What Will Drive House-Buying Power in 2020?

By

Mark Fleming on December 20, 2019

Affordability improved in October as two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, modestly swung in favor of increased affordability relative to one year ago. The 30-year, fixed-rate mortgage fell by 1.1 percentage points and household income increased 2.6 percent compared with October ...

Read More ›

Where Lower-Income Renters Can Pursue the Dream of Homeownership

By

Odeta Kushi on December 12, 2019

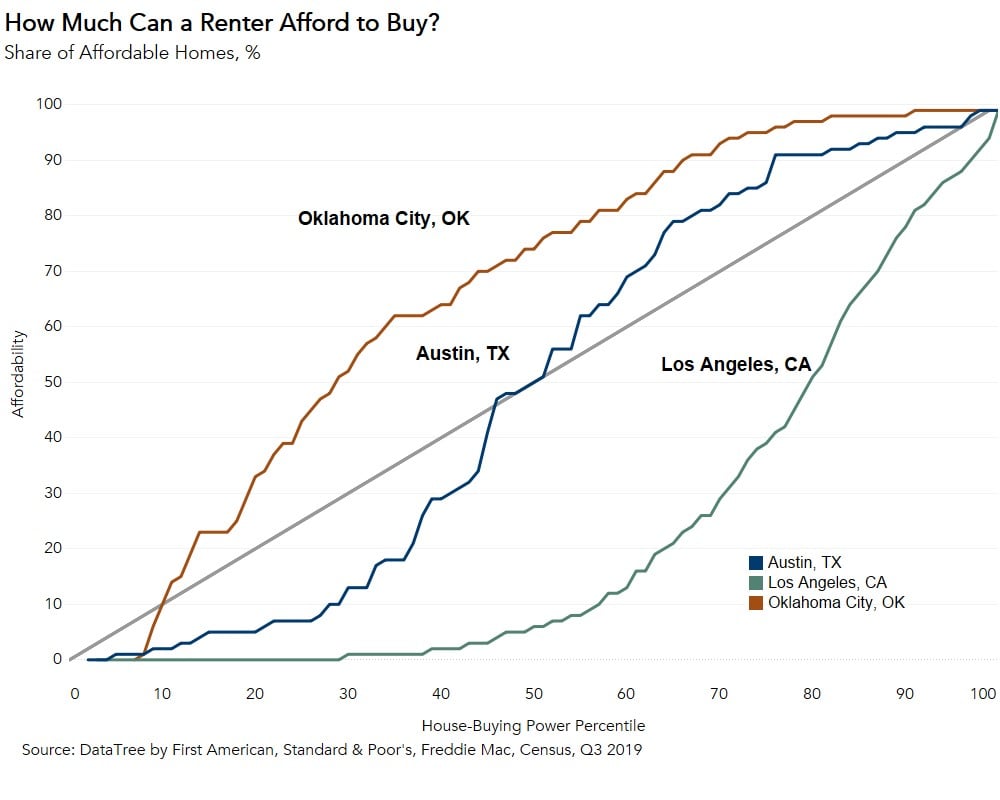

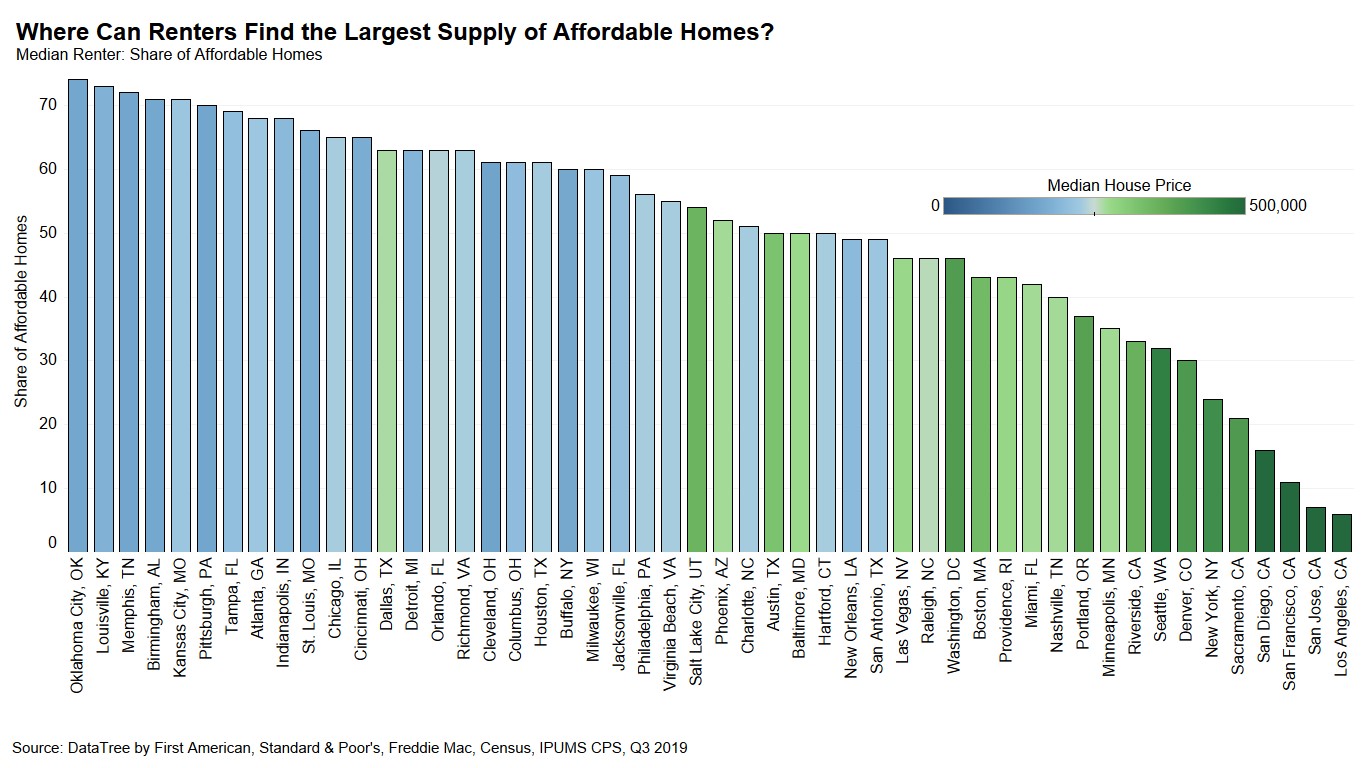

In 2019, the growth in consumer house-buying power outpaced house price appreciation for the median renter trying to buy the median priced home. But, there are many renters with household incomes below the median income in their cities. We can measure affordability for all renter households based on their household income and the share of homes ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

What Cities Are the Most Affordability Friendly for First-Time Home Buyers?

By

Odeta Kushi on December 10, 2019

Housing affordability, or the lack thereof, continued to generate discussion and headlines in 2019. That’s unlikely to change in 2020, as strong demand, driven by low mortgage rates and wage growth, collides with limited housing supply. However, it’s easy to overlook that nearly two-thirds of Americans already own homes so, generally speaking, ...

Read More ›

Housing Affordability Homeownership First-Time Home Buyer Outlook Report

Has Rising House-Buying Power Accelerated House Price Appreciation?

By

Mark Fleming on November 26, 2019

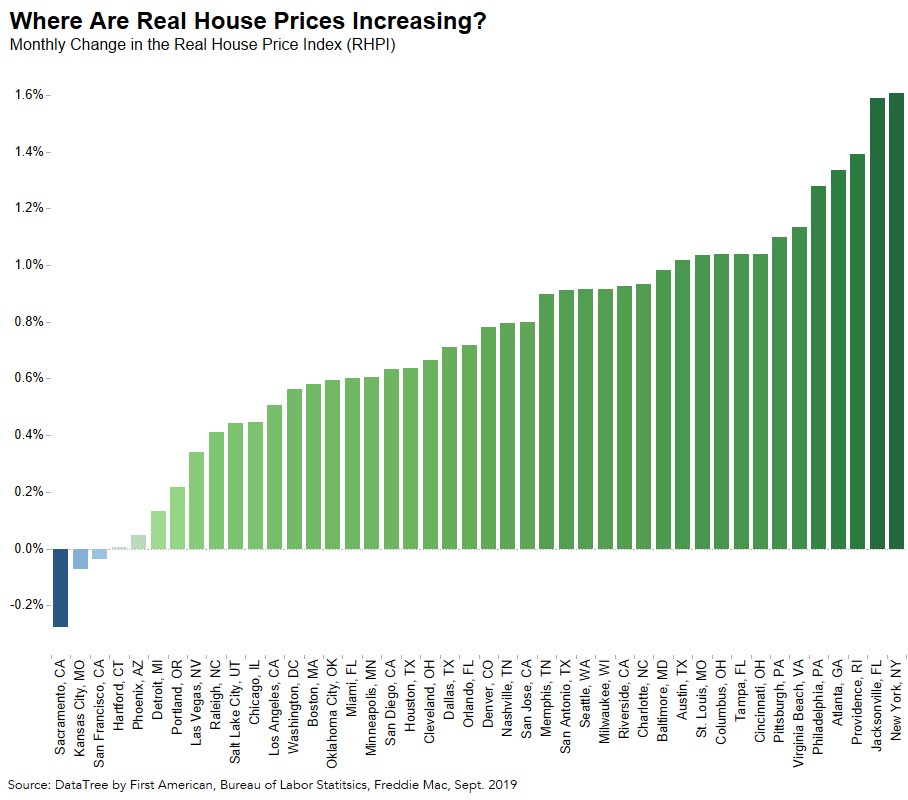

Two of the three key drivers of the Real House Price Index (RHPI), household income and mortgage rates, modestly swung in favor of increased affordability in September, yet affordability declined month over month. The 30-year, fixed-rate mortgage fell by 0.01 percentage points and household income increased 0.03 percent compared with August 2019. ...

Read More ›

The Dynamic Forces that Re-Shaped Housing Affordability in 2019

By

Mark Fleming on October 28, 2019

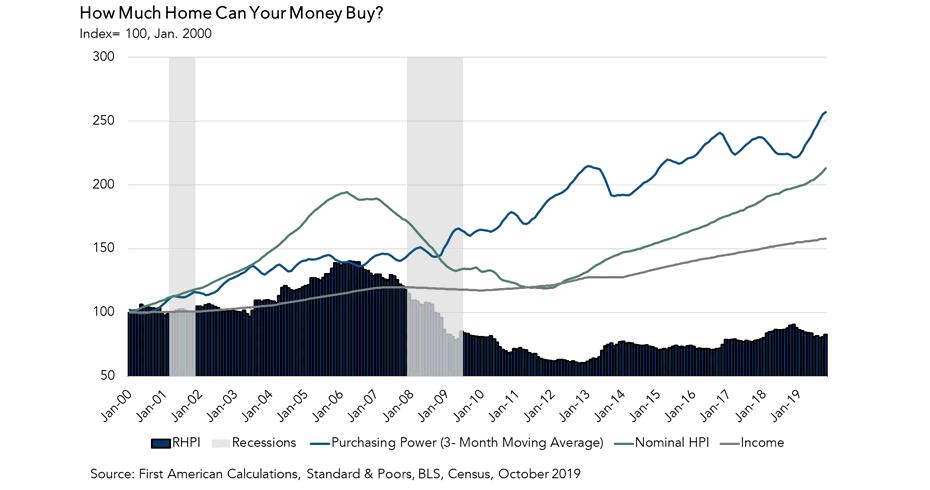

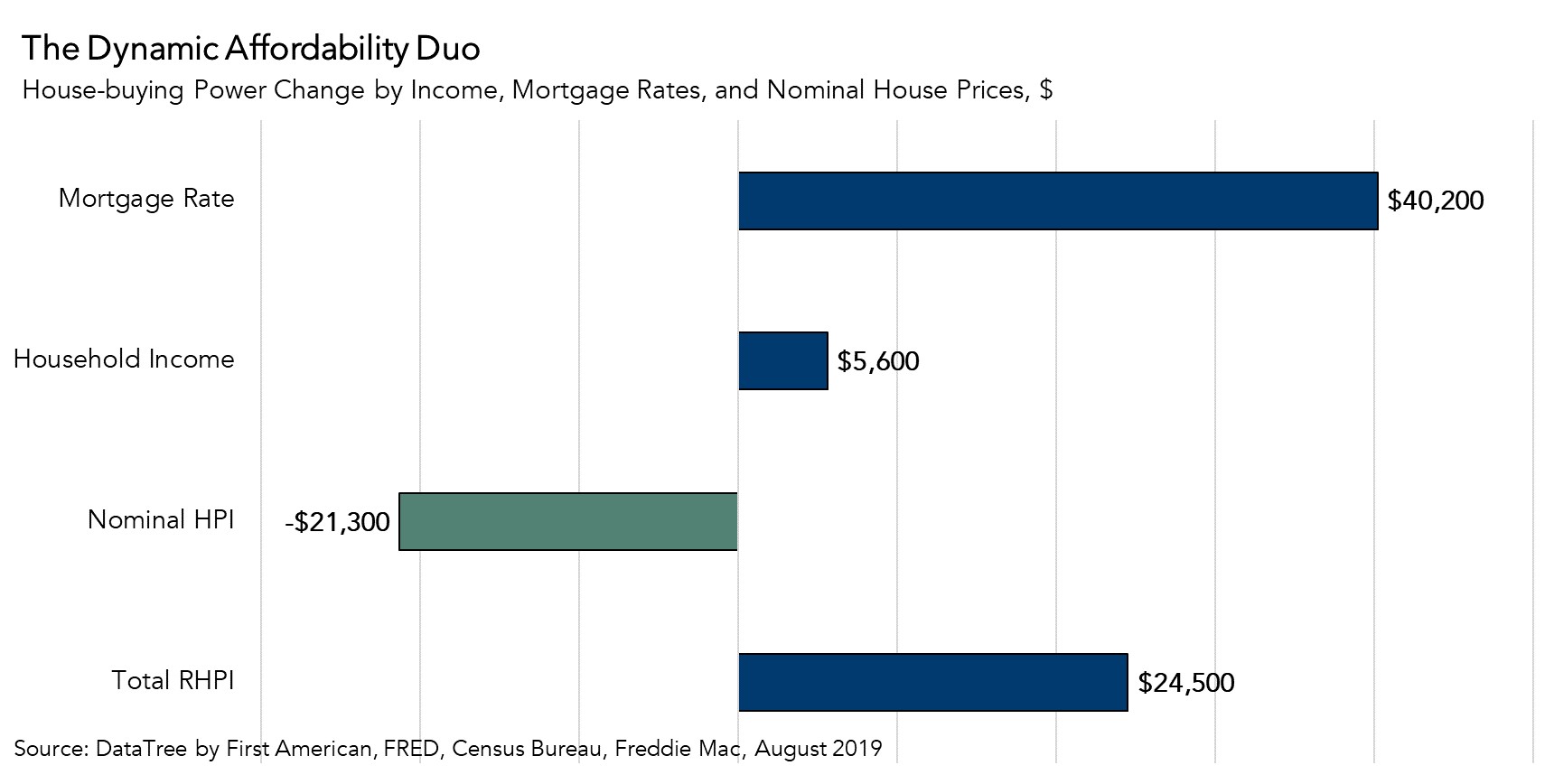

Understanding the dynamics that influence consumer house-buying power, how much home one can buy based on changes in income and interest rates, provides a helpful perspective on the housing market. When incomes rise, consumer house-buying power increases. When mortgage rates or nominal house prices rise, consumer house-buying power declines. Our ...

Read More ›

How Did Affordability Change During the Spring Home-Buying Season?

By

Mark Fleming on September 23, 2019

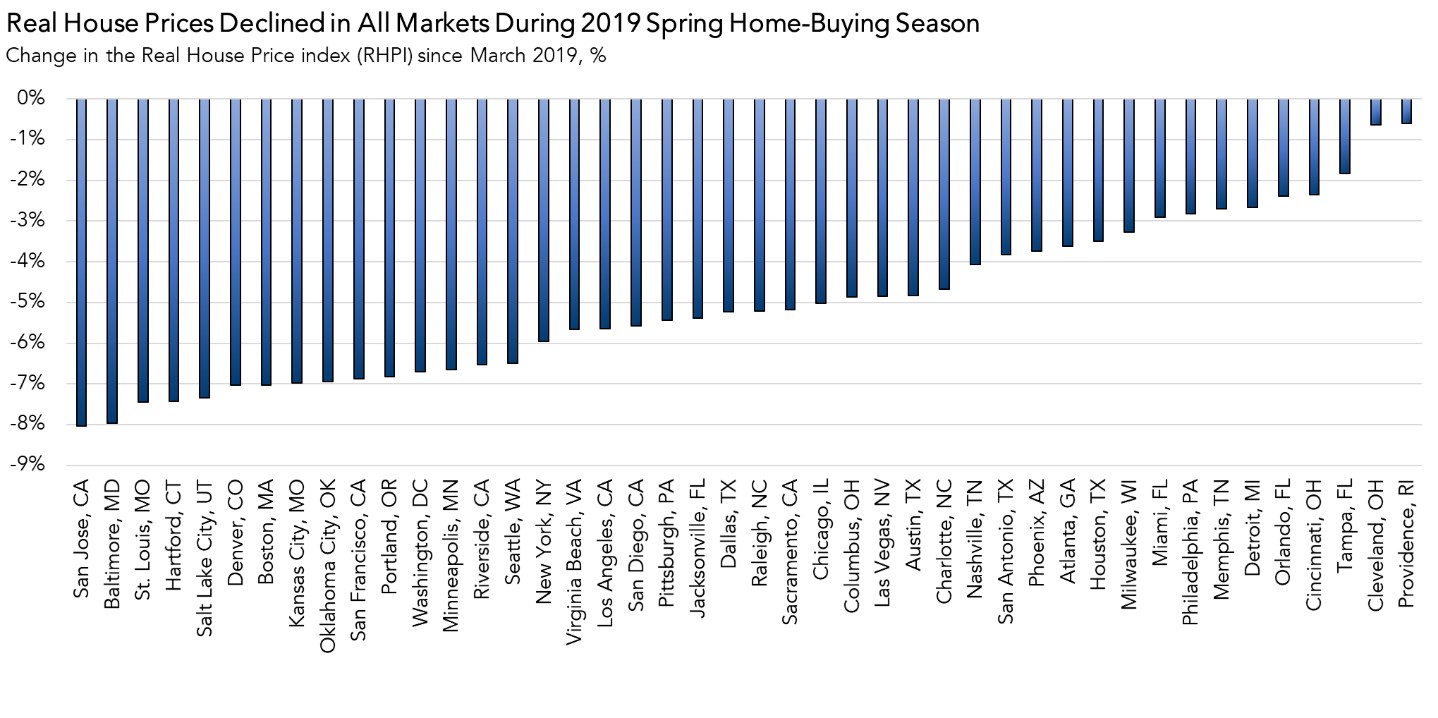

School bells ringing don’t just mark the beginning of a new school year, but for those in housing, they also signal the end of the typical home-buying season, which begins in March. As the school year begins, the housing market is finishing the spring home-buying season with strong marks for affordability. Indeed, two of the three key drivers of ...

Read More ›