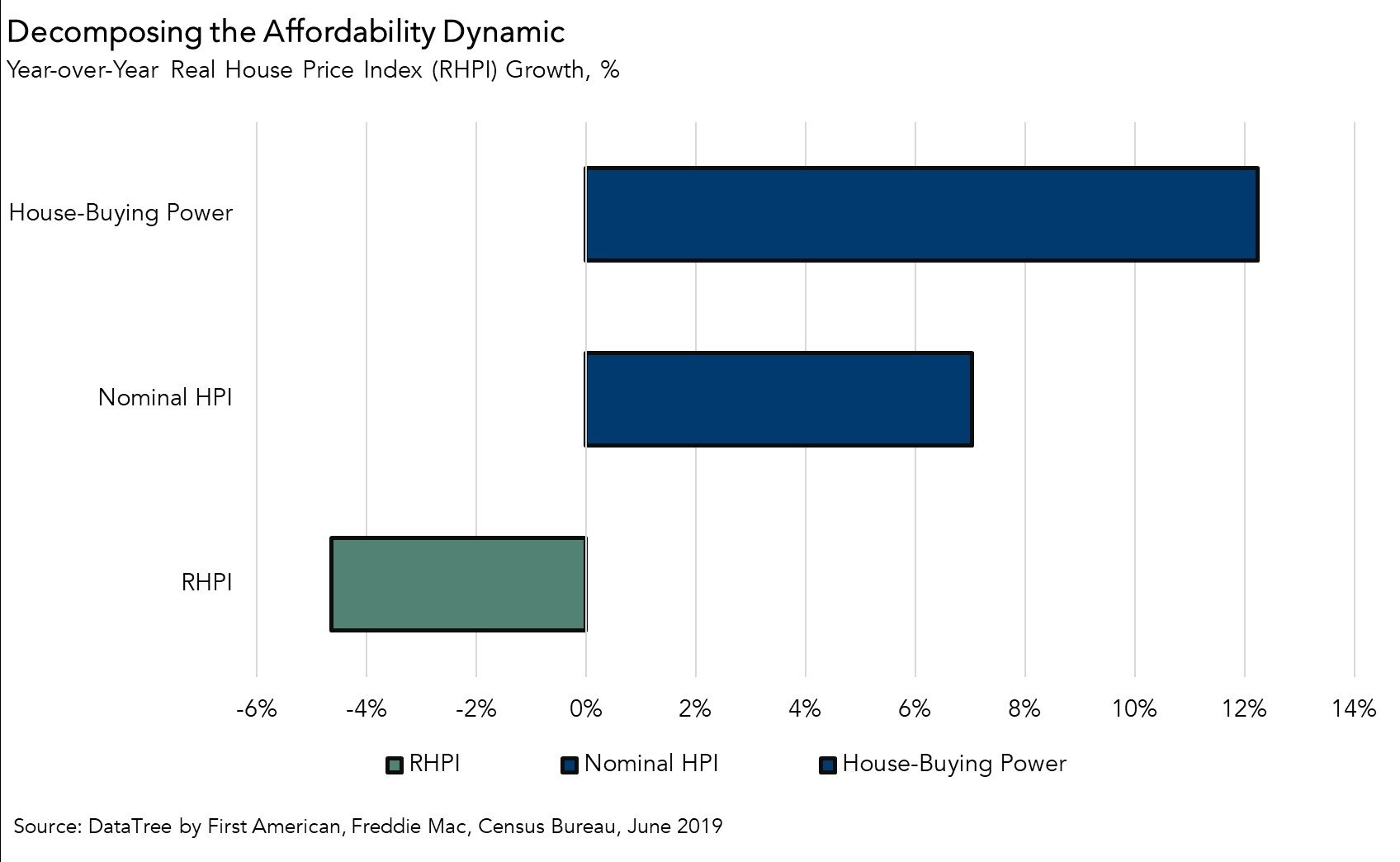

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, swung in favor of increased affordability in June. The 30-year, fixed-rate mortgage fell by 0.8 percentage points and household income increased 2.4 percent compared with June 2018. When household income rises, consumer house-buying power ...

Read More ›

Interviews on CNBC and Bloomberg TV: Discussing the Impact of Historically Low Rates and the Outlook for the Housing Market and the Economy

By

FirstAm Editor on August 23, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi on Bloomberg TV earlier this week and discussed the impact of historically low rates on the housing market, and what the Fed minutes indicate about the direction of rate policy and the economy.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability

Dispelling the Myth of the 20 Percent Down Payment

By

Odeta Kushi on August 6, 2019

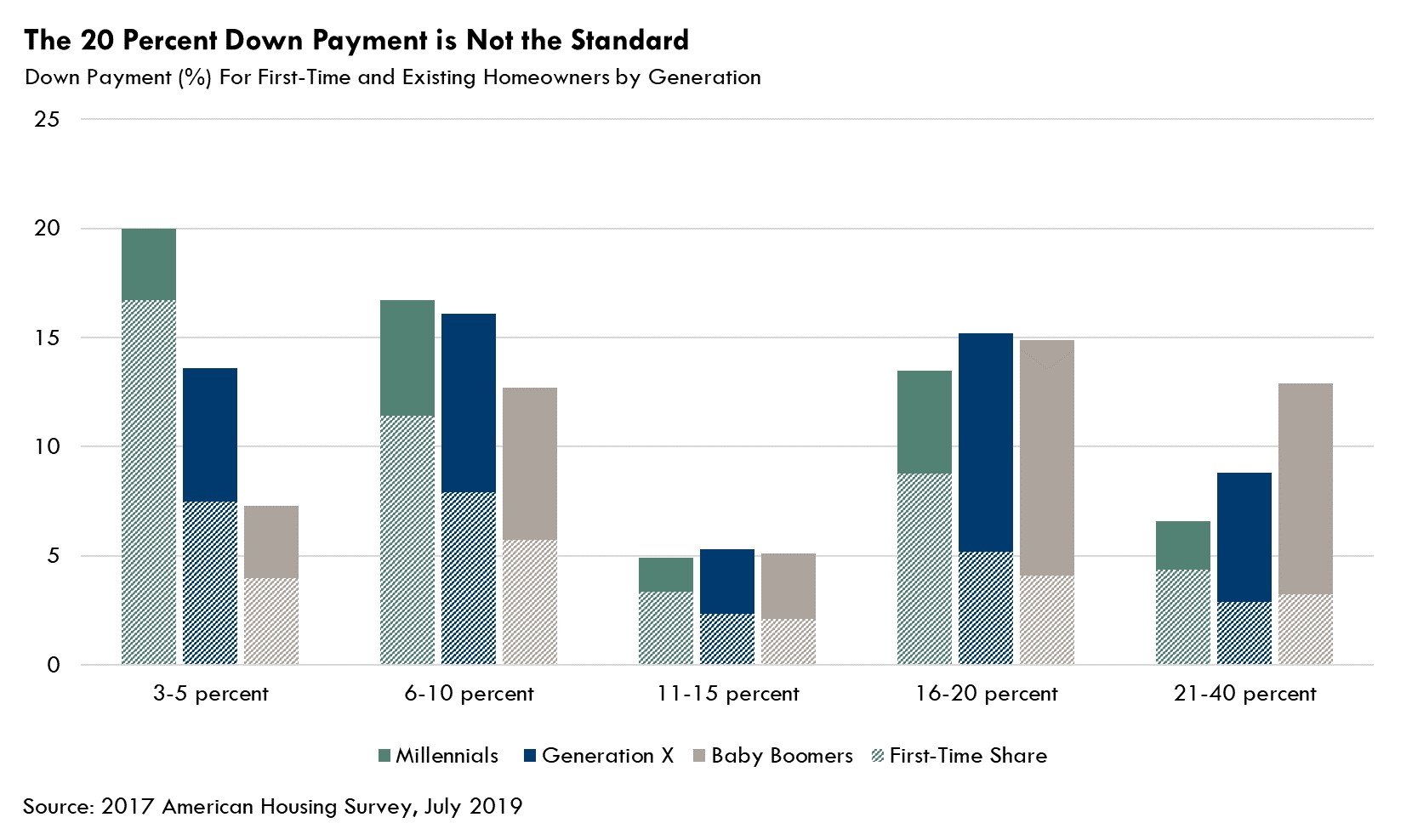

Since hitting a low point of 63 percent in 2016, the homeownership rate has rebounded, largely driven by millennial households purchasing their first homes. Many surveys, like one by Bank of the West, indicate that millennials are no different from previous generations – they view homeownership as a main tenet of the American Dream.

Read More ›

How Has the Housing Market Changed Since the End of the Great Recession?

By

Odeta Kushi on July 3, 2019

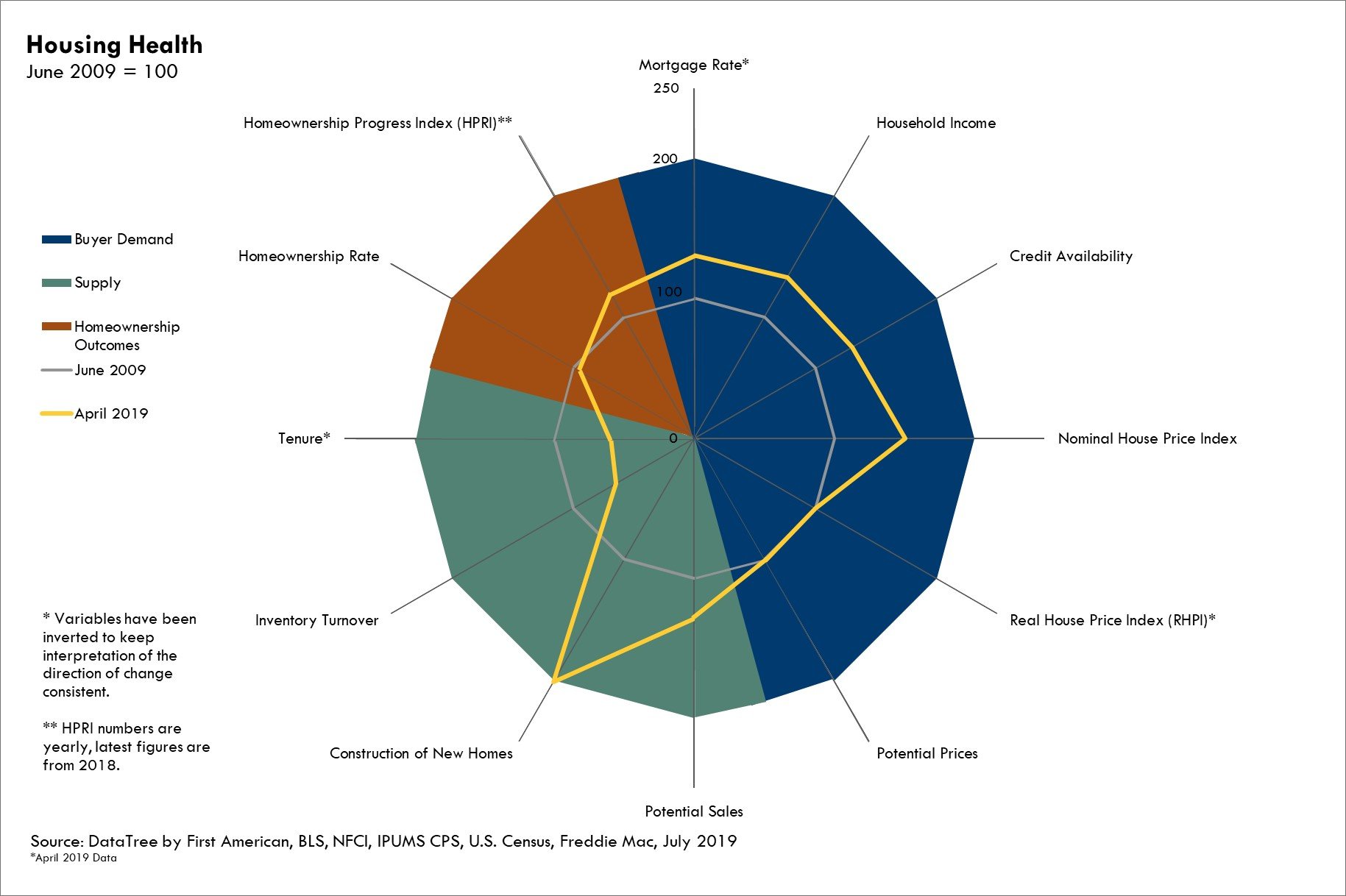

June marked the 10-year anniversary of the end of the Great Recession. Amid Independence Day celebrations, assessing how the American dream of homeownership has fared since the recession can provide helpful context for the health of today’s housing market. We have assembled a set of housing metrics and compared their values today with what those ...

Read More ›

Homeownership Progress Index Real House Price Index Affordability Homeownership